Synthetix is among the most attention-grabbing Decentralised Finance (DeFi) tasks presently within the area. A distributed asset issuance protocol on a blockchain.

Constructed on the Ethereum community, this undertaking permits customers to challenge and commerce artificial decentralised belongings. This contains not solely your typical mix of cryptocurrencies but in addition Fiat currencies and even commodities.

Nonetheless, is it actually secure and the way does it work?

On this Synthetix evaluate, I’ll take an in-depth take a look at the undertaking. I can even offer you what it is advisable to know to make use of the platform and commerce decentralised synthetics. However first, let's begin with some fundamentals…

Promise of DeFi

One of many primary guarantees that many cryptocurrencies make is to create a kind of cash and transactional system that’s universally accepted. With cryptocurrencies you need to be capable to pay anybody for something, irrespective of the place on this planet the 2 of you’re. And your transactions ought to include minimal charges.

That’s how the creator of Bitcoin envisioned using transactional cryptocurrencies simply over a decade in the past.

Now the blockchain area has developed, and the Decentralized Finance (DeFi) motion is trying to take that unique premise even additional. If the DeFi motion is profitable everybody on the planet can have straightforward and open entry to a whole vary of economic providers, all with out the necessity for banks, or third-party intermediaries.

Individuals will be capable to entry insurance coverage merchandise, loans, investments, financial savings accounts, and way more. All of this may reside on a blockchain and will probably be accessible to anybody with an web connection and a smartphone or different web succesful gadget.

All of that is already attainable on blockchains with sensible contract capabilities, such because the Ethereum blockchain. These sensible contracts are functions that execute routinely when sure circumstances are met. With sensible contracts builders are in a position so as to add very subtle performance to the blockchain past the straightforward transactional sending and receiving of cryptocurrency.

When you suppose this all feels like one thing that’s futuristic and little greater than a dream, suppose once more. There are already decentralized functions (dApps) that make the most of sensible contracts. These dApps will permit two full strangers on reverse sides of the globe to barter loans with none financial institution or different middleman vital.

The Ethereum community additionally permits for the creation of recent tokens constructed on high of its blockchain. Many tasks have taken benefit of this functionality to increase on the performance of the Ethereum blockchain.

Enter Synthetix

Synthetix is one such undertaking which has a cryptocurrency constructed on the Ethereum blockchain. Synthetix was created as a DeFi undertaking that can permit for the creation of artificial belongings.

These artificial belongings are in a position to observe the value of another asset, whether or not that’s currencies, equities, bonds, commodities, and even different cryptocurrencies. If it’s one thing that has actual world worth, then the Synthetix platform will permit an artificial asset to be created to trace the value of that asset.

The mechanism behind Synthetix is very similar to the one utilized by stablecoins to take care of their pegged worth. However somewhat than a single stablecoin, Synthetix will permit anybody to mint an artificial asset backed by the SNX token.

Synthetix perpetual futures are a set of permissionless and decentralized sensible contracts, providing deep liquidity and low buying and selling charges on a spread of artificial belongings. Extra just lately, founder Kain Warwick launched a brand new derivatives front-end known as Infinex to the decentralized buying and selling infrastructure of Synthetix.

The deliberate decentralized alternate (DEX) will cater to each novice and skilled merchants by providing options much like centralized exchanges (CEX), comparable to a noncustodial central restrict order guide. It can provide entry via a username and password whereas sustaining a noncustodial setup. Infinex would generate a novel public-private key pair for every person, saved domestically within the browser. Nonetheless, this key can’t withdraw funds. It's solely used to signal trades despatched to the account relayer on Optimism.

Infinex will launch alongside Perps V3, which is presently in improvement.

Particulars Behind Synthetix

As was talked about above Synthetix was created on the Ethereum blockchain. In contrast to most different blockchain tasks it contains two various kinds of tokens:

- The principle token which is used within the creation of artificial belongings is known as the Synthetix and it makes use of the ticker image SNX.

- The second token kind is known as the Synth. These are all of the artificial belongings which might be created utilizing the Synthetix platform.

From the surface the system for utilizing Synthetix is kind of easy and easy. Customers first buy SNX tokens after which lock them in a appropriate pockets. As soon as they’ve locked up the SNX tokens they can be utilized to create Synths to trace the value of another real-world asset.

That is the place issues get a bit extra sophisticated. The worth of every Synth is decided by oracles, and lots of of those have already been supplied via a partnership with Chainlink (LINK).

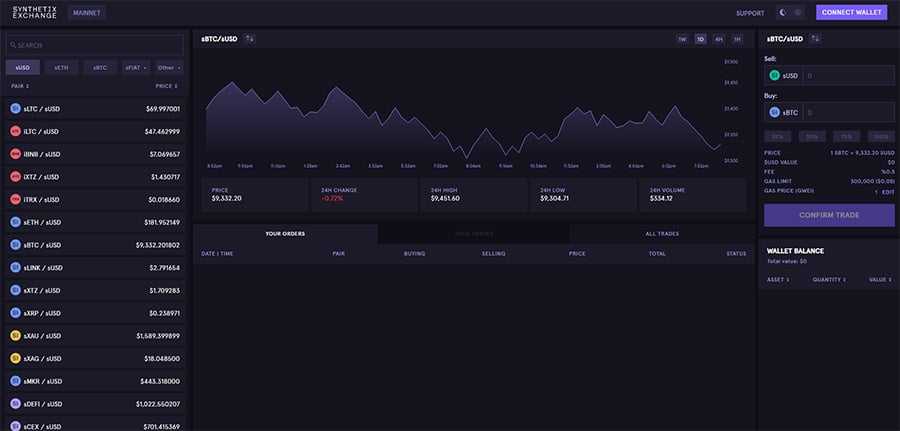

At this level the Synths out there are primarily foreign money or cryptocurrency pairs. There are additionally Synths out there primarily based on gold and silver, and all of the Synths could be traded and exchanged on the Synthetix Trade.

It’s extremely straightforward to create Synths that observe costs in no matter method the creator intends. For instance, there are Synths primarily based on Bitcoin, and the sBTC tracks the value of Bitcoin, however the iBTC is an inverse token which features in worth when Bitcoin falls in worth.

These are two of the only makes use of for Synthetix and Synths, however the skill to mint and personal Synths primarily based on totally different standards will encourage many new methods to commerce belongings, to create and handle portfolios of belongings, to hedge, and even to make funds.

Distinctive Options

There are 4 options which might be distinctive to Synthetix and may’t be present in practically another system.

- Anybody can create and convert Synths with out the necessity for a counterparty;

- Any Synth could be traded for another Synth on the Synthetix Trade and the performance supplies practically infinite liquidity

- Peer-to-contract (P2C) buying and selling through which trades are executed shortly and simply, all with out an orderbook.

- A distributed pool of token holders is answerable for offering collateral on the platform and for sustaining the soundness of the alternate.

What Can You Commerce?

Presently you possibly can commerce Synths and inverse Synths of main currencies just like the euro, yen, pound sterling, U.S. greenback, Australian greenback, Swiss franc, and others.

You too can commerce Synths and inverse Synths of cryptocurrencies comparable to Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Tron (TRX), Chainlink (LINK), and others. And there’s a Synth and inverse Synth that permits buying and selling gold and silver.

Theoretically although you possibly can commerce any asset with Synthetix. The monetary system contains derivatives, commodities, equities, and different belongings that add as much as a whole lot of trillions of {dollars}. And Synthetix supplies a platform the place any of those belongings could be become an artificial asset that lives on the Ethereum blockchain.

This permits them to be traded in a permissionless and decentralized method, which is in distinction with the standard markets which might be managed by centralized establishments.

Synthetix will permit anybody, wherever on this planet, acquire entry and publicity to world equities like Fb or Deutsche Financial institution with out the necessity to cope with the acute friction created by the centralized monetary establishments and authorities laws.

Even crypto merchants can profit via the entry to a basket of cryptocurrencies in each lengthy and brief Synths.

How Synthetix Stays Collateralized

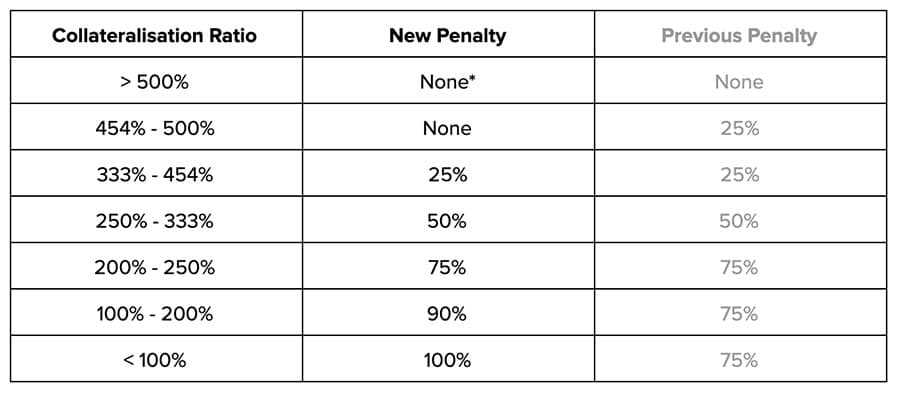

The first drawback skilled within the Synthetix system is in holding the system collateralized.

I’m certain you’ve already thought what may occur if the worth of the Synths on the platform start transferring in opposition with the underlying SNX tokens. How may the system preserve its collateralization if the value of SNX had been dropping, whereas the value of the Synths was rising?

Actually, the infinite liquidity of the platform was created to assist remedy that drawback, and there are further options and traits which were baked in to make sure that the platform continues to perform whatever the value actions of the SNX tokens and the Synths which were created.

Under you could find out extra about every of those options and traits.

750% Collateralisation required

With the intention to challenge a brand new Synth the Synthetix system requires collateralization of 750%. This implies to mint 100 artificial USD (sUSD) a person must lock up the equal of $750 in SNX tokens.

This huge collateralization requirement creates a big buffer for the Synths in circulation and protects in opposition to sudden market strikes.

Debt-driven

Within the Synthetix system the SNX collateral is locked up each time Synths are minted, and people Synths then take the type of an excellent debt on the platform. If a person needs to unlock their SNX later they should burn an variety of Synths that is the same as the present worth of the Synths they minted earlier.

The 750% collateral requirement ensures that it’s simpler for customers to purchase again their very own debt once they want to take action.

Debt Swimming pools

As you possibly can guess every one that creates Synths can have their very own private debt from the Synths they’ve minted, however there’s additionally a worldwide debt pool that underlies the whole circulation of Synths.

Within the case of the non-public money owed, they’re merely calculated as an ever-changing share of the whole Synths minted and in circulation and the alternate charges of the underlying asset and of SNX.

One offshoot of that is that issuers should not required to repay their debt with the precise kind of Synth that was initially minted. Issuers can repay their money owed with any kind of Synths, as long as it has the identical market worth as the worth of the Synths they want to burn.

That is the mechanism that provides the Synthetix platform what seems to be infinite liquidity. It additionally permits for any shifts between Synths within the system with out creating an imbalance.

Synthetix Trade

The Synthetix Trade is the place folks can go to purchase and promote all the varied Synth that’s been created. As a result of the alternate is underpinned by sensible contracts there is no such thing as a want for reliance on any counter-party or third get together within the alternate course of. Anybody should purchase and promote at any time, tapping into the infinite liquidity of Synthetix.

Accessing and utilizing the alternate is well achieved by connecting a web3 pockets to the alternate. As soon as that’s been achieved customers can shortly and simply convert between totally different Synths and SNX.

Presently the alternate price for all belongings on the alternate is 0.3%. These alternate charges present incentive to carry SNX tokens since they’re distributed to SNX holders as a reward for offering the system with collateral to again the Synths in circulation.

Inflation

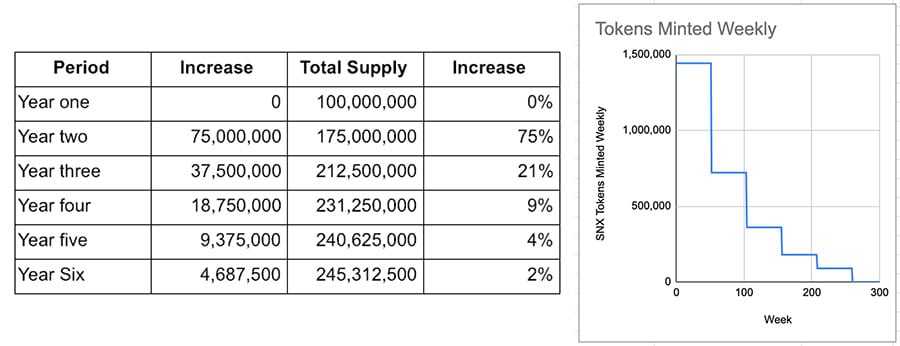

The builders of Synthetix have constructed inflation into the system too, with the whole quantity of SNX issued deliberate to extend from the preliminary 100 million tokens to 250 million tokens by 2025.

This inflation was not initially constructed into the system, however was added later when it grew to become apparent that alternate charges alone wouldn’t be an satisfactory incentive to challenge Synth. The inflation shall be distributed among the many Synth issuers, giving them an added incentive to mint new Synth.

Trade charges and Staking Rewards

Anybody is ready to buy SNX and lock it in a pockets, challenge Synth, and tackle the debt behind these Synth. When this course of is finished the person turns into a staker within the Synthetix ecosystem and so they can earn and accumulate staking rewards. The staking rewards come from Sythetix Trade charges, that are presently set to 0.3% of every transaction.

As every transaction on the alternate takes place the alternate charges are transferred to a pool. This pool is then distributed amongst SNX stakers in proportion to the quantity of excellent debt they maintain. On this method anybody can enhance the quantity of staking charges they earn by merely issuing extra Synth.

One caveat to this technique is that stakers can solely earn and accumulate staking rewards in the event that they maintain their collateralization at or above 750%. This incentivizes Synth issuers to maintain their collateral at 750% and maintains the liquidity of the system.

How Does it Work?

The precise course of works very easily. It begins by holding SNX tokens in an ERC-20 appropriate pockets after which connecting that pockets to the Synthetix Trade (beta v.2 right here).

If a person needs to stake their SNX tokens, or needs to mint Synth for some function they start by locking SNX as collateral of their pockets. Keep in mind there’s a 750% collateral requirement, so all Synth is minted relative to this collateral requirement and the worth of the SNX locked within the pockets.

After the Synth is minted anybody wherever on this planet is ready to entry it with a view to commerce, make investments, pay transactions, or do the rest vital with the Synth.

Those that create Synth are additionally thought of to be stakers within the system, and so they earn staking rewards primarily based on the quantity of SNX locked, and primarily based on the charges generated by the Synthetix Trade. So, the extra the Synthetix Trade is used the larger the whole charges generated and the bigger the reward pool for stakers.

Have in mind it isn’t essential to mint Synth should you simply need to purchase and promote Synth. Anybody can use the Synthetix Trade. All they want is an ERC-20 appropriate pockets with some ETH for fuel and a few Synth. If the person doesn’t personal Synth but they’ll use ETH to buy sUSD.

To make issues even simpler there’s an software known as Mintr that was created to make the minting of Synth and staking SNX so simple as posssible.

Mintr

Mintr is a dApp that was created as an intuitive interface for managing SNX, Synths, and all of the features of the Synthetix ecosystem.

Via the Mintr interface customers can carry out a variety of actions associated to the broader Synthetix ecosystem. This contains minting and burning Synth, lock and unlock SNX, accumulate staking charges, ship sUSD to a promoting queue, handle the collateralization ratio, and extra.

Customers are in a position to join their ERC-20 appropriate pockets to Mintr with a view to carry out any of the duties talked about above. Mintr makes managing SNX and Synth so simple as attainable.

Synth Pegging Mechanism

It’s important that Synthetix preserve a steady peg in order that the system stays steady, with good liquidity in a well-functioning system. That is required if merchants expect to make use of the system to generate earnings.

As a result of some Synths are buying and selling on the open market there’s at all times the chance that the Synth will fall beneath par as compared with the asset they observe. This implies incentives are wanted to maintain any deviations minimal, and to provide customers an incentive to appropriate any deviations.

These are the three strategies used to take care of the Synth peg:

- Arbitrage – When SNX stakers mint Synth they create a debt which could be arbitraged on if the peg is damaged. In apply it means they’ll purchase sUSD beneath par and burn that to cut back their debt at a decrease price foundation.

- sETH Liquidity Pool on Uniswap – Every week when new SNX is created a portion is distributed to these customers who’re offering sETH/ETH liquidity on Uniswap This incentive is answerable for creating the biggest liquidity pool for the Synthetix Trade. Due to this huge liquidity pool it permits anybody to simply purchase and promote any Synth at any time.

- SNX Arbitrage Contract – There’s a contract holding SNX whereby customers can ship ETH to the contract anytime the sETH/ETH falls beneath par. The contract exchanges the ETH for SNX at par worth. This permits anybody to alternate ETH for SNX at a reduced price anytime the sETH ratio falls too low.

The Synthetix Staff

Synthetix was initially conceived and created as Havven in 2017 by Kain Warwick in Sydney, Australia. As Havven the undertaking raised roughly $30 million in an ICO that was held in March 2018. One of many largest buyers within the undertaking was Synapse Capital, a crypto-investment agency that focuses on crypto native tasks and developer community results.

In late November 2018 the Havven crew introduced they’d rebrand the undertaking to Synthetix, and within the first week of December 2018 the rebranding passed off.

The chief of the Synthetix undertaking is Kain Warwick, who constructed Australia’s largest cryptocurrency cost platform previous to beginning work on Synthetix.

Within the CTO place at Synthetix is Justin Moses, who has been with the undertaking since its inception. Previous to becoming a member of Synthetix he was the Director of Engineering at MongoDB. He has in depth expertise with giant scale methods, together with each the design and deployment.

Senior architect for the undertaking is Clinton Ennis who has 18 years expertise in software program engineering. He was beforehand an Architect Lead at JPMorgan Chase.

Synthetix (SNX) Token Overview

SNX tokens energy the whole Synthetix ecosystem, since they’re used as collateral to mint the Synths, or artificial belongings. Those that maintain SNX tokens can stake them and earn a portion of the charges generated by the Synthetix Trade.

The SNX was deflationary till March 2019, when the Synthetix crew added an inflationary financial coverage part to assist incentivize customers to create Synths. After this inflationary coverage was applied the Synthetix community noticed an enormous leap in person participation, and an accompanying leap within the worth of the SNX token.

The inflationary coverage contains rising the variety of SNX tokens from 100 million in March 2019 to 260,263,816 by August 2023. The issuance of recent tokens decays at a price of -1.25% per week. After the provision reaches the August 2023 objective the protocol shifts the issuance price to a set 2.5% inflation price in perpetuity.

Despite the fact that the SNX token isn’t designed as an investing instrument itself, the token has seen huge development for the reason that March 2019 introduction of an inflationary mechanism. At the moment the token was buying and selling at slightly below $0.05, however as of January 2020 it’s at $1.20 after reaching an all-time excessive of $1.57 on November 24, 2019.

Considerations with Synthetix

Whereas Synthetix sounds futuristic and has numerous distinctive advantages that would serve many people around the globe, there’s nonetheless a big threat with the system, and that’s the truth that it’s nonetheless in improvement and there’s no ensures it’ll develop and achieve the long run.

For customers there’s a very actual threat that they would wish to burn extra Synths sooner or later than they issued with a view to unlock their SNX. There’s additionally a threat of competitors rising and overtaking Synthetix.

Different dangers embrace Synthetix’s dependence on Ethereum, and the present centralization of the undertaking.

The platform additionally wants dependable value feeds for all of the artificial belongings minted and listed within the Synthetix Trade. If there’s no option to reliably observe the value of the asset with out manipulation the entire system shall be topic to fraud.

This want for dependable value feeds has stored Synthetix restricted to main currencies, excessive liquidity cryptocurrencies, and commodities comparable to gold and silver.

Sooner or later it’s attainable regulatory modifications can even affect Synthetix. Some jurisdictions may simply classify the Synths as securities or monetary derivatives, which might make them topic to all the present laws and legal guidelines governing these asset varieties.

2020 Roadmap

The Synthetix crew listens carefully to the neighborhood, so any of the potential modifications listed beneath are solely prospects for 2020 and will simply change primarily based on neighborhood suggestions.

Development/Adoption

- Extra Synths, together with leveraged Synths;

- Artificial equities and indices;

- Artificial positions;

- Binary choices;

- Web site improve.

Mechanism/Incentive Design

- Full use of Ether as collateral;

- Extra Uniswap swimming pools to enhance liquidity;

- Improve to a “pooled” depot.

Consumer Expertise

- Greater throughput via Optimistic Rollups;

- Triggered orders comparable to stop-loss and restrict orders;

- SNX staking swimming pools;

- ERC-20 escrow tokens.

Protocol Safety

- Pausing buying and selling throughout market closures;

- Monitoring the P/L of particular person wallets;

- Pause performance added to contracts;

- Unit take a look at audit.

Decentralization

- Decentralized proxy contracts;

- DAO construction section 1;

- Upgrading The Graph to permit dApps to deploy to IPFS and keep away from a central level of failure.

System Optimization

- Optimize the calculation of ‘total issued Synths’;

- Upgraded staking mechanism;

- Refactoring the Synthetix contract;

- Improve the deployment course of;

- Create a contract deal with resolver.

Conclusion

Synthetix is on the forefront of the DeFi motion by providing artificial belongings to customers throughout the globe, thus offering entry to specialised buying and selling methods.

Given the huge dimension of conventional monetary markets, which reaches into the a whole lot of trillions of {dollars}, Synthetix has the potential to create an enormous tokenized market on the Ethereum blockchain.

It’s a grand and sweeping try and revolutionize and modernize the monetary markets, and the Synthetix crew needs to be applauded for his or her imaginative and prescient. Nonetheless it must also be famous that there is no such thing as a assure their imaginative and prescient will turn into profitable.

There are a lot of components that would restrict the unfold of the Synthetix Trade and using Synths.