Proof-of-Work, or PoW, and Proof-of-Stake, also known as PoS are two of the most common consensus methods used to secure blockchains and cryptocurrency networks. Proof-ofStake is a consensus method that can be used in many different ways. This article will only focus on Proof-of Work and Proof-of Stake.

The crypto industry has been engaged in a heated debate for many years about which consensus system is the best. They both have advantages and disadvantages, which we explore.

This is what you should do. Proof of work vs proof-of stake article, we'll explore the pros and cons of each consensus mechanism so that you can decide which one makes more sense for your project, or provide you with some insight into which camp you belong to, if either.

To make sure we’re all on the same page it might be useful to mention a few of these major blockchains which used Proof-of Work:

- Bitcoin (BTC),

- Litecoin is a cryptocurrency.

- Bitcoin Cash BCH

- Monero (XMR)

- Zcash

- Dogecoin is a cryptocurrency that was launched in 2010.

Ethereum used Proof-of-Work as well until 2022, when it merged with Bitcoin.

These are the main crypto currencies that use Proof-of Stake.

- Ethereum 2.0 (ETH).

- Cardano (ADA)

- Polkadot (DOT)

- Binance Coin BNB

- Solana (SOL)

- Avalanche (AVAX)

- Tezos (XTZ)

- Cosmos (ATOM)

- Algorand

- VeChain

If you are interested in Guy's take, you can find his spin on this subject below:

How to prove your work?

The Proof-of Work consensus method is one of the most commonly used blockchain mechanisms. In most people’s opinion, it is the safest and most decentralized consensus method. The Proof-of Work involves solving or analyzing complex mathematical problems when an online transaction is sent using computer power.

The purpose of this computing cost is to increase the fraud costs over possible rewards, thus securing the system.

What does proof-of-work mean?

Traditional proof-of-work is used to secure the blockchain. This system pits miners against one another to solve difficult mathematical problems. One might have to solve an equation that has a certain number in the middle. This would be added to the block chain and used as the block identifier. First to mine will receive the block reward, usually in Bitcoins or other cryptocurrencies.

PoW consumes a large amount of energy. (More on this later.) It has also been criticised for having a very high carbon foot print, as it demands incredibly high computing power. But it has many other benefits.

PoW has its pros

- It's highly secure because it makes tampering extremely difficult unless you control over 51% of all hashing power.

- The decentralization is greater than PoS, because any miner can be a part of the system if he or she has enough resources.

- It's more transparent as anyone can see which transactions are being added to the blockchain.

- It's more trustworthy as miners compete against each other for block rewards, creating a system of checks and balances that prevents any one person from gaining too much power over the network.

The PoW process is a computer-based method that confirms transactions in a network decentralized. This ensures network integrity and helps to prevent fraud.

In order to create new crypto-currencies, a large amount of computing power is required in order to solve the mathematical puzzle known as mining. At the same time, transactions on a network are verified.

PoW is a successful way to secure many cryptos. However, there are some drawbacks that will be discussed in the next section.

The History of Proofs of Work

PoW is a concept that dates back to early 1990s, when it was first proposed in an academic paper entitled Spam can be fought by using memory-bound functionsAs a means to stop spam,. In order to send emails, email senders were required to complete a simple mathematical puzzle. This idea, while not widely used for email (which is good for us math-phobes), was later adapted to use cryptocurrency.

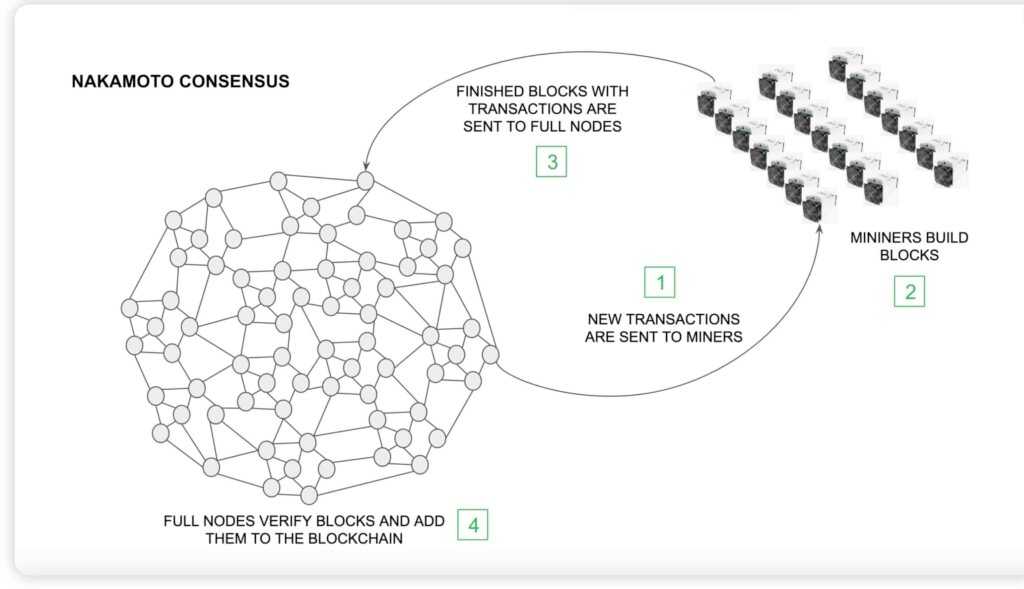

Satoshi Nakamoto published the Bitcoin Whitepaper (the world’s very first decentralized currency) in 2008. Nakamoto used this document to introduce the idea of PoW to help secure the Bitcoin Blockchain. This is why it is also known as the Nakamoto Consensus.

Satoshi White Paper details the various steps required to operate the blockchain network.

All nodes are notified of new transactions.

- Every node gathers all new transactions and puts them into a single block.

- Each node is responsible for finding the most difficult proof-of work possible.

- The block is broadcast to the nodes when a node discovers proof-of work.

- Nodes will only accept a block if it contains valid transactions and has not been spent.

- Nodes accept a block when they create the next block of the chain using its hash.

- The winner is always the chain that has the longest length. The longest chain wins.

PoW was first introduced with Bitcoin. Since then, it has been adapted by other cryptocurrencies such as Ethereum (pre merger), Litecoin and Dogecoin.

What is the PoW System?

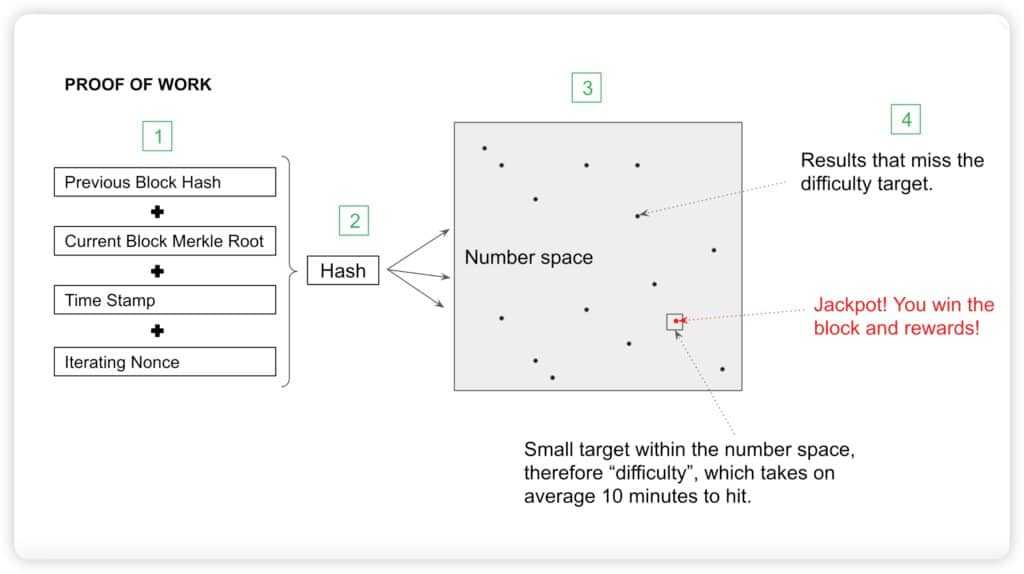

PoW is a system that, without getting into the technical details, relies on a large amount of computing power to solve a math puzzle. It is intended to be difficult for the user to solve this puzzle, but it’s easy to check once they have a solution.

Etherplan.com offers a fantastic guide on PoW Security that further explains the topic.

For Bitcoin, this involves finding a random sequence of numbers and letters that is lower than a target value. In order to do so, the miners will need their computing power in order to run millions of calculations every second.

When a miner finds a solution that is valid, they send it out to the network where other nodes verify it. The miner receives the currency being mined if the solution proves valid. The block includes a list verified transactions, and the transaction is then added to blockchain.

Understanding Proof of Stake

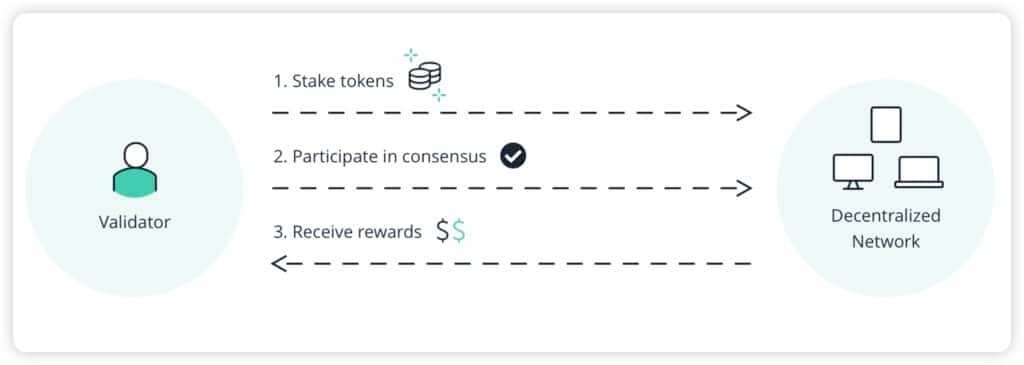

Proof-of stake is a method that uses less computing power to secure networks and validate transactions. Validators are users who choose to lock up tokens. They will then be randomly chosen for verification of the block and transaction data. For coin holders to be validators they must: "stake" A number of coins can be used as an incentive.

It is very simple to understand PoS. Guy presents some of the most common variations in PoS that are used by different blockchain networks.

What is Proof of Stake?

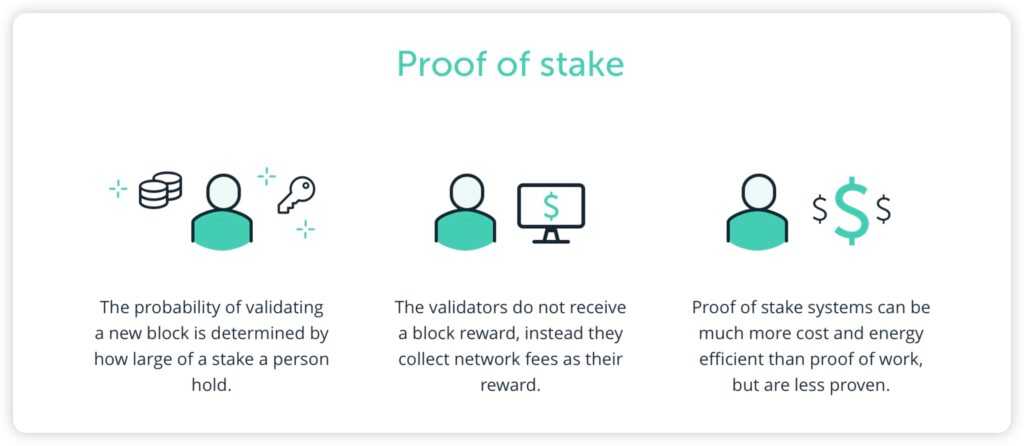

Proof-of-Stake, a blockchain concept, is growing in popularity faster than Proof-of-Work. PoS, unlike Proof of Work that requires significant computational power in order to verify transactions, rewards users by making them stake a specified amount of currency.

A PoS system selects validators to validate and create new blocks on the Blockchain based on how much cryptocurrency they stake or hold as collateral. The higher the staked cryptocurrency, the greater the chance that a validator will be chosen to create and validate the next block.

Most PoS consensus systems require validators to place a small amount of cryptocurrency in order to participate. The stake is a guarantee of the validity of the validator’s actions.

Garrick Hieman, the Head of Research at Blockchain.com, explains it perhaps best:

“In proof of stake, the cryptocurrency holders 'vote' to approve legitimate transactions. As a reward for voting on legitimate transactions, 'stakers' are paid in newly created cryptocurrency over time,"

He continues:

"PoS has two major advantages over Proof of Work: it is less energy-intensive and can have a higher transaction speed and capacity."

Pros of Proof-of-Stake:

- Less energy intensive- some projects are “eco-friendly”

- Cost-effective- Validators only need to hold a certain amount of crypto to participate in the network, making it often more accessible than needing to run PoW mining equipment.

- Many projects support delegation meaning that average people can participate by staking low amounts and generating returns.

- Security- Validators are incentivized to act with integrity as they risk losing their stake from malicious behaviour

- Decentralization- some projects are highly decentralized as validator nodes can be widely distributed and dispersed around the globe.

- Flexibility- PoS can allow for greater flexibility in the governance and decision-making of the network. Validators can be given the power to vote on proposals or changes to the network in the interest of the community.

There are a few caveats regarding the above strengths though, keep in mind that security, decentralization, and flexibility “CAN” be benefits for some networks, but not every PoS cryptocurrency is automatically decentralized just because it has the capabilities to be. Binance Coin and Solana are two examples here. Although they are PoS, there are few validators capable of securing the network, making them quite centralized. Generally speaking, PoW projects are more decentralized than the majority of PoS cryptos. You can learn more in this PoS article from Ledger.

Flexibility can also be considered a weakness. One of the strengths of Bitcoin is that it is not flexible, nor should it be. Its strength is that it is set in stone and nobody can mess with it. Many PoS cryptocurrencies can have their qualities, things like supply, security, and governance changed, similar to our modern financial system, and we all see the problems that can create.

A Brief History of Proof-of-Stake

The concept of PoS dates back to 2011 when it was first discussed on the Bitcointalk forum, but was officially put into practice in 2012 when it was first introduced by Sunny King and Scott Nadal in a whitepaper for Peercoin. At the time, PoW was the dominant method for securing cryptocurrencies, but King and Nadal saw the potential in a different approach that relied on users holding a certain amount of cryptocurrency in order to validate transactions without using as much energy.

Since the introduction of Peercoin, PoS has been adopted and modified by many centralized and decentralized cryptocurrency networks, including Cardano, Polkadot, Ethereum 2.0, and many major layer one cryptocurrencies.

How does PoS Work?

Again, without being too technical, PoS works by requiring users to hold a certain amount of cryptocurrency in order to participate in the network. This amount is known as a stake, and users are required to stake their cryptocurrency in order to validate transactions and earn rewards.

In order to validate cryptocurrency transactions, the PoS algorithm uses a pseudo-random selection process to select validators from a group of nodes. The system can use a combination of criteria such as staking age, randomization, and the number of funds staked on the node. The amount of coins staked determines the chances for a node being selected as the next validator, which is often criticized as it centralizes the selection process based on wealth.

For this reason, additional unique methods are often employed, with the most common methods being coin age selection and randomized block section. Algorand achieved something quite effective when creating a fair randomization process, you can learn more about that in our Algorand review.

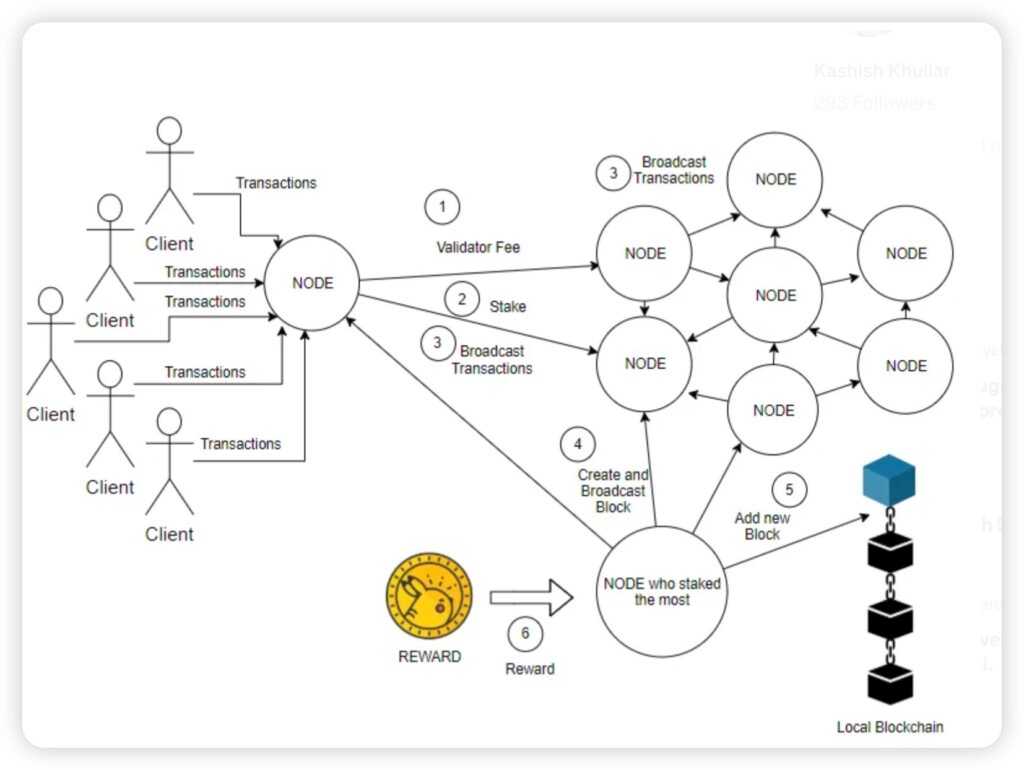

Here is a great diagram from Coinmonks showing the basic structure of PoS

Once a user has been selected to create a block, they must verify transactions and create a hash, or a unique identifier for the block. This hash is then broadcast to the network, where it is verified by other nodes. If the hash is valid, the user is rewarded with a block of cryptocurrency.

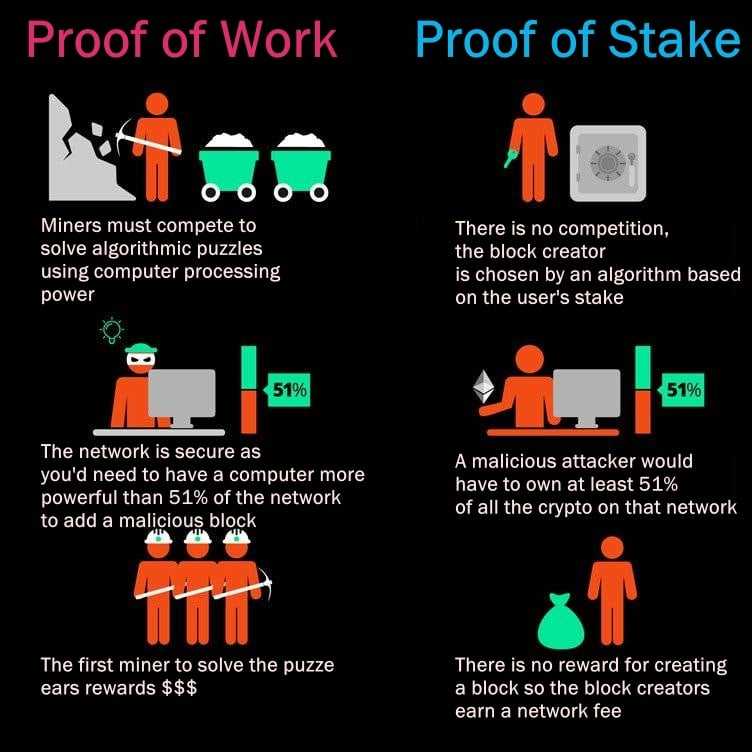

Proof-of-Work vs Proof-of-Stake: The Biggest Differences

The biggest topic to cover is one of major contention in the crypto and ecological communities, and it revolves around energy use. To preface this section, I would like to mention there has been a gross amount of negligence, malicious misinformation, rumours, and downright FUD regarding energy and Bitcoin mining.

To put it bluntly, the negative effects of Bitcoin mining have been glorified in the media, either out of malicious intent or ignorance. I can’t go into detail here, as we put together this in-depth article on Bitcoin mining that highlights its true effects, purposes, and positives.

Guy also covers this in his video on Bitcoin mining, and the last resource to put the “Bitcoin mining is bad” narrative to rest, is this fantastic video from our friends at Altcoin Daily who put out this great video on why Bitcoin mining is GOOD for the environment.

But…

Okay, yes, when comparing the two consensus mechanisms, PoW does use substantially more energy, there is no getting around that, for better or for worse.

Another significant difference between PoW vs PoS is that PoW is quite limited in the amount of transaction throughput it can handle, with Bitcoin only being able to handle about 5-7 transactions per second, and it takes about 10 minutes to settle a transaction. This is excluding the Lightning Network, of course.

Compare this to a PoS like NEAR protocol, which can handle a theoretical 100k TPS with a finality time of about 2 seconds. PoS is like a Ferrari while PoW is akin to the horse and carriage from a transaction efficiency perspective.

Both networks are susceptible to 51% attacks, with PoS being more vulnerable. In a 51% attack on PoS, a single entity needs to control the majority of the computational power on the network, which would allow them to manipulate the blockchain. This has become basically impossible on Bitcoin due to the mining difficulty and size of the network.

A 51% attack on a PoS network can be carried out by someone purchasing over half of the supply of coins and becoming a validator, with small-cap PoS networks being especially vulnerable.

There have also been criticisms against PoW in the form of mining becoming highly centralized as we have seen with the rise of “mining monopolies,” which inherently decreases the decentralization of the Bitcoin network. Other PoW projects such as Ravencoin, Firo, Epic Cash, and others have avoided this by running networks where mining can be done on simple home computing devices, with the technology being ASIC-resistant to prevent mining farms, as we see with Bitcoin.

Okay, enough beating up on PoW, let's turn the tables on PoS

We know that some of the biggest differences are that PoS is more cost-efficient and requires less energy usage while being highly flexible. As I introduced above, the flexibility of PoS systems is a double-edged sword as there is no certainty about the future tokenomics. We know that Bitcoin has a fixed supply, which is a strength, but then we see Ethereum is constantly undertaking upgrades and changing, so the Ethereum that we trust today, may not be an Ethereum that we trust in the future if the protocol changes.

In tech, there is something known as The Lindy Effect, or Lindy’s Law. It is a theorized phenomenon that the longer something survives, the higher the likelihood of it being around in the future. In the tech sector, this is around the 10-year mark, if a technology can survive a decade, it likely has staying power. Due to Ethereum’s constant protocol changes, it can no longer be considered the same as it was when it was PoS, making Bitcoin and Litecoin the two major digital assets that have reached this milestone.

Centralization is a key criticism many PoW advocates have against the PoS consensus mechanism. PoS was designed to be capable of decentralization, but many projects have proven that it is prone to centralization. This is because validators with large stakes have a higher chance of being selected to create new blocks and validate transitions, giving them more influence over the network.

Larger validators have also been shown to have the capability of swaying votes in proposals for many projects as well. Not very decentralized if it only takes one or two validators to sway the vote of a project. We recently saw this happen with the Uniswap community's vote on whether or not to launch Uniswap on the Binance chain. The venture firm A16z was able to heavily influence the vote outcome in what should be been a decentralized governance system.

Security risks are another concern of PoS. Risks such as the “Nothing-at-Stake” problem, where validators can vote for multiple conflicting blocks without any penalty can lead to network instability. There is also the “long-range attack” concern where attackers can use their old stakes to reorganize the blockchain and execute fraudulent transactions.

A high barrier to entry can also further lead to centralization problems, as some networks require validators to hold mass sums of the crypto to become a validator, with some projects requiring validators to hold a high 6-figures worth of crypto.

Then there are governance issues with PoS as well, with conflicts of interest, lack of transparency and accountability all being observed in PoS crypto projects when squabbles happen around how the protocol should be governed.

The idea that security in PoS systems is primarily bolstered due to actors having a stake in the network is not enough for some critics to trust this mechanism as money isn’t always a good enough motivator. How much do you think a company like Google would be willing to burn to take out a large competitor? Just something to keep in mind.

Why Do Cryptocurrencies Need Proof?

Cryptocurrencies use a system called "proof-of-work" or "proof-of-stake" as their consensus mechanisms to prevent fraud and ensure the integrity and security of the network. Users must demonstrate they’ve invested some effort in the network or have staked something in it. To maintain security and reliability of cryptocurrency networks, proof is required.

PoW Adoption vs PoS Adoption

Proof-of-Work was the first consensus algorithm used in blockchain networks and is still widely adopted, with many of the largest and most popular blockchain networks using PoW to validate transactions.

However, Proof-of-Stake has been gaining popularity in recent years, with an increasing number of blockchain networks adopting the PoS consensus algorithm. Most of the newer projects are choosing to build using PoS over PoW, with some of the notable PoS networks including Cardano, Polkadot, Solana, Avalanche, NEAR, and Binance Smart Chain.

One of the reasons for the growing adoption of PoS is the fact that it offers several advantages over PoW, such as lower energy consumption, greater scalability, and reduced hardware costs. Additionally, PoS networks can be more easily upgraded, as changes to the consensus mechanism can be implemented through software updates, rather than requiring a hard fork.

Though many advocates for PoW argue that the advantages of PoS are not worth sacrificing security and decentralization over. PoW is considerably more battle-tested and proven, as it has been used in the first and largest blockchain network, Bitcoin, for over a decade. PoW is also more resistant to security threats and has fewer attack vectors than PoS.

Final Verdict, Which is better: Proof-of-Stake or Proof-of-Work?

As you can see, both mechanisms have their strengths and weaknesses, this is akin to asking, “what is better, a car or an airplane?” It all depends on the use case, a car isn’t great for travelling across the ocean, and imagine if we all had to fly airplanes to our local grocery stores to get groceries.

While Proof-of-Work generally offers better security and decentralization, it also comes with some heavy trade-offs, mainly its computing power and lack of scalability with transactions being less efficient.

While Proof-of-Stake can be far more efficient in terms of scalability and transaction fees, PoS systems suffer from increased centralization risks and the algorithm has not been verified as secure as PoW.

Perhaps the most worrying aspect of PoS is the number of censored transactions we have seen as we saw as high as 73% of Ethereum transactions being censored due to not being OFAC compliant. Censorship and centralization are the very antitheses of what cryptocurrency was created for, and many PoS cryptocurrencies fall under this umbrella.

The jury's still out on which mechanism is best, and both mechanisms are still evolving and advancing, as technology always does. It is likely that both will remain in existence for a long time to come as layer two solutions and new PoS variations such as Delegated Proof-of-Stake, Leased Proof-of-Stake, Proof-of-History, and others are adopted and advanced further. As new technology develops, so will the way we use it.

Here I will sum up the pros and cons of each and you can decide for yourself if Proof-of-Work or Proof-of-Stake is best.

Proof-of-Work

- Proven security track record & Promotes decentralization

- Better protection against Sybil and 51% attacks depending on the project

- Encourages renewable energy and sourcing the lowest cost energy for mining

- Provides high levels of certainty from predictability & Difficulty adjustment ensures network operates at consistent rate

- Can provide fairer distribution of coins for miners

- Many coin projects can be mined from home with simple computers

Cons

- High energy consumption for most networks

- Less scalable than PoS & often slower transaction throughput and settlement times

- Can become less decentralized as mining centralizes

- Hardware requirements can cause high barrier to entry for miners

- Difficult to implement changes and upgrades to the network

- Some networks are vulnerable to 51% attacks

Proof-of-Stake

- Lower energy consumption than PoW

- Highly Efficient transactions & can support low transaction fees

- Highly scalable

- Can reduce mining centralization due to reduced hardware requirements

- More easily upgradeable and adaptable

Cons

- Large stakeholders can lead to centralization

- Transactions can be more easily censored

- Security risks from chain reorganizations & more attack vectors to exploit than PoW

- Monetary incentives to behave honestly may not be enough for security

- Votes can be swayed to favour higher stake holders, creating an oligarchy-style governance system

- Hasn’t yet been fully tested and proven at large scale like PoW

- More susceptible to 51% attacks on small market cap projects

Frequently Asked Questions

Is ETH Proof-of-Work or Proof-of-Stake?

Ethereum started as Proof-of-Work then transitioned to Proof-of-Stake in 2022 in an event known as “The Merge”

Why is PoW better than PoS?

Generally speaking, PoW is more secure, battle-tested, and promotes decentralization more than PoS. There are a few exceptions to this rule.

Why is PoS better than PoW?

Generally speaking, PoS is more scalable than PoW and has more efficient transactions, with lower energy consumption and lower transaction fees. Again, there are exceptions to this rule depending on the crypto network.