Poloniex is among the extra well-known exchanges and is predicated in The US of America. Having been in operation since 2014, the alternate has been in a position to seize a good portion of the market and experiences excessive buying and selling volumes for altcoins.

Up till a 12 months in the past, merchants accessing a big collection of altcoins usually used Poloniex. The alternate makes a speciality of crypto to crypto trades and because of this, typically fits extra skilled cryptocurrency merchants.

Over the past 12 months, the emergence of exchanges resembling Binance, Kucoin, and HTX (beforehand Huobi) has seen Poloniex lose a few of its market share. Nonetheless, its latest acquisition by Circle may even see the corporate rebound in 2018.

Overview

Poloniex was based in 2014 by Tristan D’Agosta, and the corporate was initially based mostly in Wilmington, Delaware, USA. Up till not too long ago there was little data out there on-line relating to possession of the corporate, nonetheless, the positioning now lists Poloniex, LLC as being based mostly in Boston, MA, USA.

The platform gained traction because it made its companies accessible to merchants situated anyplace around the globe, and in addition offered assist for a lot of digital property, and was one of many high suppliers when it comes to selection.

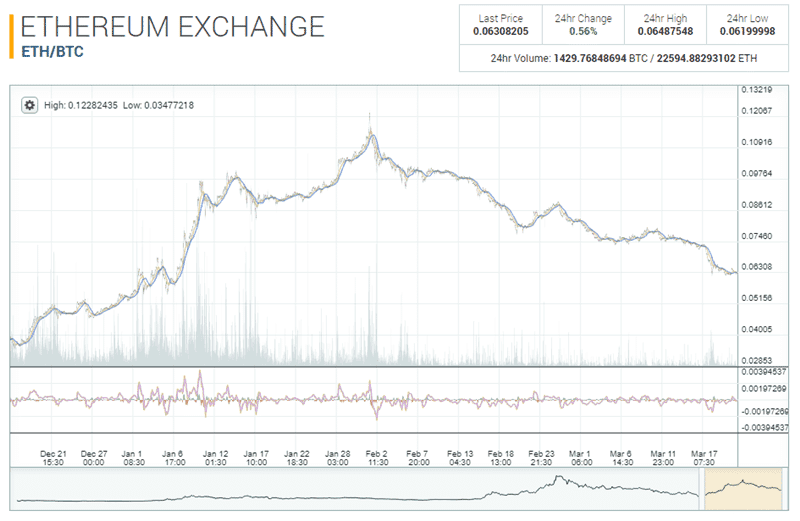

Poloniex was the world’s largest Ethereum alternate by common quantity in 2017 and sometimes ranked throughout the high ten cryptocurrency exchanges on the subject of general quantity. The alternate is at present averaging roughly $85m price of every day buying and selling, and sits contained in the world’s high twenty exchanges when it comes to general quantity.

Whereas the platform is predicated in the US, it doesn’t function any geographical restrictions. That is largely because of the pure cryptocurrency setup on the platform, and because of this, it hasn’t been required to adapt to native banking and finance rules as there’s no fiat foreign money getting used.

This has allowed it to operate with higher freedom than exchanges resembling Bitfinex which not too long ago closed their alternate to US clients or to totally regulated exchanges resembling Coinbase, Gemini, and Kraken.

Is Poloniex Secure?

In the case of selecting a cryptocurrency alternate, some of the essential considerations for the person comes right down to the security of the alternate. Exchanges are prime targets for hackers and that is one thing that Poloniex is aware of intimately.

Again in 2014, Poloniex alternate suffered a hack that noticed it lose 12.3% of all of the Bitcoin that it held in its wallets. In keeping with the proprietor of the alternate on the time in a bitcointalk put up, the hacker was capable of finding a vulnerability within the code.

After all this was over 4 years in the past and the alternate has not suffered a extreme hack since. Furthermore, not like different excessive profile hacks, Poloniex gave the affected customers a partial refund of their cash.

So how do Poloniex's safety features look now?

Chilly Storage & Monitoring

Poloniex makes use of essentially the most superior procedures in air-gapped chilly storage for his or her Bitcoin holdings. What this principally means is that Poloniex will retailer the overwhelming majority of their cash offline in a secure and safe setting.

They can even solely hold a restricted variety of cash on-line within the scorching wallets for a sure time frame. This may restrict the publicity of their coin reserves to potential hack assaults for a really restricted time frame.

From an operational safety perspective, additionally they must regulate suspicious exercise that will wish to get a foothold into their techniques. That’s the reason they’ll monitor all alternate exercise on a 24/7 foundation. The second that they spot any suspicious exercise they’ll block these IP addresses.

Lastly, not like banks, Poloniex doesn’t function on a "fractional reserve" mannequin that’s used with conventional banks. What this implies is that your funds are used solely to facilitate buying and selling and never for some other alternate functions.

Two Issue Authentication

On the person aspect, Poloniex gives you the usual two issue authentication safety features. That is an added layer of safety that may assist shield you from any makes an attempt to fraudulently entry your account.

This isn’t activated as a default so you’re suggested to allow it the second that you just begin buying and selling. It could possibly be the one barrier between hackers and your cash. In truth, final 12 months hackers have been in a position to get into person's accounts by way of a faux poloniex app.

In any occasion, you’re inspired to not depart massive quantities of cash on an alternate. It’s best to both take into account your individual private chilly storage or put money into a {hardware} pockets.

Currencies

The big selection of altcoins made out there for buying and selling has proved to be a serious attraction for customers of the platform. There are at present 99 markets involving 68 cash out there on the alternate and trades are tied to the 4 base currencies of Bitcoin (BTC), Ether (ETH), Tether (USDT), and Monero (XMR).

Poloniex operates as a crypto to crypto alternate and supplies an choice to retailer worth in USDT (Tether), a stablecoin that represents the US Greenback, with 1 USDT being equal to 1 USD. It is a useful gizmo that is useful as there isn’t any fiat foreign money assist on the alternate.

Buyer Assist

A scarcity of a good buyer assist service has been a serious drawback for Poloniex for a while. Customers of the alternate have been recognized to complain of extraordinarily lengthy response instances when reporting points to the assist group. Queries have gone unanswered for weeks and months, and horror tales have begun to rack up on boards resembling Reddit and Bitcointalk.org.

There are additionally critical points with withdrawals taking a very long time to course of and at greatest the alternate has simply been struggling to take care of a sudden surge in demand. Nonetheless, different high exchanges have been in a position to service their clients to a a lot larger customary.

Whereas the gradual customer support is little doubt a priority for merchants, there are further assets that you need to use to be able to get solutions to your questions. They’ve compiled an inventory of FAQs that the merchants have requested beforehand.

Extra seemingly than not, when you have a question you’re prone to discover the answer on this assist middle. For instance, they cowl the whole lot from utilizing the Poloniex API to alternate charges, activating two issue authentication and so forth.

Nonetheless, in case your drawback is technical in nature or associated to your account solely then you’ll have to take care of the lengthy assist instances. Nonetheless, there may be hope on the horizon with the Circle acquisition (extra under).

Poloniex Charges

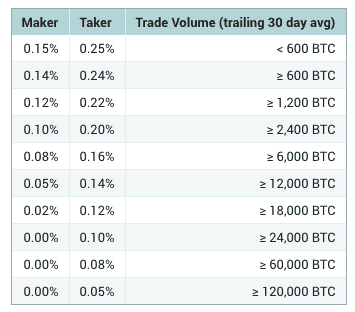

Poloniex at present costs a 0.15% maker payment and a 0.25% taker payment, and maintains an updated abstract of all charges, Poloniex additionally employs a volume-tiered, maker-taker payment schedule. All customers have been moved to this mannequin on March 20, 2016 and customers ought to verify their Buying and selling Tier Standing web page to trace their progress. For lenders, a 15% payment is utilized to earned curiosity.

Each commerce happens between two events: the maker, whose order exists on the order e-book previous to the commerce, and the taker, who locations the order that matches or takes the maker's order. When buying and selling on an alternate you should buy an asset on the lowest provide offered, or place a bid at one other desired worth. Should you determine to instantly execute your commerce, you’d successfully be taking away liquidity from the market. Right here, you turn out to be a “taker”, and pay a barely larger payment.

The maker-taker mannequin encourages market liquidity by rewarding the makers of that liquidity with a payment low cost. It additionally leads to a tighter market unfold because of the elevated incentive for makers to outbid one another. The upper payment that the taker pays is normally offset by the higher costs this tighter unfold supplies.

For these merchants who’re making markets at quantity that’s over 24,000 BTC buying and selling quantity, you may be buying and selling with no charges.

KYC and Accounts

That is one thing that has turn out to be fairly contentious for a lot of customers not too long ago.

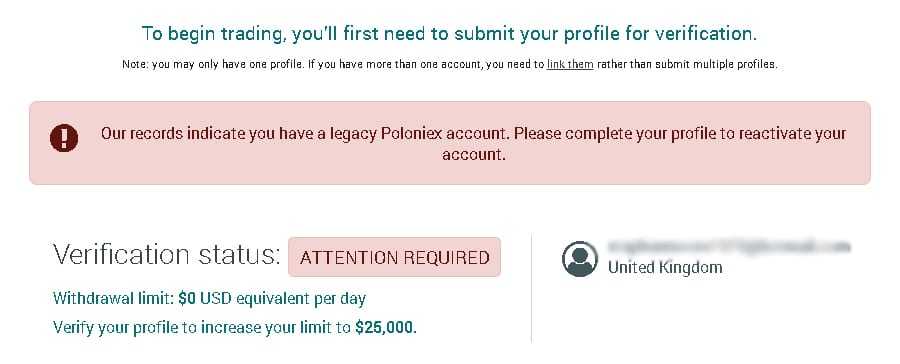

Poloniex used to permit customers to run an nameless account that didn’t require any type of identification. This was their first degree of account and lots of merchants left it at this degree. The primary degree of account had a restrict of $2,000 withdrawal in a day.

Nonetheless, it appears as if Poloniex has modified their coverage not too long ago. They’d determined that they’ll now not enable all these accounts and needed all of their merchants to be verified on their techniques.

What this meant, basically, is that every one merchants on Poloniex could be required to be verified to their degree 2 account standing that had a $25,000 every day withdrawal restrict. Nonetheless, there have been many merchants who took problem with the style by which Poloniex dealt with this.

They declare that Poloniex had promised to not maintain "funds hostage" within the occasion that legacy accounts weren’t verified on the deadline day. Now, these customers are claiming that Poloniex shouldn’t be permitting them to withdraw their funds until they ship them the required documentation.

So, what does this imply for you?

It relies upon how comfy you’re sending Poloniex your private identification paperwork. That is certainly turning into the norm with exchanges now as regulators require the exchanges to hold out applicable KYC and Anti Cash Laundering procedures.

Assuming that Poloniex is ready to shield your private data and stop any kind knowledge breach you then shouldn’t be frightened utilizing them.

Poloniex Buying and selling Platform

Allow us to transfer onto some of the essential options of any alternate. That is the buying and selling platform and matching engine.

After getting logged into Poloniex, you’ll have the choice to go to a few totally different tabs. One is the "Exchange", the opposite is the "Margin Trading" platform and the third is the lending platform. We’re wanting on the alternate platform.

Our first impression of the Poloniex buying and selling platform was that it’s barely dated however useful. That is the truth is the identical platform that has been in use by the alternate for the previous few years. Having stated that, it’s fairly person pleasant.

For instance, you have got your foremost chart proper in entrance of you. Just under that you’ve got the order types the place you may place an array of various orders shortly and effectively. On the suitable you have got the choice of switching the markets and the property that you just want to commerce.

Sadly, you’ll have to scroll down a bit if you wish to observe the order books, earlier orders and market depth. Therefore, this doesn’t make for essentially the most environment friendly buying and selling platform format.

Charting

For these merchants who’re technical analysts and are on the lookout for essentially the most superior buying and selling instruments, chances are you’ll be barely disenchanted. The Poloniex charting package deal is extraordinarily fundamental. You solely have easy indicators resembling transferring averages and Bollinger bands.

You additionally can not full any chart drawings to establish any form of retracement ranges on the platform. No less than you may zoom out and in and regulate your time horizon to get a greater image of the market.

Therefore, if charting is that a lot of an essential a part of your buying and selling then it’s best to both take into account finishing your charting evaluation with exterior software program, or it’s best to transfer to a different alternate resembling Kraken.

Order Sorts

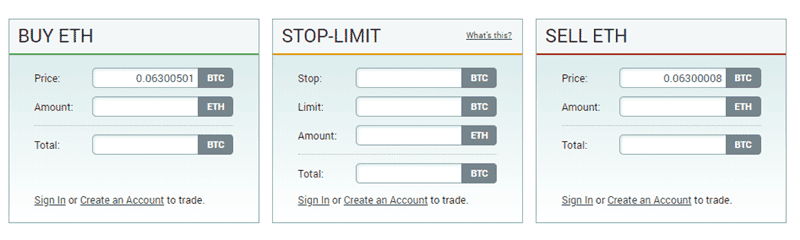

Poloniex sits someplace within the center in relation to their order performance. They’ve the usual purchase / promote order types the place you may choose a worth or commerce at market. After all, this can impression in your charges as per the "maker-taker dynamic".

Nonetheless, for these merchants who want to have the security of a cease loss in place, Poloniex has that as properly. You’ll be able to place a cease loss degree which can mechanically execute an order for you as soon as the value has fallen to a sure degree.

It’s also possible to set a restrict order which can lock in a revenue as soon as the value has reached a sure degree. These are useful orders which might restrict your threat. We might all the time encourage these merchants who’re buying and selling with a brief time period horizon to make use of those orders.

Poloniex Margin Buying and selling

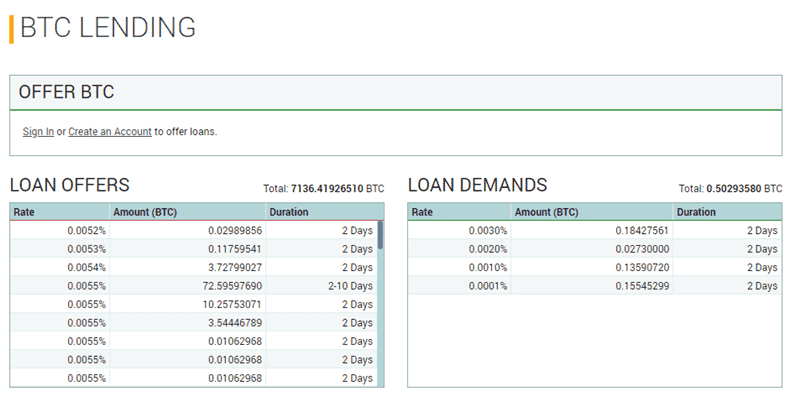

By providing margin buying and selling, Poloniex is ready to dominate the vast majority of its competitors. Customers of the platform can make the most of a peer-to-peer operate to borrow funds and begin margin buying and selling.

The system effectively permits merchants to safe buying and selling funds, and in addition benefit from the lending function to realize from lending funds out to different merchants. This function is simply provided by just a few exchanges and continues to be a serious benefit because it attracts a very good variety of extra skilled merchants.

Buying and selling on margin is synonymous with leveraged buying and selling. You take positions which are bigger than your preliminary funding.

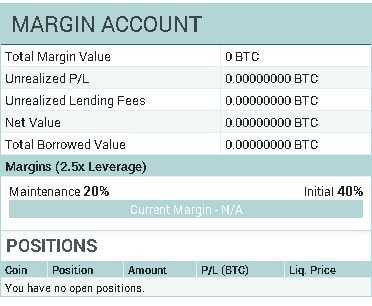

When it comes to the leverage that you would be able to commerce with, these aren’t excessively excessive. For instance, within the picture under you may see that the leverage on Ethereum margin buying and selling is simply 2.5x.

Additionally, you will have to deposit an preliminary margin of 40% in your commerce. If we have been to match this to different exchanges and brokers, IQ Possibility has CFD leverage of 20x and Bitmex has futures leverage of as much as 100x.

Nonetheless, this are actually unstable and dangerous devices so it may certainly be a wiser determination to solely begin margin buying and selling with the decrease leverage ranges.

Poloniex API

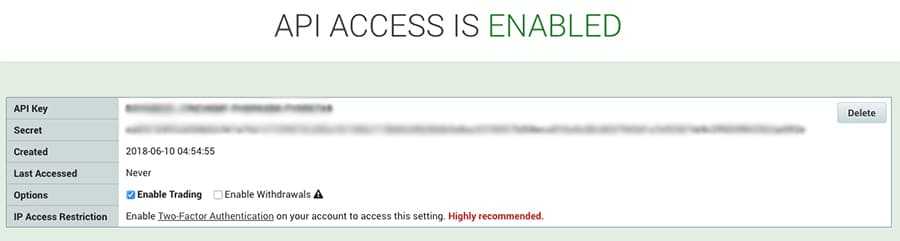

For these customers that wish to code their very own buying and selling bots, Poloniex gives API connectivity. So as so that you can make use of the API, it’s a must to get your API key. This may be retrieved by clicking on the "API Keys" of your settings.

As a way to first set it up, they’ll ship you an electronic mail that may ask you to substantiate your alternative of accessing the API key. As soon as that is completed you’ll have to generate your API key and ensure it as properly. You’ll then be introduced together with your API key like this under:

As you will note, it’s good to decide what you’ll enable your Bot to do in your account. If you’re merely getting costs then you may disable buying and selling. If you’re buying and selling however don’t wish to withdraw funds then you may choose that solely.

When it comes to the API performance, it seems to be comparatively strong and quite a few builders have coded on the Poloniex API.

What We Didn't Like

There have been just a few issues that we predict warrant point out so as so that you can take advantage of knowledgeable determination about Poloniex.

Firstly, the platform is fairly dated and scope for extra superior evaluation is kind of restricted. This might most likely be one of many causes that the amount on the alternate has been falling over the previous few months. Whereas different exchanges resembling Kraken have taken steps to enhance outdated techniques, Poloniex stays as is.

We additionally must take problem with the customer support. That is one thing that has been a serious thorn within the aspect of Poloniex over the previous 12 months. It is usually one thing that has now reared its head at locking out of for these customers that held legacy accounts.

The shortage of Fiat funding choices may be an issue for a lot of merchants. That is one thing that many exchanges together with Binance and fellow US alternate, Bittrex, are pursuing.

One mustn’t enable these supposed drawbacks to discourage you nonetheless. That is due to the latest buy of Poloniex by Circle. There isn’t any doubt that the money flush circle has some massive plans for the alternate. In truth, there have been many commentators who thought this was the most effective choices.

Acquisition by Circle

Regardless of producing a formidable amount of buying and selling quantity, Poloniex has been tormented by a rising variety of points. There was a basic lack of understanding on the make-up of the group, with little recognized in regards to the co-founders, high administration, or possession construction.

There additionally gave the impression to be an absence of a bodily workplace which all led to an absence of belief within the alternate as corporations resembling Coinbase, Kraken and Gemini all function with way more transparency and credibility.

Public opinion appeared to have reached an all time low and the variety of adverse on-line critiques referring to buyer assist continued to develop during the last twelve months. There have been additionally questions on liquidity as customers confronted difficulties when making an attempt to withdraw funds. The elongated withdrawal instances made it nearly not possible for merchants to swiftly liquidate funds after buying and selling with cash usually being frozen whereas awaiting approval.

This might have proved ruinous for Poloniex however even with all these present doubts, the alternate was nonetheless in a position to appeal to a major quantity of buying and selling exercise and Poloniex receives round 50 million visits per thirty days to its web site. Nonetheless, the positioning has clearly misplaced floor to rivals resembling Binance, HTX, OKEx, and GDAX.

The latest acquisition by Circle may sign a change of fortunes and Circle Web Monetary Ltd. introduced that it has acquired Poloniex for a worth of $400m in a latest weblog put up.

The Goldman Sachs-backed firm was based in 2013, and acts as a peer-to-peer fee platform which permits prompt transactions through the Circle Pay cell app. Circle Commerce gives crypto liquidity choices to its clients, and the corporate has obtained roughly $60m in income from this service over the previous couple of months.

Of their weblog put up, Circle co-founders Jeremy Allaire and Sean Neville define their plans for Poloniex, stating:

Firstly and instantly, you may anticipate Circle to handle buyer assist and scale threat, compliance, and technical operations to bolster the present product and platform

They went on to state:

Within the coming years, we anticipate to develop the Poloniex platform past its present incarnation as an alternate for under crypto property. We envision a strong multi-sided distributed market that may host tokens which characterize the whole lot of worth: bodily items, fundraising and fairness, actual property, inventive productions resembling artworks, music and literature, service leases and time-based leases, credit score, futures, and extra.

Conclusion

Poloniex stays an especially well-known alternate which is ready to generate a good quantity of buying and selling volumes. Its benefits have continued to draw merchants to the platform whereas the problems surrounding buyer assist and withdrawals have seen the alternate lose floor to present business leaders resembling Binance and GDAX.

Going ahead a lot depends upon how shortly the brand new administration can flip issues round by fixing the important thing points relating to transparency and the general degree of professionalism discovered on the alternate.

Poloniex nonetheless has a lot to supply and stays a viable possibility for these merchants all for all kinds of altcoins and in making the most of the margin buying and selling and lending companies out there on the platform.

There’s a variety of competitors now out there to cryptocurrency merchants, and different extra dependable exchanges are at present in operation so it might be greatest to have a look at another choices, nonetheless it’s also a good suggestion to regulate Poloniex and gauge how buyer sentiment modifications over the approaching months.