OKX Trade is a big and massively common cryptocurrency trade and one of many OG's within the crypto house, established all the way in which again in 2016. With the rebranding and platform overhaul, we felt it applicable to do an up to date OKX overview as this trade has received some thrilling developments underway.

Utilizing its experience within the spot market, OKX affords its customers the chance to commerce Futures, perpetual swaps and choices markets. As well as, whereas OKX was, and stays, a paradise for energetic crypto merchants, the platform has added an earn part, entry to an NFT market, crypto loans space, Jumpstart launchpad, crypto buying and selling bots, and even a manner for patrons to get entangled in DOT slot auctions which might be coated beneath. Every offers merchants a novel method to commerce, hedge, earn, and discover the crypto markets.

So, is it price contemplating?

On this overview, we are going to try to reply that. I may also offer you some prime suggestions that it’s worthwhile to know when utilizing the platform.

👉 Unique 40% spot buying and selling payment low cost for all times!

Observe: Customers situated within the US and UK aren’t supported.

What’s OKX?

OKX was initially based in Hong Kong in 2016, however in 2018 they moved to Valletta in Malta, whereas additionally being headquartered in Seychelles. This was little doubt in response to the beneficial crypto rules in these jurisdictions.

The unique trade was a spot crypto buying and selling trade that has expanded quickly since its launch. It’s obtainable in over 100 international locations. The BTC futures buying and selling on OKX surpasses $1.5bn per day in day by day buying and selling quantity because the trade caters to institutional and retail merchants.

Though OKX derivatives can be found in over 100 international locations, some areas don’t supply their providers. These embody the likes of the US, sanctioned international locations, and an inventory of different areas.

For our American readers, I’d extremely advocate trying out our Kraken Assessment

We’ll overview the spinoff devices on OKX, together with their plain vanilla futures, their perpetual swaps and their choices, together with the opposite platform options. As many exchanges similar to Binance and KuCoin purpose to turn out to be an all-in-one platform to cater to crypto lovers of all backgrounds, OKX will not be sitting on the sidelines and have ensured that they’re well-positioned to compete with quite a lot of international exchanges.

To cater to their massive neighborhood of merchants world wide, they’ve translated their website into 11 totally different languages, together with English, Russian, Chinese language and so on.

The corporate can also be busy hanging strategic partnerships. Extra lately, OKX expanded its partnership with English soccer (soccer?) membership Machester Metropolis, paying the membership $70 million over three years. As a part of the partnership, the OKX brand might be displayed on the sleeves of Man Metropolis uniform's shirt.

Right here is OKX buying and selling options abstract:

- Broad choice of cryptocurrencies – The trade affords a variety of cryptocurrencies for buying and selling and lists new tokens incessantly, offering merchants with a number of buying and selling choices.

- Buying and selling choices – Other than spot and margin buying and selling, the trade additionally helps futures and choices, perpetual swaps, and several other Earn merchandise.

- Superior buying and selling instruments – OKX gives seasoned merchants with superior technical evaluation and buying and selling instruments.

- Safety – OKX gives clear Proof of Reserves and maintains 1:1 deposits to make sure sufficient liquidity.

- DeFi Staking – OKX additionally affords staking providers with funds within the consumer’s account.

- OKB Token – The OKX native token, OKB, affords its house owners a number of safety, monetary, and utility providers and passive incomes providers.

- NFT Market – The trade additionally hosts an NFT market the place customers should buy well-known NFTs.

- Person interface – The OKX trade interface is easy for common customers and affords the customizability skilled merchants choose.

OKX X1

In November 2023, OKX launched X1, its zero-knowledge Ethereum Digital Machine Layer-2 community testnet, leveraging Polygon's chain improvement equipment (CDK).

OKX isn't the primary centralized trade to launch its Layer 2 (that honour goes to Coinbase's BASE), however OKX's X1 distinguishes itself as a zero-knowledge rollup answer. This permits virtually immediate settlements on each the L1 and its native community, a departure from the delayed settlement timelines related to optimistic rollups (employed by BASE).

The X1 mainnet is scheduled to launch by March 31, 2024. The primary quarter may also see the launch of zkBridge, zkOracle and zkDEX, and key companions ought to start to deploy DApps on the X1 mainnet as nicely.

Is OKX Secure?

For any crypto dealer, this is likely one of the most vital issues. Sadly, we all know all too nicely the dangers that would come from centralised exchanges.

Once we have a look at exchanges, there are a number of components that we keep in mind to find out how protected they’re for his or her merchants.

Let's check out these, we could?

Is OKX Safe?

OKX operates a safe cold and warm pockets safety process. Because of this the majority of their funds are saved offline in chilly storage, that means the funds are shielded from hackers. OKX holds 95% of their funds in offline storage, using a state-of-the-art chilly pockets storage system that requires affirmation from at the least 2 licensed personnel. OKX has a number of the most sturdy offline storage protocols I've seen; have a look beneath:

The opposite 5% of funds are stored with their servers in a "hot" setting to satisfy the demand for withdrawals/deposits.

It’s also price noting that, in contrast to many exchanges, OKX has suffered no recognized hacks so far. Appears to be like like their safety protocols are definitely as much as the challenges of blocking hackers. For a deeper look into OKX's Security measures, we’ve got an article masking a full OKX Safety Evaluation. Regardless, here’s a abstract of their safety measures:

- Fund Storage – OKX holds 95% of its funds in offline chilly wallets to guard them from assaults. The pockets entry requires authorization from at the least two safety personnel. Subsequently, the funds are saved in an acutely safe setting.

- OKX Threat Protect – OKX allocates a share of its earnings to an asset threat reserve fund.

- Necessary 2FA – OKX mandates two-factor authentication, decreasing the danger of consumer account hacks considerably.

- Safe Personal Key Storage – OKX shops personal keys in RAM as an alternative of everlasting reminiscence for enhanced safety.

- Emergency Backups – A number of backup procedures adopted by OKX guarantee optimum preparation for potential emergency eventualities.

As with all centralized monetary service, people contemplating staking belongings on OKX Earn or depositing belongings on OKX accounts should train due diligence and clearly perceive the related dangers.

Threat Administration

Provided that OKX derivatives function a leveraged buying and selling platform, they need to have measures in place to scale back the danger posed by market actions to the buying and selling pool.

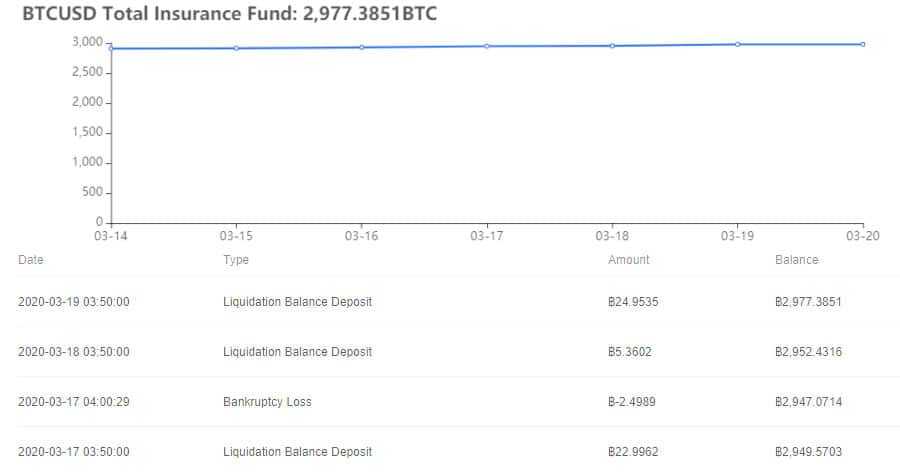

The OKX insurance coverage fund is run to be a backstop for all these trades that can not be liquidated above the chapter worth. The fund is replenished with the preliminary margin that liquidated merchants have on the outset of their commerce.

Person Safety

On the whole, one of the best safety begins with the dealer. That’s the reason OKX has supplied a number of instruments to assist customers safe their accounts.

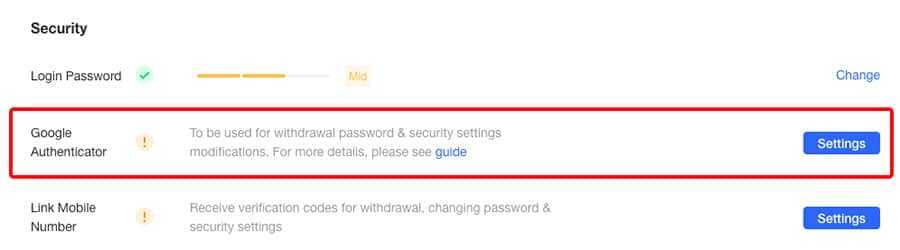

Maybe one of the vital vital of those is two-factor authentication. There are two choices to do that, the primary is to make use of an SMS authentication, and the opposite is to make use of the Google authenticator.

I’d advise in opposition to SMS authentication as this opens you as much as sim-swapping assaults. Therefore, you possibly can arrange the Google authenticator by downloading it from the app retailer and binding it to the OKX server.

One other fairly neat device that they’ve at OKX is their anti-phishing device. That is mainly a code despatched in each single e-mail they ship you. So if you don’t acknowledge the code, that the e-mail got here from an illegitimate sender. Here’s a full have a look at the safety features that OKX customers can deploy to assist maintain their accounts as protected as attainable:

- Login password

- Electronic mail verification

- Funds password

- Cell verification

- Authenticator app

- 2-factor authentication

- Anti-phishing code

We do a full deep dive into the safety of OKX in our OKX Safety Evaluation. You can even try how OKX approaches safety on their OKX Threat Protect web page.

Proof of Reserves

Given what has occurred with FTX, exchanges have been scrambling to show that shopper funds are safe and that exchanges are adequately collateralised.

Just like the opposite exchanges, OKX additionally jumped on the Proof-of-Reserves bandwagon and hurriedly pumped out their model of Merkle-Tree proofs to point out their prospects that the identify OKX does stay as much as its “OK” status. In keeping with Glassnode, Proof of Reserves (PoR) shows the belongings held on-chain and matching liabilities held each on and off-chain.

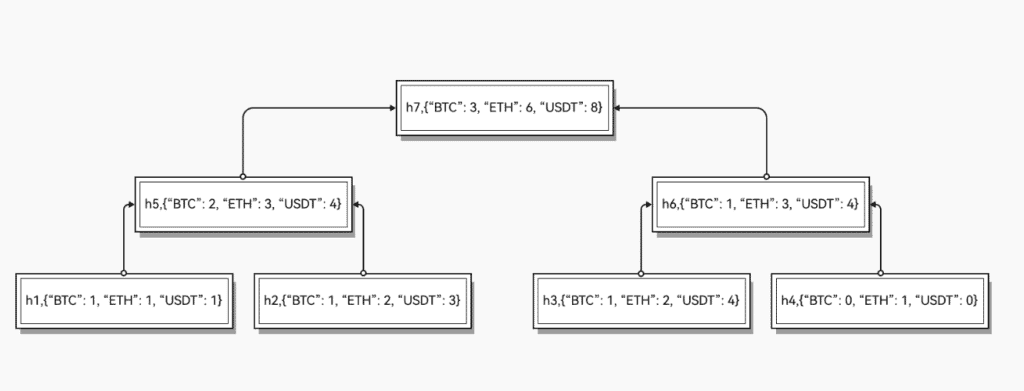

Earlier than persevering with, it helps if we all know what’s a Merkle Tree. It’s basically an information construction for a bunch of encrypted knowledge. Every transaction, whether or not a snapshot of balances or a transaction itself, is encrypted, grouped collectively and additional encrypted, layer after layer, like a Russian matryoshka doll, forming a tree-like construction.

What you’re actually verifying is that the data introduced within the Tree is right. This may be your individual belongings (to point out that they have been included within the knowledge encryption) or the belongings held by the trade.

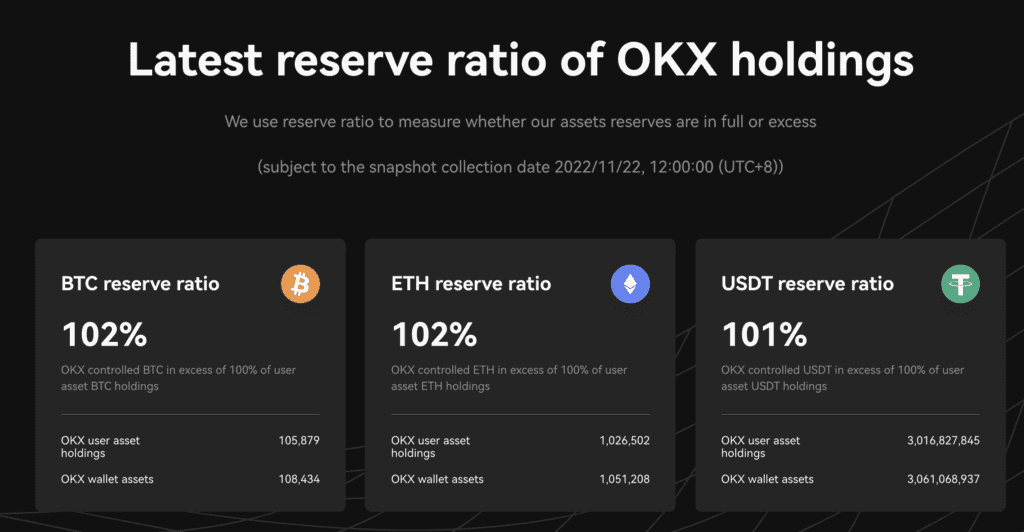

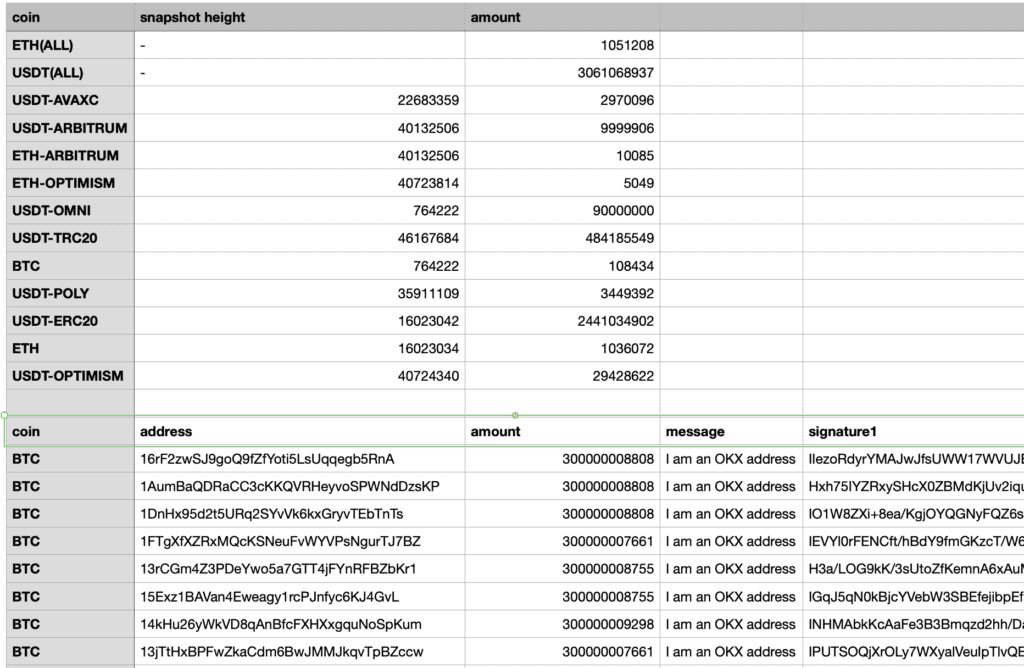

OKX affords up three kinds of knowledge for verification by the general public: customers’ personal belongings within the trade, OKX’s pockets addresses and belongings and their very own reserve ratio.

How Do Customers Confirm on Their Personal?

Clients of OKX register to their account and click on on “Audits” to view the current audits performed and “Details” to view the audit knowledge. In case you’d wish to take a extra energetic position within the verification course of, OKX affords a information on how to take action that includes copying knowledge out of your account, export to a .json file, and run it via a verification device known as “MerkleValidator”. This device checks that the info is captured in OKX’s Merkle tree snapshot.

You probably have time to spare and wish to confirm what OKX has, you may get an inventory of OKX’s public addresses and run them on Github to test the info.

What Does it Actually Imply?

Whereas it’s all nicely and good that OKX has managed to show that it has belongings in its reserves, please keep in mind that these are snapshots, i.e. a second frozen in time. What occurs to the funds earlier than and after the snapshots are taken is unclear.

Its web site states that audits might be revealed repeatedly. How common is that?

To be trustworthy, until audits are performed in real-time on an up-to-the-minute foundation, one can solely depend on the integrity of the trade.

It’s small consolation that OKX has moved up the meals chain in Nic Carter’s PoR web page from Casual asset attestations to the “Gold standard” PoR. Even so, they’re listed as self-assessment as an alternative of auditor-assisted, which is a small minus on my half.

OKX: By-product Devices & Leverage

So, what are spinoff devices? Properly, they’re an instrument that you would be able to commerce that "derive" their worth from the worth of some underlying instrument. On this case, they’re cryptocurrencies.

By-product devices are leveraged, which implies you possibly can enlarge your positive aspects/losses many instances over. At OKX, this may be as much as 100x, relying on the buying and selling pair.

So, for instance, when you have a commerce that has a leverage of 50X, it implies that for a $1 transfer within the worth of the underlying asset, your place will transfer by $50.

Let's take a more in-depth have a look at the spinoff devices they provide at OKX, however first, try our OKX buying and selling information that touches on every thing from account registration to inserting your first commerce.

OKX Futures

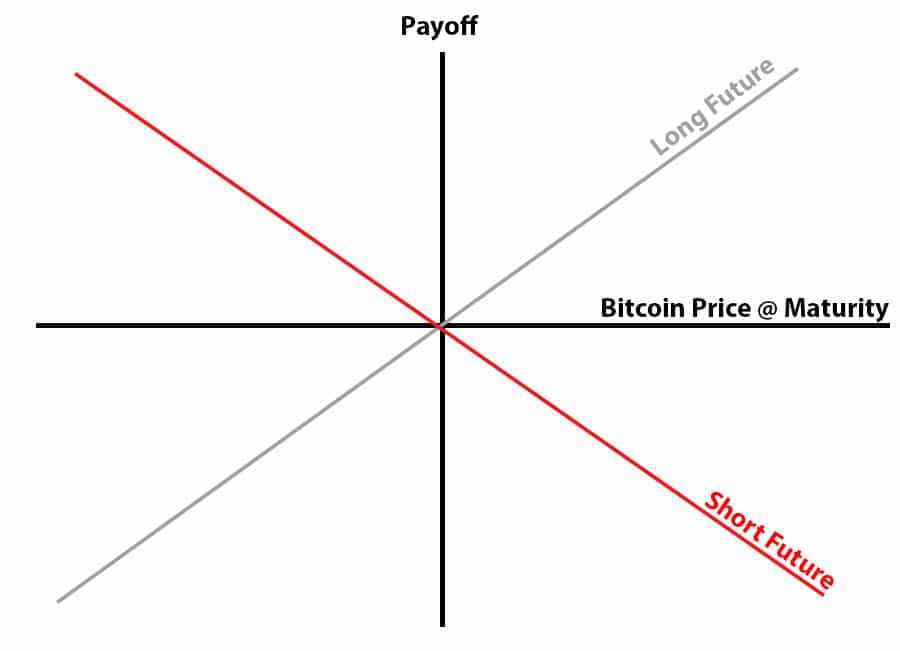

Futures are devices whereby you agree to purchase or promote some asset sooner or later at some predetermined time. These futures contracts are an obligation to purchase/promote, which differs from choices.

On OKX derivatives, they’ve futures devices on 12 belongings. These are the next: Bitcoin, Litecoin, Cardano, Polkadot, Ethereum, Ethereum Traditional, Ripple, EOS, Bitcoin Money, BSV, Filecoin and TRX. So, a fairly affordable checklist.

These futures devices have leverage of as much as 100x. They’ve expiries which might be weekly, bi-weekly, Quarterly, and Bi-quarterly. These contracts are settled day-after-day at 8am UTC.

You can even elect to get your positions margined with both cash (crypto) or Tether (USDT). This can decide the place the margin will come from.

Lastly, you possibly can elect to cross margin your futures account in relation to futures. Because of this margin can come from any considered one of your accounts at OKX.

OKX Perpetual Swaps

OKX phrases these devices at Perpetual Swaps, however they’re typically known as perpetual futures on different exchanges. So you possibly can mainly take into consideration them as a conventional future besides there isn’t any expiry time.

You may maintain a place with none time restrict and withdraw your realized earnings anytime with a perpetual future. For these of you who commerce CFDs or unfold betting devices, a perpetual swap has the identical payout profile.

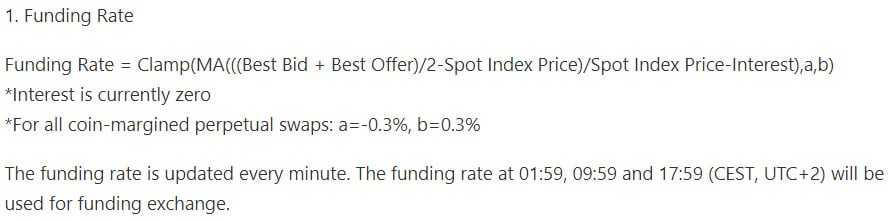

It’s known as a "Swap" since you are swapping the returns for one asset for one more. On this case, it’s a cryptocurrency vs. the US greenback. Given that you’re doing this, you’ll have to pay a funding charge.

What’s the funding charge?

It’s used to make sure that the perpetual swap worth is anchored to the spot market. When the funding charge is optimistic, longs pay shorts; when it's adverse, shorts pay longs. The trade will not be charged, however the payment between longs and shorts.

As is the case with the futures devices, you have got 100x max leverage, and you may select to margin your place both with cash or with Tether. Additionally, the settlement on the perpetual swap happens each 24 hours.

With regards to asset protection, you possibly can commerce as much as 12 totally different belongings. These embody all of these that you would be able to commerce with the futures above and the addition of NEO, LINK, and DASH.

OKX Choices

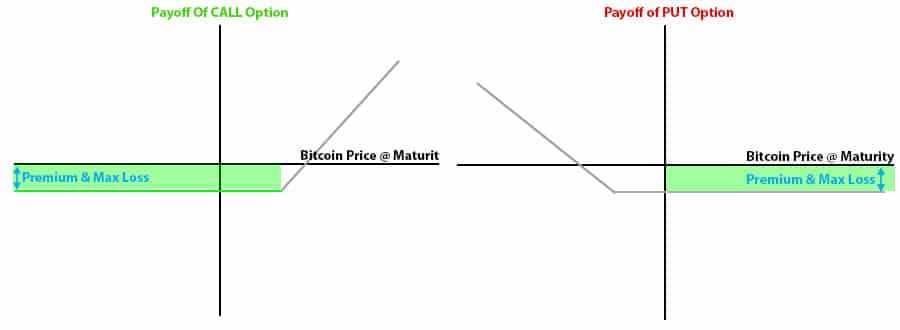

Choices are spinoff devices that give the holder the suitable however not the duty to purchase or promote some asset sooner or later at some predetermined time. They’re uneven payoff devices.

We now have an in depth information on cryptocurrency choices which you’ll learn if you would like extra info. However the important thing factor to notice is that you’ve a restricted draw back threat and a limiteless upside potential if you purchase an possibility. This may be the alternative should you promote an possibility.

There are CALL choices that provide the proper to purchase, after which there are PUT choices that provide the proper to promote some asset. When shopping for an possibility, you might be paying a premium to the counterparty and a few buying and selling charges to OKX derivatives. There isn’t any margin required.

Nevertheless, should you wished to promote an possibility, this may very well be performed, however you would need to request it. As well as, they may require a minimal steadiness in your account to cowl for the occasion the place strikes considerably away from you.

On OKX, there’s at the moment just one asset that you would be able to commerce Choices on: Bitcoin. Once we checked into the platform, there have been 4 possibility expiry instances.

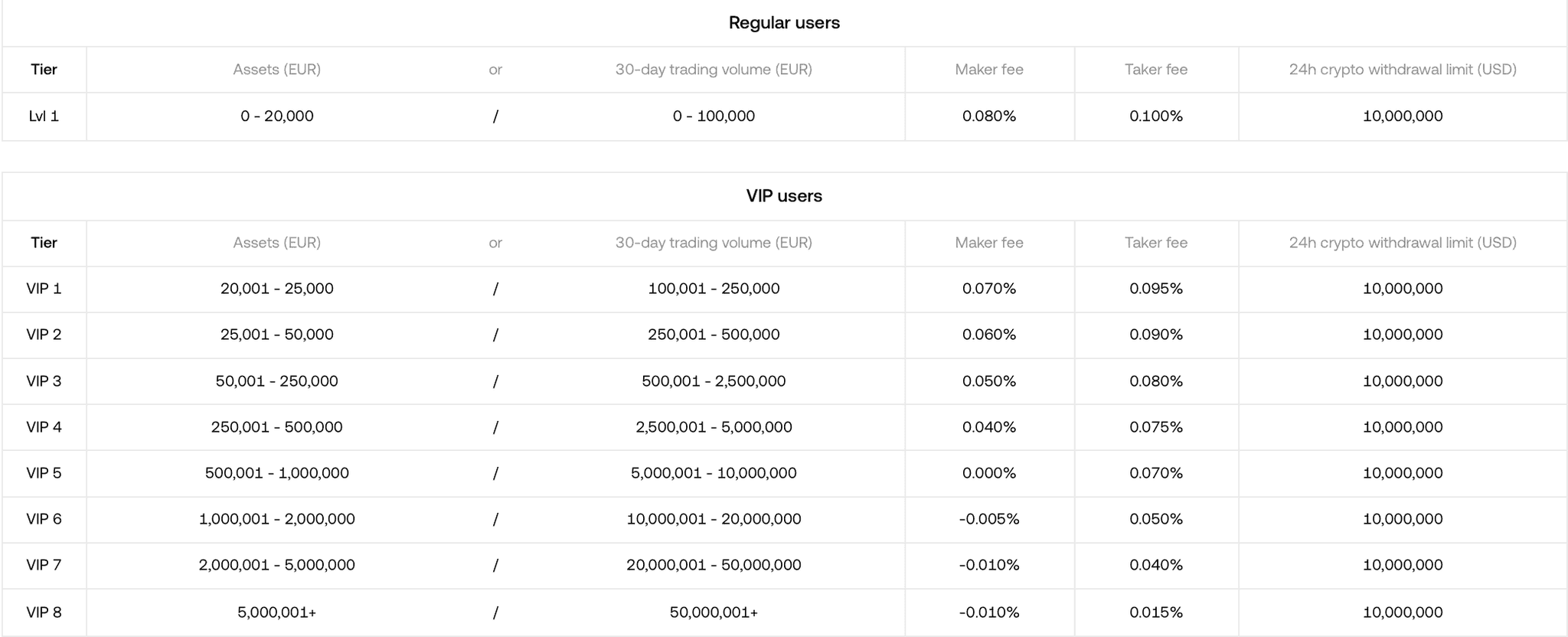

OKX Charges

With regards to your buying and selling profitability, one of the vital vital issues is the buying and selling charges on the trade.

So, how does OKX stand right here?

Fairly good really, OKX charges are among the many lowest within the business, so no want to fret about breaking the financial institution right here. After all, buying and selling charges will differ in accordance with your buying and selling tier, what the instrument is, and what number of OKB tokens you maintain in your account.

Here’s a snapshot of the maker/taker charges for spot buying and selling:

OKX Charges on Derivatives– The charges differ based mostly in your buying and selling tier, the instrument you utilize, and the variety of OKB tokens in your account. OKX makes use of a Maker/Taker Price mannequin for derivatives. Market makers can obtain rebates in the event that they generate over 100k in BTC buying and selling quantity on a 30-day foundation, much like different platforms like ByBit.

OKX Charges on Futures- There are two kinds of customers: regular customers and VIP customers. Regular customers have 5 totally different tiers based mostly on their OKB token holdings. VIP tiers are decided by 30-day buying and selling quantity.

OKX Charges on Perpetual Swaps- Perpetual swaps have comparable charges to regular Futures. To achieve VIP standing, it’s worthwhile to commerce a minimal of 5,000 BTC. VIP customers have barely increased taker charges and better maker rebates.

Perpetual swaps even have a funding charge, which isn’t a payment however displays the distinction between the funding charge on the cryptocurrency and USD. The funding charge is dynamic and adjustments each 8 hours.

OKX Charges on Choices– Regular customers' buying and selling choices have comparable charges to perpetual swaps. VIP standing will be achieved with a decrease threshold of just one,000 BTC. VIP customers have the identical buying and selling charges for various ranges.

I encourage you to take a look at the OKX web page that covers the VIP ranges and costs to study extra.

To sum up the general payment construction, OKX trade charges are fairly low, making this one of many extra fee-friendly crypto exchanges within the business. Coin Bureau readers can additional decrease the already rock-bottom charges by one other 40% after they use our OKX sign-up hyperlink!

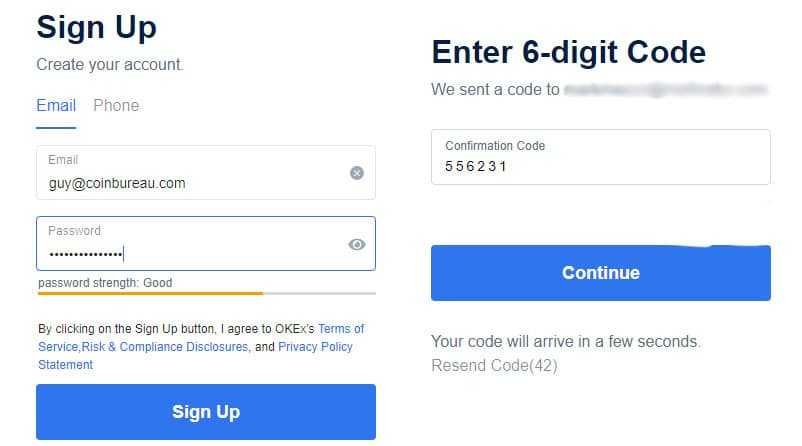

OKX Trade: Registration

Okay, as soon as you might be able to check out OKX you will want to create an account. You may hit "Sign Up" and enroll utilizing an e-mail tackle, cellphone quantity, or hyperlink to a Google account when you find yourself on the web site.

We gained't go into full particulars right here on how you can create an account as we’ve got a devoted article for that if you want to see the step-by-step signup course of damaged down:

- Find out how to Signal-Up on OKX

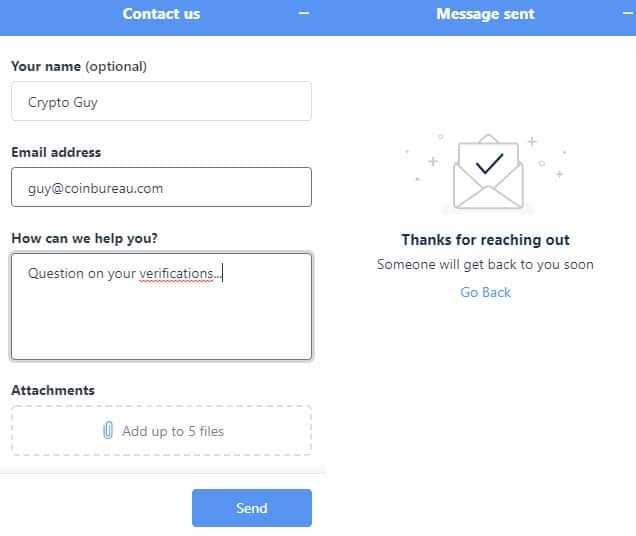

OKX.com: Verification & KYC

OKX requires that each one account customers full KYC. To finish the primary degree of verification, all you want is an ID quantity, identify, surname and place of residence. To achieve degree 2 verification and enhance buying and selling and withdrawal limits, you will want to add copies of your ID paperwork and take a few selfies to verify your id.

That is all performed via using Web Confirm, which is a third-party KYC service.

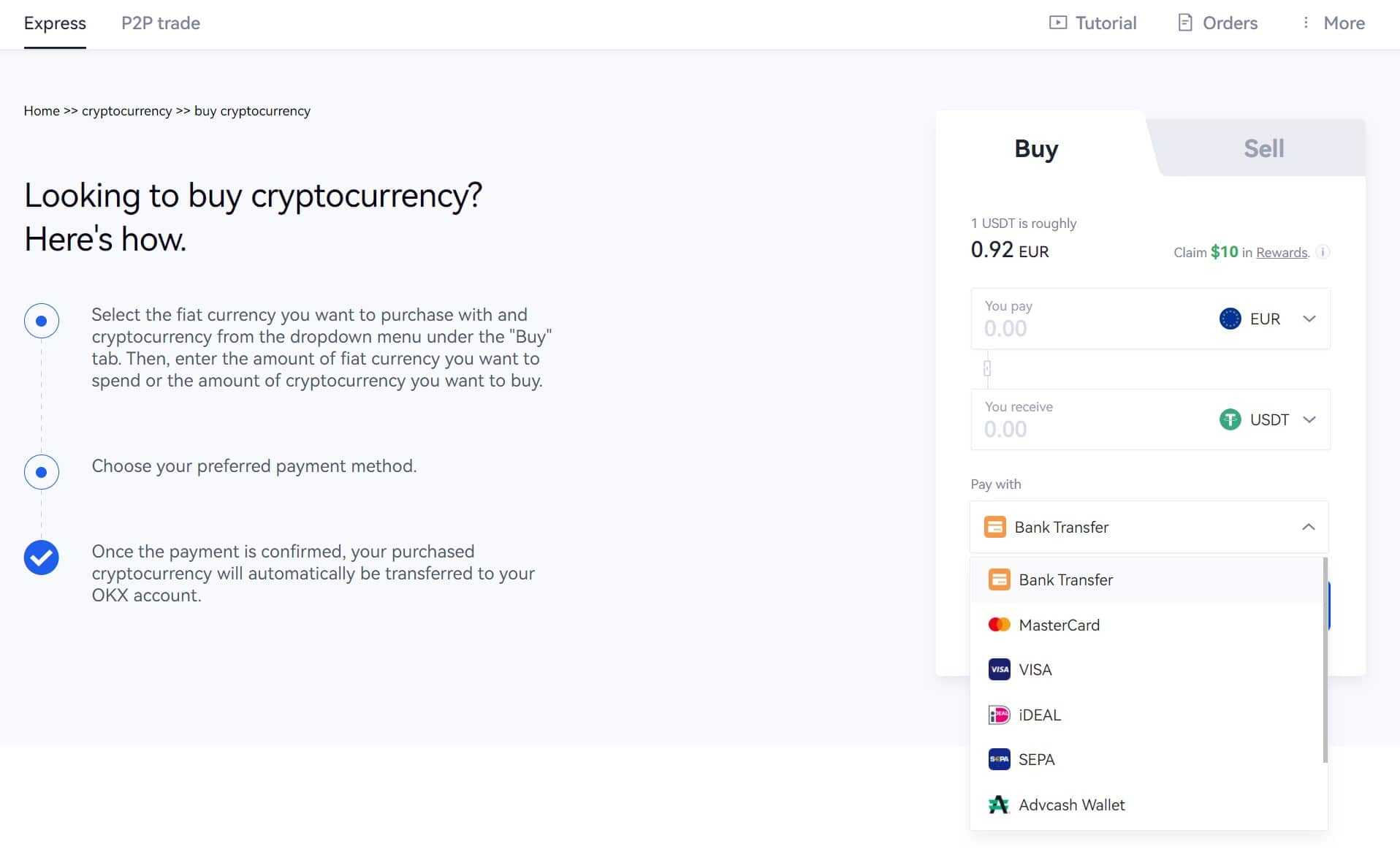

Deposits/Withdrawals

As soon as your account is about up, you will want to fund your account. There are a number of methods to do that. These embody fiat forex in addition to crypto.

In case you are shopping for with fiat, OKX makes use of a number of third-party providers. These embody the likes of Koinal, Simplex & Others. In case you are utilizing a financial institution wire, you should use Banxa, which affords SEPA and SWIFT banking providers.

The quickest and most handy technique to buy crypto with fiat is through the use of a debit or bank card. OKX additionally helps financial institution transfers, iDEAL, Advcash, ApplePay, SEPA, Sofort and Google Pay, relying in your location.

If you have already got crypto and wish to deposit, you’ll have to generate an tackle. This may be performed in your "Assets" part of your account admin. Then, you’ll choose the relevant token, which can generate a deposit tackle.

After getting despatched your funds over, you’ll have to watch for one affirmation earlier than it’s credited. If you need to trace your deposit, you should use a blockchain explorer.

Observe 📝: When you have got funded your account then you will want to maneuver that over to your futures account

Withdrawals

Withdrawals are made in the identical panel as your deposits. Earlier than you withdraw, you’ll have to arrange a funds switch. That is mainly a password that can permit you to verify any withdrawals out of your account. Additionally, keep in mind to be conscious of your withdrawal limits that are dependent in your tier and KYC verification degree.

Warning ⚠️: When organising your withdrawal password, you’ll want to use a distinct one out of your login

After getting arrange your withdrawal password, you possibly can go forward and place your withdrawal quantity and your offline tackle. After getting made the request, they may course of it, and you may monitor it on the blockchain.

Observe that Fiat withdraws aren’t obtainable in most international locations, so you’ll possible want to seek out an alternate fiat offramp.

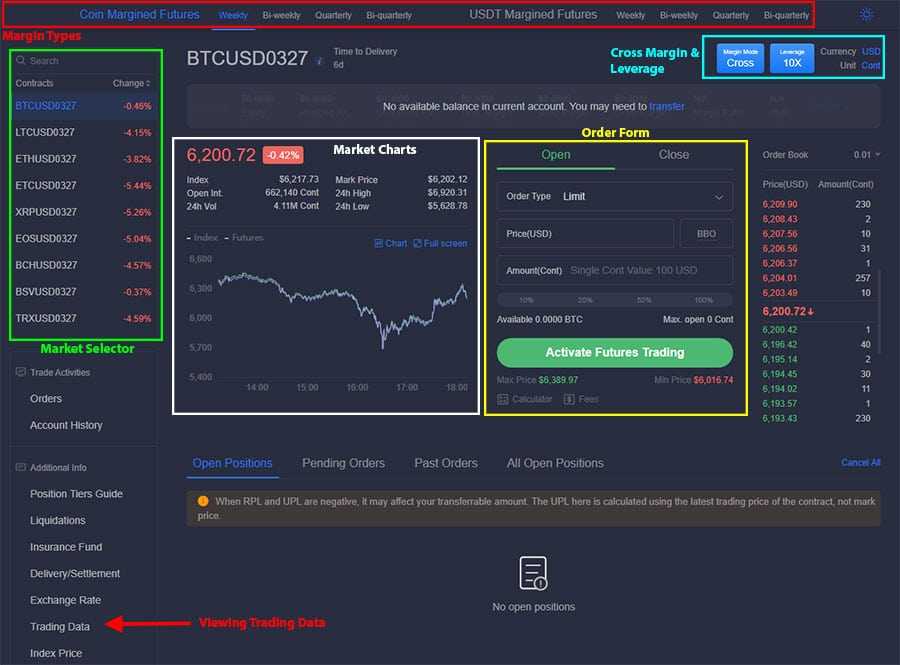

OKX Futures Platform

It's time to maneuver onto the stomach of the beast and study their buying and selling expertise and platforms. Whereas all of them use the identical consumer interface, they differ by way of the performance on the platform.

If you wish to commerce futures, you’ll first need to activate your futures account. To do that, it’s worthwhile to full just a few inquiries to ensure you are accustomed to futures buying and selling.

As soon as you might be performed organising your futures buying and selling account, you possibly can start buying and selling upon getting moved funds over out of your buying and selling account.

The UI of the buying and selling platform is comparatively intuitive. You have got all the markets that you would be able to commerce on the left. On the prime, you possibly can choose the time to expiry and what forex you prefer to the funds to be margined in.

Slightly below that, you have got your choices by way of leverage and the way you prefer to your account to be margined. Slightly below that, you have got your order varieties, charts and historic order e book

Professional Tip 💯: You may broaden the chart out to full display and use it to conduct your whole technical evaluation.

In case you broaden the chart, you’ll discover that you’ve two choices to commerce with. One is the default chart provided by OKX, and the opposite is the Tradingview chart. For many who know Tradingview, it is likely one of the most well-known third-party charting packages available on the market, popular with technical analysts.

Then, slightly below the charts, you have got the historic & stay order part. This can checklist all the orders you have got operating at OKX and your Unrealized PnL.

Then, you have got some further helpful data to the left of this. For instance, you possibly can try the index costs and mark costs. Do not forget that the mark worth is the one that’s used to settle the spinoff devices, whereas the index worth is the one that’s referenced to formulate the mark worth.

For the Evening Owls 🦉: You may change the buying and selling interface and make it a darkish theme

One thing that I actually discovered fairly useful was their Buying and selling Knowledge tab. This provides you every thing it’s worthwhile to learn about what’s going on within the OKX futures market. This consists of:

- Lengthy Brief Ratio: The ratio of longs and shorts out there

- BTC Foundation: The distinction between the longer term or swap worth and the spot worth.

- Swap Funding Price: Estimated payment charge on the perpetual swap.

- High Dealer Sentiment Index: Proportion of Longs / Shorts held by the highest 100 merchants

OKX Margin

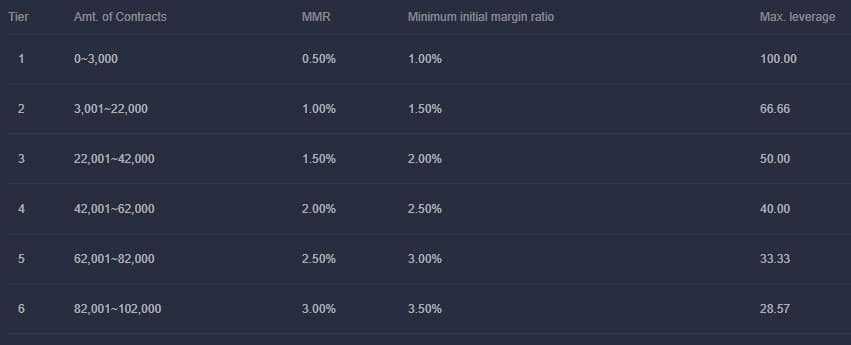

The very first thing you must be aware is that the max-margin of 100x will rely primarily on the dimensions of the place you at the moment maintain.

In case you pop on over to the place tiers information, you will notice that the 100x leverage (or 1% margin) solely applies to these positions which might be lower than 3,000 contracts. As you tackle extra contracts, your leverage issue will lower. That is due to a rise within the preliminary margin and the upkeep margin.

Then, in relation to how that is margined out of your account, you possibly can both elect to have it margined in crypto (Coin margin) or margined in Tether.

Lastly, you have got the choice to cross margin. This mainly implies that margin might be drawn from not solely your futures account the place the funds are but in addition from the opposite accounts the place you have got funds. We might advise in opposition to this, although.

OKX Perpetual Swap

If you wish to commerce perpetual swaps, it has a lot of the identical UI because the Futures devices. The one distinction is that you would be able to't change the expiry time.

One other factor that you must observe is the funding charge. That is dynamic and continually altering, so you’ll want to monitor it earlier than you place your trades.

Additionally, you will wish to take a more in-depth have a look at the place tier guides and the way that can influence the margin requirement. They’re barely totally different for the upper tier limits than with Futures.

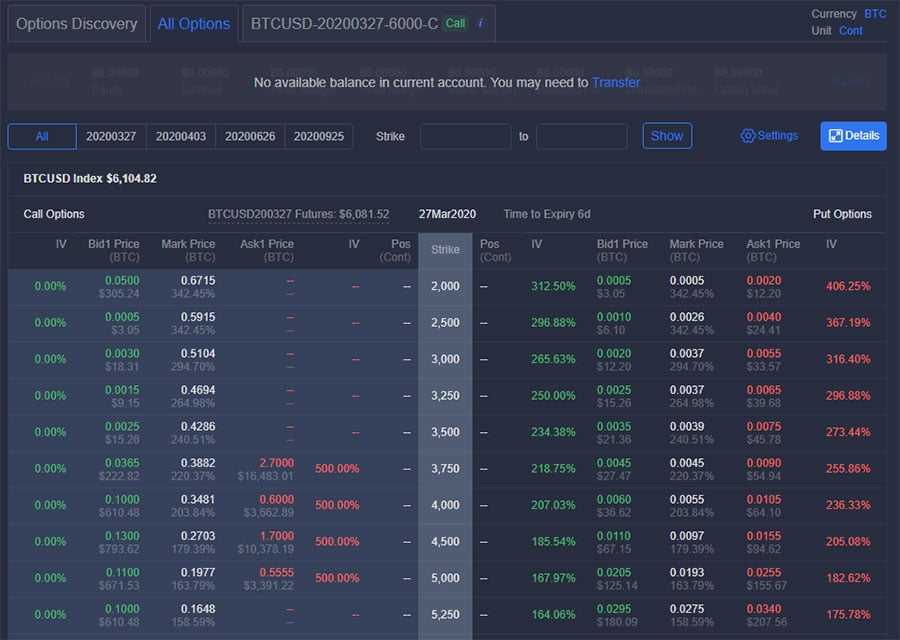

OKX Choices Platform

With regards to the choices platform, the format is comparable, though the performance is kind of totally different.

There are a number of methods during which you should purchase an possibility. Maybe probably the most user-friendly method is to make use of the choices Discovery device. This lets you hone in on the best possibility on your buying and selling situations.

Utilizing the Choices Discovery device may also draw you out a neat payoff diagram the place you possibly can see the revenue/loss that can incur for stated possibility. As soon as you might be OK with the set parameters, it would take you to the marketplace for the stated possibility.

Nevertheless, if you wish to have a look at the broader market, you possibly can go to "All Options". This UI is much like that of the likes of Deribit for these of you who’ve used that trade. You will note an outline of all the PUTs and CALLs and the totally different expiries.

Observe 📝: These choices which might be out-of-the-money are a lot much less liquid than these nearer to the cash.

After getting chosen the choice you wish to commerce, both via possibility discovery or All Choices, you’ll have an identical buying and selling interface to the Futures and Swaps.

One thing that you must be aware, nevertheless, is that you just solely have one order sort that you would be able to take out on the choice. It is a Restrict order. So that you don't want to position any stops; nevertheless, as , your draw back is restricted.

Lastly, there’s a dropdown on the prime of the charts the place you possibly can observe the "Greeks" of the choices. These are mainly the components that decide the choice worth sensitivity. We gained't go into the specifics of the Greeks right here, however Man did a whole video on that.

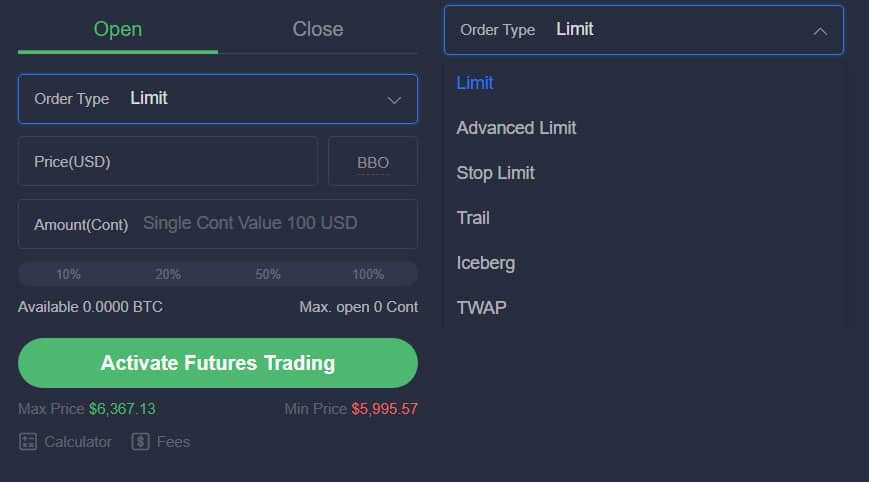

Order Types

I wished to go over the order varieties individually as these are fairly complete, and you’ve got lots of performance right here.

That is extra the case with the futures and swaps than with the choices. Beneath is your typical order type for the swap/future. As you will notice, you possibly can both open or shut your orders with opposing sorts.

For these orders, you have got 6 totally different order sorts. That is far more than we’ve got seen at different exchanges and offers the dealer many extra instruments to work with. The order sorts are:

- Restrict Order: These orders are good until cancelled. They’re merely orders which might be positioned at some predefined degree.

- Superior Restrict: It is a customary restrict order with extra performance round how you prefer to the order to be executed. For instance, it may very well be Submit Solely, Fill-or-Kill or Speedy or Cancel. "Post Only" is a normal order. Fill or Kill will execute the whole lot of the order or kill it. Speedy or Cancel will execute it now at one of the best worth or cancel

- Cease Restrict: That is an order positioned solely as soon as a selected set off worth is met. As soon as the set off worth is met, a normal restrict order is positioned.

- Path Order: With this order, a restrict order might be positioned as soon as the worth has retraced after breaking a sure set off degree. That is known as the "Callback Rate."

- IceBerg Order: That is an order that enables a dealer to position a big order with out incurring an excessive amount of slippage. This order routinely breaks up a consumer's massive order into a number of smaller orders.

- Time-weighted common worth (TWAP): TWAP is the common worth of the order over a specified time period. It’s mainly a method that can try to execute an order that trades in slices of order amount at common intervals. The fill worth equals the TWAP worth.

In case you battle with any of those order sorts, you possibly can at all times try the OKX spinoff docs. They go over them in various element. Okay, that sums up the buying and selling options of OKX; let's have a look at what else the platform has to supply.

OKX Options

As talked about, OKX has determined to dive into the world of NFTs, metaverses and GameFi, DOT slot auctions, Earn, OKX Pool and extra, so there’s a lot to unpack right here.

OKX EARN

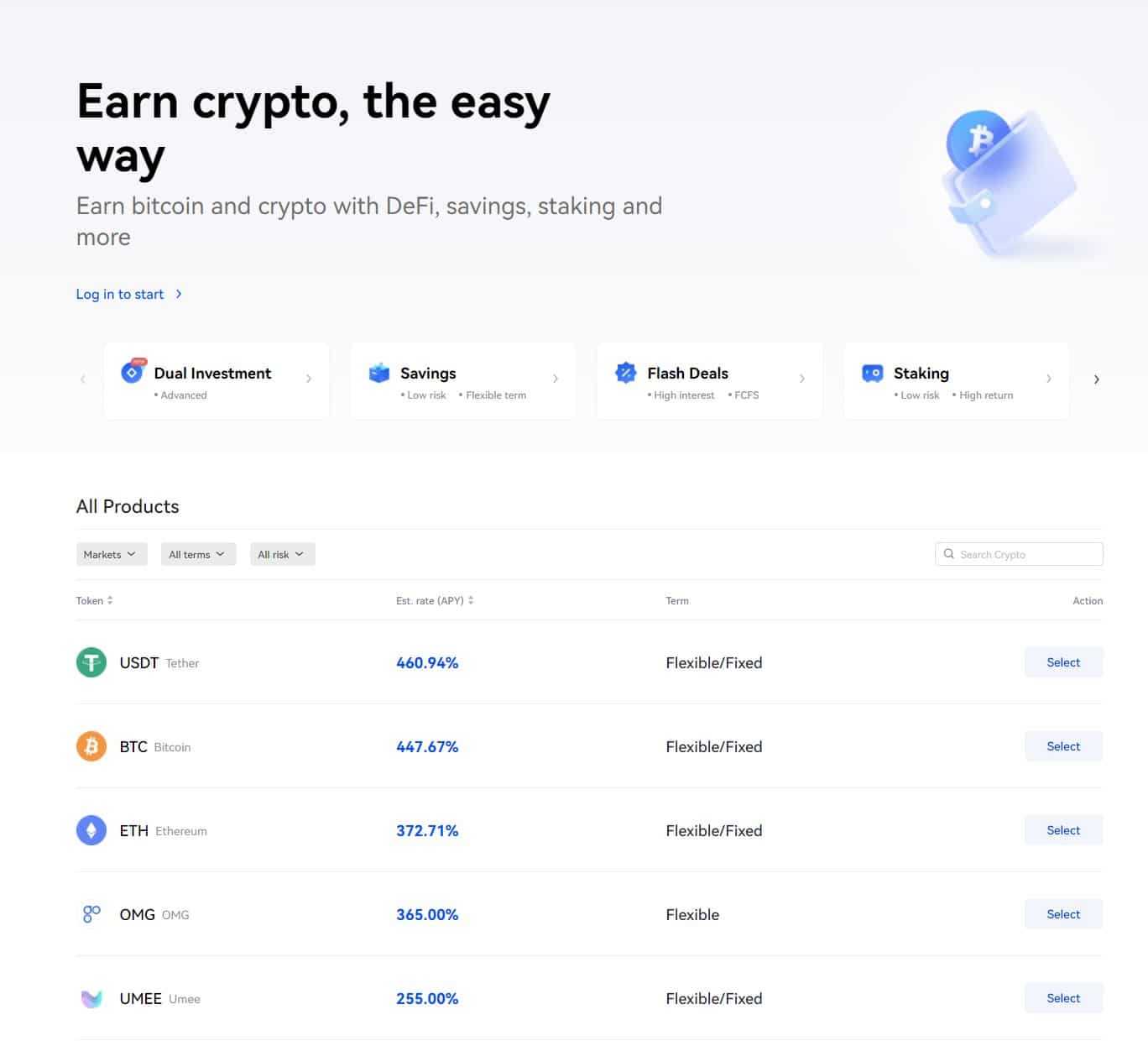

Don't simply HODL. Earn. OKX is a superb place for customers to earn a pleasant little APY on their crypto stacks. Main exchanges similar to Binance and KuCoin have launched earn sections on their platforms, and OKX wasn't going to sit down out on this extensively common crypto function.

OKX affords a number of methods for customers to earn on their crypto with merchandise suited to all ability ranges and threat appetites. The earn part options merchandise starting from easy and protected financial savings accounts to high-risk and extra superior twin funding choices. We gained't go into element about all of the earn merchandise right here as you could find out extra in our devoted OKX Earn article, however listed here are the merchandise obtainable:

Easy Earn- A spot for customers to earn APY with idle belongings. This space consists of financial savings and staking for low-risk earn choices.

Structured Merchandise- These are progressive monetary devices that earn curiosity from the derivatives market. This space consists of merchandise like Shark Fin, Twin Funding, Twin Funding Lite, and Snowball.

On-Chain Earn- This space consists of on-chain incomes alternatives from DeFi protocols and PoS staking.

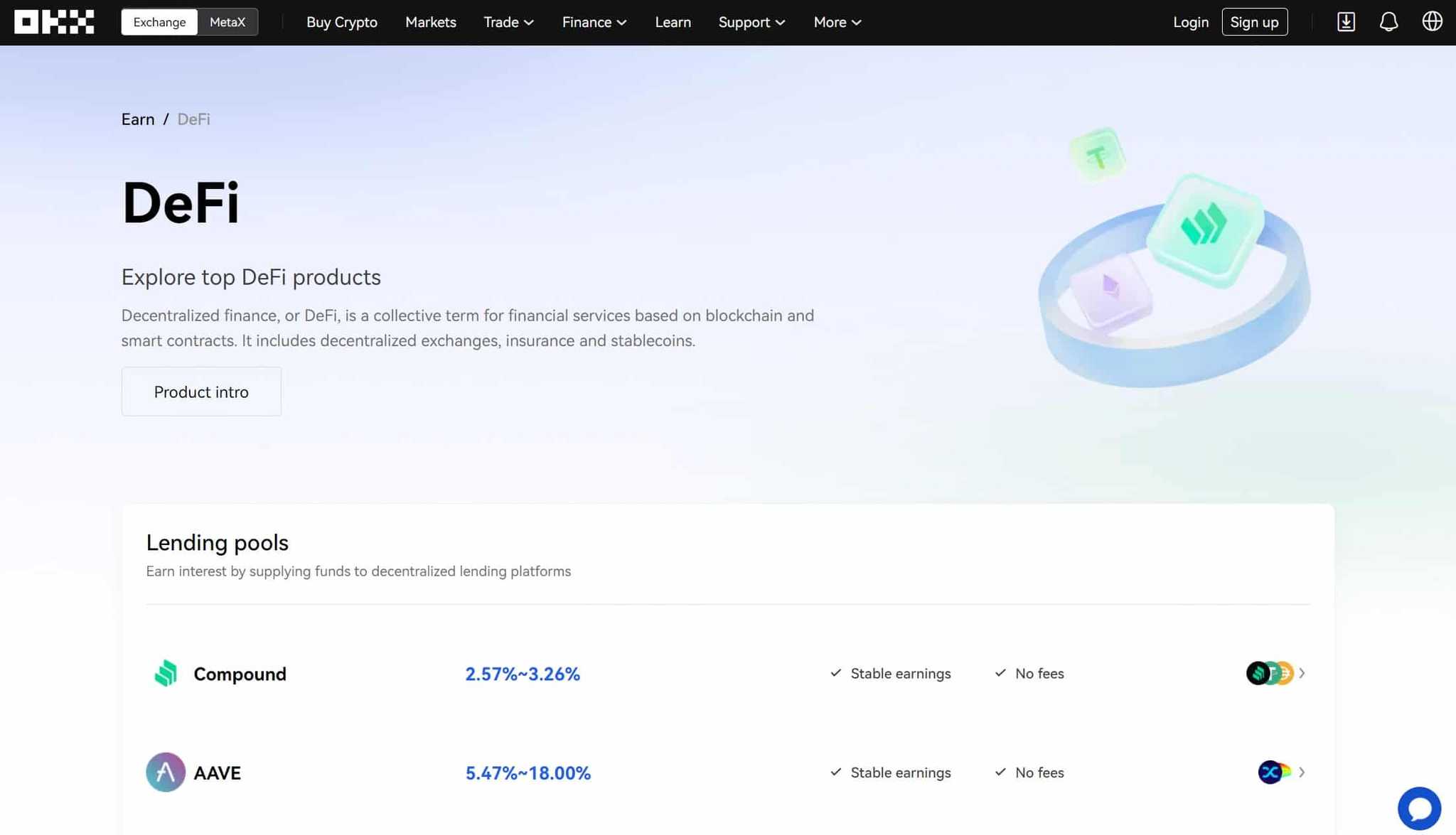

OKX DeFi

OKX have taken the dive into DeFi. Basically, customers on the OKX platform can entry the advantages of common DeFi platforms: Aave, Compound Finance, Sushiswap, and others via the platform.

What’s nice about this function is that it permits customers to entry the potential of DeFi with out having to undergo the cruel studying curve related to studying how you can use DeFi protocols. OKX acts because the gateway. They deal with the complicated DeFi stuff behind the scenes whereas customers profit from OKX's simple-to-use interface.

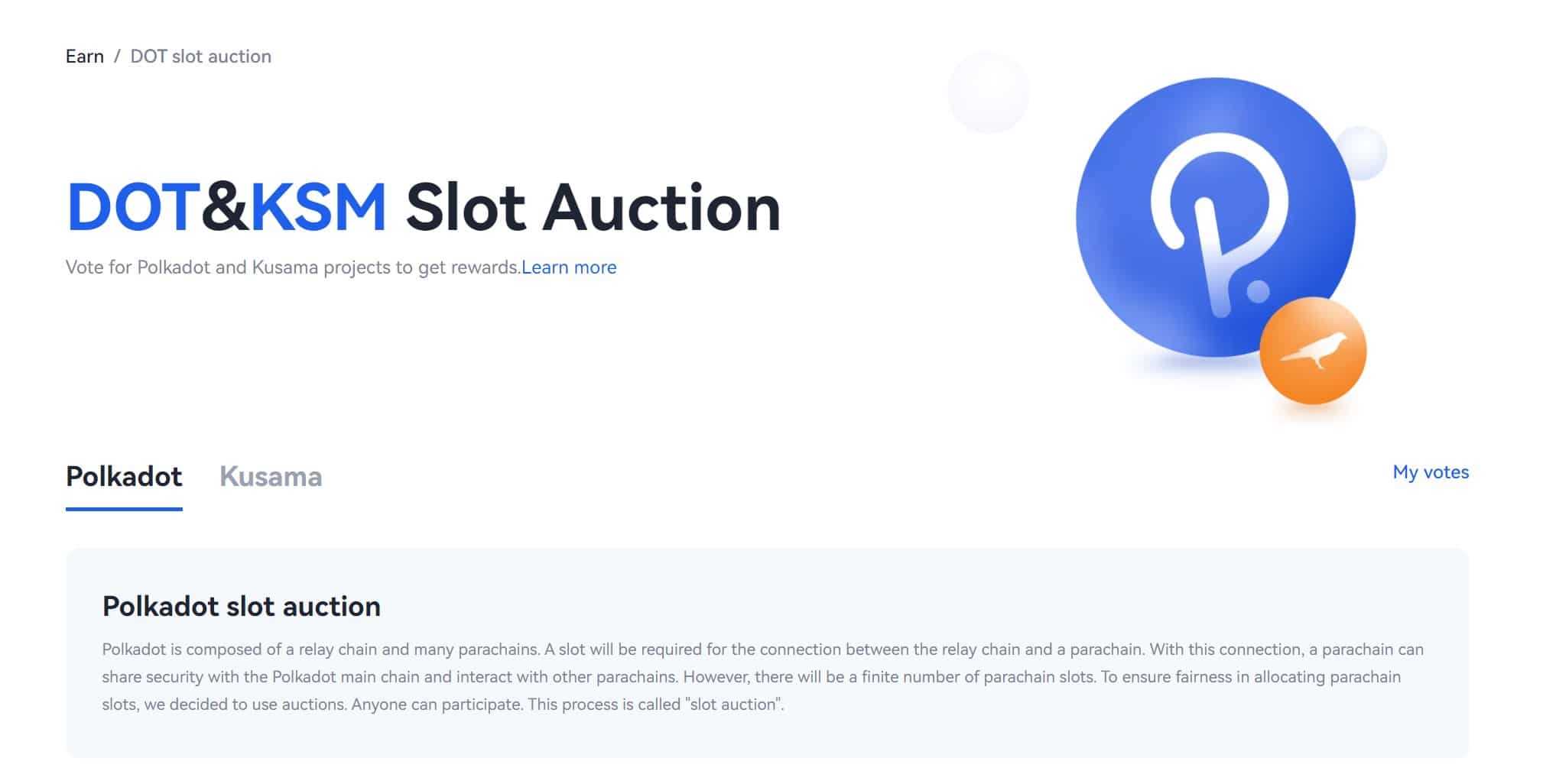

DOT & Kusama Slot Auctions

That is an attention-grabbing function within the Earn part. OKX have gotten concerned within the Polkadot ecosystem and neighborhood and have supplied a manner for its customers to get entangled in slot auctions. The complexities of DOT and KSM slot auctions are exterior the scope of this text. Be happy to take a look at Man's detailed video about Polkadot Parachain Auctions to seek out out extra.

Basically, this permits customers to simply and freely vote on proposals for future DOT and Kusama initiatives. Probably the most vital profit is that OKX covers all of the charges concerned with voting. As well as, if the challenge {that a} consumer helps wins the public sale, the Person receives rewards for voting. Customers who take part in early hen voting additionally earn unique rewards from OKX and the challenge groups. That is an easy method to get entangled with slot auctions.

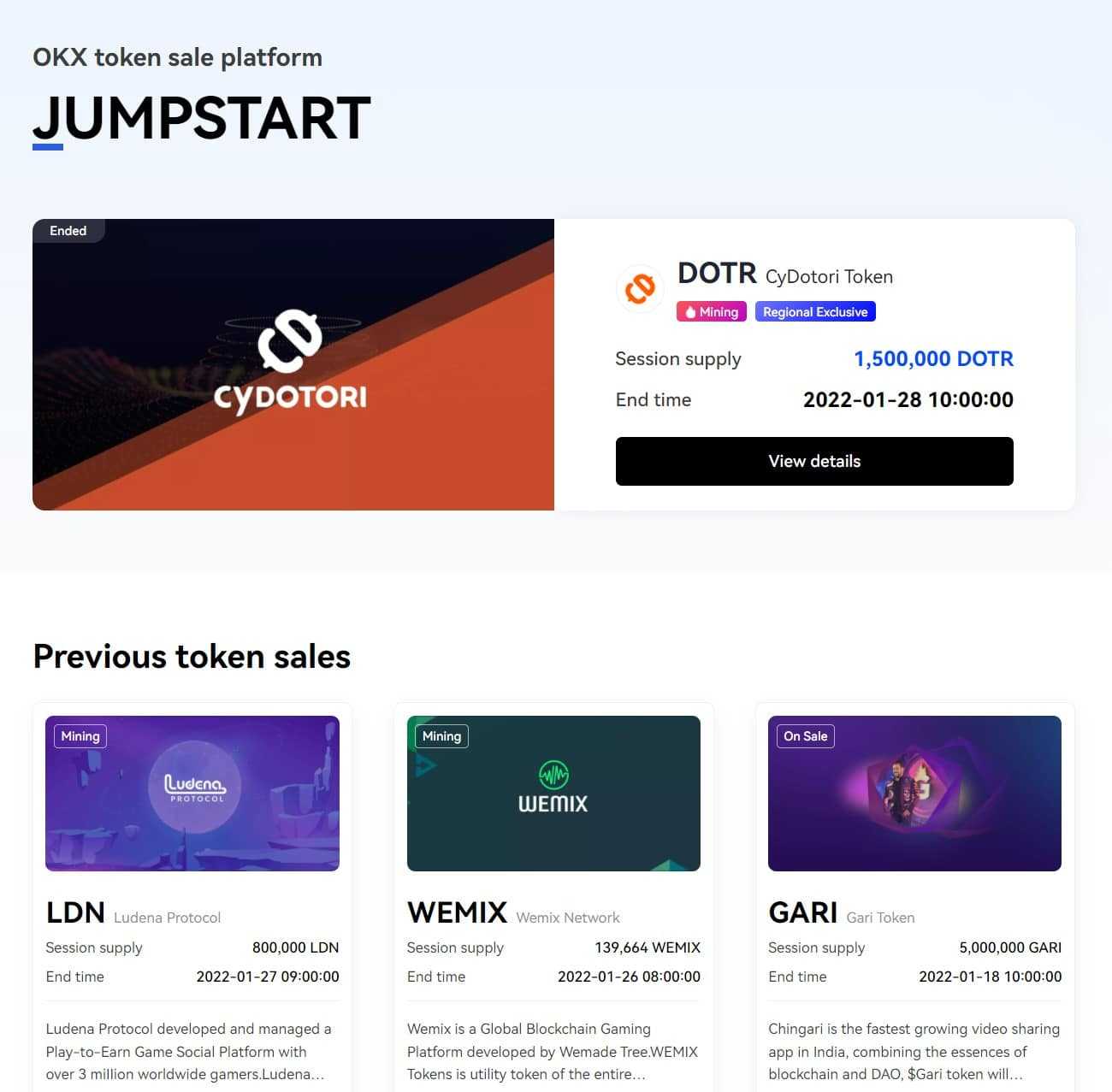

OKX Jumpstart

I instructed you there was lots to unpack right here. OKX have launched their token sale platform, which they name Jumpstart. This platform helps new initiatives launch and develop their communities. Customers can take part in campaigns by staking their OKB tokens and receiving the tokens from new initiatives based mostly on the consumer's staked quantities.

Jumpstart offers customers an opportunity to earn tokens from initiatives earlier than they launch to the general public. Moving into initiatives early and being among the many first to amass tokens from initiatives of their early levels is a good way to assist enhance your portfolio's efficiency. As historical past typically exhibits, as soon as a challenge goes public, its tokens have a very good probability of going to the moon.

The OKB Token

The OKB token is the native utility token of the OKX ecosystem, providing customers a plethora of advantages and powering varied on-chain actions. As an ERC-20 token on the Ethereum mainnet, OKB has a capped provide of 300 million items. OKB holders get pleasure from buying and selling payment reductions, with as much as a 40% discount based mostly on the quantity of OKB held. The token additionally grants entry to OKX Jumpstart, a platform that unveils new, high quality crypto initiatives, permitting customers to take a position utilizing OKB. OKB performs a task in itemizing votings, the place holders can use their tokens to vote for his or her most well-liked new listings on the trade. Moreover, OKB is accepted by exterior providers, due to OKX's partnerships with varied companies. A buyback and burn program is in place to boost OKB's worth, using 30% of the spot market buying and selling charges to buy and burn OKB tokens periodically. OKB tokenomics and its integration with the OKC chain encourages long-term holdling and provides a number of layers of utility for the token.

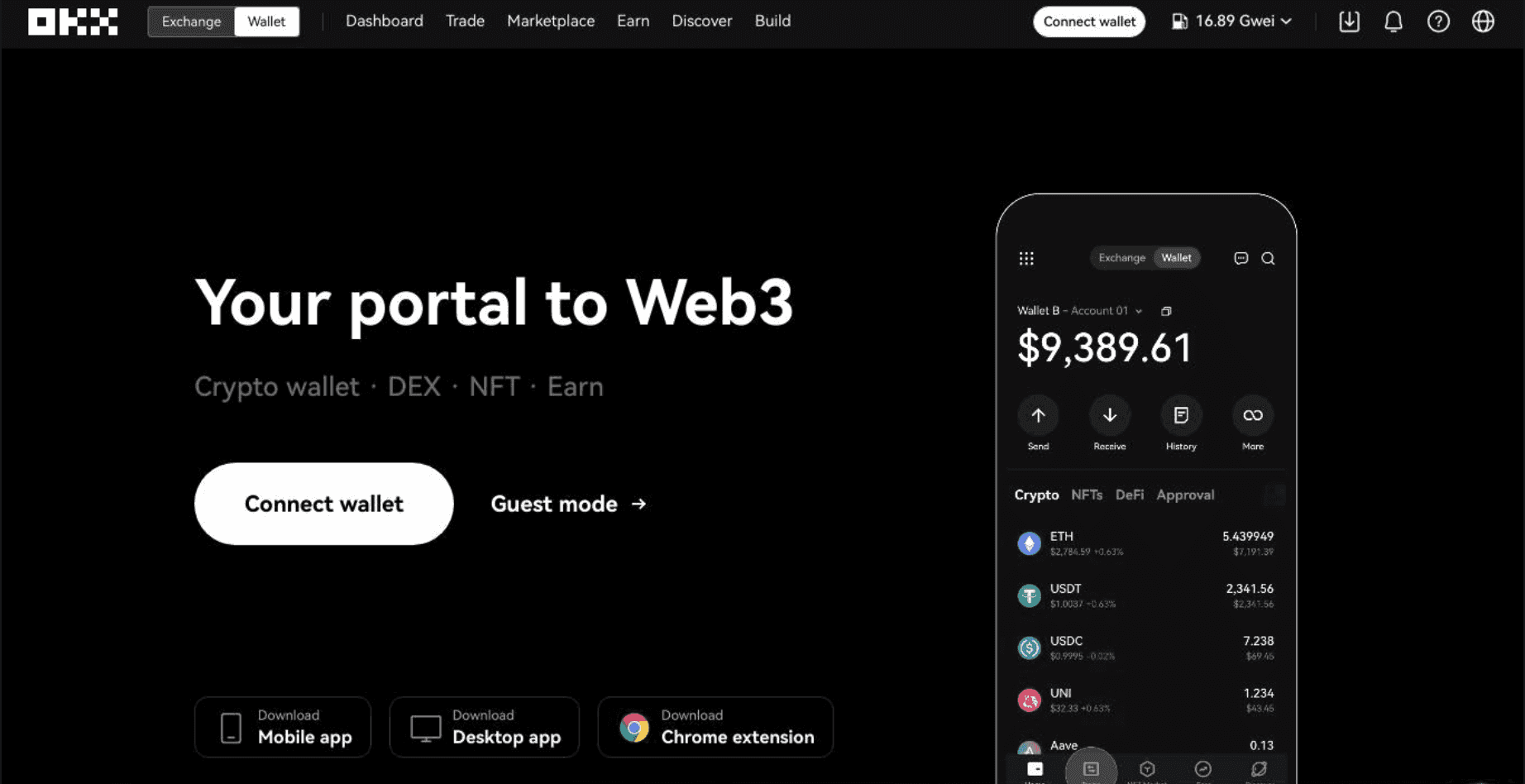

OKX Pockets

OKX Pockets is a brilliant pockets that helps multichain options with over 15 totally different blockchain networks and over 1000 DeFi protocols.

OKX aimed to create a flexible platform that can make navigating the world of DeFi a breeze, and all from one place. Anybody into DeFi understands the ache factors concerned in bouncing between a dozen totally different DeFi platforms and crypto-wallets. MetaX is a one-stop answer that integrates a number of DEXs, permits customers to create, handle, and commerce NFTs, and discover over a thousand DApps with one click on. Discuss comfort!

MetaX may very well be a severe game-changer in resulting in crypto mass adoption. One of the crucial appreciable boundaries to crypto adoption and DeFi is the complexities and studying curve. So the truth that OKX has constructed a bridge connecting a user-friendly CeFi interface with the powerhouse of DeFi deserves a standing ovation. You may study extra in regards to the feature-packed OKX Pockets in our OKX Internet Pockets Assessment.

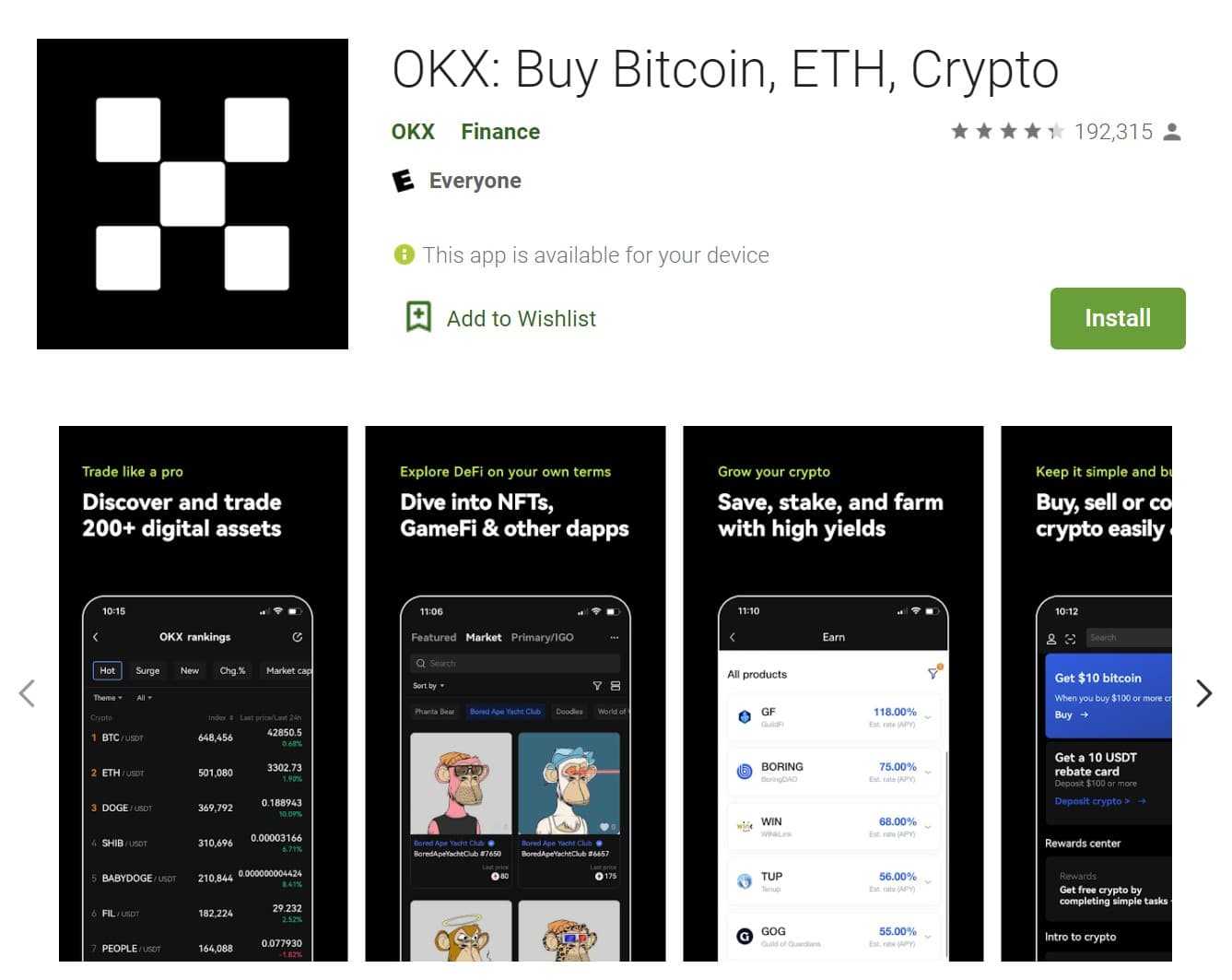

OKX Cell App & PC Shopper

For many who are on the go, you could want to observe your positions from a cellular machine. That’s the reason OKX have developed their very own buying and selling utility.

The OKX app is one severely highly effective piece of software program that matches in your pocket. This app permits buying and selling on all markets at OKX, together with their futures and spot markets and margin buying and selling. As well as, the cellular app offers customers the power to discover their NFTs and GameFi apps (amongst others). We gained't go into too many particulars in regards to the OKX app as we’ve got a full devoted OKX App overview the place you possibly can study extra about it, however the TL;DR is that the app does make all of the capabilities and contains a breeze to navigate to and entry, making the OKX app one of many extra sturdy, helpful, and easy-to-use crypto apps obtainable.

As for PC shoppers, OKX has developed a program obtainable on each Mac & PC shoppers. That is simply as practical because the web-based buying and selling platform, though it’s prone to be a bit sooner.

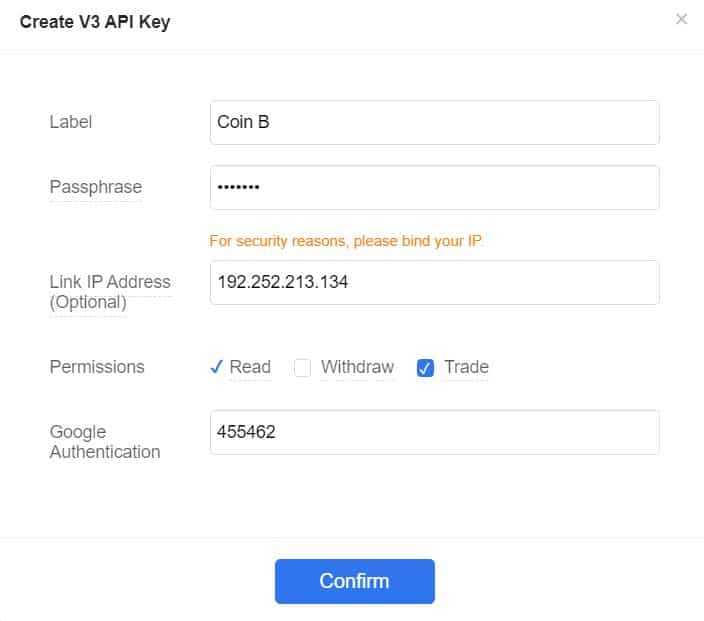

OKX API & Buying and selling Bots

For these of you who wish to code buying and selling algorithms or use buying and selling bots, you can be pleased to know that OKX has a fairly sturdy API with quite a lot of endpoints. They’ve each a REST in addition to a WebSocket model.

There may be additionally an in depth checklist of SDKs that may permit you to develop bots and buying and selling algorithms in a programming language that . These embody the likes of Java, node, Python, C++, Go, C#. There are in depth OKX Developer docs that you would be able to test to study extra about APIs and developer instruments.

If you wish to use the API, you want an API key. You may get this in your account by heading over to your username after which hitting "API". Right here you’ll choose "My API", the place it is possible for you to to create your individual key with the next parameters.

Observe that the "Link API" is if you want to certain the API key to a selected IP tackle. This may imply that solely this IP might ship instructions to the API. After getting created your key, you possibly can place it in your code to start out buying and selling.

Warning ⚠️: Though there are particular bot providers which might be provided on-line, we might discourage giving them your API key. Many of those are illegitimate and use your buying and selling account for illegitimate means.

OKX Bots

OKX has a incredible choice of pre-made and useable bots able to put your buying and selling on autopilot and commerce across the clock for you. OKX has among the best platforms for auto-trading lovers, however we gained't go into element about it right here as we’ve got a devoted OKX Bot Assessment the place we do a deep dive.

OKX Vs Different Exchanges

If you wish to see how OKX Stacks up in opposition to a number of the different main exchanges within the business, be happy to take a look at our head-to-head comparability articles:

- OKX vs Binance

- OKX vs Bitget

- OKX vs Bybit

- OKX vs KuCoin

- OKX vs Coinbase

And see how OKX Stacks up in opposition to different exchanges in our High Exchanges In contrast article.

OKX Buyer Assist

That is a type of essential issues for me. We’re all nicely conscious of the frustrations of ready eternally to get a response from an trade on our queries.

Fortunately, with OKX, you have got a fairly robust assist perform that may assist customers. As well as, there are an unlimited quantity of sources and touchpoints that you would be able to make the most of on the fundamental trade.

Maybe one of many quickest methods to pay money for an agent is thru their stay chat perform. Both they may have an agent obtainable to talk to you reside, or they may e-mail again in response to your question.

Though stay chat is probably the most handy possibility, sending a assist ticket can also be an possibility via the platform or by way of e-mail. Telegram assist can also be obtainable, however please at all times watch out using Telegram assist teams. There are lots of of scammers pretending to be buyer assist, so keep in mind that no assist employees will ever ask for passwords, personal keys, secret phrases, or ask so that you can ship them funds.

Professional Tip ✅: If you need to chase up your assist ticket, then you possibly can hit them up on their Telegram

After all, there isn’t any want so that you can attain out if you could find the required info of their assist centre. They’ve many of the solutions that different customers have posted, and it’s certainly fairly complete.

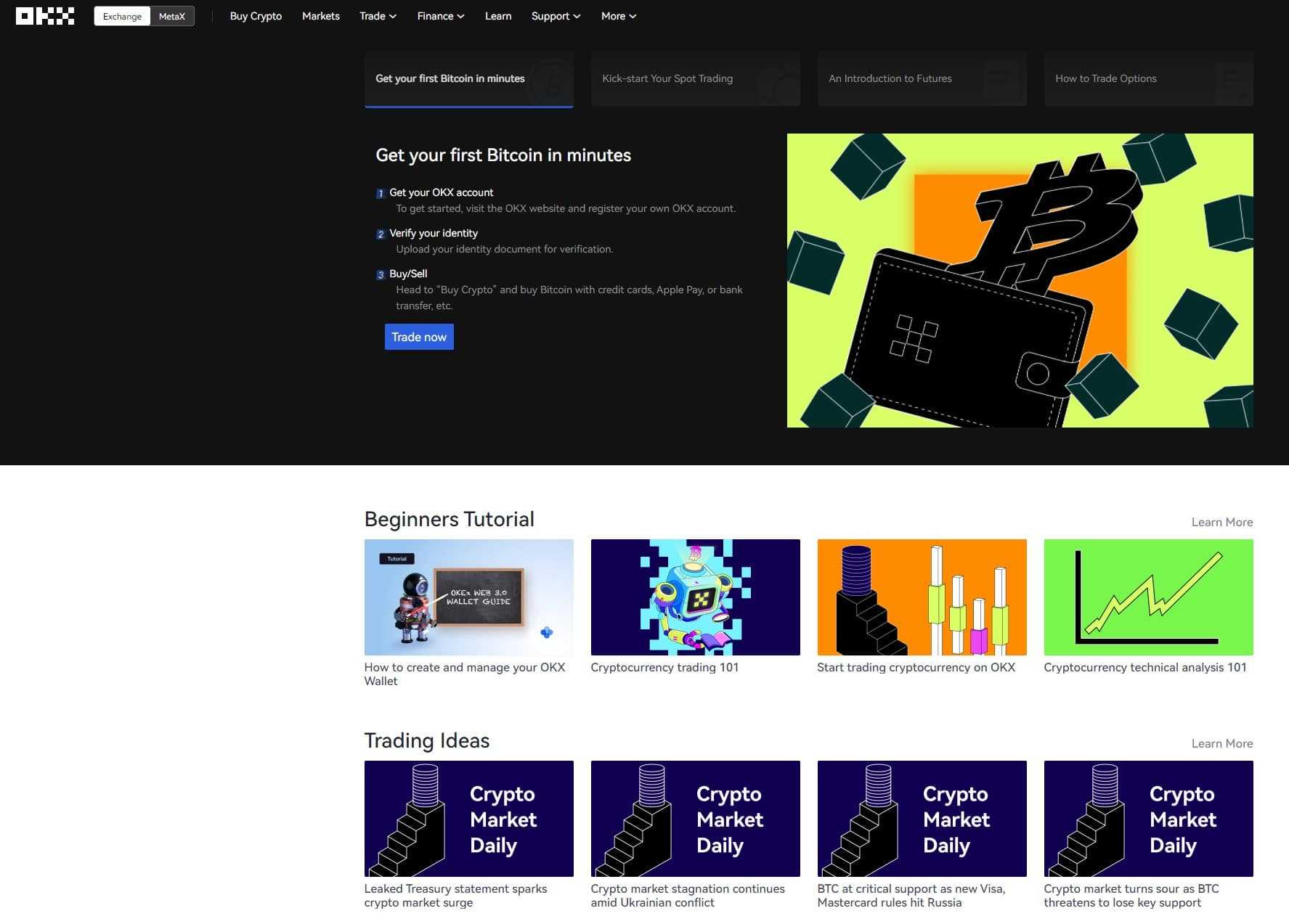

OKX Group & Academy

We actually preferred OKX as a result of they’ve a fairly robust neighborhood round it with quite a few telegram & Fb teams. This is a wonderful method to bounce some buying and selling concepts off fellow native merchants.

I additionally want to offer the OKX staff kudos as they’ve positioned a powerful emphasis on crypto schooling via their incredible instructional section- the OKX Academy. This has received every thing it’s worthwhile to know, from easy buying and selling guides to extra superior sources similar to how you can commerce choices and futures and bespoke buying and selling methods and common crypto data.

Lastly, there’s additionally a fairly helpful glossary the place you possibly can study a complete host of phrases and knowledge. This may very well be excellent in case you are unfamiliar with sure phrases on the platform.

Conclusion

In abstract, we actually just like the OKX platforms. Not solely does it have the benefit of being backed by one of many largest buying and selling platforms on the earth, however additionally it is actually well-designed. OKX has actually upped their recreation by including all the opposite nice options.

The innovation behind the platform to pursue so many various avenues of blockchain is incredible to see. Whereas OKX began off as a strong buying and selling platform, it has drawn crypto customers from varied backgrounds and pursuits and is rising in recognition.

The choice to demo commerce makes OKX an awesome place for novices to study the craft of buying and selling and the platform is very practical and very easy to make use of. That is finest illustrated with their choices devices.

There are, after all, areas for enchancment. For instance, you solely have Bitcoin choices to commerce for the time being. There may be additionally comparatively restricted liquidity for the choices market, particularly out-of-the-money ones.

So, is the OKX platform price utilizing?

Properly, in case you are taken with NFTs, excessive APYs, HODLing, GameFi, and crypto buying and selling with low charges, then you possibly can't actually go incorrect with this all-in-one platform. For energetic institutional and retail merchants in search of a extremely practical but simplistic buying and selling interface developed by a well-respected international trade, then it’s nicely price a spin.

👉 Join OKX and obtain an unique 40% buying and selling payment low cost for all times!

Going to commerce lots? Get in contact with Tom on Telegram for a bespoke OKX VIP Deal @TomCoinBureau

Warning ⚡️: Buying and selling leveraged futures merchandise is extremely dangerous. Just remember to observe sufficient threat administration

Steadily Requested Questions

Can OKX be trusted?

Sure, OKX is a longtime crypto trade and follows business finest practices in maintaining buyer funds protected. They’re utilized by thousands and thousands of consumers worldwide and have typically optimistic opinions and buyer experiences. Nevertheless, as with each centralized trade, there’s at all times a threat of hack makes an attempt.

Is OKX obtainable within the US?

No, OKX will not be at the moment obtainable in the US as a result of regulatory restrictions. U.S. residents are prohibited from utilizing OKX’s providers, and accessing the platform by way of a VPN to bypass this restriction is in opposition to its phrases of service. U.S. residents can discover different platforms that adjust to native rules.

Is OKX a Good Trade?

Sure, OKX is a very fashionable crypto trade and is a primary contender with the likes of Binance and OKX. They’ve glorious asset assist, further options, and a plethora of instruments which prospects can make the most of for his or her buying and selling, hodling, and incomes wants. They’re one of the vital common and well-respected cryptocurrency exchanges within the business.

Is OKX Accessible in the US?

OKX will not be obtainable for customers situated in the US. Crypto merchants within the US ought to take into account Kraken, Binance US or Coinbase.

The place is OKX Situated?

OKX is at the moment headquartered in Seychelles with a location additionally in Malta.

Is OKX Higher Than Coinbase?

Deciding whether or not OKX is healthier than Coinbase is determined by particular person wants and preferences. OKX affords a variety of cryptocurrencies and superior buying and selling options appropriate for knowledgeable merchants. Its low buying and selling charges and numerous monetary merchandise, similar to futures and choices buying and selling, are interesting to these in search of extra refined buying and selling instruments. Alternatively, Coinbase is famend for its user-friendly interface, robust regulatory compliance, and sturdy safety measures, making it a most well-liked alternative for novices and people prioritizing ease of use and security. In the end, the selection between OKX and Coinbase hinges in your buying and selling expertise, most well-liked options, and safety issues.

Is OKX a Chinese language Firm?

OKX, initially headquartered in Beijing, China, has expanded globally and is now headquartered within the Seychelles. Regardless of its origins, OKX is topic to a complete ban by Chinese language regulators, indicating a big pivot away from its preliminary base. This shift features a formal announcement of its withdrawal from the Chinese language mainland market, emphasizing its international operational strategy relatively than being recognized as a Chinese language firm.

Can I withdraw cash from OKX?

Sure, you possibly can withdraw cash from OKX. The platform helps withdrawals of cryptocurrencies and fiat currencies (relying in your location and the obtainable strategies). To withdraw, it’s worthwhile to full id verification and observe the withdrawal course of in your account, which incorporates coming into the quantity, tackle, and different essential particulars. Charges and withdrawal limits could apply.

How are you going to generate income on OKX?

You may make cash on OKX via varied strategies, together with:

- Buying and selling: Purchase low and promote excessive on spot or futures markets.

- Staking: Earn rewards by staking supported cryptocurrencies.

- Lending: Use the platform’s lending providers to earn curiosity.

- Yield Farming: Take part in DeFi initiatives for yield era.

- Referral Program: Earn bonuses by inviting others to hitch.

Is OKX good for day buying and selling?

Sure, OKX is an effective platform for day buying and selling. It affords superior buying and selling instruments, excessive liquidity, aggressive charges, and a variety of belongings. Its user-friendly interface and options like real-time charting, leverage choices, and varied order sorts make it appropriate for energetic merchants. Nevertheless, profitable day buying and selling requires ability, technique, and an understanding of market dangers.

What’s the day by day restrict on OKX?

The day by day withdrawal restrict on OKX is determined by your account verification degree. For absolutely verified accounts, the restrict is considerably increased than for unverified or partially verified accounts. Particular limits differ by asset and may vary from just a few BTC for fundamental accounts to lots of for higher-tier accounts. You may test your restrict in your account settings.

Is OKX a tier 1 trade?

Sure, OKX is taken into account a tier 1 trade. It is likely one of the largest and most trusted cryptocurrency exchanges globally, with excessive buying and selling volumes, robust safety measures, and a variety of supported cryptocurrencies and options. Its status and infrastructure place it among the many prime exchanges within the business.