It's no exaggeration to say that 2022 has been a terrible year for the CeFi lending business. There are still centralised exchanges with their toes in the lending game and possibly a foot. Sounds risky? Yeah, of course, but don't forget, exchanges need a certain amount of liquidity to succeed, especially during this crypto winter, when funds are few and far between. As risky as it may be, it's still worth it as long as the risk is managed well.

OKX, a leading exchange, is still active in offering crypto-loans, and keeping its doors open for both lenders and borrowers. Let's jump into this OKX loans review and see what's on offer and whether it's worth joining.

Note: Users in the US or UK will not be supported.

OKX Loans Bottom Line Review:

The OKX Exchange is a popular platform that anyone who is interested in cryptocurrency lending/borrowing and trading can use. Our OKX Deep Dive will give you more information about OKX.

We also have articles on other aspects of OKX Exchange.

- OKX Trading Bots – Automated Trading in OKX

- Earn Interest by Hodling at OKX

- OKX Mobile: Trading on the Move with OKX App

- OKX Wallet – The Portal to Web3

- OKX security: Is OKX secure?

- Sign up for OKX

- OKX NFT Market

Flexible Loans vs Fixed loans

There are two main types available to customers of OKX Crypto Exchange: Fixed and Flexible Loans. Each one has its pros and cons. Let's check them out!

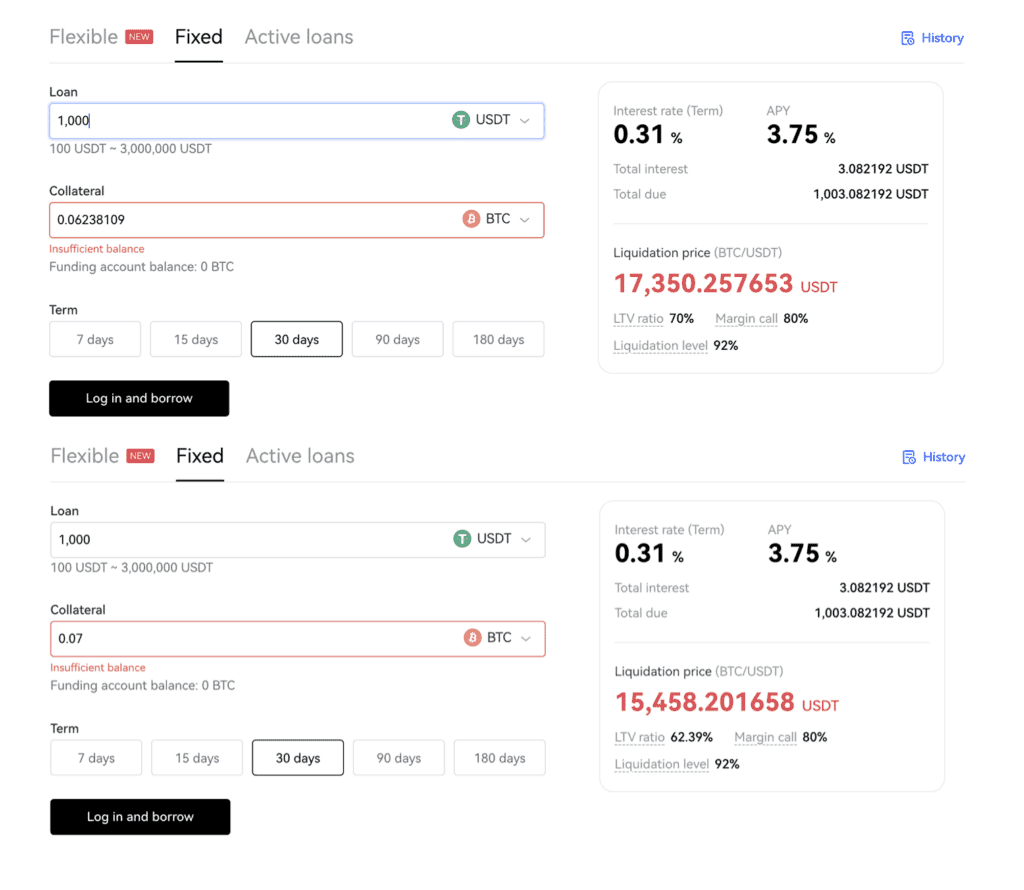

Fixed Loan

The most basic loan type available on OKX is this one. The only thing you can borrow is USDT and 4 types of crypto collateral can be used to secure the loan: USDT, BTC, ETH and OKX's native token OKB. Interest rates are fixed and based on loan duration, collateral provided, amount borrowed, and the amount of collateral. The liquidation level is lower when there are more collaterals and a longer loan period.

The interest shown is calculated daily. One thing to watch out for is that you can't repay your loan early because you will incur a penalty for doing so. In contrast, if your loan repayment is more than 3 days late, the system will liquidate automatically to repay the lender, with the remaining balance being returned to the borrower.

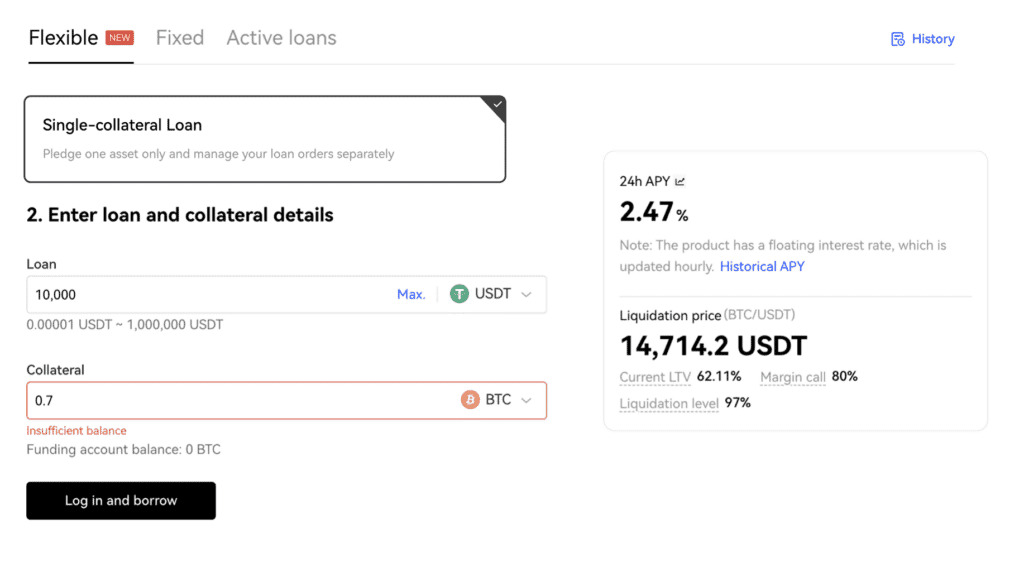

Flexible Loan

Flexible Loans is another type of loan. As the name implies, there's flexibility with this option, and it is seen in 4 places.

- Selecting collateral types

- Single-collateral This is similar in nature to a Fixed Loan, as you can only use one type of cryptocollateral at a given time. You will have to get two loans if you want more than one loan at once.

- Multi-collateral This allows you to stack multiple loans. Imagine you used BTC and ETH with a combined worth of $100,000 to secure a 50,000USDT loan. If you take out a second loan of 10,000 USDT it will be added to your previous loan. You now have a total loan amount of 60,000 USDT without adding any more collateral.

- Calculation of interest accrued hourly:

- Hourly Interest = (sum of principal borrowed + interest accrued) * current interest rate

- You can repay your loan in part or in full at any time without penalty fees.

- Support up to ten crypto assets

Notes about Borrowing

Borrowers are reminded to add more collateral to their account if the price fluctuates. The position will automatically be liquidated if no collateral is added, and the price reaches the above number.

This is an interesting fact: Whether flexible or fixed, the loan requests on the market may have more than one lender attached. The reason is that lenders aren’t obligated by law to lend the full amount requested. They can only lend what they want. As an example, a loan request of 10,000 USD can be broken down into several amounts that total the entire amount. The loan only becomes effective after the total amount is paid.

The system is set up to be more lender-friendly so that there's more available to borrow from. The liquidation order shows this:

i) auto-liquidate available collateral;

If this amount is insufficient, you may use funds from the OKX Platform.

If the amount is still insufficient, OKX reserves its right to request more money from the borrower.

Therefore, it's possible for the borrower to lose more than their collateral to cover the lender's losses.

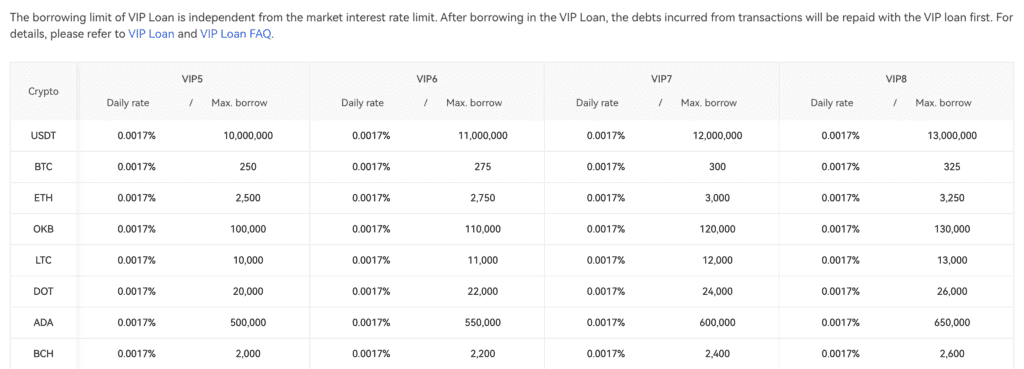

VIP Loans

There's another type of loan that can be made on the OKX platform. The VIP5 level and higher are the only ones who can apply. They have not only more attractive interest rates, but also two lending pools from which to choose. Market Borrow Savings Pool and VIP Loans Pool are the two pools. These loans have interest rates that are divided according to the number and size of pools.

The limits for borrowing are different between the two pools. Maybe an example would be better to explain these two pools.

Let’s say you want to make a 10x leveraged trade. You borrow 1000USD to buy 10 BTC using 1 BTC. You'll end up with 11 BTC and a 1000 USDT loan. With the Market Borrow pool, there's a minimum amount that needs to remain in the pool. The safety number for the Market Borrow pool is 500 USDT. If the pool only has 500 USDT or less at the moment you want to borrow, you are limited to this amount. This may mean that you are unable to complete your trade.

The rest can be obtained from the VIP Loans Pool. You will end up with 500 USDT in each pool. The interest rate will be affected by this. There's a fair bit of intricacy involved in the rates' calculation, so if you're interested, the details can be found on the OKX Loans page.

How to borrow with OKX

The platform makes borrowing easy. They offer the convenience of both mobile and desktop versions to suit users' habits. The general flow is as follows:

- Visit the Finance section of the website. Visit the loan section.

- Choose whether to apply for a fixed-rate or flexible-rate loan.

- Select the type of collateral loan you want if this is your choice.

- If you choose the former, you get to set the loan duration so pick one that you're confident of making a repayment.

- You agree to all the conditions.

- It is a good idea to get a hold of a local expert. "Risk Management" Check that the information is correct in the section. Especially the price and the levels of liquidation. Don't wanna get rekt for no good reason!

- Once you're ok with the details, go ahead and confirm the loan.

- Wait for the loan repayment to be completed.

You can also read our conclusion.

OKX wants to take as much as it can from this shrinking market, given the effort that has been made to make borrowing and lending as easy as possible (for the borrowers). It will all depend on the ease with which lenders can get liquidity and how willing borrowers are to participate. OKX can track their results in a competitive market and, where needed, create promotions, such as Interest Free Loans, to entice new business.

This overview of OKX Loans is intended to be helpful. OKX Exchange is one of those very innovative and forward thinking exchanges. Find out more in our OKX Review about this robust, all-in-1 exchange.

👉 Enjoy a lifetime 40% discount when you sign up for OKX!

FAQs

Is OKX safe?

We do. OKX is a reputable, long-standing crypto exchange. The platform has one of the most extensive security procedures in the industry.

In our OKX review, you can read more about how OKX ensures fund security and safety.

OKX is available in the US.

Unfortunately, no. Binance US and Kraken are the best options for US users.

OKX: Is it a Good Exchange or Not?

OKX is a great product. “all-in-one” The industry’s exchanges. It is hard to beat them for their huge selection of cryptocurrencies and variety of crypto products as well as fantastic UX/UI, and robust security.

Where is OKX Exchange?

OKX’s headquarters is in Seychelles. It has other offices all over the world.

What is OKX Wallet?

The OKX wallet, which is a multi-chain wallet that allows users to self-sustain their funds, is among the most innovative wallets on the market. It allows users to manage crypto and NFTs while also providing full utility. The platform features a variety of DApps, and according to the OKX team it is “the easiest way for users to manage crypto.” “portal to web3.” Learn more in our OKX wallet review.