Taxes are already a tense process, however if you throw cryptocurrency into the combination, issues can get much more sophisticated.

The decentralized and infrequently unstable nature of crypto provides layers of complexity that may depart even probably the most diligent taxpayers scratching their heads. From monitoring each commerce and switch to making sure compliance with continually altering rules, managing crypto taxes can really feel overwhelming. That is the place crypto tax software program is available in.

Designed to simplify the method, these instruments can robotically monitor your transactions, calculate your positive aspects and losses, and generate correct tax studies, taking the burden off your shoulders. Koinly is one such tax service supplier.

On this Koinly overview, we'll present you learn how to use Koinly, and spotlight its options and advantages.

Evaluate Abstract

Koinly is a complete crypto tax software program that simplifies the complicated strategy of managing cryptocurrency taxes. With automated transaction monitoring, integration with over 400 exchanges and wallets, and help for numerous tax codecs and international locations, Koinly ensures correct and environment friendly tax reporting.

The Key Options of Koinly Are:

- Automated crypto tax reporting

- Integrations with over 400 crypto exchanges and wallets

- Actual-time monitoring of crypto transactions and positive aspects/losses

- Tax studies for over 100 international locations, together with the US, UK, Canada, and Australia

- Helps a number of accounting strategies, together with FIFO, LIFO, Highest Price, Common Price Foundation, and extra

- Complete reporting of taxable occasions, together with trades, transfers, airdrops, forks, DeFi earnings, and mining

- Integration with fashionable tax software program like TurboTax and TaxAct

- Capability to import knowledge from CSV and Excel information

- Cryptocurrency portfolio monitoring and analytics

- Helps tax codecs akin to Kind 8949, and may populate figures for Schedule D

- Distinguishes earnings from totally different sources akin to staking, mining, lending, and so on.

- Person-friendly interface

In search of extra choices? Try our high picks for the perfect crypto tax software program.

| Headquarters: | London |

| 12 months Established: | 2018 |

| Regulation: | N/A |

| International locations Supported: | USA, UK, Canada, Australia, Sweden, Norway, Eire and 20+ different international locations for specialised tax report era. Common tax studies can be found for 100+ international locations. |

| Cryptocurrencies Supported: | 20,000+ |

| Platforms Supported: | 400+ exchanges, 100+ wallets |

| Newbie Pleasant? | Sure |

| Used By: | Retail merchants, crypto traders, accountants, companies, and accountancy companies. |

The Drawback With Crypto Taxes

If you’re new to the world of crypto and taxes, it may be an absolute minefield. To start out off, there is no such thing as a "one rule" to control all of your transactions, and crypto is assessed otherwise in several international locations.

Some jurisdictions classify crypto as property, some as "miscellaneous," whereas others contemplate it a commodity or "intangible property." How it’s categorised modifications whether or not the tax might be handled as capital positive aspects tax or earnings, and that is simply on the private aspect. If your corporation offers with cryptocurrencies in any capability, both as a service, to just accept funds, or if you’re buying and selling as a part of a enterprise exercise, now you may have opened up an entire new dimension of the proverbial "can of worms."

And if that isn't sophisticated sufficient, contemplate all of the other ways one can earn some type of revenue on crypto, lots of that are taxed otherwise. Listed below are some examples of occasions which can be taxable in lots of international locations:

- Promoting crypto for fiat at a revenue or loss.

- Exchanging digital belongings on a DEX or centralized exchange- Yup, even swapping an altcoin for an additional altcoin or Bitcoin can set off a tax occasion. You might want to know the fiat worth of the tokens on the time of swap, which is the place crypto tax software program is useful.

- Receiving airdrops- Sure, apparently that is “income” in lots of international locations.

- Sale of NFTs- This will set off capital positive aspects, or earnings tax relying on the character of the earnings.

- Incomes earnings from Blockchain and P2E video games.

- Staking earnings.

- Offering liquidity or yield farming- Any APY earned could also be thought of earnings.

- Utilizing CeFi lending platforms like Nexo, an alternate, or DeFi lending protocols like Compound Finance or Aave.

- Crypto mining.

- Utilizing crypto debit playing cards.

- Incomes rental/commercial earnings from digital land or renting NFTs.

What I’m driving at is that the issue with crypto taxes is that it's sophisticated and there are numerous components to think about. These distinctions matter as a result of they decide how a lot tax it’s important to pay on every transaction.

To keep away from attempting to determine all this out your self and danger making a mistake which might result in fines and even jail time, I extremely suggest a crypto tax software program like Koinly.

How Koinly Solves the Crypto Tax Drawback

Koinly makes crypto tax reporting straightforward. As talked about, crypto taxes will be extremely complicated and troublesome, and with out a software like Koinly, it could actually take hours to place collectively all of the transaction knowledge wanted to organize your crypto tax report paperwork.

Take into account the next situation:

In the event you use a decentralized alternate (DEX) to swap one token for an additional, you might have to pay a gasoline price to execute the transaction on the blockchain, a liquidity supplier price to entry the pool of tokens on the DEX, and a protocol price to help the event of the DEX. Every of those charges can have an effect on your value foundation and capital positive aspects or losses.

DeFi transactions can even generate earnings that’s taxable. For instance, in the event you present liquidity to a DEX by depositing your tokens right into a pool, it’s possible you’ll obtain a share of the charges collected by the DEX in addition to governance tokens that signify your voting rights within the protocol. Each of those rewards could also be taxable as earnings at their honest market worth if you obtain them.

DeFi transactions will be difficult to trace and report as a result of they might not be recorded by your alternate or pockets. It is usually extremely uncertain that you’ll obtain types or statements from the DeFi protocols themselves for tax reporting functions. That’s why it’s vital to make use of crypto tax software program that may show you how to determine and calculate your DeFi transactions precisely.

As a result of inherent complexities surrounding all of the totally different occasions which will or might not set off taxable occasions, and the other ways they’re categorized, attempting to do crypto tax by yourself manually additionally exposes the consumer to a major danger of errors and overpaying taxes. Koinly ensures accuracy and compliance when tax time comes round.

What’s Koinly and How Does it Assist with Crypto Tax Options?

Koinly is a crypto tax software program that helps you handle and automate your crypto taxes, and can be a really worthwhile portfolio monitoring instrument. It offers a complete set of instruments and options to assist customers precisely calculate their crypto taxes, whereas additionally offering an easy-to-use interface.

Maybe the perfect factor about Koinly is that it could actually immediately combine with most crypto exchanges and wallets, even self-custodial and DEXes to import crypto actions robotically, saving you hours, if not days of labor.

After I say days, I'm not exaggerating both. Many different crypto merchants and customers, myself included, would actually spend days scouring by crypto transactions like trades, staking, lending, and so on, throughout numerous DEX and CEX platforms, ensuring we have been recording correct knowledge. Then it acquired worse once I began utilizing a number of totally different crypto debit playing cards and realized that hundreds of purchases I had remodeled the 12 months might additionally represent taxable occasions, so yeah, tax season was a nightmare earlier than realizing about tax instruments like Koinly.

In truth, I've met crypto customers who despise attempting to determine crypto tax a lot that they even uprooted their lives to relocate to crypto-tax-friendly international locations. Utilizing Koinly might be a extra rational answer than immigrating, however if you’re in search of sunnier horizons or extra tax-friendly jurisdictions, it’s possible you’ll be keen on testing our Prime Crypto Tax-Pleasant International locations article.

On that observe, if you’re contemplating relocating to keep away from taxes, or you’re simply in search of a bit of journey, be at liberty to e book a name with our pals from Offshore Citizen to plan and execute your transfer legally. They assist with residency permits, financial institution accounts, firm buildings, and so on.

Again to taxes, with Koinly, you’ll be able to simply monitor all of your cryptocurrency transactions, generate detailed studies for tax submitting, and even get tax recommendation tailor-made to your particular person wants. With its highly effective options and user-friendly design, Koinly is the proper selection for these in search of a dependable and environment friendly answer to their crypto tax issues.

How Does Crypto Tax Software program Work?

Crypto tax software program simplifies the computation, calculation, processing, and assortment of crypto transactions and enters the info with the suitable tags and classifications and may populate that data into the suitable tax types.

The packages may also help people and companies calculate and report on their cryptocurrency actions akin to buying and selling, mining, staking, promoting, lending, and extra. The method is finished by connecting the software program to a consumer's crypto wallets, exchanges, and DeFi platforms, and the data is robotically synchronized by way of API keys. If API keys usually are not out there, the consumer can even export the info right into a CSV file to add into the tax software program.

As soon as the info is collected within the crypto tax software program, relying on the platform, the consumer can go forward and file their taxes, generate a report that can be utilized in a tax submitting software like TurboTax, or types will be printed and despatched to an accountant.

Options & Advantages of Koinly for Crypto Buyers

As Koinly robotically imports and organizes your crypto transactions, and the software program is up to date for compliance so it stays updated with the continually evolving regulatory surroundings, utilizing Koinly ensures that customers usually are not overpaying any pointless taxes on crypto investments or violating tax obligations.

The software program can be able to automated tax loss harvesting and utilizing capital losses to offset capital positive aspects for max tax effectivity.

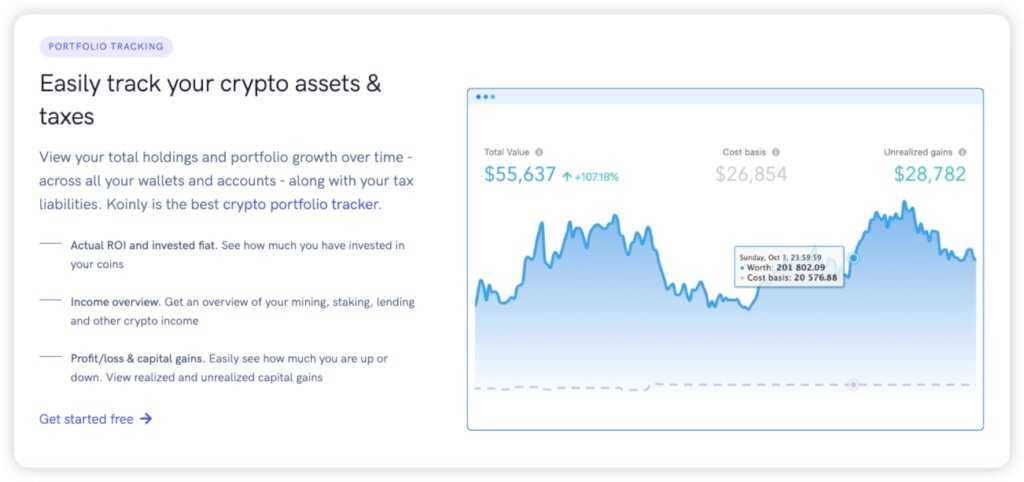

Portfolio Monitoring

With Koinly, customers can monitor their crypto belongings and efficiency throughout a number of platforms. It is not uncommon for crypto customers to have digital belongings unfold in every single place, from totally different wallets and platforms to exchanges, making it not possible to trace your portfolio's efficiency. Koinly offers an all-in-one dashboard view displaying your whole crypto asset place.

The portfolio monitoring function is beneficial as it could actually calculate your precise ROI throughout all holdings, development over time, and supply an outline of any mining, staking, lending earnings, and extra.

Information Import

Koinly wouldn't be very helpful if it didn't help automation and mass knowledge import, now would it not? As an alternative of getting to commute between each platform you retailer crypto and enter each single knowledge level, customers can sync their knowledge to Koinly and mass add information for something that can’t be robotically synced.

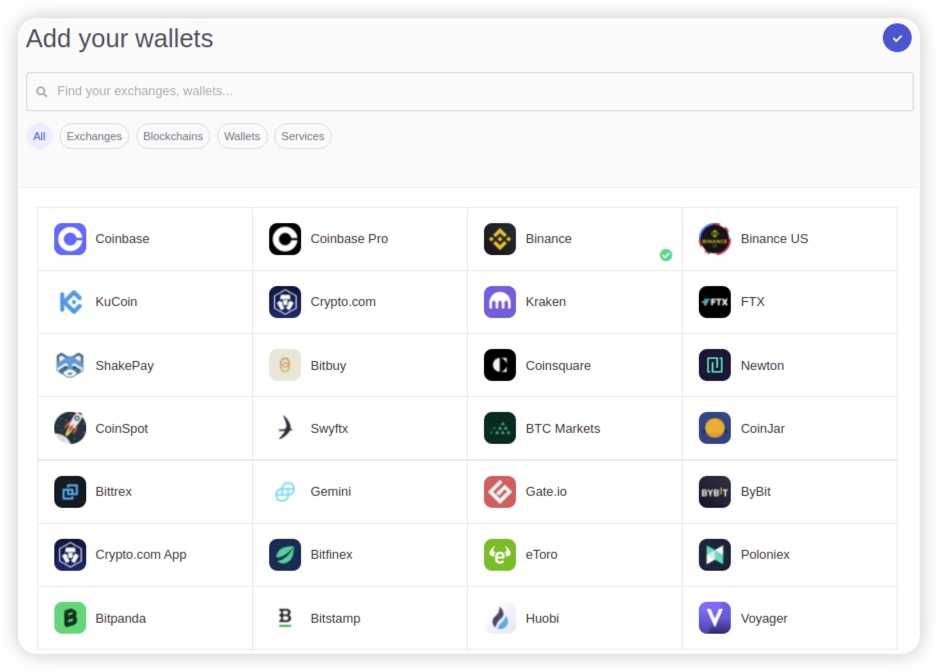

Supporting over 20k tokens, 170 chains, 400+ exchanges, wallets and companies, here’s what will be accomplished:

- Join accounts by way of API and add wallets utilizing x/y/zpubs and ETH tokens utilizing your public deal with.

- Monitor margin buying and selling on centralized exchanges

- Robotically tag "income" from imported sources coming from platforms like Nexo, Compound, Aave, and so on.

- Sensible Switch Matching- Koinly has an AI detection software and may detect transfers made between your personal wallets to exclude them from tax studies.

With automated knowledge enter, the software program additional eliminates handbook effort by recording the date of the transaction, the variety of tokens within the transaction and the value of the transaction.

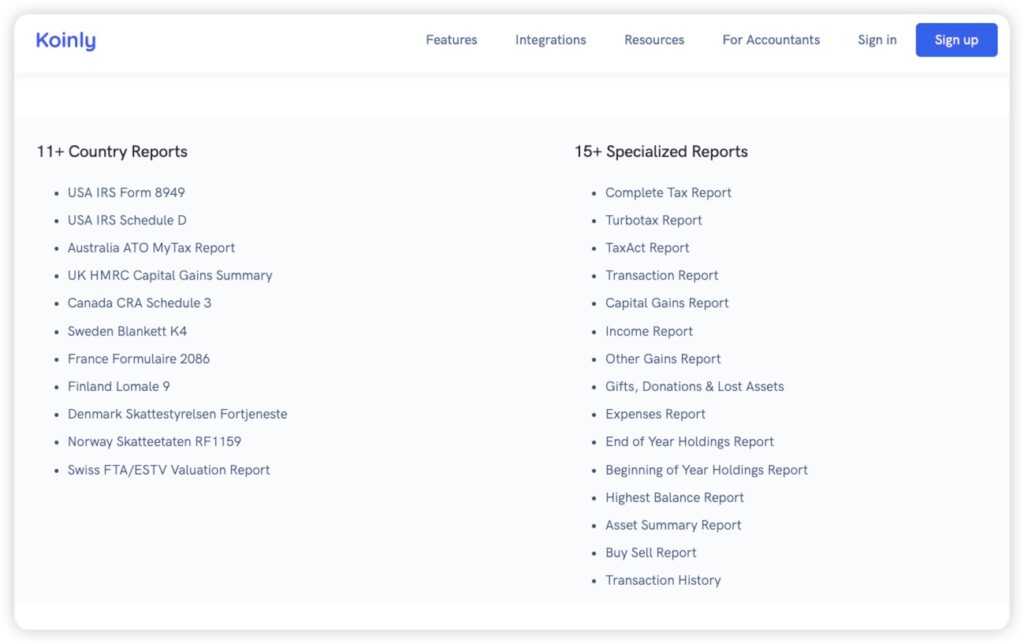

Cryptocurrency Tax Stories

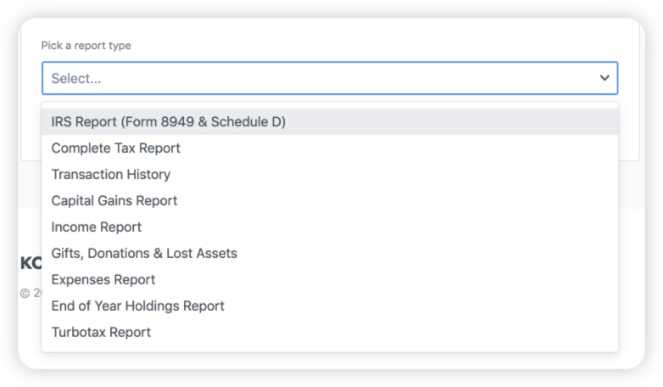

As soon as all the info has been collected, Koinly permits customers to preview their capital positive aspects and losses, together with another tax studies without spending a dime, and generate the suitable tax paperwork when the consumer is prepared. Listed below are a few of the tax studies out there:

- Kind 8949, Schedule D. For US customers, Koinly can generate filled-in IRS tax types in your behalf.

- Worldwide tax studies for the USA, Canada, UK, Germany, Sweden, Brazil, and 100 different international locations. Localized and particular tax studies can be found for 20+ international locations.

- Tax studies appropriate for customers seeking to declare taxes in any nation that makes use of these accountancy strategies: First In First Out (FIFO), Final In First Out (LIFO), Highest Price, Common Price Foundation, Shared Pool, or PFU.

Koinly instruments additionally make error reconciliation straightforward because of its double-entry ledger system. Each change in your asset balances is backed by an entry so any errors will be recognized and rectified rapidly and simply. The software program may even spotlight and flag any lacking transactions or errors that come up from importing, so you may have that double-check to ensure every part is sweet to go. The software can be sensible sufficient to determine and take away duplicate transactions, saving you the concern of duplications if you’re importing knowledge from a number of sources.

How you can Use Koinly

You'd assume that signing up and utilizing a software as complete and sturdy as Koinly can be troublesome and solely appropriate for superior customers, however you'd be extra mistaken than those that nonetheless consider Bitcoin transactions are nameless and a software solely utilized by criminals. 🤦

Koinly is surprisingly user-friendly and simple to get arrange and working. You don't even need to be an accountant or know something about taxes to learn from it. The online-based platform is accessible from any laptop and any browser, and there’s no specialised software program that must be downloaded. They’ve a "how to" video and step-by-step information on the Koinly Assist Web site, however I may even summarize right here:

Step 1

The very first thing it would be best to do is add all of your wallets, alternate platforms, lending companies, and so on. That is accomplished within the "Add Wallets" part. Word that every part in Koinly is known as a "wallet" when connecting platforms.

Step 2

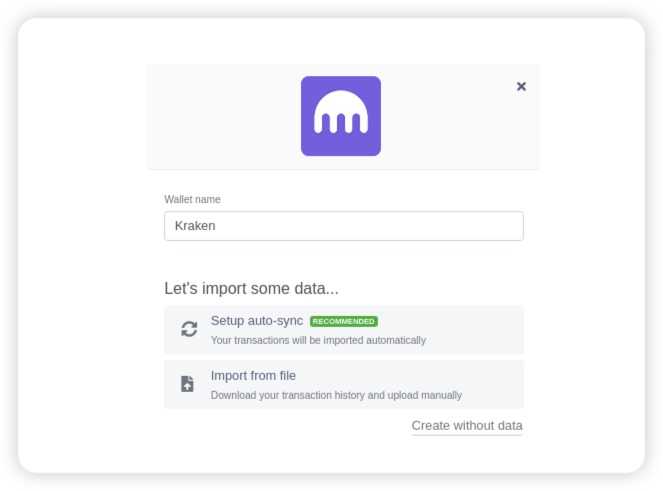

That is the enjoyable half, importing your knowledge. Upon getting chosen the platform from step 1, it is possible for you to to decide on the way you wish to import your transactions. Importing knowledge will be accomplished merely both API keys or by x/y/zpubs and/or pockets addresses. Right here we will see the choice for importing knowledge from Kraken. Try that auto-sync possibility. May it’s any simpler?

Most main exchanges have the auto-sync function that makes use of API keys to seamlessly combine the alternate with Koinly.

Step 3

Now you will have to attend for Koinly to do its factor so you’ll be on a loading display for some time. What Koinly is doing is fetching market costs, matching transfers, figuring out transactions, and calculating capital positive aspects.

Step 4

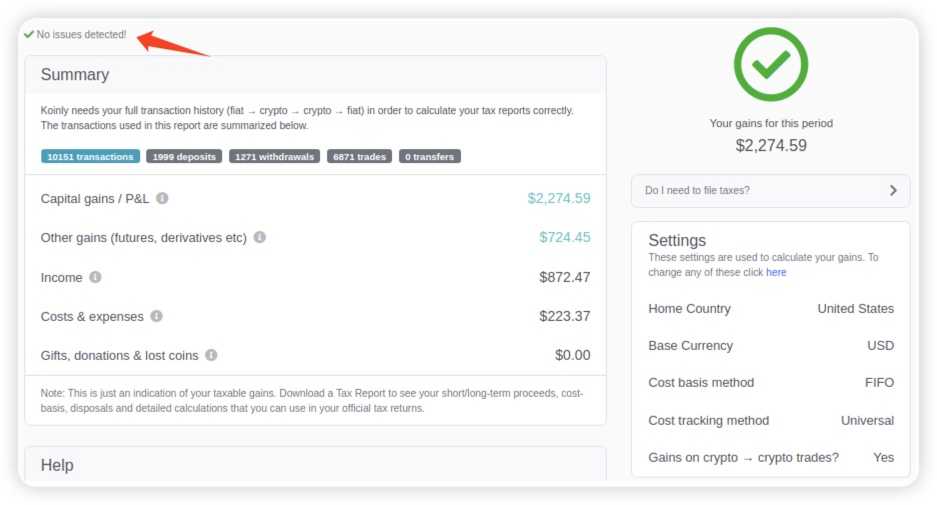

As soon as the tax software is finished "thinking," it is possible for you to to navigate to the Tax Stories web page to see a abstract of your positive aspects and earnings for the tax 12 months.

Make sure to regulate the highest the place it says "No issues detected." If there are points, it would be best to make sure that they’re rectified. Koinly has self-help articles for frequent points and their buyer help group is admittedly environment friendly in the event you get caught.

Wanting on the report, it is possible for you to to scroll to the underside and choose one of many obtain choices out there, or just obtain as a CSV, Excel, or PDF file.

And that’s it. From right here you’ll be able to both ship this tax report off to your accountant or log into your tax preparation software program like TurboTax and add the doc, job accomplished. 🤓

Who’s the Finest Match for Koinly?

Koinly is a software that anybody who dabbles in cryptocurrency can use, from those that merely hodl, to superior {and professional} customers who regularly commerce, run a enterprise, or dive into the complexities of DeFi.

This tax software program is utilized by retail merchants, accountants, companies, and accountancy companies alike, there isn't anybody that Koinly isn't appropriate for. For anybody who finds crypto taxes overwhelming, Koinly additionally has a group of specialists who’re more than pleased to stroll you thru the entire course of to ensure you are assured along with your tax duties.

The Execs & Cons of Utilizing Koinly vs Different Crypto Tax Software program

There are a number of cryptocurrency tax softwares out there that intention to fulfil the identical want as Koinly, however there are two that I might say stand out above the remainder. These two are Koinly and CoinLedger (beforehand referred to as Cryptotrader.tax).

The explanation I really feel these two are the perfect crypto tax software program instruments is that they’ve been within the business a very long time and the groups aren't simply "crypto bros" designing software program to attempt to assist with crypto taxes. Each corporations have labored carefully with tax professionals to make sure that the platforms are as correct and compliant as potential. Each corporations even have tax professionals on the payroll, so customers will be assured these platforms are up to date to replicate the most recent cryptocurrency rules and necessities.

Each platforms even have licensed accountants readily available to assist customers with any tax questions or points they might have, which is a big plus. Each CoinLedger and Koinly are additionally trusted by a whole bunch of hundreds of customers worldwide, not simply retail customers, however skilled accountants and companies as nicely.

Both of those platforms is greater than appropriate for any retail or enterprise consumer, however I must give Koinly the sting for accountants as they’ve devoted instruments and assets out there to assist accountants develop their enterprise and tackle crypto shoppers as nicely.

In all honesty, I can't actually provide you with any cons to utilizing Koinly over most crypto tax software program. The fee is affordable, there’s a free model, and the platform delivers very nicely on what it guarantees. If you’re keen on exploring different tax software program, we examine the highest crypto tax instruments in our Prime Tax Instruments article.

In the event you favor video format or are keen on Man's take, listed here are his favorite crypto tax instruments:

Koinly Charges

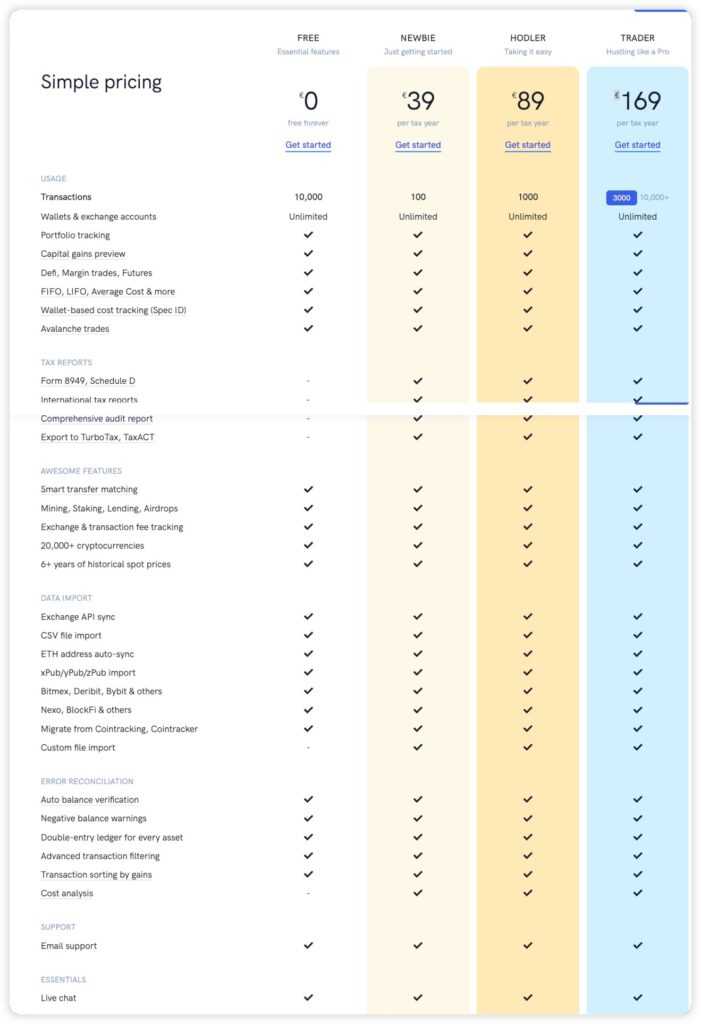

Koinly has a tiered price construction starting from free to €169 per 12 months relying on utilization and wishes of the consumer. The free model is nice for lite customers who solely want portfolio monitoring and previews, then the costs improve because the consumer wants get extra complicated. Here’s a have a look at the options which can be out there with every worth stage.

Conclusion

Koinly is a improbable tax software that makes crypto tax administration as straightforward as potential, offering one of the complete platforms out there that may present options to satisfy the wants of any crypto consumer.

The Koinly group has years of expertise within the subject of finance and accounting, in addition to crypto, and that is evident within the platform developed that’s trusted by each common customers and tax professionals around the globe. I wouldn't hesitate to suggest Koinly to anybody who’s seeking to make tax season as painless as potential.

👉 Signal as much as Koinly and get your taxes accomplished in minutes with ease!

Incessantly Requested Questions

What does Koinly do?

Koinly is a crypto tax software program that simplifies the complicated strategy of managing and reporting cryptocurrency taxes. It robotically tracks cryptocurrency transactions throughout numerous exchanges and wallets, calculates positive aspects and losses, and generates detailed tax studies.

Moreover, Koinly helps totally different accounting strategies, integrates with fashionable tax software program like TurboTax, and affords complete instruments for portfolio monitoring and analytics. It’s designed to assist customers guarantee correct and compliant tax reporting, saving them vital effort and time, particularly throughout tax season.

How Correct is Koinly?

Koinly has been precisely aiding individuals with their crypto taxes since 2018, and was developed with the assistance of a group with huge expertise within the tax and finance business, resulting in a tax software program that’s extremely correct. Koinly states that it has over 98% accuracy in matching transfers between wallets and states that tax calculations are correct and compliant with tax authorities.

Does Koinly Report back to IRS?

No, Koinly doesn’t report on to the IRS, however customers can use it to file their taxes and create capital positive aspects and losses calculations on Schedule D and populate kind 8949 which can be utilized for IRS reporting.

Does Koinly Work with DeFi?

Sure, Koinly may also help with tax imports and generate tax studies from crypto exercise undertaken on decentralized exchanges, wallets, lending protocols and extra.

Is Koinly Compliant with Native Tax Legal guidelines?

Sure, Koinly collaborates with native crypto and tax specialists to generate crypto tax studies that conform to tax workplace necessities and cling to native tax legal guidelines. When you select the respective consumer’s residence nation, Koinly summarizes crypto capital positive aspects and losses in response to the native tax rules and accounting approaches, whereas presenting the full in the popular forex.

Is Koinly protected and legit?

Sure, Koinly is a protected and legit crypto tax software program. It’s extensively trusted by particular person customers, accountants, and companies globally. Koinly has been in operation since 2018, and its repute is bolstered by its potential to combine with over 400 exchanges and 100 wallets, supporting the tax reporting wants of customers in additional than 100 international locations.

The software program is designed with safety in thoughts, utilizing API keys for read-only entry to alternate knowledge, and it doesn’t have the flexibility to provoke transactions in your behalf.

Is Koinly utterly free?

Koinly affords a free model, however it’s restricted in performance. The free model permits customers to trace their cryptocurrency portfolios and preview capital positive aspects and earnings studies. Nonetheless, to generate tax studies, customers might want to improve to one in all Koinly’s paid plans. The price of the paid plans varies relying on the extent of utilization and the complexity of the consumer’s tax wants, starting from fundamental to superior tiers.

Are you able to withdraw cash from Koinly?

No, you can not withdraw cash from Koinly. Koinly is a crypto tax and portfolio monitoring software program, not a pockets or alternate. It doesn’t maintain or handle your funds. As an alternative, it integrates along with your wallets, exchanges, and different platforms to trace transactions and generate tax studies.

Is it protected to hook up with Koinly?

Sure, it’s usually protected to hook up with Koinly. The platform makes use of read-only API keys to entry your transaction knowledge, which suggests it can not provoke transactions or withdraw funds out of your accounts. Moreover, Koinly adheres to sturdy safety protocols to guard your knowledge. Nonetheless, it’s at all times really helpful to make use of distinctive API keys with the minimal permissions required and observe finest practices for securing your crypto accounts.

Who’s the proprietor of Koinly?

Koinly was based in 2018 by Robin Singh, who serves because the CEO. The corporate is headquartered in London and has turn into a trusted answer for crypto tax administration throughout the globe.