Decentralized Finance is without doubt one of the most progressive items of economic expertise prior to now decade. Right this moment, we’re going to discover one of many market leaders within the house that exists on the Binance Sensible Chain- PancakeSwap.

PancakeSwap got here onto the scene in September 2020 and has shortly expanded its set of options and providers to rival these provided by most decentralized exchanges and a few centralized exchanges. Within the article, I’ll be supplying you with a good suggestion of all you might want to know earlier than you employ the trade.

PancakeSwap Abstract

| HEADQUARTERS: | Japan |

| YEAR ESTABLISHED: | 2020 |

| REGULATION: | None |

| SUPPORTED CHAINS: | Binance Sensible Chain (BSC), Ethereum, Polygon zkEVM, zkSync Period, Linea, Base, Arbitrum One, Aptos. |

| NATIVE TOKEN: | CAKE |

| TRADING FEES: | For AMM swaps- 0.25% of the commerce worth

For Perpetual Futures trading- 0.02% of notional worth for makers and 0.07% for takers. |

| SECURITY: | PancakeSwap is open-source and has gone by a number of safety audits by Certik, Peckshield and SlowMist. It additionally makes use of multi-sig for all contracts. |

| BEGINNER-FRIENDLY: | Prior expertise with Dapps beneficial |

| KYC/AML VERIFICATION: | None |

| FIAT CURRENCY SUPPORT: | None |

| DEPOSIT/WITHDRAW METHODS: | Non-custodial for swaps,

Perpetual buying and selling makes use of good contracts to retailer collateral. The funds could be withdrawn again to pockets anytime. |

What’s PancakeSwap

PancakeSwap is a decentralized trade (DEX) that initially launched on the Binance Sensible Chain (BSC) in September 2020. Using an automatic market maker (AMM) mannequin, it facilitates seamless token swaps by permitting customers to commerce straight in opposition to liquidity swimming pools. Over time, PancakeSwap has expanded past BSC and now operates on a number of blockchain networks, together with Ethereum, Polygon zkEVM, zkSync Period, Linea, Base, Arbitrum One, and Aptos. As a permissionless DEX, it permits anybody to record their tokens by making a corresponding liquidity pool, fostering a various and inclusive buying and selling ecosystem.

PancakeSwap presents a wide range of options for its customers corresponding to token swaps, liquidity provision and farming, staking, perpetual buying and selling, lottery, NFT market, launchpad and so on. It’s one the few DEXs that gives customers a extra well-rounded Defi expertise with entry to a wide range of monetary merchandise in a single interface. This type of consumer expertise is often native to centralized exchanges that work with big operational groups and funding. DEXs are likely to deal with one or two monetary merchandise and follow them.

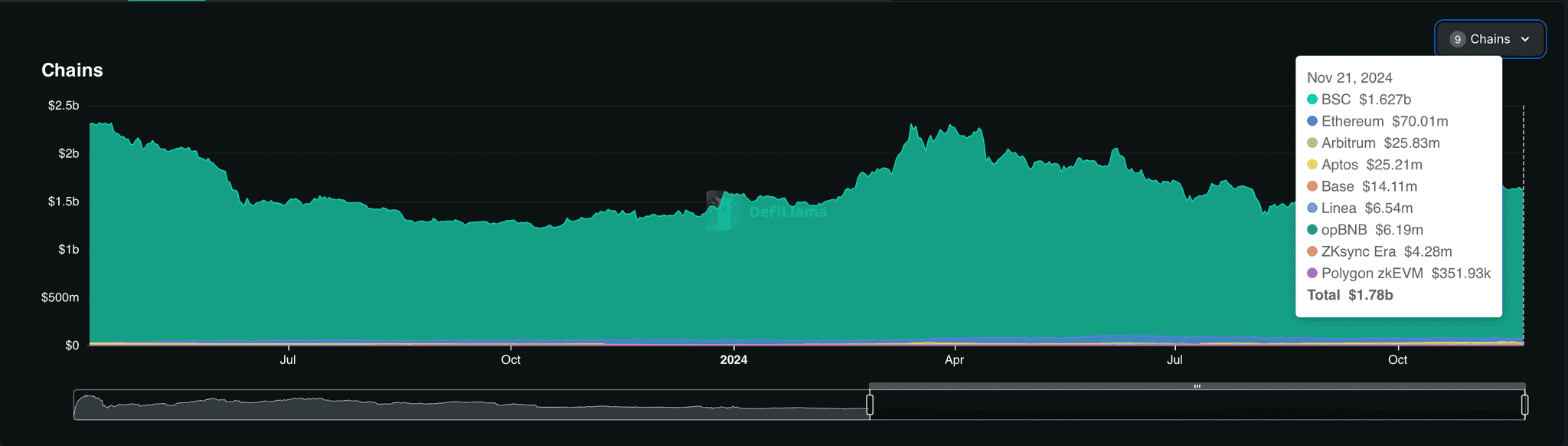

At the moment, PancakeSwap stands as the most important decentralized trade (DEX) and DeFi utility on the BSC community by whole worth locked (TVL), boasting an estimated $1.62 billion in property held on the platform. The remaining property are unfold throughout different supported chains, indicating considerably decrease adoption on these networks. PancakeSwap additionally options its personal governance token, CAKE, which permits holders to vote on proposals. Moreover, CAKE is distributed as a reward to liquidity suppliers and stakers.

PancakeSwap Trade Key Options

PancakeSwap has managed to carry on to the title of ‘biggest DEX on the BSC chain’ this lengthy for one reason- its capability to supply a variety of economic services and products in a single interface. Nicely, most of that is doable due to the diligent work performed by its staff of builders behind the scenes. In slightly below two years, PancakeSwap has managed to increase its vary of providers from easy token swaps to an on-chain derivatives market. An inventory of its present set of providers are:

- Spot Buying and selling

- Yield Farming

- Syrup Swimming pools (Staking)

- Prediction Market

- Lottery

- Perpetual Futures Buying and selling

- IFO- Preliminary Farm Providing

- NFTs

PancakeSwap Spot Buying and selling

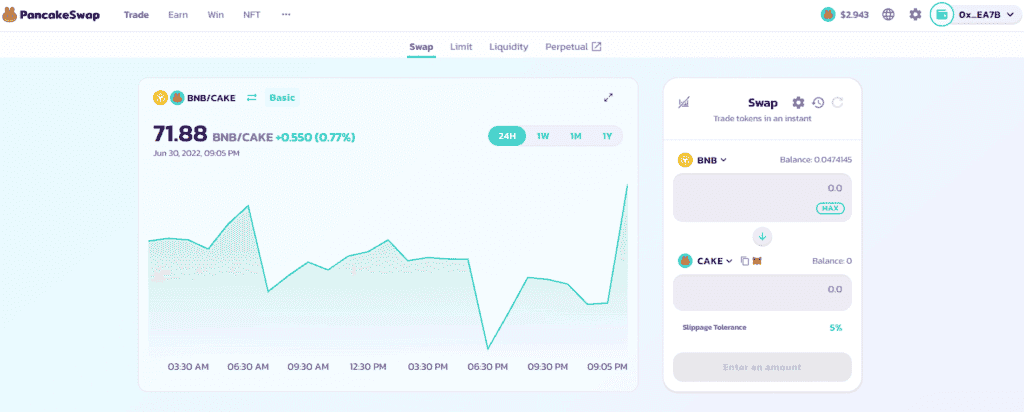

Spot Buying and selling on PancakeSwap is executed through the swapping of property in a liquidity pool by an automatic market maker (AMM). Often, AMM swaps are executed stay with the worth being decided by the ratio of property within the pool, customers shouldn’t have definitive management over the worth at which they buy or promote property.

PancakeSwap solves this for customers by permitting them the choice to pre-set orders through the restrict order perform on its interface. In contrast to centralised exchanges, this doesn’t entail the matching of 1 order in opposition to one other. As an alternative, the AMM deploys a swap on its liquidity pool as soon as the pre-set worth goal is hit. Nevertheless, needless to say PancakeSwap doesn’t help restrict orders for tokens which have a payment/tax on the ‘transfer’ of tokens. Open restrict orders will stay open indefinitely till they get executed or cancelled by customers. A customizable expiration date characteristic is deliberate for the close to future.

Furthermore, since PancakeSwap is constructed on the BSC community, transaction speeds are quicker and less expensive than they’re on Ethereum. Whereas executing swaps on PancakeSwap make sure that you’re utilizing the V2 swap, because the older model (V1) is extra liable to slippage which ends up in lack of capital.

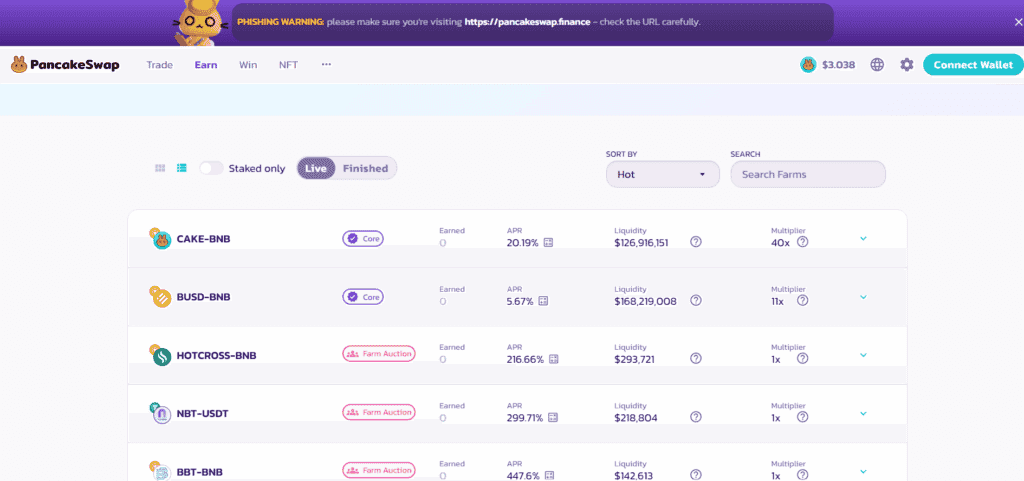

PancakeSwap Yield Farming

Customers can farm rewards within the type of CAKE tokens by offering liquidity to the Liquidity Swimming pools on PancakeSwap. PancakeSwap has a number of yield farms, all of which require you to stake two tokens to get the LP tokens that correspond to the precise farm. Every farm on PancakeSwap has its personal yield fee and multiplier, so you’ll want to take a look at which farm you need to earn from earlier than offering liquidity. For instance, the CAKE-BNB farm has a 40x multiplier, which implies that, for each block produced, it receives 40 CAKE.

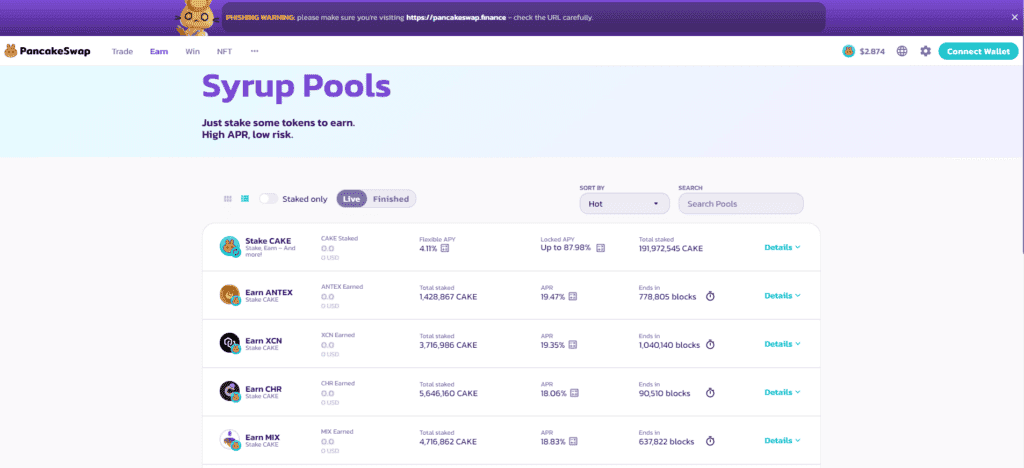

PancakeSwap Syrup Swimming pools (Staking)

Syrup Swimming pools enable customers to stake CAKE and earn rewards within the type of CAKE or different tokens. The CAKE Syrup Pool particularly permits customers to decide on between versatile and locked staking. The locked staking choice supplies a excessive APY however requires customers to lock their tokens for a set length of time. The versatile staking choice presents customers a decrease APY however permits them to withdraw the tokens at any time limit.

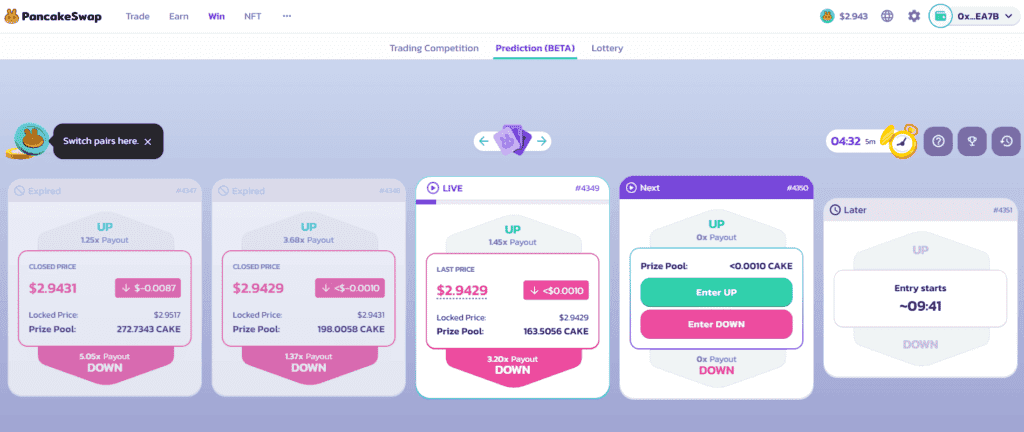

PancakeSwap Prediction Market

PancakeSwap’s prediction market permits customers to earn tokens by precisely predicting the worth motion of both BNB-USD or CAKE-USD pairs. Customers can both guess on the worth of BNB or CAKE going up or down inside a five-minute timeframe.

Primarily based on the closing worth on the finish of the spherical, outcomes might be calculated and rewards might be distributed.

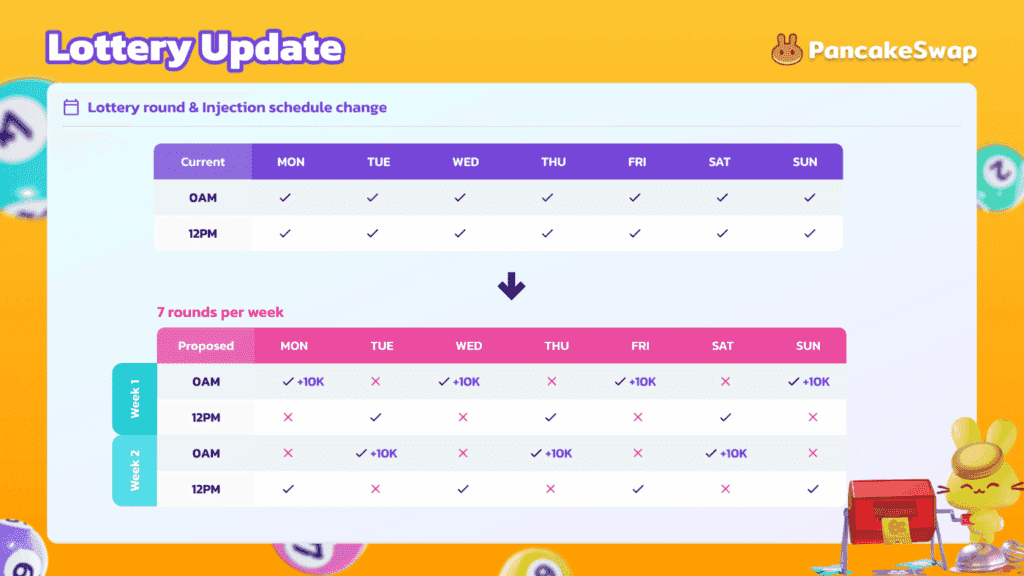

PancakeSwap Lottery

The PancakeSwap Lottery permits customers to purchase lottery tickets which every have a 6-digit mixture on them. Every lottery interval lasts between 12-36 hours, on the finish of which a random six-digit mixture is generated.

To win, customers should possess tickets that match the successful mixture from left to proper. The nearer your quantity is to the successful mixture, the higher your rewards might be.

For instance,

If the successful mixture is 8-9-6-5-9-4, and your ticket is 8-9-6-2-3-4. You’ve efficiently drawn a ticket which is eligible for the ‘match-three’ prize bracket. The extra customers with successful tickets within the bracket, the lesser your rewards might be.

If the successful mixture is 8-9-6-5-9-4, and your ticket is 0-9-6-5-9-4. You’ve misplaced the lottery though the final 5 digits match, it’s because successful mixtures are counted from left to proper.

Below Lottery V2, every ticket prices $5 paid in CAKE.

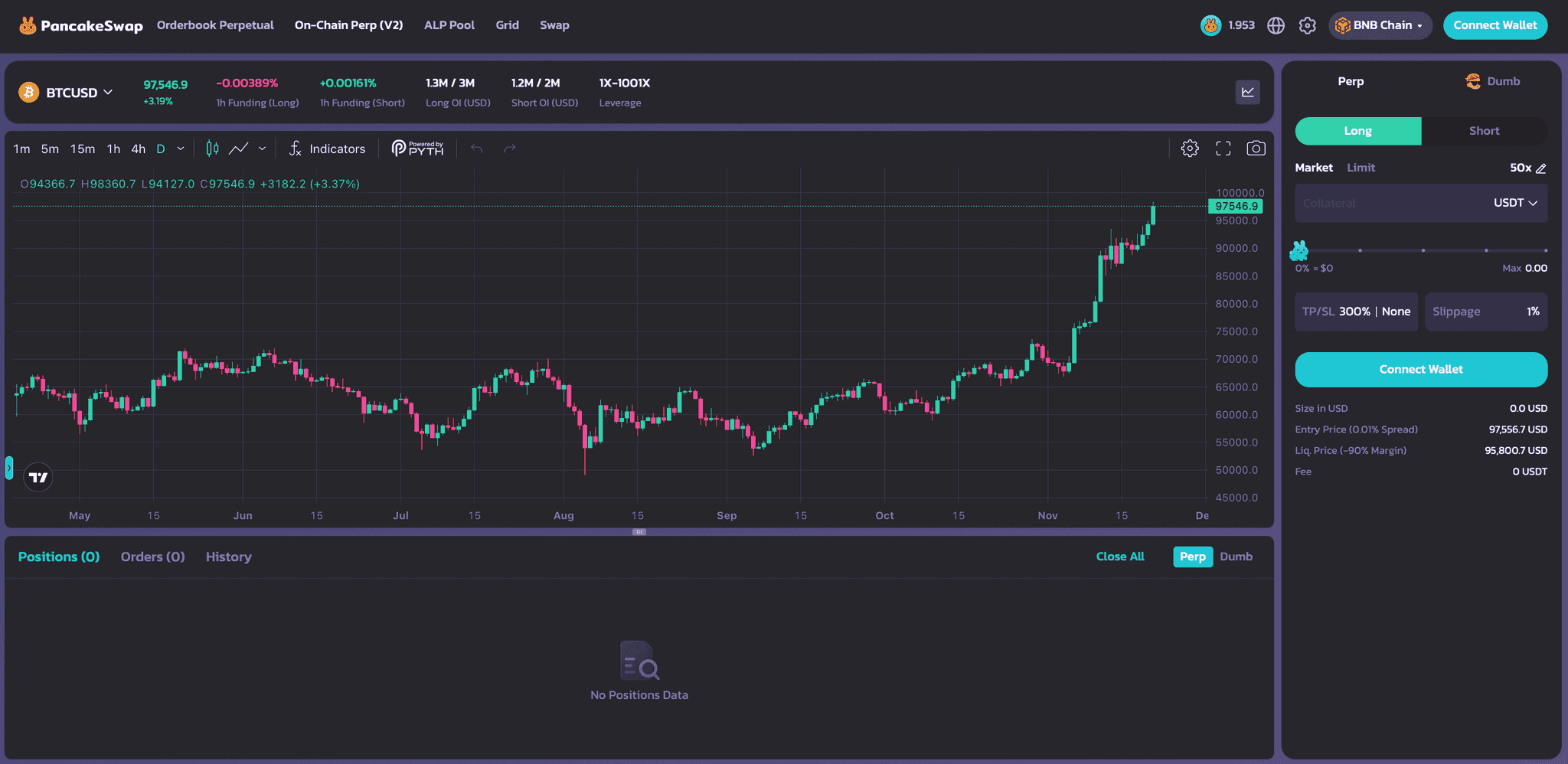

PancakeSwap’s Perpetual Futures Buying and selling

PancakeSwap has partnered with ApolloX Finance to permit customers to commerce perpetual futures contracts on its interface. The buying and selling infrastructure is constructed with off-chain order-book matching and on-chain settlement, which permits essential buying and selling options like completely different order sorts (corresponding to restrict orders, cease limits, and post-only orders) whereas sustaining the privateness and safety of a DEX — i.e., doesn’t require KYC and doesn’t contain intermediaries when interacting with good contracts.

PancakeSwap Preliminary Farm Providing (IFO)

IFO, or preliminary farm providing, is a brand new ICO idea pioneered by PancakeSwap. To take part in an IFO, customers will need to have a PancakeSwap ‘profile’ created. After which, customers can commit CAKE tokens to the IFO pool with a purpose to buy the token. The quantity of CAKE a consumer can commit is set by the variety of iCAKE {that a} consumer has acquired. iCAKE shouldn’t be a token however moderately a numerical metric used to calculate the variety of CAKE staked within the fixed-term CAKE staking pool and the whole staking length of your present fixed-term staking place.

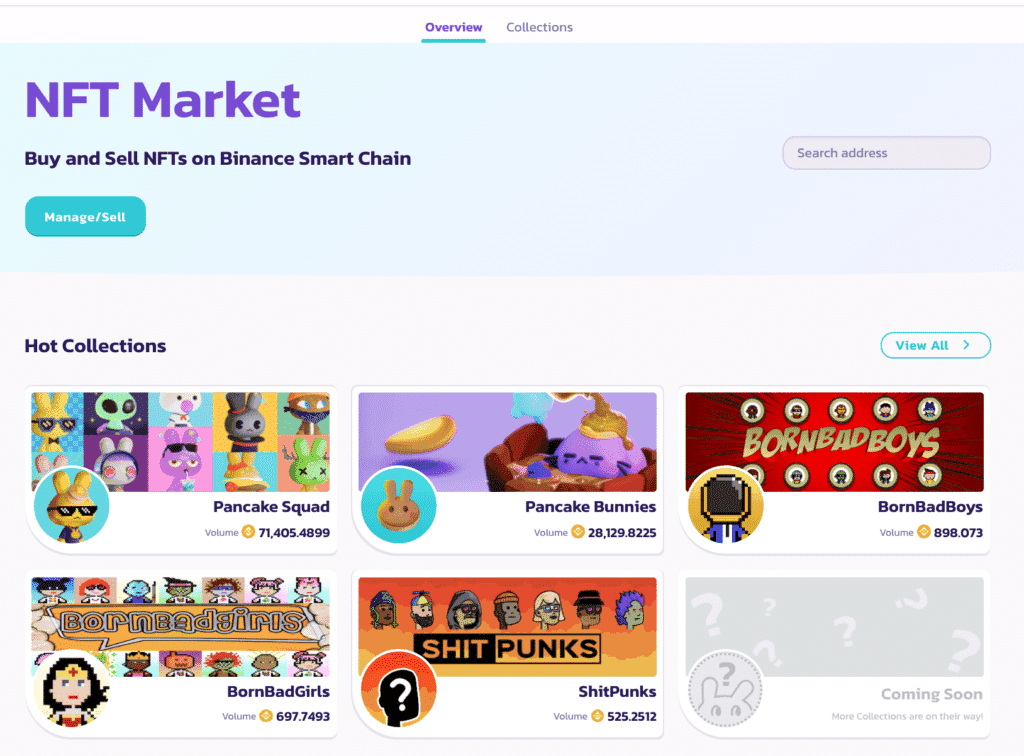

PancakeSwap’s NFTs and NFT Market

PancakeSwap is staying forward of the sport by launching its personal NFT collections and providing customers the flexibility to create personalised profiles on the trade by linking them to an NFT. PancakeSwap additionally has its personal NFT market that enables for the buying and selling of white-listed NFT collections.

For a extra detailed “how-to” on all of the completely different options of PancakeSwap, consult with our devoted profile.

PancakeSwap Charges

Liquidity Pool Token Swapping

PancakeSwap’s spot market buying and selling occurs through the swapping of property in liquidity swimming pools. Buying and selling through liquidity swimming pools doesn’t entail the ‘matching’ of orders like in ‘order-book’ exchanges, subsequently there aren’t any maker or taker charges. The one buying and selling payment charged is a protocol liquidity pool payment that’s paid to the liquidity suppliers both partially or in full. PancakeSwap prices a 0.25% buying and selling payment, which is damaged down as follows:

0.17% – Returned to Liquidity Swimming pools within the type of a payment reward for liquidity suppliers.

0.03% – Despatched to the PancakeSwap Treasury.

0.05% – Despatched in direction of CAKE buyback and burn.

In PancakeSwap V3, buying and selling charges can range relying on the liquidity pool’s payment tier, which could be set at 0.01%, 0.05%, 0.25%, or 1%. This flexibility permits liquidity suppliers to tailor payment constructions primarily based on the buying and selling pair's traits.

Perpetual Futures Market

PancakeSwap’s perpetual futures market operates solely on-chain, leveraging ApolloX V2 for enhanced transparency and decentralization. In contrast to the earlier off-chain order e book system, this improve ensures a totally decentralized buying and selling expertise whereas sustaining aggressive charges.

The buying and selling charges are 0.08% of the notional worth for opening or closing a place on the BNB Chain, opBNB, and Base. On Arbitrum, the buying and selling payment is barely decrease at 0.05%. Moreover, a small execution payment applies when opening a place, which is fastened as follows:

$0.30 on BNB Chain and Base.

$0.20 on Arbitrum.

$0.01 on opBNB.

These charges are deducted from the collateral within the consumer’s perpetual futures account, which might embrace property like USDT, BUSD, and CAKE.

PancakeSwap KYC and Account Verification

PancakeSwap is a decentralized and non-custodial trade, which means that there isn’t any authorized entity holding and taking management over your funds for you. All funds and trades are executed on-chain through good contracts and the software program is open supply. This implies there isn’t any KYC or account verification course of on PancakeSwap. The one requirement for utilizing the DEX is a self-custody browser pockets or {hardware} pockets and a few crypto to pay for community charges.

PancakeSwap Safety

PancakeSwap is open-source and has gone by a number of safety audits by Certik, Peckshield and SlowMist. There’s a whole of 9 safety audits listed on the official documentation.

PancakeSwap additionally employs the most effective safety practices through the use of multi-sig for all contracts and enabling a time-lock characteristic for them. Furthermore, most of PancakeSwap’s code is publicly seen and all their contracts are verified on BscScan for optimum transparency.

Cryptocurrencies Accessible on PancakeSwap

PancakeSwap permits the buying and selling of tokens through token swaps on a number of blockchain networks, together with Binance Sensible Chain (BSC), Ethereum, Polygon zkEVM, zkSync Period, Linea, Base, Arbitrum One, and Aptos. Whereas PancakeSwap initially supported solely BEP-20 tokens, its multichain enlargement now permits buying and selling of tokens adhering to numerous requirements, corresponding to ERC-20 on Ethereum and others on supported chains.

PancakeSwap’s perpetual futures trade is made doable by partnering with ApolloX. In consequence, all buying and selling pairs presently obtainable on PancakeSwap’s perpetual futures platform are these listed and authorised by ApolloX on their very own interface.

PancakeSwap Trade Platform Design and Usability

PancakeSwap has a easy and nice consumer interface that gives customers entry to a variety of economic merchandise and options. Whereas the trade is initially a fork of SushiSwap, it has since expanded its providers and options far past what SushiSwap presently supplies for customers.

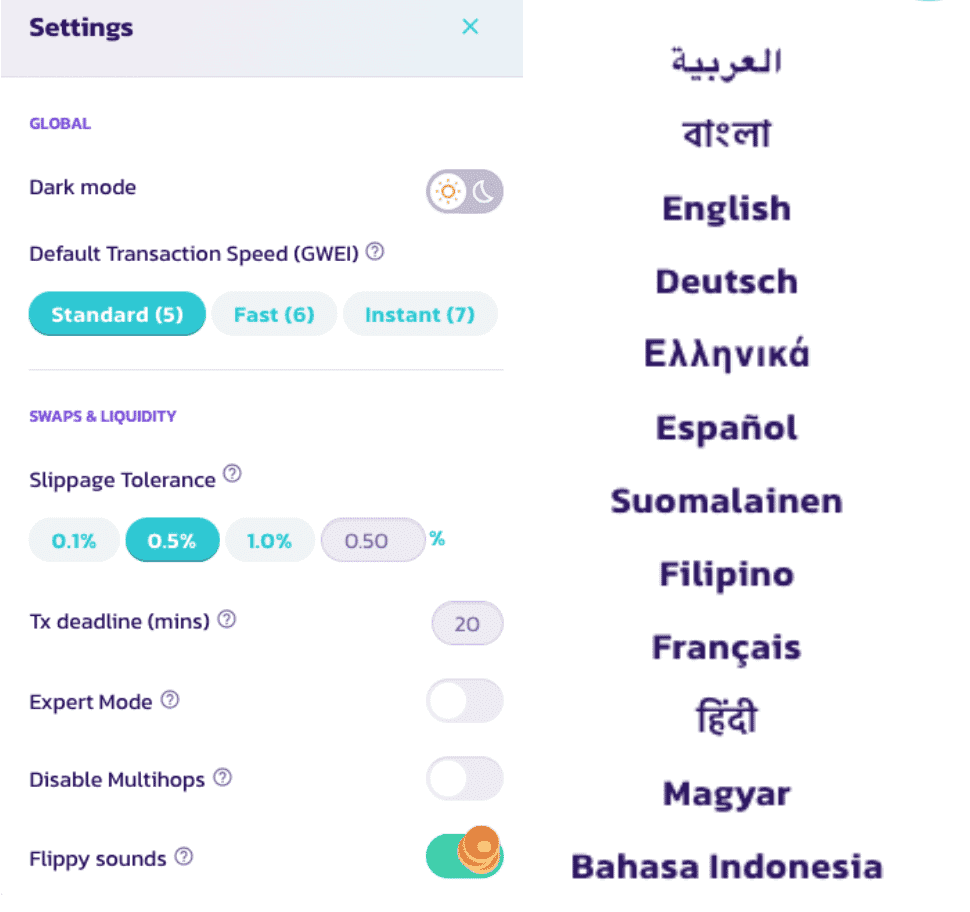

From a design perspective, the platform presents customers a variety of language choices that they’ll select from. Among the languages supported are English, Dutch, Spanish, French, Arabic, Russian, and so on. PancakeSwap additionally permits customers to configure their most well-liked commerce setting through the settings icon current subsequent to the language choice icon. It additionally presents a darkish mode setting that reduces the depth of white mild produced by the display. It is a private favorite, I can’t depend the variety of occasions I’ve been greeted with a gush of sunshine whereas attempting to commerce tokens late at night time in my crypto dungeon.

From a usability perspective, I completely love that PancakeSwap permits customers to create a personalised profile of themselves on the trade. After all, I need to point out that this characteristic prices the consumer a payment of 1.5 CAKE tokens, however you do get a profile and an NFT out of it. As of now, having a profile permits you to observe previous transactions and think about all PancakeSwap NFTs owned by you in your profile.

PancakeSwap additionally has intensive documentation and a vibrant neighborhood that gives solutions to any queries you may need or come throughout.

PancakeSwap Token (CAKE)

PancakeSwap has a local governance token known as CAKE.

Utility

CAKE acts as each the governance token in addition to the rewards and utility token of the PancakeSwap trade. CAKE holders can vote on governance choices, declare reductions on buying and selling charges in perpetual futures, acquire entry to IFOs, buy lottery tickets, and so on.

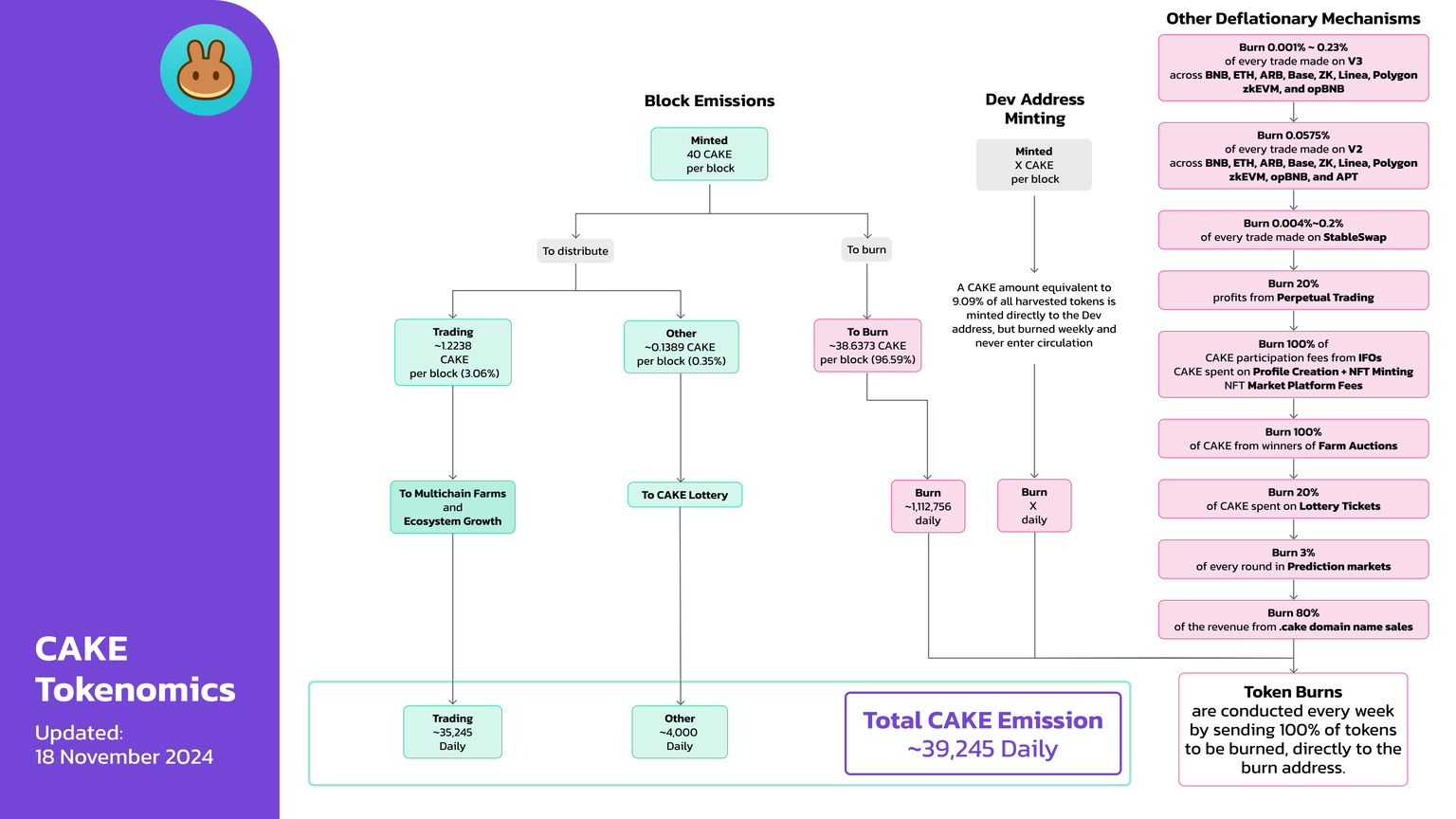

Token Provide and Emissions

The present whole provide of CAKE is 381 million with a max provide of 750 million. The present market cap of CAKE is $556 million with an emission fee of 40 CAKE/block.

The place to purchase CAKE

CAKE can presently be purchased on each centralized and decentralized exchanges. The obtainable markets are listed beneath

Centralized Exchanges- Binance, KuCoin, Huobi International

Decentralized Exchanges- PancakeSwap

Are you able to stake CAKE

CAKE could be staked on the PancakeSwap trade through the Syrup Pool characteristic. Syrup Swimming pools assist you to stake CAKE and earn CAKE or different tokens in trade. Syrup Swimming pools supply customers versatile and locked staking. The locked staking choice supplies a excessive APY however requires customers to lock their tokens for a set length of time. The versatile staking choice presents customers a decrease APY however permits them to withdraw the tokens at any time limit.

PancakeSwap Buyer Help

PancakeSwap doesn’t formally supply buyer help that you may get in contact with. On the PancakeSwap web site, customers can discover the troubleshooting web page that lists frequent points like "price impact is too large" and "PancakeSwap router has expired," together with fixes and an evidence of why they occurred.

Whereas there isn’t any official buyer help, customers can discover assist from the neighborhood through the varied chat areas on Telegram and Discord. Personally, I discovered that PancakeSwap’s telegram had a extra participating presence with faster replies than its Discord Channel. Nevertheless, be warned that you’ll be spammed with ‘support lines’ and ‘customer support’ scamsters claiming to be useful together with your concern. DO NOT ENGAGE with these chats. The perfect factor to do is to change your privateness settings to extra beneficial choices that can block these calls from coming by.

Customers of PancakeSwap’s perpetual futures market are supplied with a ‘support ticket system’ through ApolloX. It will enable customers of the product to at all times obtain well timed help.

PancakeSwap Prime Advantages Reviewed

PancakeSwap is a wonderful trade on the BSC community as a result of following reasons-

- Big selection of providers– PancakeSwap is the closest DEX that compares with the vary of providers supplied by most centralised exchanges.

- Constructed on the BSC Community– PancakeSwap supplies a quicker and cheaper Defi expertise than its Ethereum counterparts.

- Liquidity– PancakeSwap supplies the most effective liquidity on the Binance Sensible Chain with a complete TVL of $2.95 billion.

What could be Improved

Actually, there isn’t a lot to complain about in relation to PancakeSwap. The trade has a sufficiently well-rounded suite of providers that cater to the wants of most defi customers. The one ache level on the trade at this level of time could be the impermanent loss confronted by liquidity suppliers. There are different DEXs on the Ethereum community corresponding to Bancor which have centered on fixing this ache level for Defi customers. One other characteristic that PancakeSwap may take into account implementing could be increasing onto different chains in addition to the BSC community.

Closing Ideas

Having seen what we’ve so far, I’m satisfied that PancakeSwap is without doubt one of the greatest DEXs throughout chains. After all, there are some considerations concerning the comparatively centralized nature of the BSC chain however I consider the long run is multi-chain. Most exchanges have already began increasing their presence onto a number of chains. I wouldn’t be shocked to study if PancakeSwap has comparable plans too sooner or later.

Prime Options

- Low Transaction Prices- 8/10

- Vary of Options- 9/10

- DEX Charges- 7.5/10

Professionals and Cons

- Huge Vary of Merchandise and Providers

- Constructed on BSC- Decrease Transaction Prices

- Sturdy developer base, neighborhood and roadmap

Cons

- Impermanent Loss in liquidity swimming pools

- Prediction and lottery may end up in shedding funds shortly (playing)

- Community can get congested due to recognition

- BSC has a fame for being centralized and internet hosting rip-off tasks and tokens

Incessantly Requested Questions

Is PancakeSwap higher than Uniswap?

It is a exhausting query to reply. Largely as a result of it’s like evaluating pears to oranges. Each PancakeSwap and Uniswap are nice decentralized exchanges, however they exist on completely different chains. PancakeSwap is the only option for customers who have already got BEP-20 tokens and are keen to maintain their actions on Binance Sensible Chain. Whereas Uniswap is the higher selection in case you’re trying to transact and preserve your actions restricted to the Ethereum blockchain. Although, I’d prefer to level out that PancakeSwap presently presents extra monetary merchandise on its interface than Uniswap presently does. Conversely, Uniswap has twice the liquidity that PancakeSwap presently has, this could change with the rising recognition of the BSC community.

Is PancakeSwap Reliable?

PancakeSwap was created by a bunch of nameless builders. The platform is open-source and has gone by a number of safety audits by Certik, Peckshield and SlowMist. There’s a whole of 9 safety audits listed on the official documentation.

PancakeSwap additionally employs the most effective safety practices through the use of multi-sig for all contracts and enabling a time-lock characteristic for them. Furthermore, most of PancakeSwap’s code is publicly seen and all their contracts are verified on BscScan for optimum transparency.

Methods to Farm on PancakeSwap?

‘Farming’ on PancakeSwap refers back to the technique of offering liquidity after which staking the liquidity pool tokens with a purpose to earn further token rewards. Every farm has its personal rate of interest, so you’ll want to take a look at which farm you need to earn from earlier than offering liquidity as every farm solely accepts the corresponding LP token which is obtained by offering liquidity to a particular pair of tokens.

What’s the Slippage Tolerance on PancakeSwap?

Slippage refers back to the distinction in pricing between the worth on the affirmation time and the precise worth of the transaction customers are prepared to just accept when swapping on AMMs. Slippage tolerance refers back to the most proportion of slippage a consumer is prepared to just accept. PancakeSwap units the default slippage tolerance at 0.5%. Customers can alter this manually by clicking on the commerce settings button.