Sonic is an EVM-compatible Layer-1 blockchain rebranded and developed from Fantom. It’s centered on pace, incentives, and strong infrastructure. At Coin Bureau, we've beforehand reviewed Fantom, highlighting its modern DAG-based design, which affords important scalability benefits over conventional blockchains.

The transition from Fantom Opera to Sonic, introduced on Aug. 1, 2024, represented greater than a mere model replace. Sonic Labs launched a brand new community structure, a revamped tokenomics mannequin, and developer incentives particularly designed for the way forward for Web3. Sonic's method is notable as a result of it challenges the prevailing desire for Layer-2 scaling options by providing a quick, safe, and interoperable Layer-1 resolution.

This text completely covers Sonic's technical options, tokenomics, developer incentives, and broader ecosystem implications. We’ll additionally assess the platform’s strengths, determine potential dangers or challenges, and consider the general effectiveness of the migration from Fantom to Sonic.

Background: Fantom to Sonic

In our earlier evaluation of Fantom at Coin Bureau, we highlighted its distinct Directed Acyclic Graph (DAG)- based mostly construction, which units it other than conventional blockchain designs. This structure allowed Fantom appreciable scalability as a layer-1 blockchain, enabling excessive throughput and speedy transaction finality, which had been significantly interesting options in an more and more aggressive blockchain panorama.

Nevertheless, on Aug. 1, 2024, Fantom Basis made headlines by rebranding to Sonic Labs, marking a major evolution in its blockchain imaginative and prescient. This rebranding coincided with preparations for the launch of a wholly new blockchain community, dubbed Sonic, and its native token, $S. Though this transfer would possibly initially seem to be a contemporary coat of paint, it represents a extra profound strategic pivot towards ushering in what Sonic Labs describes as the subsequent era of Layer-1 blockchain innovation.

The transition from Fantom Opera to a wholly new community was pushed by substantial technical enhancements that couldn't be integrated by way of an improve. Launching an impartial blockchain with a brand new native token allowed Sonic Labs to capitalize on developments in know-how and infrastructure absolutely. Sonic guarantees a considerably higher developer and person expertise. In line with their weblog, Sonic affords:

- 10x sooner node synchronization, dramatically reducing the time required for brand new nodes to affix and synchronize with the community.

- A 66% discount in validator node prices considerably lowered entry boundaries for validators and additional decentralized the community.

- Enhanced knowledge administration with live-pruning capabilities, eliminating downtime beforehand required throughout upkeep.

- A considerably smaller database footprint significantly lowers infrastructure prices—as much as a 96% price discount for operating large-scale RPC nodes.

- Sub-second transaction finality, successfully eliminating the opportunity of rollbacks or reorganizations, reinforcing community safety.

Furthermore, Sonic revamped its tokenomics mannequin, introducing deflationary mechanisms that differ considerably from the Fantom token mannequin. This technique goals to steadily cut back the token provide, providing extra financial incentives to holders and fostering a more healthy ecosystem. These tokenomics changes and important backend upgrades, corresponding to database administration enhancements, had been inherently incompatible with the present Fantom Opera structure, thus justifying the clear break into Sonic.

With Sonic, the workforce positions itself to leverage the most effective of Ethereum compatibility and its personal modern tech stack by way of EVM interoperability and the safe Sonic Gateway. This strategic pivot suggests Sonic Labs' dedication to changing into a vibrant hub for builders and customers, providing substantial incentives and an improved basis that may compete head-on with essentially the most performant Layer-1 platforms out there immediately.

Sonic Technical Overview

Sonic is an EVM-compatible Layer-1 blockchain engineered to ship distinctive scalability and effectivity by way of a Proof-of-Stake (PoS) consensus mechanism. Sonic achieves speedy transaction processing with sub-second finality by leveraging a Directed Acyclic Graph (DAG) construction. Moreover, the community options its native $S token, which is crucial for protecting transaction charges, staking, and taking part in governance actions.

Proof-of-Stake (PoS)

Sonic employs a strong Proof-of-Stake (PoS) mechanism. This mechanism requires validators to lock up the community's native $S token to take part within the consensus course of. Validators play a vital function by validating transactions and creating new blocks, making certain the integrity and safety of the community. Sonic additionally helps delegated staking for $S holders trying to keep away from energetic node administration.

The minimal requirement to run a validator node on Sonic is 500,000 $S tokens. This stake ensures that validators are deeply invested within the platform’s success and safety, aligning their pursuits straight with the community’s total well being and stability. Moreover, validator rewards are structured round staking, incentivizing energetic participation, and dependable node administration.

Sonic Design

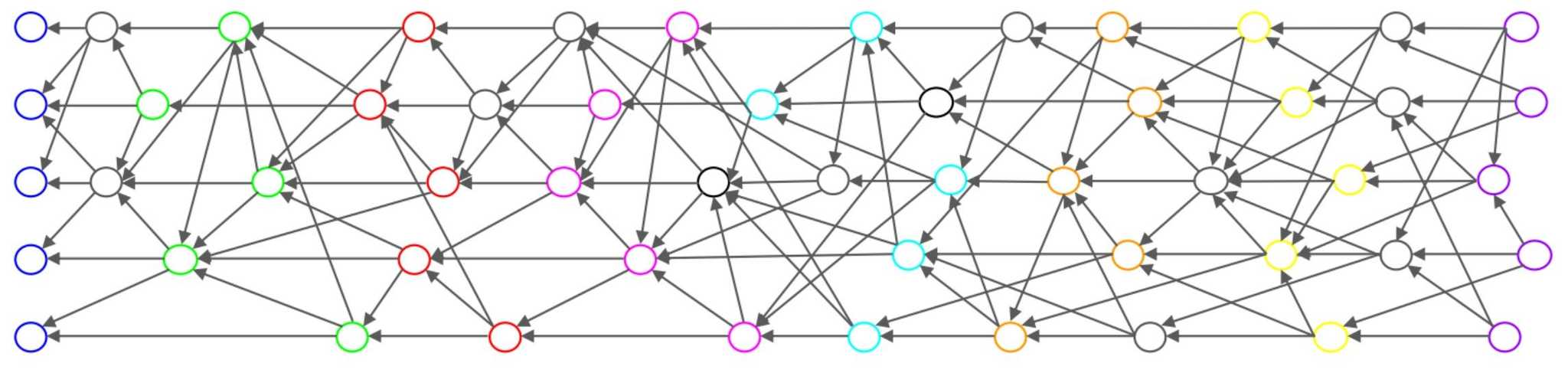

Sonic makes use of a DAG-based (Directed Acyclic Graph) distributed ledger structure. Whereas initially sounding complicated, DAGs signify a versatile various to conventional blockchain designs. In contrast to a traditional blockchain, which arranges blocks in a linear chain, DAG networks construction blocks extra dynamically. Every block connects to a number of earlier blocks, making a web-like community.

In easy phrases, whereas conventional blockchains resemble a single chain, DAGs look extra like a branching tree or graph, permitting transactions to be validated extra flexibly. The Coin Bureau's latest article on Blockchain vs. BlockDAG explores DAG as a viable scaling resolution for blockchains, noting its potential to considerably enhance transaction speeds and community effectivity.

Key traits of Sonic's DAG construction embody:

- A number of Block Connections: Every new block (or occasion) can hook up with a number of earlier blocks, forming a posh community somewhat than a singular linear chain.

- Concurrent Validation: Completely different validators (nodes) can concurrently validate completely different blocks, considerably enhancing total throughput.

- Scalability and Velocity: The DAG method permits Sonic to course of hundreds of transactions per second, as blocks will not be restricted to sequential formation.

- No Cyclical Dependencies: Blocks by no means reconnect or loop again, making certain transactions transfer in a single path, from unconfirmed to confirmed, sustaining community integrity.

- Decreased Latency: With DAG, transactions don't wait to be grouped into sequential blocks, resulting in faster validation and decreased transaction affirmation time.

This modern design underpins Sonic’s capacity to realize excessive efficiency and scalability, positioning it as a sensible Layer-1 resolution for decentralized purposes.

DAG with Byzantine Fault Tolerance (ABFT)

Sonic employs a complicated consensus methodology, Asynchronous Byzantine Fault Tolerance (ABFT), layered on its DAG-based design. Byzantine Fault Tolerance refers to a blockchain’s capacity to operate appropriately even when some nodes act maliciously or fail unexpectedly.

In Sonic’s ABFT implementation, nodes will not be required to synchronize their operations strictly by time. As an alternative, validators independently affirm transactions of their blocks and related transactions propagated by different nodes. This asynchronous operation ensures the community continues easily, even when some validators are delayed or misbehave.

Right here's how consensus by way of ABFT operates inside Sonic:

- Unbiased Block Creation: Validators independently create and validate their occasion blocks earlier than propagating them to friends.

- Root Block Formation: As soon as a majority of validators have acknowledged and validated a propagated occasion block, it turns into a "root event block."

- Immutable Principal Chain: The foundation occasion blocks are then organized sequentially into the Sonic most important chain, a blockchain that shops the community’s finalized consensus state.

- Environment friendly State Administration: Validators constantly retailer and replace a duplicate of this finalized most important chain, permitting fast entry to historic transaction knowledge and enabling environment friendly processing of latest blocks.

By pairing DAG flexibility with ABFT robustness, Sonic ensures quick, safe, and dependable transaction finality. This hybrid method considerably enhances scalability and efficiency in comparison with conventional Layer-1 consensus mechanisms.

EVM Compatibility

EVM compatibility is crucial for any Layer-1 blockchain trying to combine with Ethereum’s in depth ecosystem, and Sonic ticks this important field. Being absolutely EVM-compatible, Sonic permits builders to deploy present Ethereum-based decentralized purposes simply with out modifying their codebase. This compatibility signifies that apps beforehand constructed utilizing Solidity—the first coding language for Ethereum good contracts—can migrate straight onto Sonic with out friction or rewrites.

Furthermore, Sonic extends its compatibility to assist Solidity and Vyper. Vyper is standard as a consequence of its readability and added safety for good contracts, offering builders with extra flexibility and choices when coding decentralized purposes. For builders already conversant in Ethereum or different EVM chains, deploying apps to Sonic requires minimal changes

This compatibility dramatically lowers the barrier to entry for builders, enabling Sonic to quickly onboard and broaden its DeFi ecosystem by tapping into Ethereum’s already in depth developer group.

Sonic Database Storage System

A blockchain’s capacity to scale is intently tied to how effectively it handles knowledge storage. Sonic implements a specialised database storage system to effectively handle and retailer the blockchain’s world state, together with account balances and VM bytecode to good contract knowledge.

Sonic's storage system's standout characteristic is its dwell pruning mechanism. In contrast to conventional approaches, dwell pruning constantly and routinely trims historic blockchain knowledge with out requiring validators to go offline, avoiding downtime. Validators now not must interrupt their operations for guide database upkeep, considerably enhancing uptime and community stability.

Right here's a fast breakdown of Sonic's database storage benefits:

- Environment friendly Information Administration: Automated removing of historic knowledge retains storage wants manageable and prevents database bloating over time.

- Decreased Validator Price: By constantly trimming out of date knowledge, validators save on storage infrastructure and associated operational bills.

- Elevated Uptime: Steady pruning means validators expertise minimal downtime, decreasing dangers related to validator suspension and reward loss.

- Optimized Information Entry: By effectively storing latest states, nodes present sooner question response instances for customers and purposes on the community.

The dwell pruning characteristic represents a vital improve over Fantom Opera, contributing considerably to Sonic's enhanced effectivity, cost-effectiveness, and total community sustainability.

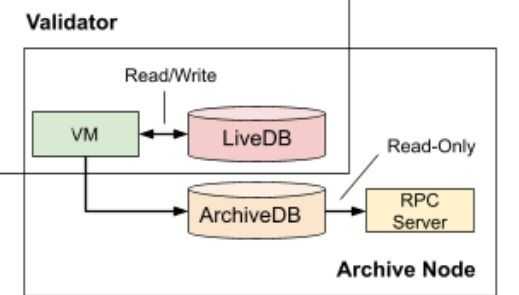

Sonic Nodes

Nodes are central to any blockchain’s infrastructure, and Sonic operates two main varieties of nodes: Validator Nodes and Archive Nodes. Every sort serves a definite function in supporting the Sonic ecosystem.

Archive Nodes retailer the total historical past of the Sonic blockchain from its very inception—the genesis block. These nodes protect historic knowledge, together with transaction information, previous states, and block particulars. Archive nodes are significantly helpful for purposes or chain explorers that depend on historic blockchain knowledge to function successfully. Nevertheless, they don’t take part in validating present transactions or block creation. Consider archive nodes as detailed historic information of the community.

In distinction, Validator Nodes actively take part within the Sonic community’s day-to-day operations. They validate transactions, produce new blocks, and safe the blockchain by sustaining real-time consensus. Validator nodes don’t retailer in depth historic knowledge; as an alternative, they focus totally on real-time transaction validation, community safety, and sustaining the blockchain’s present state. Validator nodes type the spine of Sonic’s Proof-of-Stake consensus, securing the chain by staking S tokens.

To take part in staking and function validator nodes on Sonic, customers should comply with particular necessities:

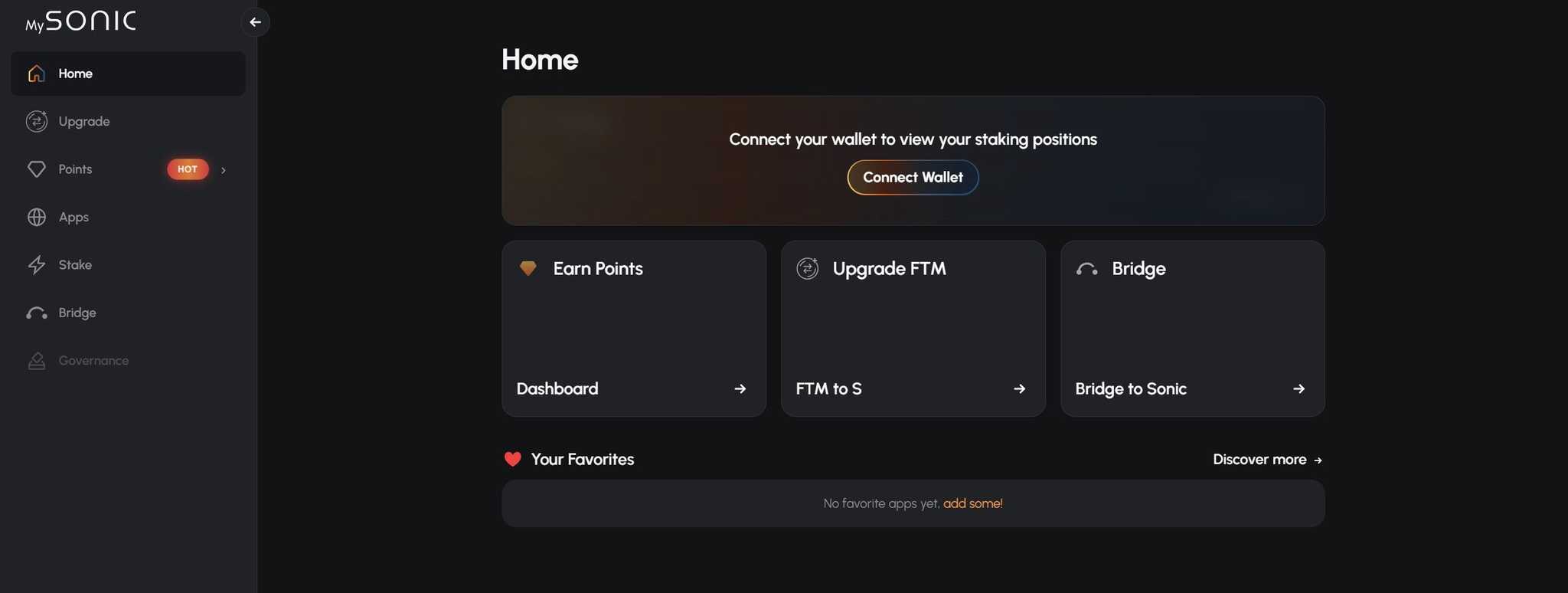

- Staking: Customers can stake their S tokens by way of the MySonic interface. Nevertheless, there’s a 14-day ready interval earlier than withdrawing staked S.

- Minimal Stake: To make sure community safety, a validator node have to be launched and operated with a minimal stake of 500,000 S tokens.

- Validator Setup: Validators should create a validator pockets and a singular validator signing key. The general public key from this signing secret’s important for validator registration.

- As of March 2025, the Sonic community boasts 41 energetic validators.

When organising a validator node, assembly particular {hardware} standards is crucial to sustaining community effectivity and safety:

- Server Occasion: It is strongly recommended {that a} devoted server occasion be created, both on bare-metal {hardware} or by way of cloud suppliers like Google Cloud Platform (GCP) or Amazon Internet Providers (AWS).

- CPU & RAM: Really useful specs embody a minimum of 4 digital CPUs and 32 GB of RAM.

- Storage: A minimal of 1 TB native SSD/NVMe storage is critical. Distant storage like AWS Elastic Block Retailer (EBS) sometimes doesn't present the required efficiency.

This strong setup ensures Sonic validators can hold tempo with the community’s excessive throughput and efficiency, serving to ship the quick and safe expertise Sonic goals to supply its customers.

$S Tokenomics

The S token is the native token of the Sonic community, central to its ecosystem with roles starting from transaction payment funds and staking to validator operations and decentralized governance. At Sonic’s launch, the community launched a set preliminary provide of 3.175 billion S tokens, of which roughly 2.88 billion had been circulating instantly. The distinction in tokens is strategically allotted to assist community operations, corresponding to validator incentives and ecosystem funding.

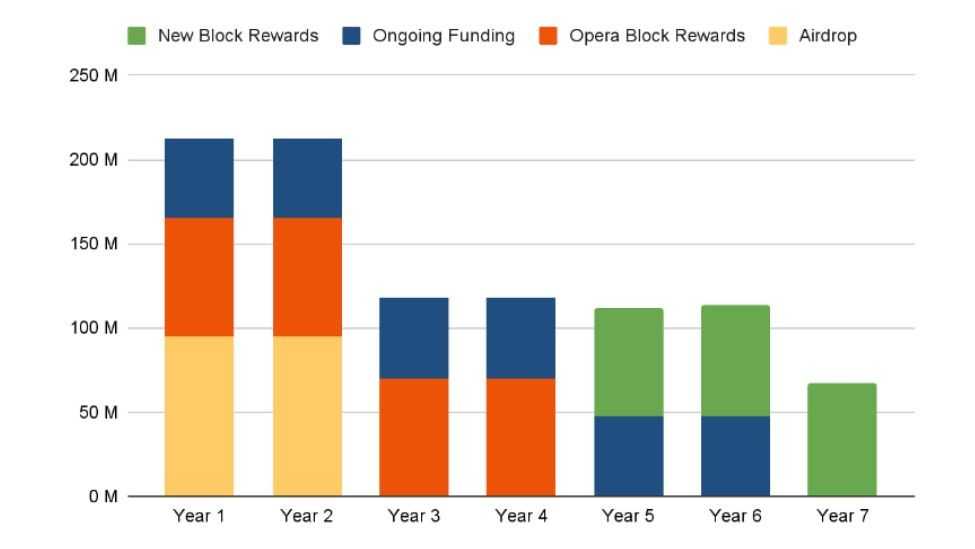

Preliminary Provide and Inflation Schedule

The preliminary token provide of three.175 billion S tokens was designed to offer a robust basis for community actions whereas managing inflation rigorously. Though Sonic initially averted token inflation at launch, community-approved governance proposals outlined plans to introduce managed token issuance post-launch. Particularly, beginning six months after the mainnet launch, the Sonic community will mint a further 1.5% (47,625,000 S) yearly for six consecutive years. These tokens fund strategic ecosystem development initiatives, together with person incentive airdrops, ecosystem growth efforts, and validator rewards.

Validator Rewards and Block Rewards

Sonic migrated the present block rewards from the earlier Fantom Opera community in a major transfer designed to bootstrap validator participation with out instantly inflating token provide. This modern method offered validators a secure reward charge of 3.5% APR (assuming 50% of the community is staked) with out creating extra inflationary pressures for the primary 4 years. After this four-year interval, Sonic will resume minting tokens for validator rewards at a sustainable charge of 1.75% yearly, making certain long-term incentivization.

Deflationary Mechanisms

Sonic introduces a number of deflationary mechanisms geared toward curbing inflation and incentivizing useful behaviors inside the ecosystem:

Sonic Airdrop Deflationary Mechanism (Early Declare Burn):

Sonic incorporates a singular deflationary vesting mechanism to distribute round 200 million S tokens to customers. Customers instantly obtain 25% of their airdrop tokens upon declare. Nevertheless, the remaining 75% is locked for 9 months as ERC-1155 NFT tokens. If customers go for early withdrawal throughout this vesting interval, they sacrifice a portion of those tokens to a burn mechanism, progressively lowering over time. For example, an early declare inside the first month ends in an 88.9–100% burn, whereas ready till the ninth month eliminates burn penalties fully. This methodology incentivizes sustained person engagement and promotes long-term ecosystem exercise.

Instance: If a person named Alice earns 1,000 S tokens from the airdrop, she instantly receives 250 S. Nevertheless, If she tries to say the remaining tokens after simply 90 days, she is going to solely obtain 249.75 S, burning roughly 500.25 S tokens. This burn mechanism thus encourages customers to remain engaged longer, positively impacting total community exercise.

Deflation by way of Ongoing Community Funding

Sonic introduces one other burn mechanism linked to its ongoing funding initiative to make sure accountable community funding and forestall pointless inflation. Yearly minted tokens meant for ecosystem development that stay unused inside their designated yr are completely faraway from circulation. For instance, if the community makes use of solely 5 million S from the allotted 47,625,000 S tokens minted in a single yr, the remaining 42,625,000 S shall be burned.

Charge Monetization Burn

Sonic incentivizes utility builders by way of its Charge Monetization (FeeM) program. Taking part apps obtain as much as 90% of community charges from their platforms. Nevertheless, Sonic imposes a penalty on apps that select to not take part in FeeM: 50% of the transaction charges from such apps are burned. This mechanism encourages extra builders to undertake Charge Monetization, rewarding participation whereas constantly decreasing token provide, contributing to deflationary strain.

Collectively, these mechanisms permit Sonic to rigorously stability token inflation mandatory for development and improvement whereas embedding strong deflationary programs to take care of token worth and encourage energetic participation in its ecosystem.

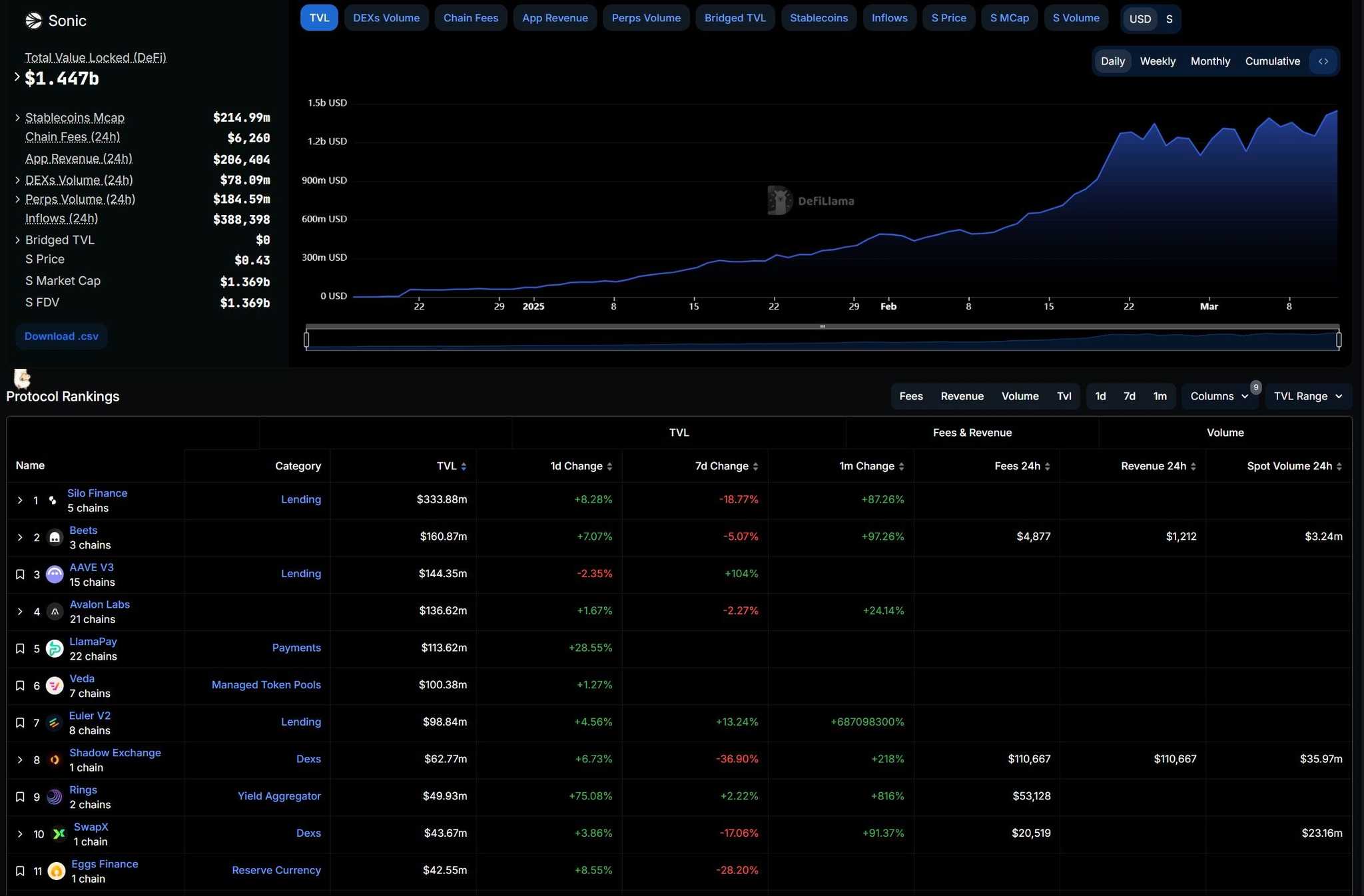

Sonic Ecosystem

The Sonic blockchain is a high-performance, EVM-compatible Layer-1 community able to dealing with 10,000 transactions per second (TPS) with sub-second finality. Constructed particularly for DeFi purposes, Sonic merges speedy transaction speeds, safety, and in depth incentives to draw builders and customers alike.

Chainlink for Cross-Chain Interoperability

Sonic leverages Chainlink's Cross-Chain Interoperability Protocol (CCIP), which gives builders with a safe, decentralized technique of transferring property and knowledge throughout chains. Chainlink integration affords strong safety by way of a number of validation layers and programmable token transfers, enhancing the performance of cross-chain purposes.

Sonic Factors and Gems

To stimulate ecosystem development, Sonic launched a twin airdrop mechanism:

- Sonic Factors: Person-centric incentives rewarding engagement and exercise.

- Sonic Gems: Developer-centric incentives, rewarding apps that generate person exercise. Apps can redeem Gems for S tokens to additional incentivize person exercise.

USDC.e Integration

Sonic options USDC.e, an official bridged model of USDC from Ethereum, using Circle’s Bridged USDC Normal. This stablecoin gives seamless DeFi interactions, supporting environment friendly buying and selling, liquidity provision, and cost-effective funds throughout the ecosystem.

Solv Protocol Collaboration

By its partnership with Solv Protocol, Sonic introduces yield-bearing Bitcoin property (SolvBTC and SolvBTC.BBN) and a liquid staking token for Bitcoin, enhancing Bitcoin’s usability inside DeFi. Customers can mint these property to earn yields and take part in broader monetary methods.

Rings Protocol

Leveraging Rings Protocol and Lombard Finance, Sonic affords superior Bitcoin derivatives corresponding to scBTC (yield-bearing Bitcoin asset) and LBTC (liquid staking Bitcoin token). These tokens facilitate Bitcoin's integration into Sonic’s DeFi panorama, offering choices for yield era, liquidity, and governance participation.

Curious in regards to the high Sonic DApps? We've bought you coated.

Extra Ecosystem Highlights:

- DeFAI Hackathon: Hosted with companions Hey Anon, DoraHacks, and Zerebro, Sonic’s DeFAI Hackathon affords $295,000 in prizes and encourages the event of AI brokers with social and on-chain functionalities to advance DeFAI purposes on Sonic.

- MemeCoin Promotion: Sonic launched the MemeCoin competitors, rewarding customers holding top-performing memecoins with 1 million OS tokens, highlighting group engagement.

- Arkham Intelligence: This partnership integrates Arkham's real-time blockchain knowledge analytics into Sonic, offering customers with superior instruments for entity and tackle monitoring, real-time alerts, dashboards, and visualization. Thus, it enhances transparency and safety inside Sonic's DeFi protocols.

- Symbiosis: The collaboration with Symbiosis facilitates seamless cross-chain token swaps, connecting Sonic with over 30 different networks. This integration enhances liquidity circulate and affords customers a streamlined expertise for cross-chain transactions.

- Excessive-Worth DeFi Purposes: Distinguished purposes embody Silo Finance (main lending market), Beets Finance (liquidity and staking), and Avalon Finance (specializing in liquid staking and LSDfi protocols).

- AAVE Integration: AAVE V3 is deployed on Sonic, additional enriching the ecosystem by offering superior decentralized lending options.

Extra Highlights:

- Pierre Gasly Partnership: Sonic has partnered with System One driver Pierre Gasly for the 2025 World Championship, emphasizing shared values of efficiency excellence and innovation.

- Developer Incentives: Sonic promotes in depth developer exercise by way of its Innovator Fund, which helps undertaking innovation, and Charge Monetization, which rewards builders with 90% of transaction charges generated by their apps.

Sonic positions itself as a compelling Layer-1 blockchain by way of superior infrastructure, engaging incentives, safe bridging, and strategic integrations, shaping a vibrant ecosystem for customers and builders alike.

Sonic Strengths and Dangers

The next complete overview highlights Sonic’s potential whereas clearly outlining key dangers to think about for buyers, customers, and builders evaluating the platform.

Professionals/Strengths:

- Excessive Throughput and Quick Finality: Sonic’s DAG-based consensus mechanism delivers over 10,000 TPS with sub-second finality, offering quick transaction affirmation appropriate for purposes that demand pace and scalability.

- Full EVM Compatibility: Builders conversant in Ethereum can deploy Solidity or Vyper good contracts straight onto Sonic with minimal friction. This lowers boundaries to entry and accelerates ecosystem development.

- Distinctive Developer-Centric Options (Charge Monetization – FeeM): Sonic’s Charge Monetization program incentivizes builders by returning as much as 90% of transaction charges generated by their DApps. This Web2-like monetization mannequin can appeal to builders by offering a sustainable income stream that’s absent on most blockchains.

- Sturdy Tokenomics and Deflationary Mechanisms: Sonic introduces modern tokenomics, that includes ongoing token burns (airdrop burn, unused funding burn, FeeM burn) that keep token worth whereas funding ecosystem development.

- Present Market Recognition by way of Fantom Heritage: The Fantom community was already well-regarded in Web3 circles. Sonic inherits Fantom's model fairness, established group, and trade presence, doubtlessly aiding in person and developer adoption.

- Sturdy Infrastructure and Tooling: Complete developer tooling simplifies developer onboarding, together with devoted testnets (Blaze), straightforward contract deployment strategies, and integrations with main Web3 instruments (Alchemy, The Graph, Band Protocol, and many others.).

Dangers/Cons/Challenges:

- Restricted Migration Regardless of EVM Compatibility: Though absolutely appropriate with Ethereum’s EVM, Sonic has seen restricted migration of standard DApps from different EVM chains. Tasks sometimes want to stay inside Ethereum’s confirmed ecosystem or transfer towards Layer-2 scaling options.

- Layer-2 Dominance: Ethereum's growth efforts are dominated by Layer-2 scaling options like Optimism, Arbitrum, zkSync, and Polygon zkEVM. As a standalone Layer-1 chain, Sonic faces important competitors from these L2 networks, which regularly supply seamless integration with Ethereum's liquidity and group.

- Comparatively Low Variety of Lively Validators: On the time of writing, the community had solely 41 energetic validators, which might pose potential dangers associated to centralization. The small validator set might additionally have an effect on builders' and customers' perceptions of community resilience, decentralization, and safety.

- Diminishing Worth of Excessive Throughput as a Distinctive Promoting Level: Whereas excessive TPS and low latency as soon as differentiated initiatives, quite a few Layer-1 and Layer-2 networks now supply comparable or superior efficiency metrics. This reduces Sonic’s distinctive worth proposition in a crowded market.

- Restricted DApp Migration and Person Retention: Preliminary adoption has proven minimal migration of DApps from Fantom Opera regardless of full EVM compatibility, probably indicating developer hesitancy, friction in migration processes, or inadequate incentives for present initiatives.

- Decentralization Issues (Low Lively Validator Rely): Sonic at present has solely 41 energetic validators, which presents decentralization challenges. Restricted node distribution will increase potential centralization dangers, doubtlessly undermining safety and person belief.

- Innovation Adoption and Neighborhood Momentum: Regardless of rebranding and new options, the preliminary group momentum constructed beneath Fantom have to be re-established. If developer incentives or person curiosity fade post-migration, group engagement would possibly decline.

Remaining Ideas

Sonic affords substantial improvements and clear enhancements over its Fantom predecessor. The choice to launch a very new chain as an alternative of merely upgrading Fantom Opera was justified by a number of important technological enhancements: sub-second transaction finality, considerably sooner node synchronization, drastically decrease validator prices, and superior database storage administration with dwell pruning. Distinctive developer-centric options, particularly the Charge Monetization mannequin, present significant incentives to draw dApp builders.

These strategic adjustments clearly distinguish Sonic from being merely a superficial rebranding. As an alternative, Sonic Labs efficiently used the rebrand as a possibility to introduce technical developments and compelling incentive buildings explicitly tailor-made for builders and energetic individuals.

Nevertheless, regardless of these constructive developments, Sonic's ecosystem stays underdeveloped. The blockchain continues to face stiff competitors from Layer-2 options most popular by Ethereum builders, and early migration of dApps from Ethereum and Fantom Opera has been sluggish. To realize significant adoption, Sonic should construct a strong dApp ecosystem, broaden node decentralization, and overcome Ethereum’s gravitational pull towards Layer-2 networks.

In the end, Sonic exhibits important promise with robust technical capabilities, developer-focused improvements like Charge Monetization, and a considerate method to tokenomics and incentives. Its success will largely rely upon attracting a vibrant ecosystem of purposes, builders, and customers in a fiercely aggressive panorama.

Regularly Requested Questions

What’s the Sonic Blockchain?

Sonic is a high-performance EVM-compatible Layer-1 blockchain, launched because the successor to Fantom Opera. It leverages a DAG-based consensus mechanism for prime scalability and speedy transaction affirmation. Sonic was created as a result of the technological enhancements it launched—like asynchronous Byzantine Fault Tolerance and dwell database pruning—could not be simply built-in into Fantom Opera by way of a easy improve.

What’s the Utility of the S Token?

The S token is Sonic’s native cryptocurrency. It serves a number of features on the community, together with paying gasoline charges, staking to safe the community, operating validator nodes, and taking part in governance. It additionally options modern deflationary mechanisms, corresponding to token burning by way of its airdrop vesting schedule, Charge Monetization incentives, and ongoing funding mechanisms.

Why Did Sonic Rebrand From Fantom?

The transition from Fantom to Sonic was way over a easy rebranding. Sonic Labs used the shift as a possibility to introduce important technological improvements, revamped tokenomics, developer incentives, and a brand new native token (S). These adjustments offered concrete enhancements, together with 10x sooner node synchronization, decreased validator prices, and Ethereum interoperability by way of the Sonic Gateway.

What are Sonic Factors and Gems?

Sonic Factors and Gems are a part of Sonic’s incentive system to draw and reward each customers and builders. Sonic Factors incentivize person participation, rewarding actions like liquidity provision and app utilization. Sonic Gems, then again, are developer-oriented incentives, rewarding apps for producing person engagement. Apps can redeem Gems for S tokens, distributing them to their customers as extra incentives.