The concept of cryptocurrencies is relatively new. Satoshi Nakamoto published the Bitcoin whitepaper back in August 2008. It’s a very young concept, and the infrastructure that surrounds cryptocurrencies is still forming. The crypto sector as a whole is not dominated by the traditional players, like many other sectors.

For both crypto newbies and veterans, it can be confusing to choose the best platforms for news and analytics. It can be difficult to find them and you may miss out on valuable information regarding your investments if you don’t. That’s why you'll find in this article the top 10 tools to do several types of research from the market as a whole to all your altcoins.

This is because it would be pointless to rank platforms with such a wide range of use cases. It would be futile to rank platforms that have such diverse use cases. You may also prefer other sites to those I have chosen. Some of these can be replaced by other options that work equally well. It’s sometimes a question of personal taste.

10. CoinMarketCap

Let’s start with a simple, but very useful platform. CoinMarketCap, as many of you may know, is the place where many people go to check crypto rates. I am one of these people. The amount of research that you can perform here is limited but it’s still an excellent place to get a general overview of the crypto markets.

CoinMartketCap offers the most basic statistics that you will need to investigate any crypto project, coin or token. The market is broken down into the number of coins, their total market cap, volume and BTC dominance. You’ll also find the latest news from your favorite websites. CoinMarketCap also offers a number of other features, such as a description, price, market cap and volume supply. The platform has a lot of information that is easily accessible. You can even create your own watchlist.

A platform that is constantly evolving. Image via CoinMarketCap.

A platform that is constantly evolving. Image via CoinMarketCap.

CoinMarketCap provides you with the basic information you need to research new altcoins that you may not have heard of. You can search for these coins using filters that allow you to sort by volume, market cap or other criteria. When you come across a crypto you like, you can quickly scan it to see if it is likely to be a fraud or something you should investigate further. You can check which exchanges are offering the cryptocurrency to do this. CoinMarketCap also grades the exchanges in terms of credibility, so that you know what exchanges to use and if the crypto is traded at reputable exchanges. Then, you can look at the number of addresses and token allocation. You can get a good idea of what is going on before you dig deeper. Last but not least, I’d like to mention that many of you probably use Coingecko, which, according to some, is even better. CoinMarketCap has always been my favorite.

9. CryptoPanic

The crypto-space is evolving at a rapid pace, and I think everyone can agree on that. You’ll find yourself overwhelmed by the amount of content on the web. There’s no way you can read everything. CryptoPanic can help. CryptoPanic collects the best content from across all websites. Not only do they offer news, but also everything from Twitter to Youtube videos.

CryptoPanic helps me to stay on top of everything. I read Cointelegraph every day and Coindesk.com every week, and watch every Coin Bureau video. CryptoPanic makes sure I don’t miss anything. I like to search regularly for the cryptos that are in my portfolio, to see if anything has changed. CryptoPanic’s layout is not the easiest to use, so I prefer to read the content on the original website.

Lastly, CryptoPanic has a very useful feature: the ability to rate posts. It’s easy to sort out the news according to what people read and like. The amount of information on CryptoPanic is overwhelming. You should bookmark the site because it is a very good one.

8. CoinMarketCal

CoinMarketCal is another tool that can help you stay up-to-date. This calendar shows all events relating to many coins. It is the perfect place to see if there is any big event happening.

Swing traders can use this research to find the best trading opportunities, as many cryptos tends pump up before a big event. It could be anything, from a project launching on a specific blockchain to an upgrade such as EIP 1559. Calendars can also include exchange listings and ICOs. Both are excellent trading opportunities.

The number of events in an industry that is rapidly changing, such as cryptocurrencies, is large. This is why it is possible to filter the events. CoinMarketCal is designed in such a way as to rely on the community for new events. Then they allow community members to vote on the events listed to indicate whether they're likely to happen or not. You can sort by major events, which include things like the launch EIP 1559. You can also sort the news by a particular crypto or perhaps just the top 10. But, do you want to know the most important part of it all? CoinMarketCal has no cost.

7. TradingView

TradingView is a platform that I must absolutely mention. It is the best charting software I’ve ever used. You can read more about TradingView in an article from Coin Bureau. There are still a few points I’d like to make.

TradingView is a great tool for anyone who has a background in technical analysis. TradingView is the only software you will ever need. TradingView offers tools to help you create your own analyses and all the indicators you’ll ever need. They not only integrate the most popular indicators, they also let their community create and share their own indicators. These indicators can be found by clicking on the indicator button. TradingView allows you to “like” these public indicators, and the number displayed next to their name makes it easy to choose which one to use. TradingView has the most positive reviews, and I would recommend that you visit Coin Bureau first to read this article. Then, you can go to TradingView to open an account and begin researching.

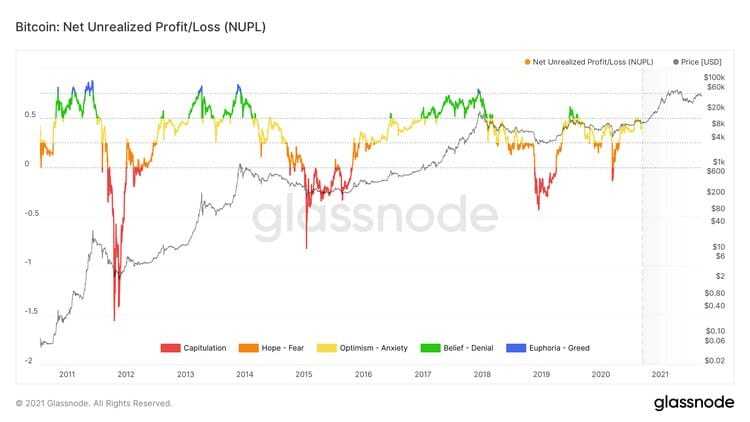

6. Glassnode

Glassnode analyzes the chain. I am sure you’ve heard of it. News sites such as Coindesk often use it to reference the statistics that they refer to. Its credibility is one of the reasons I use it. Glassnode gives us a wide variety of on-chain analytics and therefore if you're not familiar with on-chain analysis you might be overwhelmed. To help you understand some potentially valuable metrics, I will borrow Guy’s wisdom from Coin Bureau.

Null unrealized profits/losses (NUPL) is one. As the name implies, this metric shows how many active HODLers have profit versus losses. This metric becomes valuable when the euphoria sets in because more and more people have unrealized profits. This creates an underlying selling pressure that is waiting to be released if anything unexpected happens. If the price has moved sideways and a large number is in the red, it might be time to get into the market. The weaker hands will HODL. This reduces the pressure to sell, which might naturally entice buyers as their risk/reward looks good.

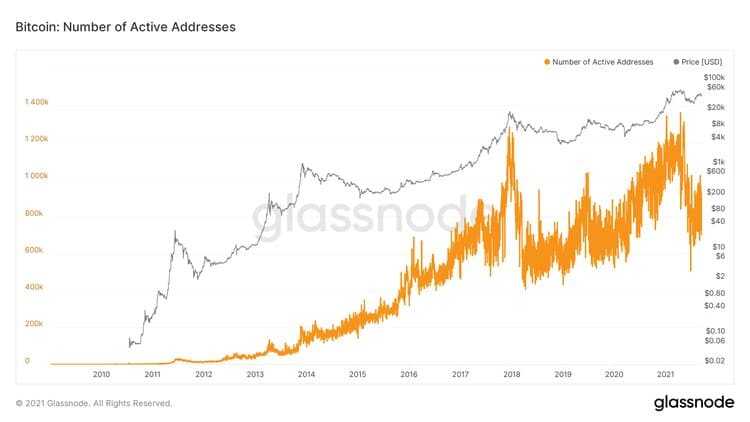

Active addresses are another useful metric that is often used. You’ve probably heard of this before, but it’s worth mentioning. The number addresses is the best indicator of long-term adoption. It is bullish to see the number of active addresses rise, regardless of what crypto you are talking about.

Glassnode provides many more useful metrics. They don’t, however, offer everything free. Glassnode’s free plan, as they put it, offers the basic on-chain analyses. If you want more current information and a few extra metrics, you will need to purchase their advanced plan for $29 per month. This plan is designed to provide you with all you need for even a thorough analysis. Glassnode offers a plan at $799 per month. The average retail investor is unlikely to spend that much money. You can start with the basic plan, and then upgrade to the advanced one if you feel you need it.

5. Messari

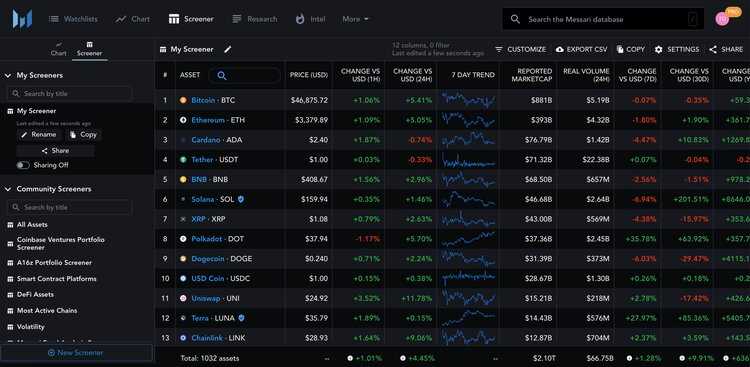

It’s no secret that when many of us first entered the world of cryptocurrencies, we dreamed about finding 100x altcoins. However, to do that you need to know where to look and scrolling through all the over 11,000 cryptocurrencies might be a pain in the … well you know what…since a high percentage of available cryptos are, as Guy likes to call them, shit coins.

We are lucky to have Messari, which can help ease the pain. In a Coin Bureau YouTube video, Guy said that Messari was his go-to site when looking for the next super altcoin. The Messari crypto screener, which is among the best available, is the reason for this. You can narrow your search by using a variety of metrics. There are many metrics to choose from, including market cap, volume and time since ATH. Messari reports actual volume, and not that reported by sketchy exchanges. Messari also has a trusted icon next to the cryptos it has verified. It also lists trusted exchanges to help you trade.

They offer so much more than just their crypto screener. The community can submit research reports about a wide range of topics. It’s a great way to discover interesting altcoins, without having to dig around yourself. They offer so much useful information that you will need to pay $29.99 (or $24.99 if your subscription is for a full year). However, if crypto is something you are interested in then the price might be worth paying.

4. CryptoQuant

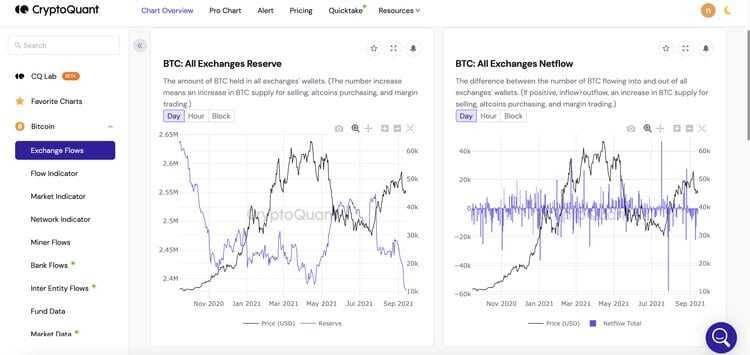

Another awesome analytics tool that keeps us in the same group. CryptoQuant has visual charts on just about anything, so it’s a good tool for comparing what others are up to. It would be boring to go through all the metrics they have to offer. So I’ll just stick to a couple and explain how useful they could be.

First, a particularly useful metric to try to find the top is all exchanges' net flows. It’s easy to see if people plan on selling or holding. If there’s an increase in the flow to exchanges then a drop might be near, 'cause if not to sell your coins why would you move them to an exchange? In the opposite direction, it’s also true. If the outflow is increasing, it indicates that more people plan to HODL. Keep in mind that major outflows could leave exchanges with a small supply, which can lead to price fluctuations both upwards as well as downwards.

There are a few bigger players, besides the investors, who transport coins from and to exchanges. The most notable of these is the miner. Miners will also occasionally sell their coins, either to pay taxes, or to invest in equipment. CryptoQuant allows you to track mining data and a look at this could help you identify the top. If you see miners moving money around, it could mean they are planning to sell their holdings. This can be checked by examining all the exchange flows between miners.

Combining the metrics for fund flow and other metrics that are available from platforms will give you an overall picture of how things are going. I strongly recommend that you do not look at just these statistics, but combine them to the maximum extent possible.

3. Bybt

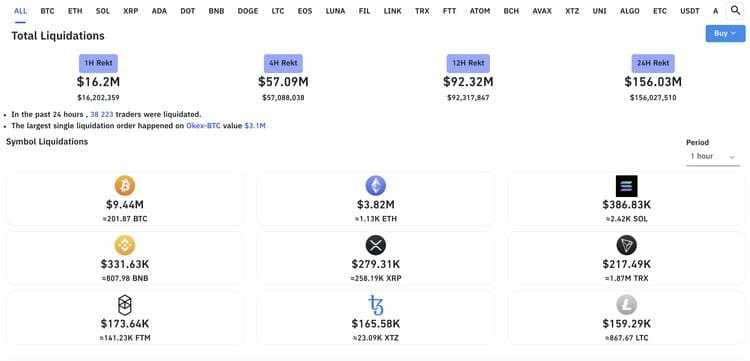

Many of you may have heard the term liquidation when the stock market crashed. What does it mean? I’ll explain what it is in one sentence. Liquidations mean that leveraged traders are forced to sell what's left of their holdings due to the price action of the asset which has caused them to lose money. This happens when BTC falls and makes the dip stronger.

Bybt is a tool that allows us to track the amount of liquidated. Bybt provides traders with a lot of valuable information. For less experienced traders, the number of liquidations can provide valuable insights. It can provide you with much-needed comfort to know that the crash was not caused by fundamental factors but rather liquidations.

Bybt can also provide useful information about the money flowing to and away from Grayscale. Grayscale, as many of you may know, is the world’s largest digital asset manager. It is also the place to go for institutional investors seeking crypto exposure. These statistics are important to see how institutional adoption is progressing. I do want to bring up a recent announcement that ARK investment is moving their Bitcoin exposure to Canadian ETFs. This will then show a negative impact on Grayscale statistics but naturally, it shouldn't harm the wider crypto markets since the amount invested is the same but just on a different platform. Keep your eyes peeled for any abnormalities you may see in the statistics.

2. Lunar Crush

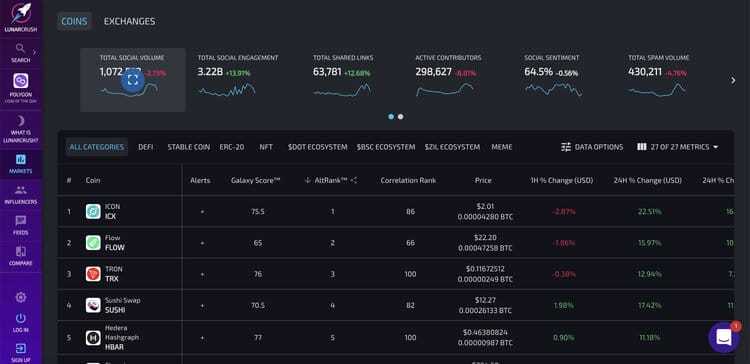

Lunar Crush can save you countless hours of scrolling through YouTube and TikTok to find out if the community supports a particular project. Lunar Crush gathers data from Google searches to price trends. They then, using AI, and a much higher IQ technology way beyond my level of knowledge, form a number of different rankings to let you know the sentiment surrounding a cryptocurrency.

The first thing to look at is the Galaxy score. This score measures a crypto’s performance against four indicators. You can find them in the image below. Galaxy score is calculated by adding up all the indicators. The higher the Galaxy score, the more successful the project. Altrank is another ranking system. This compares the project's price actions and data to Bitcoin, and number 1 is the best. The list can be sorted to display the best projects first.

CryptoMood is a good alternative to Lunar Crush if you do not like it. This is a sentiment analysis tool which can provide you with important information to help you trade. If you want the full version, you will have to pay. This is why it’s worth visiting their website for some research.

1. 3Commas

All those who enjoy trading will find this useful. 3Commas, which has been active in the crypto industry since 2017, has had plenty of time to build a platform offering a wide range of services including trading and crypto bots. The reason I chose to add this platform to the list was the same as Guy’s video on crypto-research tools. They allow you to test out your trading strategy by paper trading.

**Important Security Notice** 3Commas customers reported unauthorized trades on their exchange account in December 2022. There were also claims of funds stolen. At first, 3Commas stated that the result was likely a large-scale phishing attack that customers fell for, but further investigations show that there was a hack and users' API keys were leaked. 3Commas recommends that all users update and review their API keys.

3Commas’ security has been upgraded, but its users remain upset and demand an apology for the poor way the 3Commas Team handled the situation. "gaslighting" And falsely accusing users.

3Commas community traders created a tool that allows you to test out your trading strategies on historical price action. Even though it’s been said that you shouldn’t rely solely on past successes, you must still acknowledge that trading strategies were developed based on the idea that they had worked in previous years. It’s not a guarantee, so paper trading can be a good way to test out your strategy. Although I haven't myself tried paper trading on 3Commas, I have heard a lot of good things. The only criticism is that it doesn't consider volumes. Keep this in mind, and only trade cryptocurrencies that have large volumes. Trading low liquidity cryptos is a risky business and can lead to major losses.

The conclusion of the article is:

This article was a difficult one to write because I left out so many excellent platforms. I am sure many of you will feel that some of the choices that I made should have been replaced with other options. But, as I stated at the start, many things are based on individual preference. The information on some platforms may be the same, but the platform that uses your favorite colour might be different. The platform with the color of your choice is your first pick. If you are interested in seeing what Guy from Coin Bureau chose for his top 10, then watch this video.

In addition, this list could look completely different in one year. It is difficult to keep up with the rapid growth of new research tools and companies. The platforms chosen for this article are well established and shouldn't be gone anytime soon but the chance that someone creates an even better version of the same thing isn’t unlikely at all. These platforms can be used as benchmarks by other platforms. Compare sites side-by-side to see which can provide you with better information, a better experience for users and the lowest price.

You can now open your portfolio, and look at your investments. Before you go out to hunt for 100x projects, check if anything needs to be adjusted.