There are still ways to earn in crypto, even in a bearish market. This is why we’re taking the time dig deeper into the Earn Program at OKX. OKX is not only a global leader in crypto-exchanges, but it also offers a variety of specialized offerings that are worth looking into. You can check out our OKX exchange review to learn more about it. Also, don’t miss the chance to get a discount on all fees for life when you open an account with OKX via Coin Bureau.

👉 Join OKX and receive a 40% discount on all spot trading fees for life.

The management of OKX wanted to show the world that they were so much more than just an exchange, that in 2022 they underwent a complete brand revamp, removing all the traces. “E” Previously, they were part of their “OKEX” name. Name. “E” Stand for “Exchange” It was a way to show the world that OKX is more than just a stock exchange.

You can also read articles about the OKX Exchange in other ways:

- OKX Trading bots: Automated trading on OKX

- OKX Mobile: Trading on the Move with OKX App

- OKX NFT Market Overview

- OKX wallet: The Portal to Web3

- OKX Security: How safe is OKX?

- How to sign up on OKX

After that, let’s look at some of the Earn features that will help you make money using your cryptos as we move into 2023.

Note: Users from the US and UK do not receive support.

OKX Earn

Don't just HODL. Earn.

Staking is the first thing that comes to mind when you think about earning platforms for crypto. OKX Earn includes staking but is much more. When you enter the Earn portal, you will find the following main components:

- Fixed Income – Stable earnings.

- DeFi – Earn with DeFi and 0% fees.

- Savings – Low risk deals & flexible terms.

- Flash Deals – Limited, high APY investments.

- Staking – Stake popular coins for stable returns.

- Carnival – Earn with high APY, and get free NFTs.

- ETH 2.0 Staking – Get into ETH 2.0 staking with no added costs.

- Dual Investment – Advanced investing strategies with potentially higher profits.

You can see that there are several ways to earn at OKX. There are safe, stable strategies with low yields and aggressive strategies with high risks but higher rewards. We’ll dive deeper below into what each of these OKX Earn Products can offer you.

OKX Staking

Staking can be a low-risk way to earn steady returns. Staking is an excellent way of earning a return on tokens, which would otherwise be idle. It is also a good way to ensure a stable and secure yield in any market.

As of December 2022, OKX will allow staking for more than 80 different tokens. Locking your tokens is required. The lock period can range from 15 days to 120, with longer locks bringing higher yields. The yields for top tokens like Litecoin and Ripple are usually lower, around 5%, while many smaller projects can have yields up to 70%. On the OKX Staking rewards page, you can find a full list of the available tokens.

Stake ETH 2.0

Ethereum’s switch to Proof of Stake offers new opportunities for earning money for the millions of ETH users. Many smaller ETH owners are put off by the 32 ETH required to run a fully validator node. OKX avoids this requirement because they pool ETH staked through their ETH2.0 staking protocol, and require a more manageable 0.1 ETH for a minimal stake.

As a proof of staking, you will receive BETH tokens in a ratio of 1:1 when staking with OKX. Daily rewards are given out and, once the Ethereum mainnet is live, you can redeem your BETH tokens for ETH in a 1:1 ratio. The yield for staked ETH on OKX (at the moment of writing) is 5.60%. It’s worth noting that according to the ETH 2.0 on-chain rules, the staked asset is estimated to be locked up for 1-2 years and can't be redeemed until the transfer feature is available in ETH 2.0.

Savings

OKX’s Savings program is an option for those who are seeking a low-risk method to earn a return on their tokens. The money that is deposited in the savings program goes to funding OKX margin loans, and interest payments are made hourly. Note that 15 % of the interest on loans is retained as an insurance fund. Thus the hourly interest rate for lenders is loan principal*APY/365/24*0.85.

Over 140 tokens are available on the platform. While the majority offer a low 1% yield, a few have double-digit yields. The 10% APY on USDC and USDT stablecoins, as well as 365% APY on OMG tokens are particularly attractive.

Fixed Income

The Fixed Income product at OKX offers another way to earn a yield with a small number of tokens. This investment is very similar to the bond issuance of traditional financial models. The borrower must fully secure the loan amount, the terms are fixed (7 to180 days) and the interest will be paid at the end of the term. “bond” The maturity date is reached. At the time of writing there are just four tokens in the fixed income program – USDT, BTC, ETH, and OKB. Yields are between 1% and 4%.

DeFi at OKX

DeFi at OKX lets you earn interest on funds that are sent to decentralized platforms such as Compound and Aave. You can also send money to projects like OpenDAO, SushiSwap and OpenDAO. These DeFi platforms are confusing to some users, especially those who are new. A simplified interface can be very beneficial to the average crypto user.

OKX has stated that the ease of use does not eliminate the risks inherent to DeFi platforms.

“OKX accesses third party DeFi protocols, and only provides related services such as project display and revenue distribution, and does not take responsibility for any asset losses caused by potential risks such as contract vulnerabilities, hacking incidents, or termination of business, bankruptcy, abnormal suspension or cessation of trading of third party DeFi platforms or projects.”

There are no charges for participating in these platforms.

OKX Dual Investment

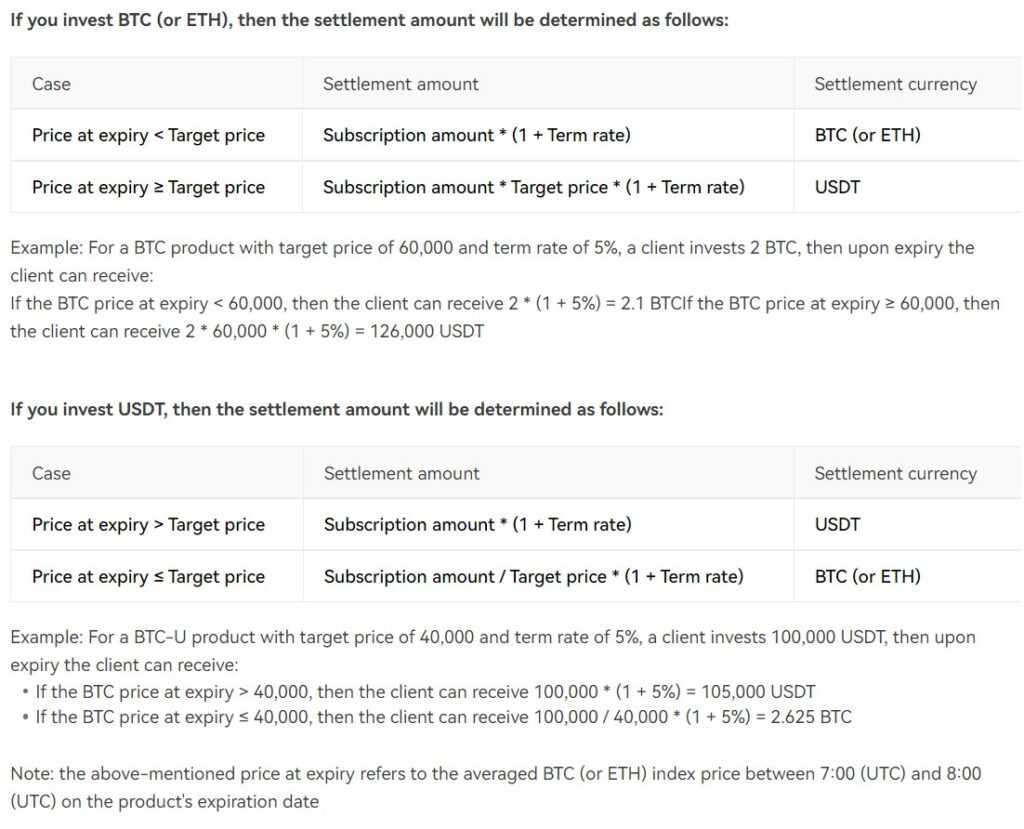

Dual Investment is a product similar to an options offering. This product can be purchased with BTC, USDT, or ETH. You are basically making a prediction on the price of BTC.

You choose a BTC/ETH target price, and you can then decide whether you want to speculate using the crypto target or USDT. Subscribers get a fixed APY for the entire term of the contract, which could be as little as 15 hours or as long as 302 day.

If you reach your target and have USDT in your subscription, the crypto will be sold at the target rate and you will receive USDT if you are successful. When your target is reached and you have USDT remaining in the subscription, it will be used to buy BTC or ETH for the target price. You will then receive payment in BTC/ETH. If the target is not reached during the term of your subscription, you will receive the principal back plus the interest that was set up at the beginning of the subscription.

It’s a lot like selling put and call options. This gives you the opportunity to earn a stable return over the course of the subscription. However, you risk losing your funds if the price of the target crypto/stablecoin is reached. This is an advanced product that should be used with caution and full knowledge.

OKX Flash Deals

You’ll want to be on the lookout for the OKX Flash Deals as they appear at irregular intervals. These are high-yielding opportunities with limited investment slots and a fixed window. If you miss your window, you will lose the opportunity to earn these high yields.

The catch is that the tokens you earn are different. For example, one recent Flash Deal offered 110% APR with a 3-day term for USDT deposit. This is a great yield, but you’ll receive your rewards in MENGO tokens. If MENGO rises or stays the same during your 3-day staking, you are in luck. But if it falls, your APY is also affected. Although you may not get the best return possible with a 110% annual percentage yield, it’s worth looking into.

The OKX Carnival

OKX Carnival consists of the Flash Deals but with some added sweetness. Signing up for a Flash Deal through this site will allow you to fill out a form and receive a NFT. This is a limited-time opportunity.

NFTs have a minimum price of $10. But who knows if they will increase in value. Why not earn a nice yield and get one for free.

OKX Earnings: Wrapping up

OKX offers a variety of ways to earn some or much yield on your idle cryptocurrency. You should be aware that the risk levels vary with each program.

Staking is the best way to be safe. Fixed Income, DeFi and Carnival programs have some risks but stable yields. Dual Investment, Flash Deals, and Carnival have the highest risk but also offer the best rewards. There’s something for everyone in OKX’s Earn program, so why not head over there to 👉 Sign up for an account and get a 40% discount on trading fees for life!

FAQs

Is OKX a safe app?

OKX does not disappoint when it comes to safety. OKX has a cold wallet where 95% is held offline and securely, and a hot wallet which holds the remaining 5%.

OKX operates an insurance fund for risk management to protect against unexpected liquidations. You will also benefit from industry-leading security measures, including encryption of all communications. OKX, unlike other exchanges, has not been hacked to date.

What is OKX earn?

Earn offers a variety of investment options to help you generate interest in your crypto. The products include Staking and Savings as well as third-party DeFi.

OKX and OKEx are the same thing?

They are exactly the same. In 2022, the exchange changed its name from OKEx (formerly OKEx) to OKX to emphasize that it is much more than an exchange. Since the rebranding, the exchange has released Earn products and Lending products as well as an NFT market place.