There are a rising variety of decentralized cryptocurrency exchanges, and one of many higher recognized is THORChain, which is powered by the RUNE token.

For those who’re trying right into a decentralized resolution that lets you simply swap tokens throughout chains with out wrapped or pegged tokens, then THORChain could be what you’ve been looking for. You too can earn by offering liquidity to the alternate, or run a node to assist safe the community.

You’re most likely already evaluating THORChain to Uniswap in your head, so hold studying on to learn how THORChain is completely different, what it’s, the way it works, and lots of different points of this blockchain-based decentralized alternate.

What’s THORChain?

THORChain doesn’t have a very lengthy historical past, it wasn’t even conceived of till 2018. It does supply a full vary of alternate providers nevertheless, and its steady liquidity swimming pools are distinctive within the trade. As a result of THORChain is constructed as a cross-chain resolution it’s potential to swap any asset utilizing THORChain, which is superior to different decentralized alternate choices.

The core idea behind THORChain is clearly defined of their whitepaper

“THORChain is a liquidity protocol designed to connect all blockchain assets in a marketplace of liquidity through cross-chain bridges and continuous liquidity pools secured by economically incentivised validators.”

Constructed on Tendermint, the Byzantine Fault Tolerant engine that powers Cosmos, THORChain is a Proof-of-Stake blockchain that features community validators who’re required to bond RUNE tokens. Validators might be punished for unhealthy habits by means of slashing the bonded tokens, which acts as a disincentive towards misbehavior. Community nodes are additionally used to create vaults and to validate transactions.

Who makes use of THORChain?

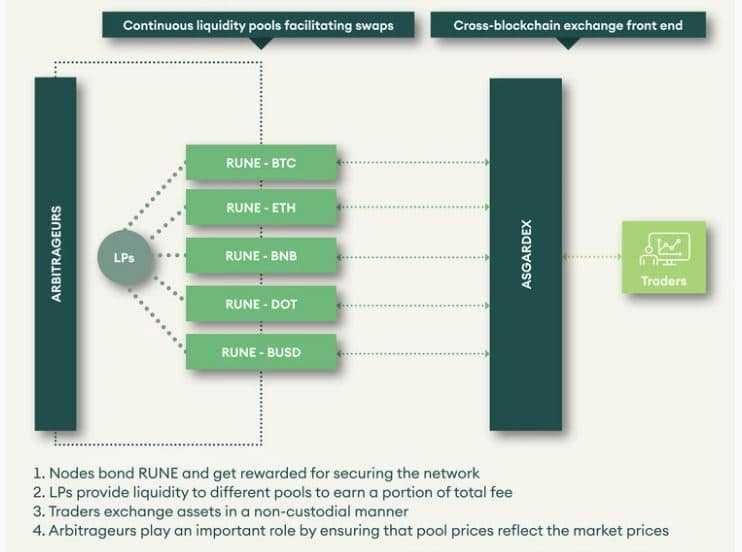

Basically there are two teams within the THORChain ecosystem. The primary are the customers, and the others are the liquidity suppliers.

Customers are the first contributors within the community who use the cross chain providers of THORChain to alternate tokens simply. Such exchanges are made between liquidity swimming pools, with the person paying a slip price to cowl gasoline charges and for the execution of the alternate. The swapping achieved by customers are non-custodial and unrestricted.

The second group utilizing THORChain are the liquidity suppliers who add liquidity to the assorted swimming pools to energy the alternate. This liquidity is certain utilizing RUNE tokens and is then stored in separate vaults powered by the community nodes. Through the use of a steady liquidity pool on this method THORChain avoids the necessity for exterior value feeds or for oracles. Liquidity suppliers earn rewards by means of the slip charges charged to customers. As defined on the THORChain web site:

“Liquidity is provided by stakers who earn fees on swaps, turning their unproductive assets into productive assets in a non-custodial manner. Market prices are maintained through the ratio of assets in pools which can be arbitraged by traders to restore correct market prices.”

Nodes Defined

Nodes underpin all of THORChain’s providers and so they have three major capabilities for the community:

- Bonding RUNE

- Create vaults

- Produce blocks

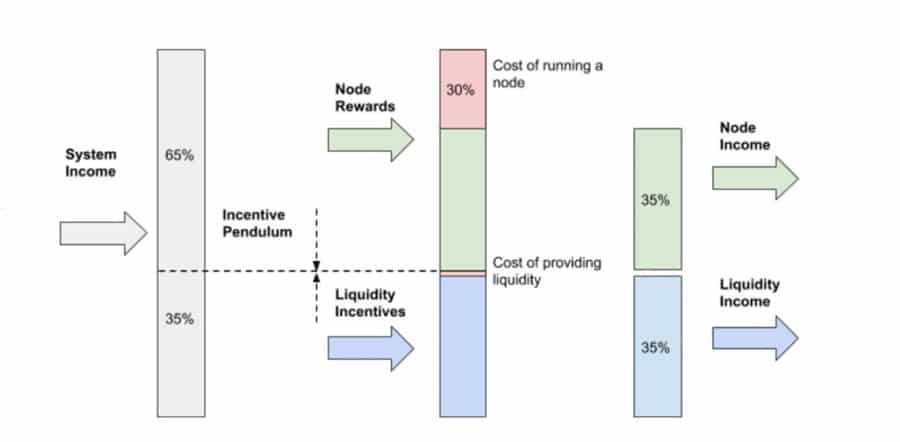

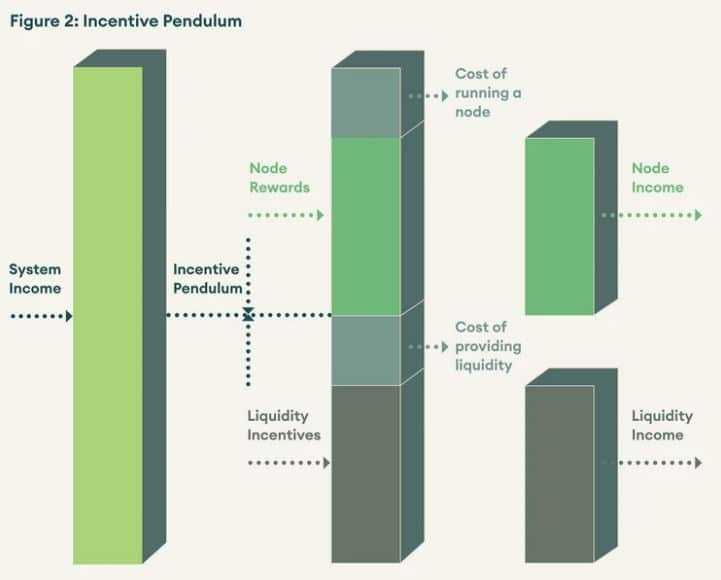

Every node is run by a node administrator and so they obtain bond rewards for serving to to keep up the community. The full they earn is two-thirds of all system revenue. Nodes are created each three days and must compete with each other utilizing bonded capital. So as to make sure the community stays recent the older nodes are sometimes churned out of the system and changed. Nodes profit from being nameless with believable deniability on all transactions.

ThorChain and Asset Liquidity

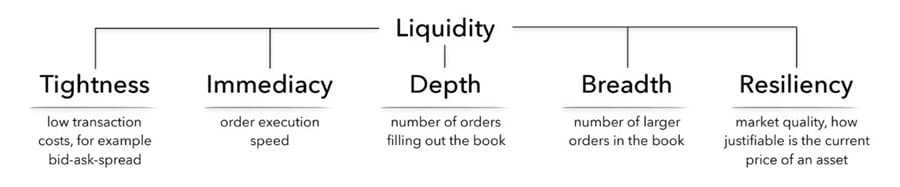

It’s clear to anybody who’s aware of the cryptocurrency markets that all the cash and tokens, even Bitcoin and Ethereum, are significantly missing in liquidity. In an effort to raised perceive how liquid markets operate, economists Tonny Lybek and Abdourahmane Sarr sub-divided liquidity into 5 elements:

As you may see, most of those 5 elements are hardly current within the cryptocurrency markets right this moment. Costs typically have little to do with the precise utility or fundamentals of a venture, however as an alternative are pushed purely by hypothesis. And in lots of instances the low cap altcoins are missing in each breadth and depth, which not solely slows execution velocity, but in addition results in extreme bid-ask spreads.

Penalties of illiquid markets

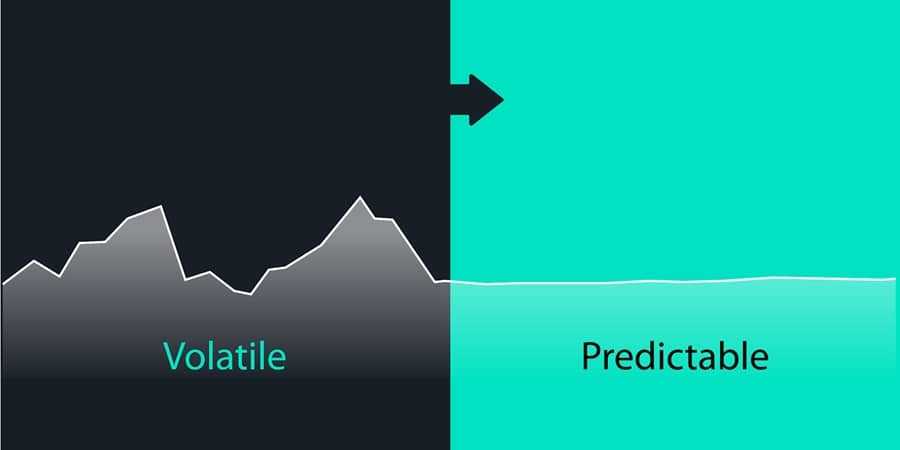

The surplus volatility typically seen in cryptocurrency markets is primarily a operate of the illiquidity within the markets. Whereas this volatility is engaging to these retail traders who’ve a excessive tolerance for threat, since it will possibly ship unbelievable returns in a brief time frame, in essence the cryptocurrency markets of right this moment are extra like casinos for playing than markets for investing. This excessive volatility additionally exhibits how immature the crypto markets are and in lots of instances retains institutional traders and huge funds from coming into the cryptocurrency markets.

We are able to additionally speculate that the volatility brought on by illiquidity within the markets is a significant component within the lack of adoption seen for cryptocurrencies. As a result of financial stability requires greater ranges of liquidity it isn’t probably that any of the illiquid cryptocurrencies, even Bitcoin, will grow to be a world transactional forex at any level within the close to future.

This lack has triggered many to assert that Bitcoin shouldn’t be a transactional forex in any respect, however as an alternative ought to be thought-about a retailer of worth, much like the position performed by gold in monetary markets. Nonetheless, with gold we don’t see the large fluctuations in value which might be seen in cryptocurrencies and serve to discourage established traders from using Bitcoin as a retailer of worth. Skilled traders are extra serious about discovering a retailer of worth that has value stability and a gentle appreciation over time.

Some would possibly argue that you will discover a extra steady buying and selling atmosphere on the main cryptocurrency exchanges like Binance and Coinbase, however these pose their very own issues, chief of which is the centralized nature of those exchanges. Due to their centralization additionally they include the everyday belief and safety points widespread with centralized exchanges.

Along with that it’s not possible to say that these exchanges even have liquidity, or if what appears to be like like liquidity is just wash buying and selling. A decentralized alternate will get round all the problems introduced by centralized exchanges, nevertheless the one factor they do lack is liquidity, which makes utilizing a DEX an typically tortuous problem.

Thorchain's Decentralized Liquidity Community

THORChain is a protocol, nevertheless it gives way over only a protocol, it’s also an entire ecosystem that’s designed to unravel all the issues we’ve already talked about concerning cryptocurrency exchanges of their present state.

The creators of THORChain know that by making the whole ecosystem chain-agnostic it is going to simply assist all current digital property, even people who haven’t but been created. That’s essential as a result of it means THORChain shouldn’t be in competitors with different exchanges and protocols, however is reasonably working to create one underlying liquid decentralized community.

Due to its decentralized nature THORChain is able to fixing these points in a trustless method. That would finally eliminate third-party involvement within the alternate ecosystem.

The community was created round incentivizing the supply of liquidity and security by means of staking and bonding. The notion of liquidity swimming pools is definitely nothing modern by itself, but there are at the moment solely a small variety of underutilized liquidity swimming pools.

And the present options like Uniswap and Bancor assist solely single chains, which makes them much less helpful. The chain-agnostic method being taken by THORChain is one thing unque and new, and finally it might result in the answer of the liquidity drawback in cryptocurrency markets by supporting the alternate of anybody cryptocurrency with every other cryptocurrency in a trustless method.

If the THORChain resolution can attain mass adoption and grow to be a major alternate resolution it will possibly finally take away a superb portion of the volatility current within the cryptocurrency markets. That might result in extra value stability, which in flip would result in elevated adoption from institutional traders.

One other offshoot of value stability and enough liquidity could be the elevated use of digital currencies as a transactional cost methodology. With this in thoughts THORChain additionally has a long-term purpose of deploying a cost community to allow trustless digital funds between any events.

Incentivized On-Chain Liquidity

The core of the whole ecosystem being created by THORChain is its protocol, and the purpose of the venture is to unravel the liquidity points at the moment current in cryptocurrency markets. With that in thoughts, the protocol is designed to deal with three capabilities:

- Trustless and safe, bi-directional bridging throughout all chains;

- Incentivizing asset holders for staking with a view to guarantee liquidity;

- Permitting for fast asset swaps and trans-currency funds, any digital asset with one another.

It’s most likely not shocking that the expertise and arithmetic behind THORChain is extraordinarily advanced, however the primary idea for the venture is kind of easy: incentivize the creation of liquidity after which join all liquidity and blockchains collectively for full interoperability, improved liquidity, and finally create mass adoption of cryptocurrencies that enables anybody to pay for something, wherever, with any forex.

In precept is works by means of a number of capabilities. First it incentivizes customers to carry their property on-chain and to put them in steady liquidity swimming pools to extend general market liquidity. In return for doing so they’re rewarded with staking rewards that come from the community charges.

THORChain can obtain this purpose, however to take action it might want to join as many chains as potential, notably the chains which might be already thought-about considerably liquid and economically energetic comparable to Bitcoin and Ethereum, together with others like Binance Chain. Because the token distribution grows, so too does the decentralization and incentivization of THORChain.

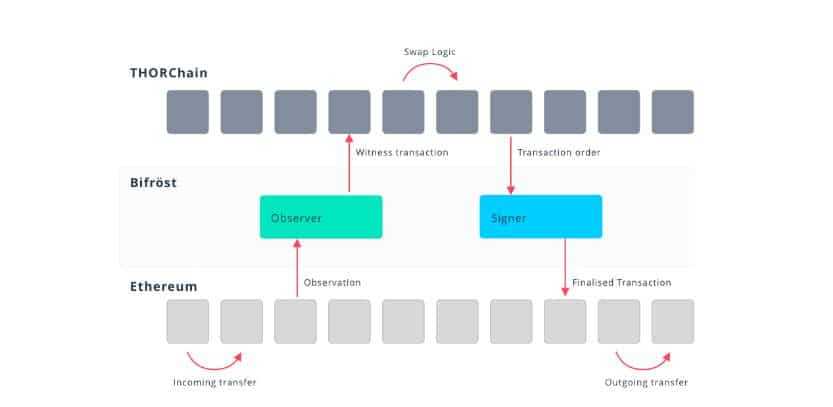

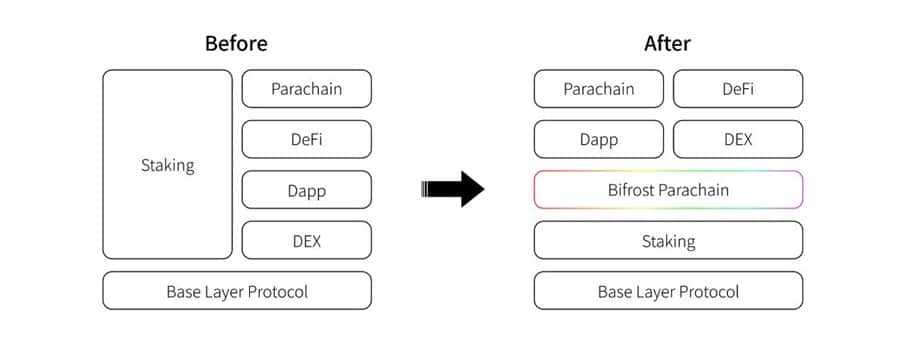

The BiFrost Protocol

The factor that holds the whole THORChain ecosystem collectively is the BiFrost Protocol. That’s as a result of it’s this protocol that allow interoperability between chains. That interoperability is likely one of the most essential fundamentals of the ecosystem as a result of with out interoperability the whole ecosystem will fail to ship.

The THORChain crew has created the BiFrost protocol from scratch, and it does only one factor – connects all the prevailing blockchains with each other. Finally the crew hopes that this protocol would be the ecosystem for all digital property, which is able to assist present a greater buying and selling atmosphere, decrease transaction charges, and higher staking rewards. And naturally it is going to enable for ease of alternate for any digital asset.

It ensures the belief and safety of the community and avoids double-spending and different malicious habits. In easy phrases it does this by means of the implementation of a set of 100 staked validators. These staked validators govern the multi-signature accounts on THORChain to create vaults.

Any time an exterior coin is moved to a THORChain vault it’s the accountability of one in every of these validators to signal the transaction. As soon as they achieve this a brand new equal model of the exterior coin is created on THORChain. When somebody desires to withdraw their staked cash the exterior coin is unlocked by burning the THORChain equal coin. This method makes bridging between chains far safer and it provides far higher liquidity than the present implementation of atomic swaps.

Bifrost is initially supporting Bitcoin and Binance Chain within the testnet that was launched in November 2020. The following cash to be supported are Ethereum and Litecoin, following which it’s thought that Monero can be added to the combination. The mainet ought to launch someday within the first half of 2021.

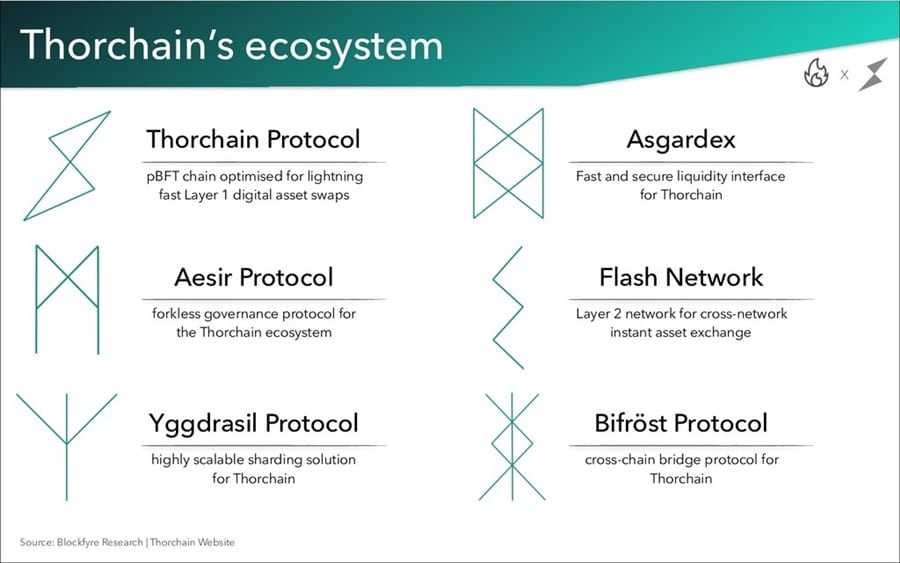

Yggdrasil Protocol

THORChain can be engaged on fixing the blockchain scalability difficulty by means of the Yggdrasil protocol. If THORChain desires mass adoption in some unspecified time in the future it might want to have each a excessive transaction throughput and low transaction prices. That’s what the Yggdrasil protocol goals to do.

The protocol introduces a brand new vertical sharding method meant to unravel all three components of the scalability drawback. With the Yggdrasil protocol THORChain will be capable of obtain most scalability whereas additionally remaining decentralized and as trustless as potential.

Aesir Protocol

The Aesir protocol is aimed on the governance of THORChain. It hopes to supply a good and economically efficient on-chain governance mechanism that may stay fork-free.

As well as the sustaining the community and receiving rewards, staking additionally conveys voting rights on THORChain. These rights prolong to governance modifications, on-chain instructions, token construction modifications, state modifications, structure modifications, and modifications to consensus guidelines.

Asgardex

At the moment THORChain’s alternate performance works by means of the net BEPSwap instrument. Finally the venture plans on switching to Asgardex, which would be the alternate person interface sitting on prime of THORChain. Asgardex seeks to unravel all of right this moment’s points with each centralized and decentralized exchanges. Additionally it is meant to showcase the aptitude of THORChain and can be community-run and fee-free.

Fixing Safety

- Incentives guarantee bonded RUNE is at all times double pooled RUNE

- Malicious nodes are slashed to guard pooled capital

- The liquidity and safety of the system is tightly coupled

- A Threshold Signature Scheme with no trusted supplier protects property

- The system is at all times Byzantine fault tolerant

Fixing Scalabilty

- Liquidity is sharded into realms to cut back signing committee sizes

- Liquidity is delegated into smaller vaults for sooner signing

- Base infrastructure is Tendermint (100+ Nodes potential)

- Chains and Belongings added by way of financial weight

- Excessive efficiency CosmosSDK replicated state machine

Fixing Cross Chain

- THORChain observes transactions on exterior networks

- State is highly-validated: incorrect transactions are ignored or refunded

- Logic is utilized to state modifications, producing outgoing transactions

- Transactions are signed by way of a series agnostic TSS protocol

- Outgoing transactions are broadcast again to the exterior community

What’s BEPSwap?

BEPSwap is the very first person interface for THORChain. It permits for swapping and staking BEP2 tokens, and customers also can earn staking rewards by offering liquidity to the ecosystem. Merchants are additionally capable of monitor altering costs and act as arbitrageurs, profiting by exchanging tokens to appropriate pricing.

Launched in beta in September 2020 BEPSwap has grown to a number of thousand customers and roughly $10 million in each day commerce quantity. Small nonetheless, however it’s a beta venture and in addition warns customers to not stake or add giant quantities of liquidity. Nonetheless, with a bonding APY of just about 30% it’s a beautiful various to lending, yield farming, or conventional financial institution accounts.

The RUNE Token

The RUNE token is THORChain’s native token and it too is an important a part of the system. It’s a BEP2 token that’s utilized in all of the liquidity swimming pools and is bonded by the nodes. As a result of RUNE tokens stay at a 1:1 ratio to asset worth all of the liquidity swimming pools might be linked. RUNE additionally serves because the reward token for the ecosystem.

Apart from offering liquidity on-chain and staking rewards, RUNE additionally gives the community with safety. That is achieved by means of its incentive system, which provides potential malicious actors extra incentive to supply liquidity than to deprave the system, since nodes earn two-thirds of the system revenue. Which means all transactions carried out with RUNE obtain bigger rewards in contrast with liquidity suppliers. As well as, the nodes robotically shut down each time any malicious habits is detected.

The RUNE token serves 4 functions throughout the THORChain ecosystem: Safety, Liquidity, Governance, and Rewards.

Safety – Validators stake RUNE tokens with a view to safe the community. Nodes are required to bond RUNE tokens to have an opportunity at changing into one of many 100 validators. That bonding creates Sybil resistance throughout the community. Operating a validator node requires 1 million RUNE as a bond.

Liquidity – Within the liquidity swimming pools each token is bonded to RUNE. This creates the mandatory liquidity to carry out swaps. Through the use of RUNE to bond property there are fewer connections wanted between tokens.

Governance – Voting rights come from staked RUNE tokens, offering decentralized governance to the community.

Rewards – Validators and liquidity suppliers obtain their rewards within the type of RUNE tokens.

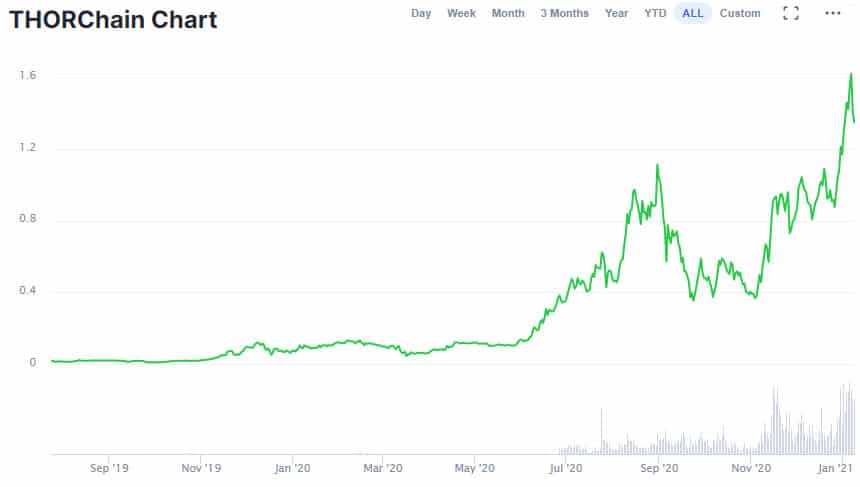

There’s a complete provide of 500 million RUNE, with a circulating provide of simply over 158 million. These are primarily the 150 million tokens that have been bought in July 2019 through the RUNE IEO. These traders have achieved very effectively as the value was simply $0.032 for the 20 million RUNE bought within the public sale, and simply $0.0245 for the 130 million RUNE bought in non-public gross sales. As of early January 2021 the value of RUNE is at $1.58, which is simply off the all-time excessive of $1.66.

Along with the 150 million tokens bought each publicly and privately there are 150 million tokens allotted to the event crew and for operational and neighborhood reserves. The remaining 220 million tokens are saved for the emissions reserve.

Governance on THORChain

THORChain was created with minimal governance by design. The event crew was serious about making a system the place the validators are chargeable for creating their very own cross-chain bridges as wanted. New chains can be added to the ecosystem by means of neighborhood or node participation within the governance. Bigger quantities of staked capital imply new property get added to the ecosystem.

Mainly customers create new liquidity swimming pools on their very own on an as wanted foundation. New property are simply listed by making a staking transaction with the brand new asset within the THORChain transaction memo. As soon as the brand new pool is created it’s bootstrapped and swapping is disabled. Then, each few days the property which have the deepest liquidity are enabled for swapping. The protocol will checklist new property primarily based on the quantity of liquidity, with the best liquidity getting desire.

Thorchain in 2021 and Past

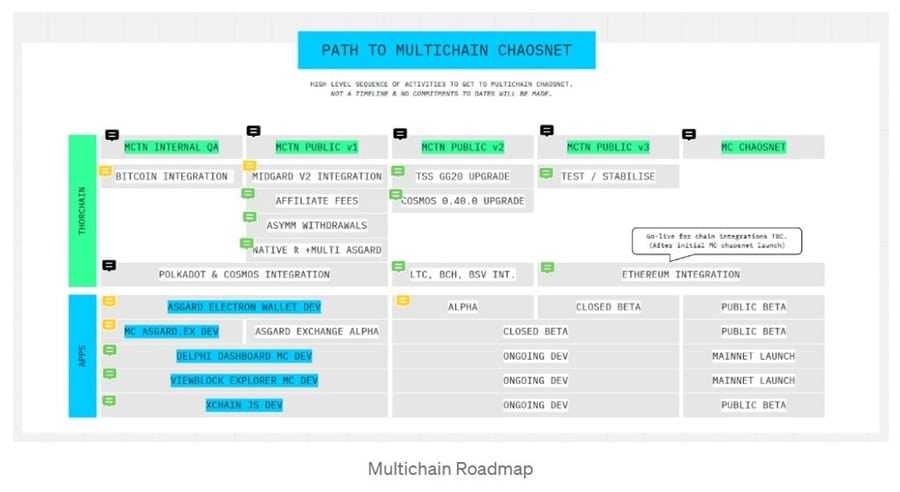

THORChain deliberate on releasing their mainet in 2020, however have been unable to succeed in that purpose. They have been capable of launch the beta for BEPSwap, retiring the prior RUNEVault app. Clearly launching the mainet is a significant purpose for 2021. The crew can be serious about including extra chains to BEPSwap, in addition to creating developer instruments that enable for validators to construct bridges to different chains when demanded to take action by the neighborhood.

Different plans for 2021 and past embrace making a layer-2 scaling community referred to as the Flash Community, which is able to then be related to different lightening networks. The aim of the Flash Community is to resolve the difficulty that at the moment exists the place there isn’t any option to show a recipient has acquired funds in a lightening to lightening swap. THORChain plans to make use of the value feeds from its personal liquidity swimming pools to energy this Flash Community.

In Conclusion

As you may see THORChain is an intensive venture, with some big potential as soon as it’s absolutely launched and able to seize extra market share from the present centralized exchanges and DEX. As talked about above, the extra property it will possibly add, the higher the liquidity will probably be capable of present, and the extra adoption we might count on. General it has the potential to develop big over time.

We additionally consider the tokenomics of the venture are fairly good, and that demand for RUNE will inevitably develop as adoption will increase. That ought to clearly result in greater pricing for the token. RUNE tokens are required by validators for bonding, and that’s a restricted quantity since there are solely 100 validators.

Nonetheless they’re additionally wanted for staking in liquidity swimming pools, and there the demand is limitless. Plus transaction charges are burned, making this a deflationary token. With the present bonding APY round 30% RUNE is a wonderful staking token proper now. Better of all, the great tokenomics may even assist appeal to extra customers to the platform.

RUNE has seen huge value progress, though it hasn’t been with out volatility. That’s considerably ironic contemplating the venture is trying to counter volatility and produce stability to cryptocurrencies, however there you might have it. As a result of THORChain is blockchain agnostic it has the power to increase dramatically by including tons of, if not hundreds of chains. It’s all as much as what the neighborhood desires.

With a market capitalization of $240 million RUNE tokens are at the moment the 82nd largest cryptocurrency by market cap, and so they have been quickly transferring up the ladder after including greater than 100% in December 2020.