Blockchain expertise has redefined finance with a digital native structure. Novel, cryptocurrency-based revenue methods like staking and yield farming are the brand new face of passive funding.

The blockchain world is dwelling to a number of centralized and decentralized platforms providing passive revenue providers on cryptocurrencies. This KuCoin Earn evaluate will discover the ‘Earn’ passive funding merchandise of the KuCoin crypto trade, which includes a suite of conventional and DeFi funding providers.

If you wish to study extra about KuCoin, be at liberty to take a look at our:

- KuCoin In-Depth Overview

- KuCoin Buying and selling Information

And see how KuCoin stacks up towards the competitors in our evaluation articles:

- KuCoin vs

- Bitget

- Coinbase

- Bybit

- OKX

- Binance

- SwissBorg

Be aware: Customers positioned within the US and UK usually are not supported.

KuCoin Earn Overview Abstract:

KuCoin Earn is a multi-faceted monetary product on the KuCoin trade that seeks to assist customers earn returns on their cryptocurrency holdings with quite a lot of cryptocurrency-based funding merchandise. It gives conventional passive revenue providers like mounted deposit financial savings merchandise and lending. Earn additionally options DeFi funding merchandise like crypto lending, staking, and Polkadot auctions, in addition to a number of superior merchandise that leverage choices to supply multiplied earrings for seasoned merchants. It’s important customers conduct the required due diligence to weigh KuCoin Earn’s related dangers towards their preferences.

| Headquarters: | Seychelles |

| 12 months Established: | 2017 |

| Regulation: | Not regulated by any nationwide licensing our bodies. Is legally working as a Digital Asset Alternate underneath Seychelles regulation |

| Spot Cryptocurrencies Listed: | 900+ |

| Native Token: | KuCoin Token (KCS) |

| Maker/Taker Charges: | Lowest: 0.00%/ 0.04% Highest: 0.08%/ 0.08% |

| Safety: | Excessive |

| Newbie-Pleasant: | Some options are beginner-friendly, although KuCoin is greatest suited to skilled and superior merchants. |

| KYC/AML: | Required. Limits will be discovered on KuCoin’s Assist Web page. |

| Fiat Foreign money Assist: | 50+ Currencies supported via integrations and varied strategies |

| Deposit/Withdrawal Strategies: | SEPA Financial institution Switch, Debit/Bank card, P2P, Apple Pay, Simplex, Banxa. Quick Purchase helps 70+ cost strategies via varied third-party integrations Withdrawing fiat just isn’t supported |

The Key Options of KuCoin Earn Are:

- Balanced merchandise:

- Financial savings – Earn curiosity from crypto deposits.

- Staking – Take part in DeFi protocols to earn rewards.

- Promotions – Earn larger curiosity than Financial savings.

- ETH Staking – Ethereum liquid staking product.

- KCS Bonus Plan – Hodl KCS to earn a share of buying and selling charge income.

- KuCoin Wealth merchandise:

- Snowball – Predict market vary to earn amplified returns.

- Twin-Win – KuCoin event-driven funding technique.

- Covert Plus – Assured asset conversion at a predetermined charge.

- Twin Funding – Volatility-driven funding product.

- Future Plus – Leverage with restricted draw back.

- Shark Fin – Principal preserving funding product.

- Specialised merchandise:

- Crypto Lending 2.0 – Lend cryptocurrency with customizable APYs

- Polkadot Public sale – Take part within the Polkadot and Kusama Slot public sale by way of KuCoin.

- Burning Drop – Stake crypto to earn token distribution airdrops.

KuCoin Firm Overview

KuCoin is a cryptocurrency trade based by Johnny Lyu and Michael Gan in September 2017. It is among the hottest crypto exchanges identified for its numerous crypto listings which might be wider than well-known exchanges like Binance and OKX. The corporate is headquartered in Seychelles, though the crypto trade serves a world buyer base that’s interested in its user-friendly interface and aggressive buying and selling charge construction.

Key Options of KuCoin:

- Numerous itemizing – KuCoin gives a whole lot of cryptocurrencies spanning in style tokens, stablecoins, DeFi tokens, meme cash, and a number of other small-cap cash on its buying and selling platform.

- Consumer expertise – The platform’s user-friendly interface is simple to navigate and ideally suited for common customers.

- Low buying and selling charges – KuCoin gives probably the most aggressive charges amongst cryptocurrency exchanges.

- KuCoin Buying and selling Bot – KuCoin gives buying and selling bots for a number of well-known cryptocurrencies.

- Superior options – Apart from the spot market, Kucoin helps superior buying and selling methods like margin buying and selling, futures buying and selling, and leverage.

- Passive revenue instruments – KuCoin gives passive revenue alternatives on crypto mounted deposits.

- DeFi options – The platform additionally gives some DeFi-specific merchandise like staking crypto on the blockchain.

- KuCoin token – As Kucoin's native token, KCS gives buying and selling charge reductions and a share of KuCoin’s buying and selling charge income.

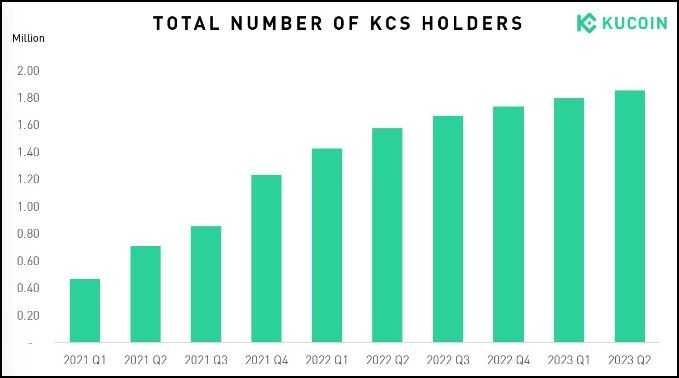

Regardless of the worldwide financial downturn drying up VC taps, fleeting curiosity in digital property, and the detour of funding initiatives towards AI-driven startups, KuCoin has displayed resilience and development in 2023.

Benefits of KuCoin:

- Regular development – KuCoin customers jumped by 26% midway via 2023, signalling a rising consumer curiosity and buying and selling quantity within the crypto trade.

- Sturdy buyer assist and safety measures– KuCoin is dedicated to providing globally accessible buyer assist and launched anti-fraud measures earlier this yr to enhance platform safety.

- Proof of Reserves – The platform constantly updates its Proof of Reserves (PoR) information and retains essentially the most traded property like BTC and ETH over collateralized for added safety.

- KuCoin Neighborhood Chain (KCC) – KCC is a rising ecosystem of DeFi, GameFi, NFT, and different Web3 infrastructures with important partnerships with safety kinds like Certik and PeckShield.

This evaluate will give attention to the ‘Earn’ part of KuCoin. For those who want to delve deeper into the specifics of the KuCoin platform, take a look at our KuCoin evaluate.

What Earn Merchandise Does KuCoin Supply?

To make use of the KuCoin trade and its Earn merchandise, customers should first register with the trade and create an account utilizing their e mail. KuCoin mandates a KYC verification for all its customers to make sure fund safety and integrity of the consumer’s account.

As soon as registered, customers can entry the Earn part from the web site homepage, the place the merchandise are categorized as balanced (together with merchandise like staking and financial savings), superior (with merchandise like twin funding), and a few specialised merchandise like lending and Polkadot auctions.

Allow us to dive deeper into every of those merchandise, beginning with the balanced Earn merchandise:

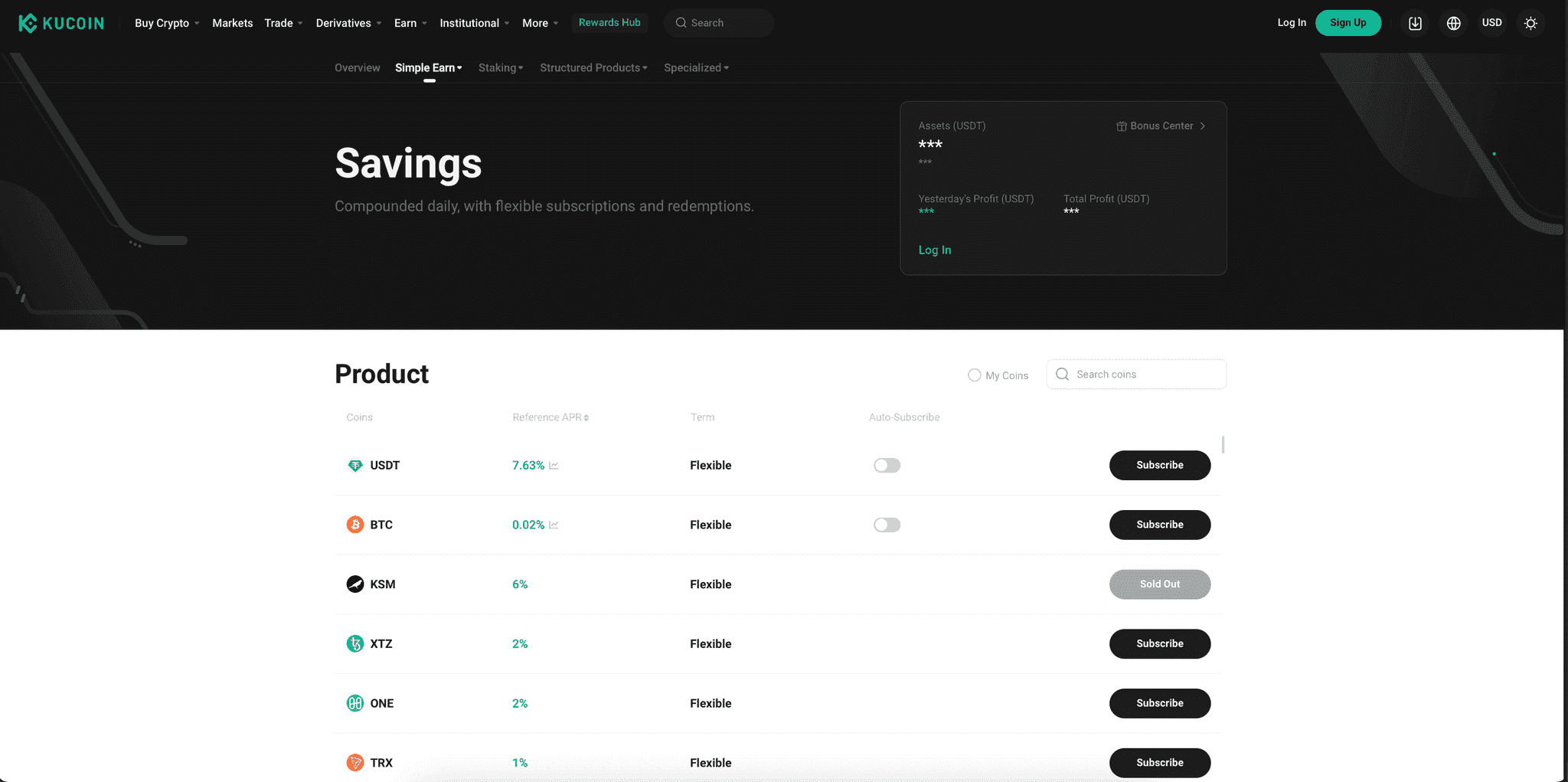

KuCoin Financial savings

Buying crypto from the Spot buying and selling account opens entry to the KuCoin Financial savings product. Subscribers earn compound curiosity on their crypto deposits, that are credited to their Monetary account.

Advantages of the Financial savings Product:

- Passive revenue – The Financial savings product stands out as a simple, easy-to-use stream of curiosity revenue.

- Versatile – KuCoin permits fast withdrawal of the subscriber’s deposits.

- Compound curiosity – The earned curiosity is reinvested into the financial savings product for added earnings, compounding the returns.

Dangers of the Financial savings Product:

- Default threat – KuCoin doesn’t explicitly assure the crypto asset deposits within the Financial savings product. Subsequently, the deposits could run a threat of loss if the borrower defaults.

- Counterparty threat – As a centralized trade, KuCoin doesn’t possess a verifiable and decentralized safety mannequin. It might get hacked or go bankrupt.

- Rate of interest fluctuations – The rate of interest provided by the financial savings product could change with dynamic market situations, making returns unpredictable.

- Regulatory threat – Kucoin is topic to regional rules concerning providing cryptocurrency-based monetary merchandise, that are nonetheless immature.

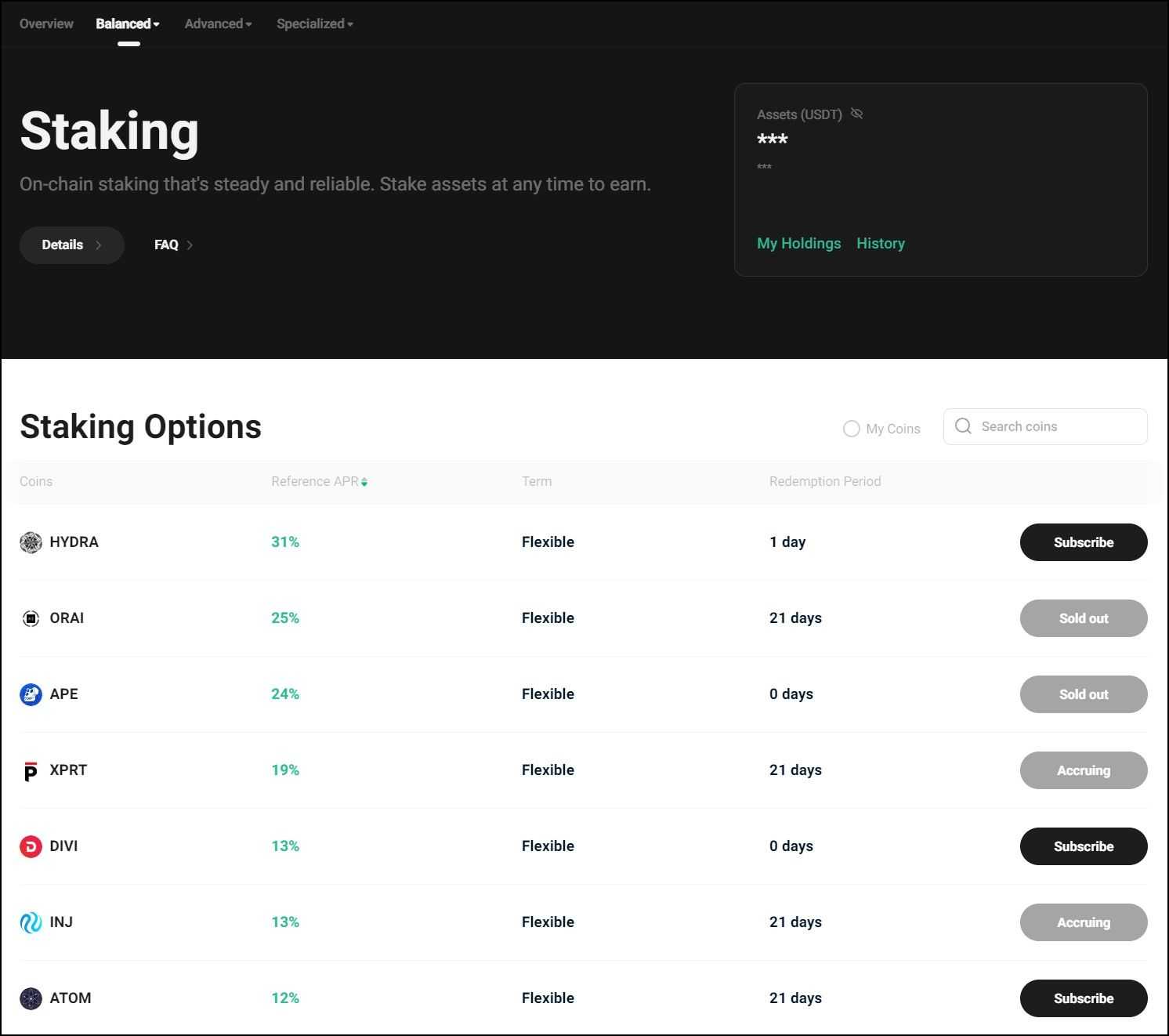

Kucoin Staking

Customers can take part in a number of DeFi protocols with the assistance of the KuCoin Staking product. After the locking interval of staked property ends, KuCoin will routinely launch the property to the consumer’s Buying and selling Account. In the course of the staking interval, customers can commerce their staked property within the Liquidity Buying and selling Market or select to redeem their stake earlier than the redemption interval.

Advantages of KuCoin Staking:

- Simple to make use of – It doesn’t contain difficult key administration and gives straightforward redemption of funding.

- Selection – KuCoin gives a number of cash in its staking product and updates this checklist recurrently.

- Versatile Phrases Accessible– Staked property don’t have to be locked up

Dangers of KuCoin Staking:

- Good contract threat – The corresponding DeFi protocols run the chance of exploitation or programming errors.

- Platform threat – Customers don’t management the personal keys used for staking their funds and should belief KuCoin’s integrity.

- Market threat – The returns from the staking merchandise are estimates and will fluctuate when the market is extraordinarily risky.

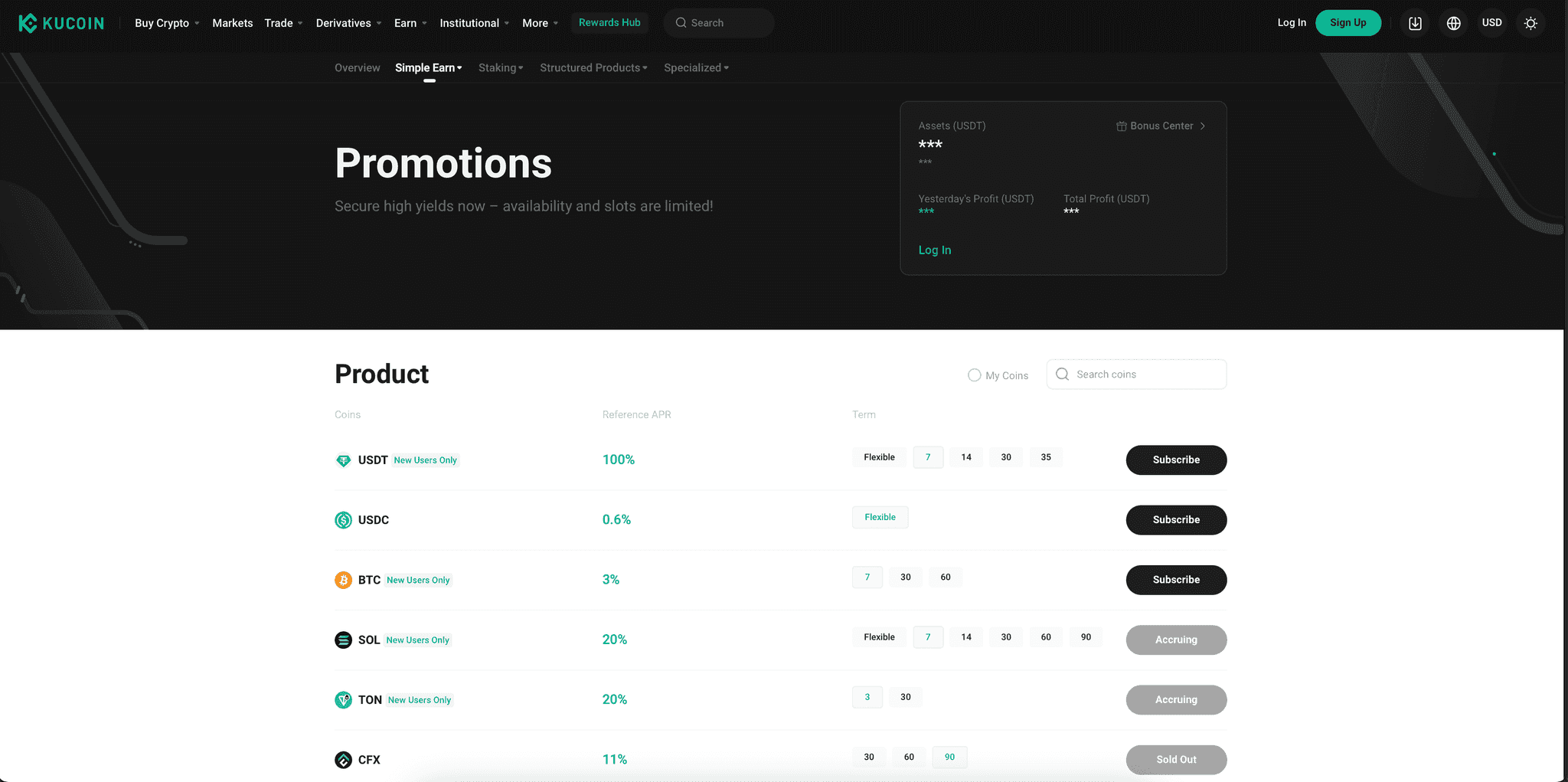

KuCoin Promotions

Just like the KuCoin Financial savings product, Promotions is a hard and fast deposit product that accrues curiosity over time. Nevertheless, in Promotions, the accessible liquidity is restricted, and customers can select between a versatile or mounted funding scheme. It normally gives larger returns than what Financial savings and Staking merchandise on KuCoin provide.

Versatile deposits are redeemable at any time, whereas Mounted deposits are locked for the chosen time period, and funds are routinely redeemed to the consumer’s account upon maturity. Mounted merchandise have a tendency to supply higher returns than versatile merchandise.

Dangers and Advantages of the KuCoin Promotions Product:

The KuCoin Promotions merchandise run the identical dangers because the Financial savings product. Moreover, customers who go for mounted deposits are extra delicate to market and platform dangers. The Promotions product’s restricted liquidity and higher returns additionally topic this product to excessive demand.

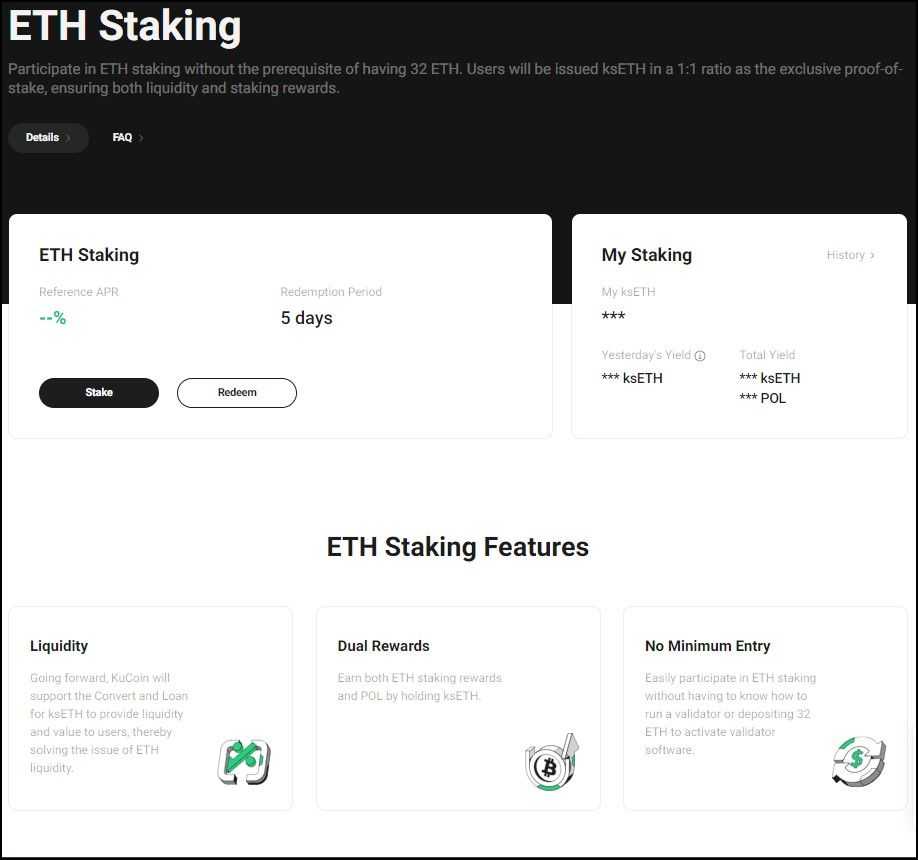

KuCoin ETH Staking

The Ethereum community migrated to Proof of Stake after the Merge. The intricately designed and financially demanding stipulations for staking as a validator propelled the liquid staking business in Ethereum.

In staking as a service, customers leverage third-party service suppliers to take part within the Ethereum consensus without having to run a validator node independently. A 3rd-party validator node swimming pools ETH deposits from a number of customers and stakes them on the community on their behalf, distributing the rewards proportionately after charging compensation.

Liquid staking is a passive funding product that gives publicity to Ethereum staking rewards and lowers entry limitations by letting customers stake an quantity considerably lower than the 32 ETH required historically. Moreover, liquid staking suppliers mint a liquid, one-to-one illustration of the consumer’s staked ETH that they might use for buying and selling or in DeFi. KuCoin is among the many centralized (Binance, Coinbase, Kraken, and many others.) and decentralized (Lido Finance, RocketPool, and many others.) liquid staking service suppliers.

KuCoin ETH Staking Options:

- ksETH – KuCoin customers who stake ETH on KuCoin get hold of an equal quantity of ksETH, which they might preserve of their Funding or Buying and selling Accounts. Holders of ksETH will obtain the proportionate staking rewards distributed by KuCoin.

- Liquidity – KuCoin helps the ksETH/ETH pair on its buying and selling platform to make sure their straightforward trade and practically equal worth.

- Redemption – The ETH staked on KuCoin is redeemable anytime after a brief ready interval.

- Rewards – KuCoin retains 8% of the staking rewards to cowl working prices and distributes the remaining amongst ksETH holders proportionately.

KuCoin ETH Staking Market Comparision:

| KuCoin | Binance | Coinbase | Kraken | RocketPool | Lido Finance | |

| Fee | 8% | 10% | 25% | 15% | Variable | 10% (variable) |

| Min. Staking Quantity | 0.01 ETH | 0.0001 ETH | No min. quantity | Unspecified | 0.01 ETH | No min. quantity |

| Reward Distribution | Every day | Every day | Each Three Days | Weekly | 2-3 Days | Unspecified |

| Governance | CeFi | CeFi | CeFi | CeFi | DeFi | DeFi |

| Staking Dangers | Not lined | Lined | Lined | Not Lined | Not Lined | Not Lined |

| Different | Extra Platform Rewards | Easy Earn Advantages | Retain Possession | Extra Rewards | rETH Token Advantages | stETH Token Advantages |

KCS Bonus Plan

KCS Bonus is an incentive system to encourage customers to carry KCS and earn passive revenue. It’s a easy plan the place customers simply want to carry at the very least 6 KCS of their KuCoin account, making them eligible to get a every day bonus coming from 50% of KuCoin’s every day buying and selling charge income. The reward quantity could fluctuate relying on the buying and selling quantity and the quantity of KCS the customers maintain. KuCoin claims the bonus plan has rewarded an APR of 3-30% in 2021.

The KCS Token

KCS is the native token for the KuCoin trade. It’s a utility token with which customers will pay charges on KuCoin, gasoline the Dapp ecosystem of the KCC chain, and share the expansion advantage of the trade. Initially an ERC-20 token, KSC has continued emigrate to the KCC chain since 2021.

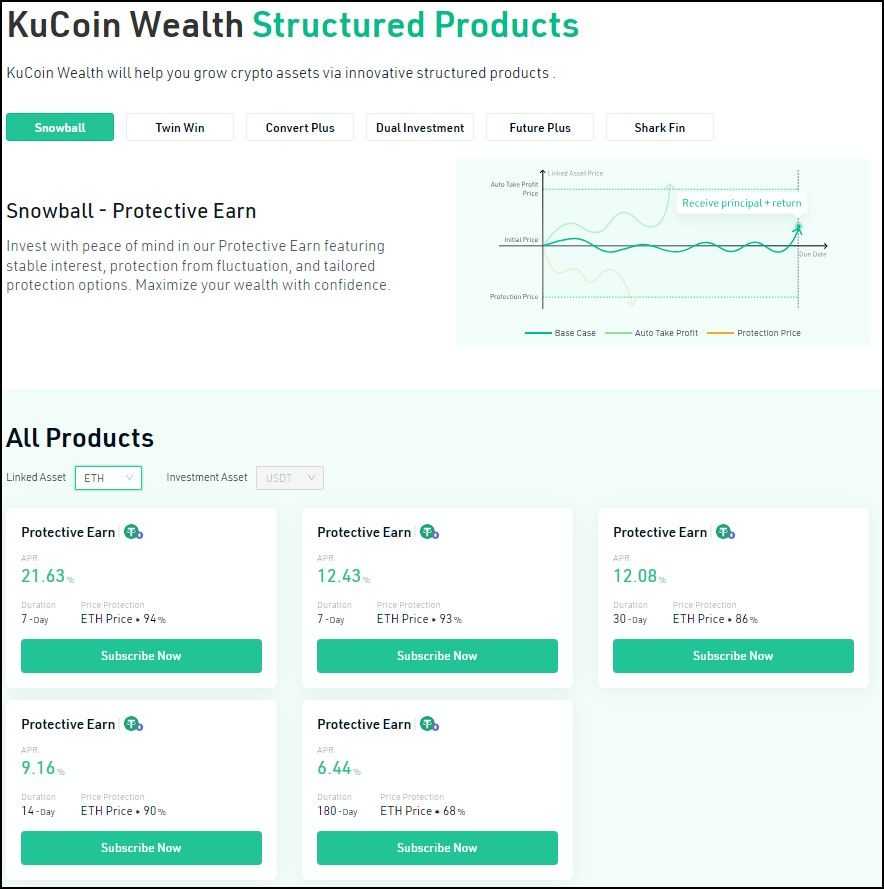

KuCoin Wealth Merchandise

KuCoin Wealth is a set of structured funding merchandise that lets customers revenue from totally different market situations. These merchandise are monetary devices with diversified risk-reward ratios that the traders could select based mostly on their wants.

Most KuCoin wealth merchandise are constructed with a mix of choices methods. Customers will need to have a view of the long run motion available in the market based mostly on which they might subscribe to KuCoin Wealth choices. These merchandise are pretty intricate and prone to detrimental returns if the market strikes towards the consumer’s bets.

KuCoin Wealth is supposed for seasoned merchants with an intensive information of monetary devices and volatility dangers and a good thought about cryptocurrency markets. KuCoin gives a variety of Wealth merchandise. Some are principal-protected, whereas others are extra aggressive. KuCoin gives the next Wealth merchandise:

KuCoin Snowball – Protecting Earn

KuCoin gives the Snowball technique for USDT, ETH, and BTC. Snowball deploys choices methods the place the consumer receives the designated returns so long as their place stays within the desired vary.

Subscribers are protected towards sharp fluctuations as follows –

- The breach of the higher vary closes the place and credit the consumer with the principal and accrued curiosity.

- The breach of the decrease vary closes the place and protects the consumer towards additional loss.

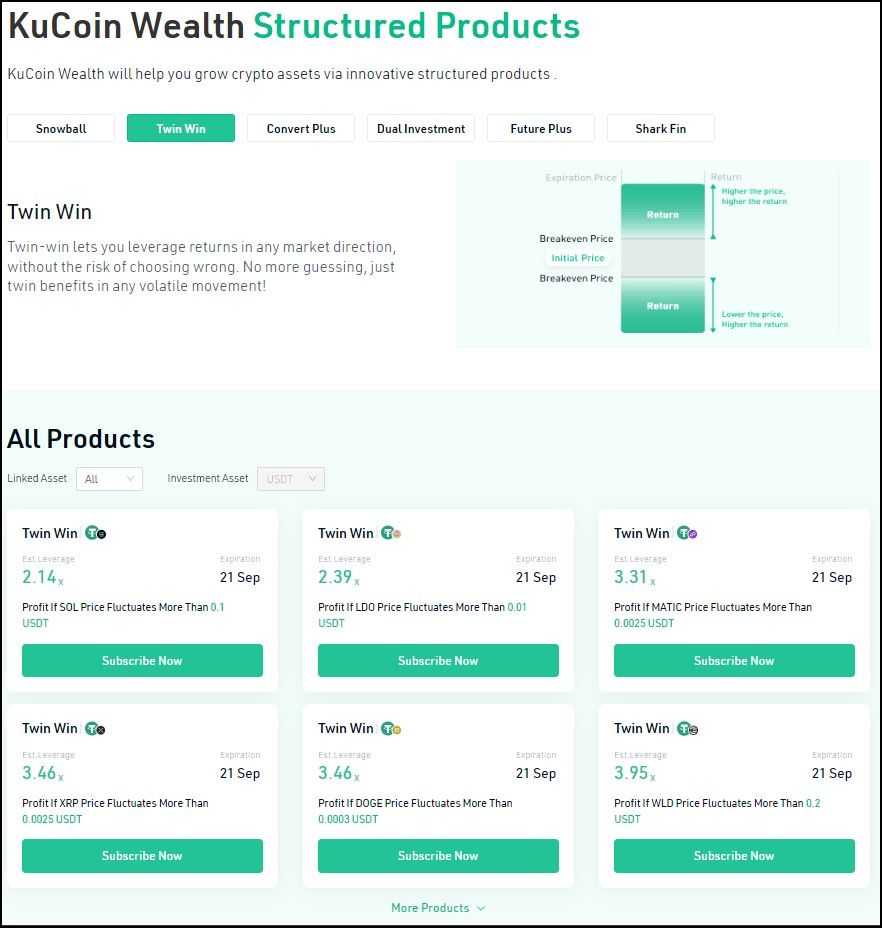

KuCoin Twin-Win

KuCoin Twin-Win is an event-driven buying and selling technique. It’s a technique the place customers can capitalize on market volatility pushed by important market occasions. The technique bets on volatility, which suggests the extra risky the market, the upper the return, whereas they incur a loss if the occasion fails to realize the goal volatility.

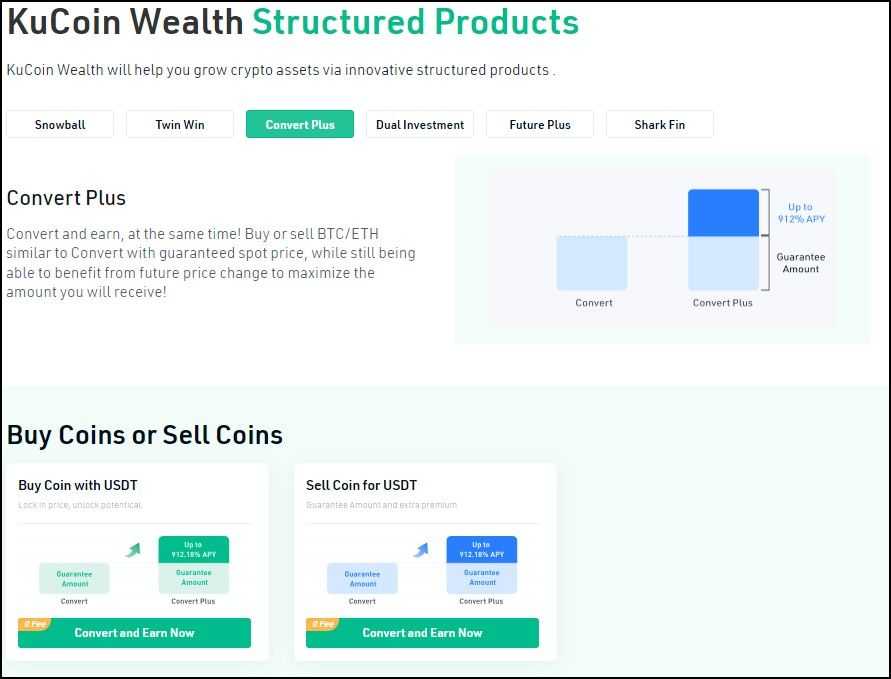

KuCoin Convert Plus

Convert Plus is a buying and selling technique that deploys choices to let customers lock a conversion value for an asset they need to convert at a later date. The technique ensures the conversion value upon maturity and gives extra rewards if the underlying asset's value rises above the conversion value.

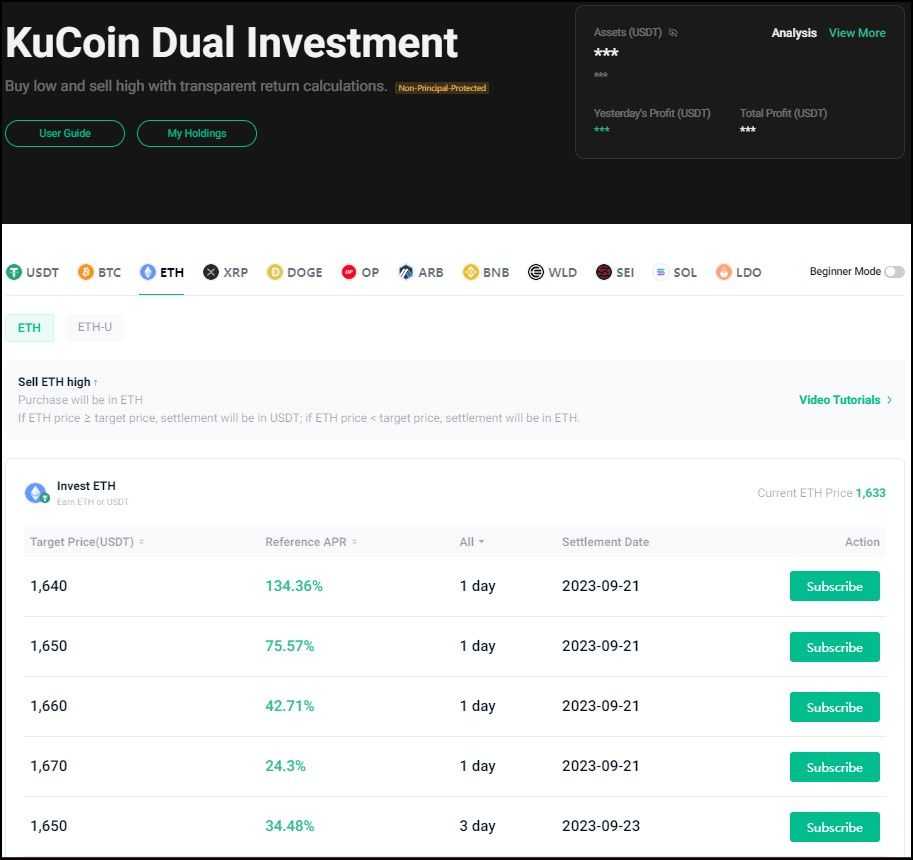

KuCoin Twin Funding

The KuCoin Twin Funding is a sophisticated, non-principal-protected monetary product that gives excessive yields. Right here’s the way it works:

- Choose the pair: subscribers first select a pair of property to spend money on. Normally, a cryptocurrency is paired with a steady asset like stablecoins.

- Choose the phrases: The consumer should select a goal value and settlement date they like for the cryptocurrency. They might wager on its value to go up or down and choose the goal value accordingly.

- Deposit the asset: Subscribers deposit the required property into the funding product.

- There are two attainable return situations.

- Value above the goal value: On this case, the consumer will get their preliminary funding again within the stablecoin denomination on the maturity date with the accrues curiosity.

- Value beneath the goal value: On this case, the consumer will get their preliminary funding again in cryptocurrency denominations, primarily permitting them to purchase extra of the asset at a “discount” in comparison with the goal value.

The Twin Funding product gives potential positive factors from rising and falling markets whereas incomes curiosity. Nevertheless, subscribers should be cautious of this technique throughout extreme volatility, the place the chance value of this technique could outweigh its positive factors.

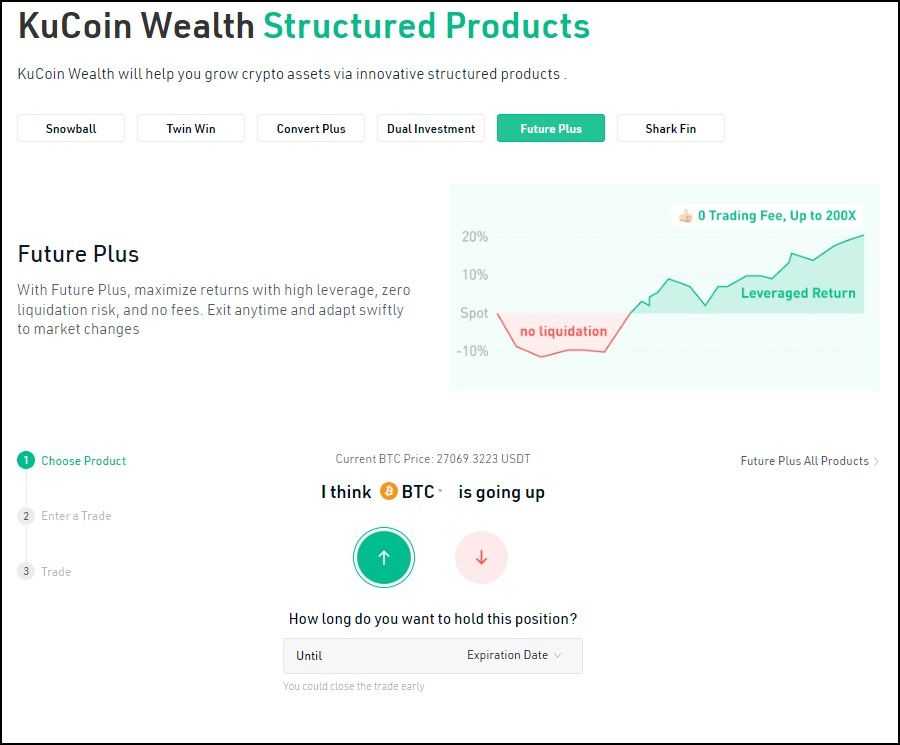

KuCoin Future Plus

The KuCoin Future Plus is a structured funding product that mixes returns from directional market motion and leverage whereas limiting draw back threat. Subscribers choose a breakeven value, leverage quantity, and market view.

If their view is appropriate, the upside revenue is multiplied by their leverage, however the draw back threat is mitigated by locking their loss to the preliminary capital invested into the product.

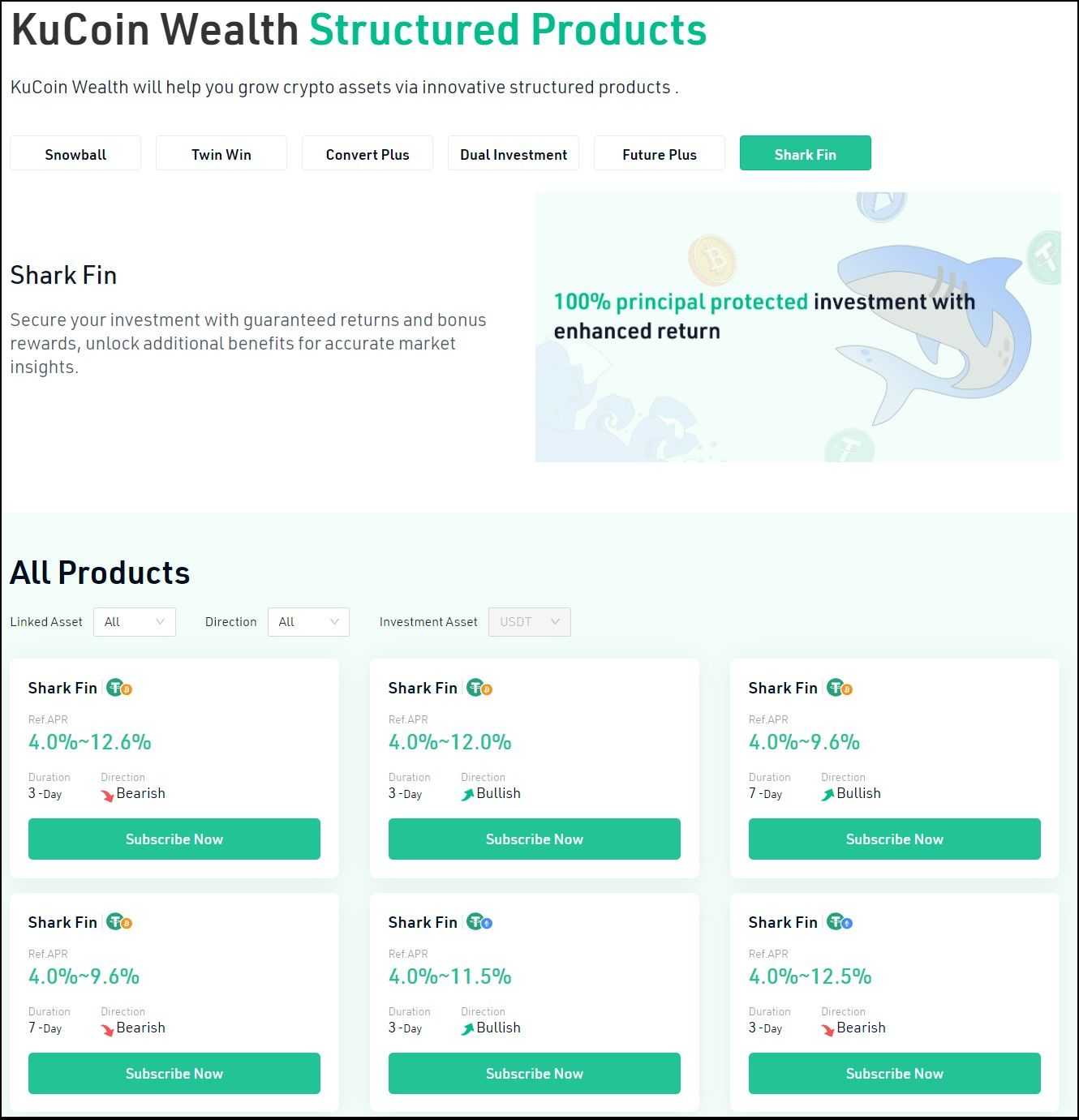

KuCoin Shark Fin

The KuCoin Shark Fin is a principal preserving passive funding product that makes use of choices to generate assured returns for its subscribers. This product ensures a minimal return to subscribers and gives extra rewards if their directional view of the market seems appropriate.

KuCoin Crypto Lending 2.0

Crypto Lending 2.0 is a passive funding product the place KuCoin mediates capital stream between lenders and debtors. It permits subscribers to lend their crypto property and earn curiosity on them. Right here is the way it works –

- Subscription – Customers can subscribe to lend a number of supported property and set a minimal lending APY.

- Matching – The consumer’s subscription is matched with a borrower who agrees to pay the curiosity the lender calls for.

- Curiosity distribution – Subscribers obtain an curiosity based mostly on the quantity lent out and the lending rate of interest, which is distributed each hour.

- Redemption – Lenders can redeem their property at any time however with a one-hour delay. The redemption could get additional delayed if the funds within the asset pool that cowl the lender’s mortgage are inadequate.

- Auto-Subscribe – KuCoin additionally supplies an Auto-Subscribe characteristic, which lets customers automate the lending course of.

Advantages of crypto lending on KuCoin:

- Passive revenue – Lending your crypto property permits you to earn curiosity, offering a passive revenue supply.

- Flexibility – KuCoin Crypto Lending 2.0 gives a extra versatile lending expertise, with hourly curiosity distribution and the flexibility to redeem lent property with a minimal of T+1 hour after matching.

- Diversification – Crypto lending will be part of your funding technique, serving to to diversify your portfolio and handle threat.

- Consumer-friendly – The platform is designed to be straightforward to make use of, making it accessible for each skilled and new crypto traders.

Dangers of crypto lending on KuCoin:

- Counterparty threat – When lending your property, there’s a threat that the borrower could default on their mortgage. Nevertheless, KuCoin requires debtors to keep up a certain quantity of collateral to reduce this threat.

- Platform threat – There’s a threat related to utilizing any on-line platform, together with potential safety breaches or technical points. KuCoin has applied safety measures to guard customers' property, however staying knowledgeable concerning the platform's safety practices is crucial.

- Market volatility – Crypto markets are identified for his or her volatility, impacting the worth of your lent property and the curiosity you earn.

- Regulatory threat – Crypto lending is topic to regulatory modifications, which might affect the platform's operations and your capability to lend or redeem your property.

KuCoin Polkadot Public sale

Polkadot auctions parachain slots, a layer-2 on the Polkadot community the place helps bid for his or her favourite initiatives with DOT. The bids are locked on-chain and returned after the public sale is full. The bidders of the successful slot obtain extra rewards as token allocation on the Polkadot community.

A KuCoin account with DOT holdings can even take part within the Polkadot Slot Auctions. Listed here are some advantages of collaborating within the public sale by way of KuCoin:

- Easy – An public sale participant on KuCoin doesn’t need to take care of good contracts and complex blockchain purposes, making the public sale expertise easy and simple.

- Kusama auctions – Kucoin additionally lets customers take part in Kusama Slot Auctions, one other Polkadot blockchain community from the identical account and DOT holdings.

- Extra rewards – KuCoin rewards public sale winners with a share of the KuCoin Rewards Pool as an extra incentive, amplifying returns.

If you wish to study extra about Polkadot Slot Auctions, Guys covers that within the video beneath:

KuCoin Burning Drop

KuCoin Burning Drop permits customers to take part in token distribution schemes of latest initiatives by staking supported property like KCS, ETH, and USDT of their KuCoin account.

Right here is how the Burning Drop course of works:

- Staking – Customers stake the required tokens for a specified interval, normally 20 days.

- Burning Acceleration Interval – It is a interval when customers who beforehand staked within the Burning Drop can burn their POL (a reward obtained for subscribing to KuCoin Earn merchandise) to earn extra tokens rewards.

- Token distribution – Individuals obtain their share of latest tokens on the finish of the staking interval.

Is KuCoin Protected?

KuCoin is a widely known cryptocurrency trade that has been in operation since 2017. The platform employs safety measures like encryption protocol and two-factor authentication for added account safety.

Nevertheless, the security of KuCoin, like all centralized monetary service, just isn’t utterly clear and verifiable. KuCoin emphasizes the significance of data of inherent dangers related to staking cryptocurrencies. Customers should perceive the significance of possessing personal keys and if giving up that privilege is a viable trade-off of their private funding context.

KuCoin can be topic to operational and upkeep downtimes and susceptible to blackswan occasions like exploits. On September 25, 2020, KuCoin underwent a safety incident the place hackers obtained personal keys to the trade's sizzling wallets and drained over $280 million in varied crypto property traded on the platform.

As with all monetary service, due diligence and a transparent understanding of the related dangers are important for customers contemplating staking property on KuCoin Earn.

KuCoin Earn Overview: Closing Ideas

KuCoin Earn is a powerful participant within the fast-paced world of cryptocurrency finance, providing a broad vary of merchandise and a user-friendly expertise that appeals to each newcomers and seasoned traders trying to broaden their portfolios.

But, like all funding enterprise, it's essential to proceed with warning and totally perceive the related dangers and intricacies. Because the cryptocurrency market continues to evolve, KuCoin Earn is well-positioned to leverage this development, offering a complete platform for managing crypto property that distinguishes it from different opponents.

Often Requested Questions

Does KuCoin Have Earn?

Sure, KuCoin gives a characteristic known as KuCoin Earn, which permits customers to stake cryptocurrency in varied passive funding merchandise and earn rewards. KuCoin goals to supply a user-friendly expertise with options like mounted and versatile funding in order that it caters to each novice and expert traders.

Is KuCoin Earn Protected?

KuCoin deploys security measures like encryption and 2FA to safe consumer accounts. Nevertheless, no funding platform is totally risk-free, and KuCoin has suffered exploits previously. KuCoin has executed lots to enhance its safety and follows business greatest practices, however as with all monetary service, due diligence is crucial.

How Do You Stake in KuCoin?

To stake in KuCoin Earn, customers want a KYC-verified account with adequate deposits of the involved cryptocurrencies. Customers can navigate to the KuCoin Earn part and flick through varied staking plans to seek out one which fits their funding wants. Keep in mind to learn the staking product phrases earlier than locking the property for staking. The rewards are distributed to the consumer’s Buying and selling Account or Monetary Account routinely.

Can US Residents Use KuCoin?

The KuCoin trade just isn’t licensed to function within the US. Subsequently, US residents can not full the KYC verification required to unlock the KuCoin Earn merchandise.

Is KuCoin Higher Than Coinbase?

KuCoin and Coinbase are each in style cryptocurrency exchanges, however they cater to barely totally different consumer preferences. KuCoin gives a variety of cryptocurrencies and easy and superior passive revenue options. Coinbase is extra user-friendly however is topic to stricter rules and fees larger charges than KuCoin.

How Does KuCoin Earn Work?

KuCoin Earn permits customers to stake varied cryptocurrencies to earn rewards. After depositing the cryptocurrency you want to stake into your KuCoin pockets, you possibly can navigate to the KuCoin Earn part. Right here, you will discover a vary of staking choices, together with versatile and stuck staking.

Select the product that aligns along with your funding technique, learn the phrases, and lock in your property. Rewards are sometimes distributed routinely based mostly on the situations of the particular staking product you’ve got chosen. The platform goals to supply aggressive returns and caters to each novice and skilled traders.

How A lot Does KuCoin Cost to Withdraw?

The platform doesn’t cost deposit charges, however it does have withdrawal charges that depend upon the cryptocurrency being withdrawn. Listed here are the withdrawal charges for some in style cryptocurrencies:

- Bitcoin (BTC): 0.0005 BTC

- Ethereum (ETH): 0.005 ETH

- Solana (SOL): 0.5 SOL

- Cosmos (ATOM): 0.02 ATOM

- Polkadot (DOT): 5 DOT

- Cardano (ADA): 2 ADA

Please be aware that these charges are topic to vary based mostly on community situations and different components. It is suggested to verify essentially the most up to date charge listed on every withdrawal web page on the KuCoin platform.

Has KuCoin Ever Been Hacked?

Sure, KuCoin suffered an exploit in September 2020. Hackers obtained the personal key to a number of the trade’s sizzling wallets and drained about $280 million in varied cryptocurrencies.

Is KuCoin a Good Alternate?

KuCoin is mostly thought-about a good cryptocurrency trade that has been in operation since 2017. It gives a variety of cryptocurrencies for buying and selling and supplies extra monetary merchandise like KuCoin Earn for staking. The platform is understood for its low buying and selling charges and user-friendly interface. Nevertheless, like all monetary platform, it isn’t with out dangers, together with regulatory scrutiny and potential safety vulnerabilities. The standard of an trade typically depends upon particular person wants, such because the forms of property you want to commerce, charge constructions, and security measures.