Welcome, Coin Bureau readers, to an article in regards to the ever-exciting world of taxes. Who doesn't love taxes? I do know I positive do! Writing about it, studying about it, speaking about it, paying it, I simply can't get sufficient!

Who’s with me? Can I get a high-five…? anybody?

Yeah, yeah, I do know. You'd in all probability moderately be studying articles about superior Metaverse initiatives, crypto initiatives which are making the world a greater place, or how one can earn a pleasant yield on these hefty moonbags in a incredible DeFi protocol. However hey, tax is part of life, and as that outdated cliché goes…Demise and taxes and all that. In case you are somebody who doesn't need to play by these outdated guidelines and needs to maintain each Satoshi you earn, then strap in as we’re going to dive into the highest crypto tax-free international locations to assist keep away from the tax man, (legally, in fact).

This text will cowl crypto tax-friendly locations that individuals can think about relocating to if they’re severe about minimizing their revenue tax obligations or avoiding capital acquire tax. Be aware that this record is in no specific order. There isn’t a single “best” nation for crypto tax as they’ll all range fairly considerably. There are quite a lot of various factors at play.

For instance, some international locations cost little tax on crypto, some cost no tax. Some don't tax crypto capital good points, however they may deal with frequent crypto day buying and selling as revenue tax or enterprise tax. Some international locations received't tax staking or yield revenue however might tax capital good points. Lastly, some international locations will solely tax crypto held for below a 12 months, so selecting “the best” crypto tax-free nation actually comes down to what’s most necessary for the crypto holder.

Additionally, don't overlook that elements akin to high quality of life and facilities are necessary, so make sure you try the elements to contemplate part close to the top earlier than you up and yolo into shifting to a different nation.

Disclaimer right here that nothing on this article is tax, monetary, or life recommendation by any means. I’m solely offering a really high-level overview of my expertise and findings. I’m just a few dude who writes articles on the web; what do I find out about taxes? Nada. Whereas I’m pleased to offer you a very good head begin in your analysis, make sure you carry out deeper DYOR on any concerns as these legal guidelines and laws could also be outdated and have modified by the point you learn this text. There may be additionally an opportunity that I may have some inaccurate information right here as my sources could also be outdated or misinterpreted. Please seek the advice of a global tax skilled for particular tax information.

Okay, on with it! In no specific order, listed here are the highest crypto tax-friendly jurisdictions.

15 Greatest Crypto Tax-Free International locations

El Salvador

Although I discussed this text is in no specific order, come on, we gotta kick this record off by speaking about El Salvador, as they’re an actual international pioneer in the case of crypto adoption and real-world purposes at scale.

El Salvador turned the primary nation to legalize Bitcoin and acknowledge it as a forex. This was a critically daring transfer because it got here with penalties from the IMF within the type of threats that they might not be capable to get a mortgage from the establishment, and Moody's downgraded El Salvador's debt, warning the nation would seemingly default.

Regardless of warnings, El Salvador pushed ahead and has not solely been thriving, however has performed so properly that they’ve doubled down on their bullish behaviour. Since adopting Bitcoin, El Salvador has:

Paid off the $800 million debt, plus curiosity. An enormous flex after mainstream media and authorities businesses warned of a excessive chance of default for months prior in what appeared like an try to unfold FUD to discourage different nations from following swimsuit.

Has an financial system that’s rising sooner than common Latin American international locations, and for the primary time in historical past, achieved double-digit GDP development (10% in 2021).

Had its residents save over $400 million over one 12 months in remittance commissions that exist in conventional finance.

Skilled development in tourism of over 30%.

Elevated its exports by over 13%

That is the financial equal of a mic drop.

Not solely are you able to pay for items and providers in Bitcoin, however from a tax perspective, El Salvador has no capital good points tax on crypto, no revenue tax for overseas buyers, and a simple path to everlasting residency for crypto entrepreneurs.

El Salvador has loads of stunningly stunning locations and is nice for followers of seashores. Due to the distinctive volcanic panorama, you will discover each powdery smooth sand seashores and volcanic-sand seashores, together with the extra rugged fashion landscapes and harsh cliffs to appease nature lovers of all kinds. Due to El Salvador's location, there isn’t a have to state the plain in regards to the superb year-round climate and tropical local weather.

That local weather comes with moist and dry seasons although, and higher-than-average humidity that many individuals might discover uncomfortable although, so that’s one thing to remember. The price of residing in El Salvador can be fairly low. The estimated month-to-month price for a single individual is round 547.8€ (585.7$) with out lease, and for a household of 4, estimated month-to-month prices are on common 1,974.9€ (2,111.3$).

In case your solely objective is to keep away from paying crypto capital good points tax or revenue tax, El Salvador can’t be crushed, although the standard of life right here will not be fairly what you’re in search of. Regardless of its development, the nation continues to be a growing Latin American nation, affected by excessive ranges of poverty in lots of areas, low ranges of training & well being care, and an especially excessive crime charge. In truth, El Salvador has one of many highest homicide charges on the planet resulting from gang violence.

And if the gangs don't get you, El Salvador can be susceptible to pure disasters resulting from it being positioned in a really seismically energetic area, so in the event you think about relocating there, you might need to pack a helmet, water wings, life jacket, whistle, compass, map, and perhaps some physique armour. Whereas issues look like getting higher, make sure you maintain your crypto further secure and hidden in the event you determine to journey there.

Portugal

Full disclosure right here that I could also be a bit biased in putting Portugal so excessive on the record as I moved right here about three years in the past and the tax legal guidelines are fairly candy. Although a little bit of a bummer disclaimer time, as there are quite a lot of misconceptions in regards to the crypto tax in Portugal.

Be aware- as of 2023, crypto is NOT tax-free in Portugal in all instances. Sadly, this has just lately modified, however the nation continues to be loads friendlier for crypto than many European nations.

Any crypto asset offered after being held for lower than one 12 months shall be topic to a capital good points tax of 28%, which nonetheless isn't too unhealthy in comparison with the 50% capital good points tax in lots of international locations, however what’s even higher is that there aren’t any capital good points taxes on crypto held over one 12 months. This makes Portugal best for long-term hodlers. Business exercise together with mining and frequent buying and selling shall be thought of self-employment and topic to Revenue Tax and social safety.

Portugal is nice for worldwide expats due to pretty relaxed immigration necessities and is an apparent selection for EU residents residing in high-tax international locations throughout the European Union. Members of the EU can simply jump over with little to fret about with regard to immigration hurdles, however the course of is a little more cumbersome for these outdoors the EU.

Portugal affords a extremely popular freelancer visa that’s nice for digital nomads, although that won’t assist you get hold of long-term residency until you’re keen to decide to a very long time right here. After you have been within the nation for five years, spending a minimal of 6-months right here every calendar 12 months, you may apply for everlasting residency.

Another choice for many mentions on this record is that you could possibly take a crack at marrying a citizen from the nation to acquire residency. And although I discussed that this text will not be tax or monetary recommendation, it’s also undoubtedly not marriage or relationship recommendation!

Portugal is constantly ranked among the many most secure international locations globally with low crime charges and it has incredible free well being care that ranks increased in high quality than the well being care system within the UK and most of Europe. Which means violent crimes listed here are unlikely to occur, and will it’s essential go to a hospital, it would seemingly be from doing one thing you in all probability shouldn't have been and the damage is probably going self-inflicted. Fortunately, in that case, you may get a few of the highest high quality healthcare on the planet.

Portugal additionally has one thing for everybody. Lisbon and Porto present all of the nightlife and metropolitan way of life one may need. If you wish to social gathering laborious and spend these crypto good points you may't go incorrect with the social gathering capital Albufeira, which has change into a extremely popular vacationer vacation spot, competing with the likes of Ibiza for a celebration way of life. When you journey inland, Portugal has some stunning landscapes, lush forests, and plenty of medieval villages which are UNESCO world heritage websites.

The climate in Portugal can be incredible and there are climates to swimsuit everybody. The northern elements and town of Porto may be fairly cool in the summertime and chilly within the winter for individuals who should not a fan of the warmth. The south enjoys sizzling summer season months and delicate winter months. Portugal additionally owns the gorgeous tropical island of Madeira and the beautiful Azores islands.

The price of residing in Portugal can be comparatively low in comparison with many locations in Europe and is particularly low outdoors the capital metropolis of Lisbon. Within the metropolis, a snug month-to-month revenue of round $US 2,500 would afford you a pleasant way of life whereas outdoors town it may be considerably decrease. Significantly, I've been to cities simply outdoors of Lisbon the place a glass of wine prices $0.50, beer for $1, and full meals may be discovered for round 5 bucks, fairly reasonably priced certainly!

Puerto Rico

Puerto Rico is a extremely popular tax-friendly vacation spot for People because it is among the simpler locations for them to maneuver to flee taxation. America is among the few international locations that tax each residents and residents, which is in distinction to international locations just like the UK or Canada the place you generally is a Canadian or UK citizen, however a tax resident of one other nation and the taxman received't chase you down as you may surrender your own home tax residency standing whereas remaining a citizen.

In Puerto Rico, People can get pleasure from paying 0% capital good points tax in the event that they get hold of their Puerto Rican residency, with the requirement that they pay 4% of their revenue to Puerto Rico. This has prompted rich People to flock to the island in droves, which has raised the price of residing considerably and has resulted in reasonably priced housing being extremely tough to seek out. In response to Windham Brannon Tax specialists, to qualify for Puerto Rican residency, people should fulfill the entire following three situations:

Bodily presence take a look at– Will need to have a bodily presence in Puerto Rico for at the least 183 days throughout a tax 12 months.

Tax house take a look at– Would not have a tax house outdoors of Puerto Rico throughout any a part of the tax 12 months, or the person's "regular or principal place of business" is positioned in Puerto Rico.

Nearer connection take a look at– A information and circumstances take a look at proving the person has an mixture nearer connection to Puerto Rico than to the U.S., or every other overseas nation.

Moreover, Resident People should apply for and acquire a tax exception decree below the Incentives Act, making certain these three standards are met:

- A one-time price of $5,000 have to be paid and deposited right into a particular fund to advertise the relocation of Resident People to Puerto Rico.

- All Resident People that maintain a tax exemption decree should adjust to an annual contribution of $10,000 to an organized and registered nonprofit group in Puerto Rico; and

- A Resident Particular person should buy residential property in Puerto Rico throughout the first two years after acquiring the decree.

As of 2024, Puerto Rican residents pay a lot decrease Territorial Revenue Tax in comparison with the US Federal revenue tax charges, and any digital property acquired on the time of being a Puerto Rican resident are exempt from capital good points tax. When you purchased crypto earlier than shifting there, you'd nonetheless want to stick to the IRS crypto tax legal guidelines for these property.

Except you’re a severe crypto whale with financial institution accounts bursting on the seams, you would possibly discover it tough to have the ability to discover reasonably priced housing within the nation. Other than housing, the price of residing is sort of reasonably priced with a single-person revenue of round $US 1,800 being sufficient to reside comfortably.

For any People trying to relocate, I’d extremely advocate talking to a tax and immigration skilled although as there are many rumblings in regards to the US authorities trying to decelerate the exodus of US residents who’re utilizing Puerto Rico as a tax shelter.

The capital metropolis of San Juan is house to round half one million folks and the island nation is thought for a few of the most stunning seashores and nature on the planet. There’s something right here for everybody so long as you’re proud of common web speeds.

The crime charges in Puerto Rico are additionally fairly low, a lot decrease than the crime charges in lots of main US cities, making it an much more enticing place to relocate.

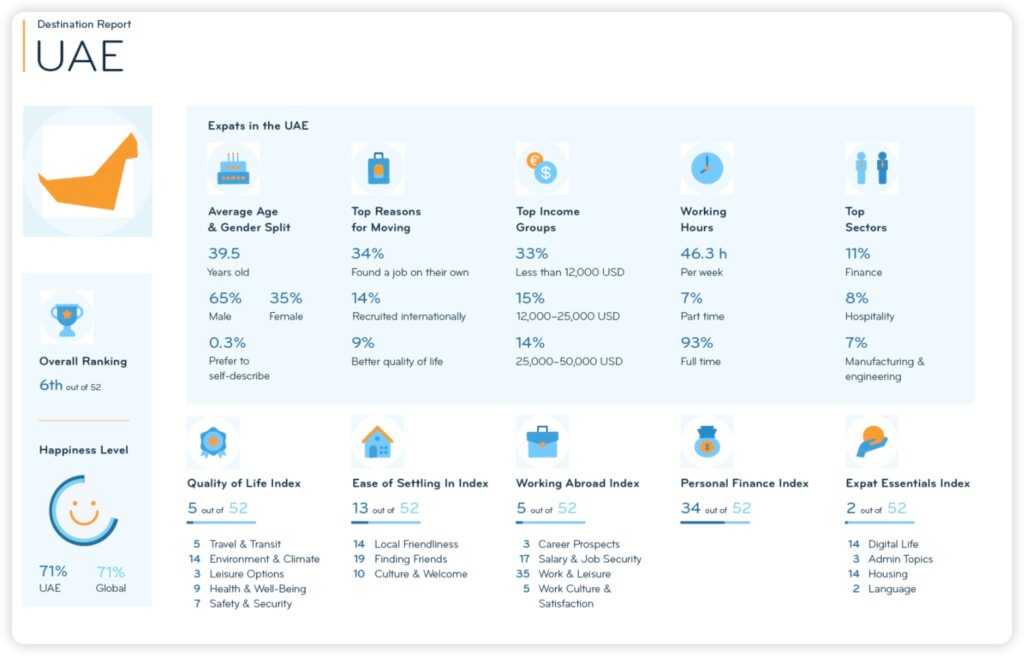

United Arab Emirates- Dubai

Dubai is among the hottest mentions on the record as being a resident of the United Arab Emirates is in regards to the closest anybody can change into to having the ability to reside tax-free with out breaking legal guidelines. Residents should not obligated to pay capital good points taxes on crypto, property, and even fear about revenue tax.

The town of Dubai is a paradise for folks in search of an insanely prime quality of life and a metropolitan way of life. There isn’t a scarcity of high-end eating places, ethnic meals, Lambos on the market, or nightlife actions. It might simply be the “party-est” metropolis on the planet. It definitely is the house of luxurious sports activities vehicles, flats, and yachts.

Rating amongst a few of the prime most secure cities on the planet, crypto millionaires can really feel fairly secure right here as they drop their good points on costly bottles of Dom Perignon and luxuriate in a lush way of life.

You’ll assume {that a} land filled with millionaires and luxurious the whole lot would include an insanely excessive price of residing, however Dubai is definitely fairly reasonably priced with an estimated month-to-month residing price for a single individual coming in at round $US 2,700 monthly.

This price will in fact scale up considerably relying on how “bling-bling” you need to reside, with some sources saying you may reside decently for $1,360 monthly, whereas some who like slightly extra consolation cite budgeting about $5,800 a month.

Probably the most reasonably priced technique to get your visa there’s by organising an organization and using your self as a crypto dealer. I do know a couple of YouTubers and crypto merchants who’ve performed simply that with a purpose to keep away from the capital good points tax, revenue tax, and normal annoyance of coping with the tax division. Web speeds in Dubai are among the many finest on the planet, and the climate is incredible, albeit a bit dry and too sizzling for some. It’s within the desert, in spite of everything. The summer season temperatures can rise to above 40 levels Celsius, so you want air con.

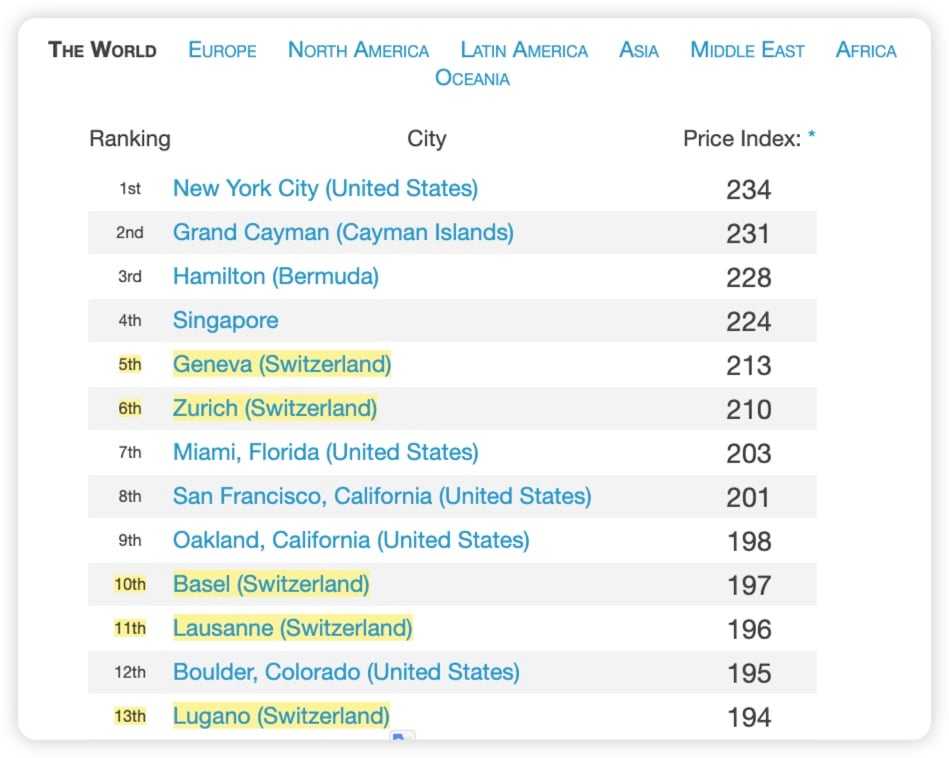

Switzerland

Ah, Switzerland's basic tax-friendly and monetary powerhouse framework with the long-lasting “Swiss bank account” usually talked about by villains in Bond films. For many years, Switzerland has been a world tax haven, and crypto was not excluded. Crypto traded or held as an funding will not be topic to capital good points tax.

Although getting Swiss Everlasting Residency will not be straightforward. To get residency, it’s essential meet the next standards:

- Beneath 55 years of age for many visas

- Been residing within the nation for at least 5-10 years

- Don’t have any felony document

- Go a stringent interview and be cleared of not being a menace to nationwide safety

- Make investments a minimal of CHF 1,000,000

- Be capable to communicate and write the nationwide language

- Show a degree of integration into Swiss society

- the flexibility to assist your self with out recourse to social welfare

Actually, the immigration standards for Switzerland is fairly complicated and I can't even scratch the floor right here. You’ll be able to study in regards to the 13 several types of residency permits on the Ch.Ch web site and the 20+ several types of visas obtainable on this complete Swiss Immigration weblog by Expatica.com

Switzerland has been nicknamed by many "Crypto Valley," resulting from their forward-thinking crypto stance. There are over 1,000 crypto and blockchain corporations working within the nation, and in 2022, the Blockchain Regulation was launched, formally regulating digital currencies and blockchain tech. There may be additionally town of Zug, which will be the most crypto-friendly metropolis in Europe the place you may spend Bitcoin freely in lots of companies, discover crypto jobs galore, and is house to the world's first regulated 100% crypto financial institution. Zug is just like the Silicone Valley of the Alps.

The climate there’s excellent for anybody who enjoys the winter months and actions like snowboarding as Switzerland is thought for a few of the finest ski hills on the planet. So pack a parka and get the recent chocolate brewing in the event you plan on relocating there.

Whereas Switzerland principally has the best high quality of nearly the whole lot, the price of residing can be one of many highest on the planet. After you make investments your 1 million CHF to get residency, you’ll need sufficient left over to cowl month-to-month residing bills of round $3,500 for a single individual on the underside finish, and practically 7k monthly for a household of 4, and that’s thought of residing cheaply. In truth, Numbeo reveals the price of residing in Switzerland is 148% dearer than Portugal, ouch! I feel I’ll follow my €0.60 cups of espresso, and €5 lunches with a seaside view. Switzerland is ranked because the third most costly nation globally for residing prices, with many Swiss cities being within the prime ten for most costly on the planet.

Switzerland is definitely not the perfect place for individuals who get pleasure from an affordable and cheerful way of life.

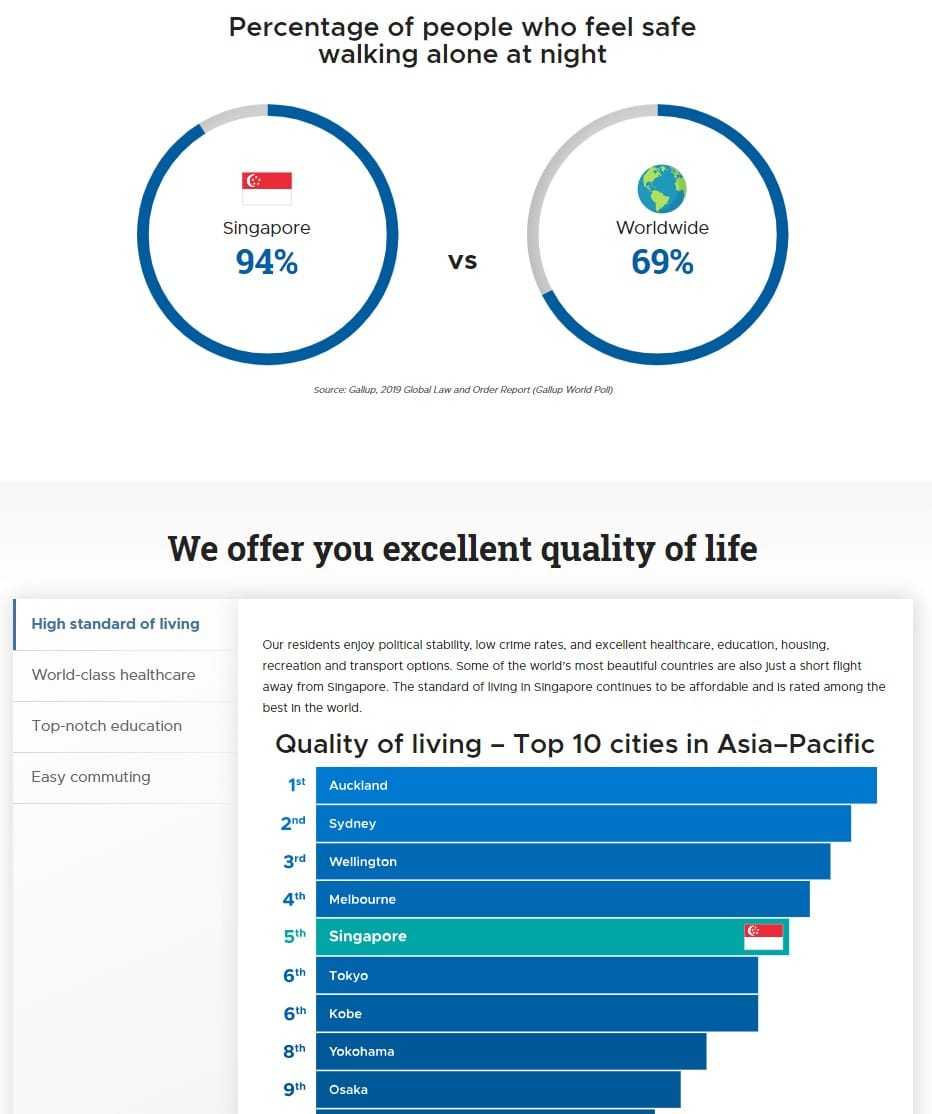

Singapore

Singapore is a well-liked selection as it’s a fascinating and fashionable metropolis. Significantly, in the event you haven't been there, it’s fairly mind-blowing how superior the place is. Identified for its iconic metropolis centre gardens that characteristic a light-up music show and a lodge that appears like a cruise ship within the sky, Singapore is a really clear, secure, and incredible place to reside.

After I visited town, it virtually appeared too excellent even; I felt like I used to be residing within the Truman Present. I didn’t see a single individual residing on the road or perhaps a single piece of litter floating round.

Singapore residents get pleasure from zero capital good points tax and no GST/VAT on crypto. Crypto day merchants are free to commerce right here so long as it’s not being performed as a part of a enterprise exercise.

That is potential as a result of cryptocurrencies are considered as intangible property from a tax perspective, which means whenever you spend crypto on items and providers, it’s considered as a barter commerce, not a fee. In case you are performing as a enterprise and also you settle for crypto, then there shall be revenue tax on it.

Moreover, if crypto buying and selling is completed as a enterprise, it will likely be handled as enterprise revenue tax as properly. Whereas this all sounds fairly good, there’s a catch, and that’s that Singaporean residency is tough to acquire. The quickest technique to get residency there’s by taking part within the International Investor Programme. This program permits buyers and entrepreneurs to acquire residency in two methods:

- Make investments at the least 2.5 million SGD in a brand new enterprise or start-up growth of an present enterprise or,

- Make investments at the least 2.5 million SGD in a GIP-approved fund that invests in Singapore-based corporations.

The eligibility necessities to qualify for the International Investor Program are fairly complicated, you will discover the complete rundown of the factors on One-Visa.com.

For these hoping to get Singaporean residency with out the upfront funding, the Singapore Authorities web site lists the choice eligible standards:

- In case you are a partner of a Singapore citizen or Singapore everlasting resident (PR)

- An single baby aged beneath 21 years outdated, born throughout the context of a authorized marriage to, or have been legally adopted by, a Singapore citizen or PR

- An aged guardian of a Singapore citizen

- A holder of an Employment Go or S Go

- A scholar learning in Singapore

To summarize the tax framework in Singapore:

- No GST/VAT on crypto

- No capital good points tax

- There may be enterprise revenue tax

Singapore constantly ranks as one of many most secure locations to reside globally and has a top quality of residing. As you’ll count on, web speeds are lightning quick, and there are incredible eating places and the very best of just about no matter it’s you’re in search of.

The price of residing in Singapore may be very excessive in comparison with different mentions on the record, coming in at a whopping 5k+ USD monthly wanted for a single individual, and that’s excluding lease. Whereas the price of issues like meals isn't too bank-breaking, that is undoubtedly not the place for a quaint getaway or a boozy vacation as alcohol purchases are additionally very dear right here…Not that I’d know something about that.

The climate in Singapore stays fairly heat year-round however is fairly humid, so it would be best to reside in an air-conditioned house for positive.

Bermuda

Let's flip again to the gorgeous seashores of the world. Bermuda has no private revenue tax and there’s no capital good points tax for promoting crypto. Using crypto as a type of fee can be deemed completely authorized right here, making Bermuda the primary nation whose authorities was pleased to just accept tax funds in any acknowledged cryptocurrency! Very cool and forward-thinking of them.

As Bermuda is utilized as a world tax haven for a lot of the world and created its crypto regulatory framework all the way in which again in 2018, taxation is sort of complicated on this jurisdiction, I like to recommend testing this text from Freeman Regulation to get into the finer particulars of crypto taxation in Bermuda.

Bermuda is among the simpler international locations to get a one-year visa in as properly, so if you’re good at timing crypto markets, you might need to attempt and ensure the crypto prime shall be coming in over the subsequent 12 months earlier than you make the transfer.

It’s potential to realize longer-term residency in Bermuda, although it’s trickier. You’ll be able to acquire residency there by taking part within the Bermuda Residency by Funding Program. To get this, of us are going to want to satisfy these necessities:

- Make an funding of $US 2.5 million {dollars}.

- Investments may be made in actual property, authorities bonds, authorities funds, charitable donations, investing in present companies or beginning a brand new firm.

Bermuda charges extremely by way of security, has good web speeds, and the proper climate. So long as you aren't afraid of disappearing within the Bermuda triangle, that is a fully stunning place to calm down and expertise a incredible high quality of life with world-class seashores.

That’s so long as you're proud of a sluggish and stress-free tempo because the island is just house to round 65,000 folks with an older inhabitants and little to do by way of nightlife.

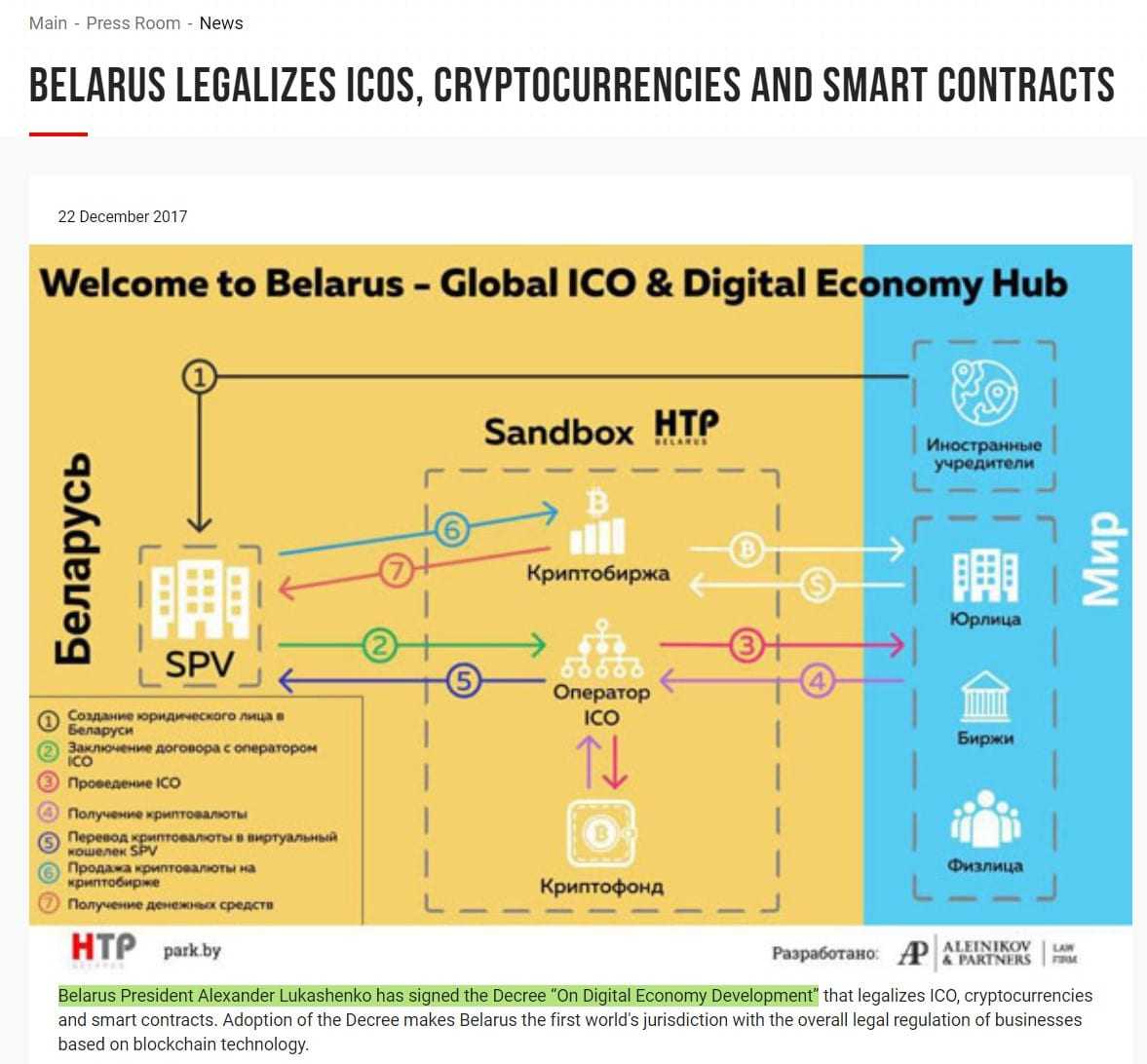

Belarus

Belarus is another choice in Europe and has welcomed crypto holders with open arms since 2018. The federal government legalized crypto actions and selected to impose no tax for crypto-related actions, together with crypto mining and day buying and selling, neither is there company tax on crypto. Be aware that this laws was set as much as be in impact till 2023, and it’s unknown how this will change this 12 months going ahead, however because it stands now, there’s:

- No revenue tax on crypto

- No capital good points tax on crypto

- No company tax on crypto

Although the tax legal guidelines are unlikely to change into Draconian as Belarusian President Alexander Lukashenko has taken crypto laws a step additional in signing a decree for “digital economy development,” turning Belarus into probably the most forward-thinking hubs for blockchain improvement. This legislation was handed to offer a robust increase to the digital financial system and assist digital innovation round blockchain know-how.

Belarus is house to some unimaginable World Heritage websites, and the capital metropolis of Minsk has loads of sights to appease the residents. Sadly, I can’t give any private perception as I’ve by no means been there, nor do I feel I've ever met somebody from Belarus, however in accordance with this relocating to Belarus web site, the nation has a wealthy cultural historical past and stays “culturally isolated.” Undecided if being culturally remoted is a optimistic factor or not, you might need to look into it a bit additional earlier than relocating.

The local weather there’s nothing thrilling, fairly customary heat summers and colder-than-average winters. The Japanese European local weather usually experiences loads of rainfall and snow within the winter, and web speeds listed here are merely acknowledged as "average." Be aware that Belarus has shut ties to Russia and has been impacted by the Russia-Ukraine battle, so make sure you do your personal analysis and verify for journey advisory notices earlier than packing your baggage and heading over.

Slovenia

The federal government of Slovenia additionally views crypto taxation favourably as they’ve handed tax laws that permits for particular tax legal guidelines for crypto buyers. Cryptocurrencies are thought of movable property as per article 32 of the Private Revenue Tax Act referred to as ZDoh-2.

There isn’t a capital good points tax imposed on the promoting of crypto for people, however crypto mining and business exercise utilizing crypto shall be taxed as enterprise revenue tax at 25%. Slovenia is a serious Central European hub of exercise with various geography, local weather and tradition. The nation has a small inhabitants of round 2 million folks. The local weather varies vastly relying on the area, primarily experiencing cool winters and heat summers.

Slovenia enjoys good web speeds and a excessive way of life, rating fairly excessive on the world security index. There are fairly a couple of choices for anybody trying to relocate to this picturesque nation. A few of these choices are:

- Enterprise Immigration Program

- Gaining employment by way of an employment contract

- Household reunification

- By way of training in a public or non-public instructional establishment

Extra info on relocating to Slovenia may be discovered on this Methods to Relocate to Slovenia Information.

Germany

German residents can make the most of zero p.c capital good points tax for anybody who sells crypto that was held for longer than three hundred and sixty five days, much like Portugal. Crypto is considered as "private money," and never a capital asset. This makes Germany a incredible place for long-term holders who can get pleasure from no capital good points tax with a facet of beer and sausage wurst.

Even property offered in below a 12 months are tax-free so long as the revenue is below €600. Only a heads up although that Germany isn't all dancing in lederhosen whereas stacking sats, there’s nonetheless tax topic for people who:

- Receives a commission in crypto

- Mine Crypto

- Stake Crypto- This turns into tax-free if held over 10 years, discuss being a king or queen of holding!

Germany goes from being tax-friendly to a tax nightmare actual fast for crypto property held below a 12 months and over €600, as you’re looking at paying the identical charges as common revenue tax, as much as 45% plus 5.5% solidarity tax. This tax is triggered in the event you promote crypto for fiat, and even commerce crypto for crypto.

Not-So-Enjoyable-Truth- In Germany, in the event you lose your non-public keys or your crypto is stolen, you might be able to declare a capital loss.

DeFi tax is even properly laid out with German effectivity:

Buying and selling LP tokens are taxed as revenue tax if held below 1 12 months, tax-free if held over 1 12 months

New tokens earned shall be taxed as revenue tax for any quantity over the €256 extra revenue threshold.

NFTs and mining are taxed largely the identical as cryptocurrencies with the 1-year rule. For mining, new cash are taxed as revenue tax if offered earlier than holding for 1 12 months.

As with different EU international locations, European Union members get pleasure from free journey between nations so getting German residency is a breeze. When you reside outdoors of the EU, the method is a bit tricker. To relocate to Germany, there must be a cause. In response to the German visa web site, these causes may be:

- Immigration for employment,

- Immigration for training,

- Immigration for entrepreneurs,

- Immigration for household reunions,

- Immigration residence permits.

There are various methods to acquire these, however earlier than being accepted within the nation, people have to show that they’re financially steady, have medical insurance and have fundamental German language proficiency. Visas can be found for individuals who need to begin a enterprise in Germany, research, work, carry out scientific analysis, carry out an internship, and for household reunification.

I’d undoubtedly advocate wanting on the visa immigration web site above because it lays out what’s required for every of those avenues. There are requirements like funds wanted for enterprise actions and employment contracts that have to be met earlier than a visa may be accepted.

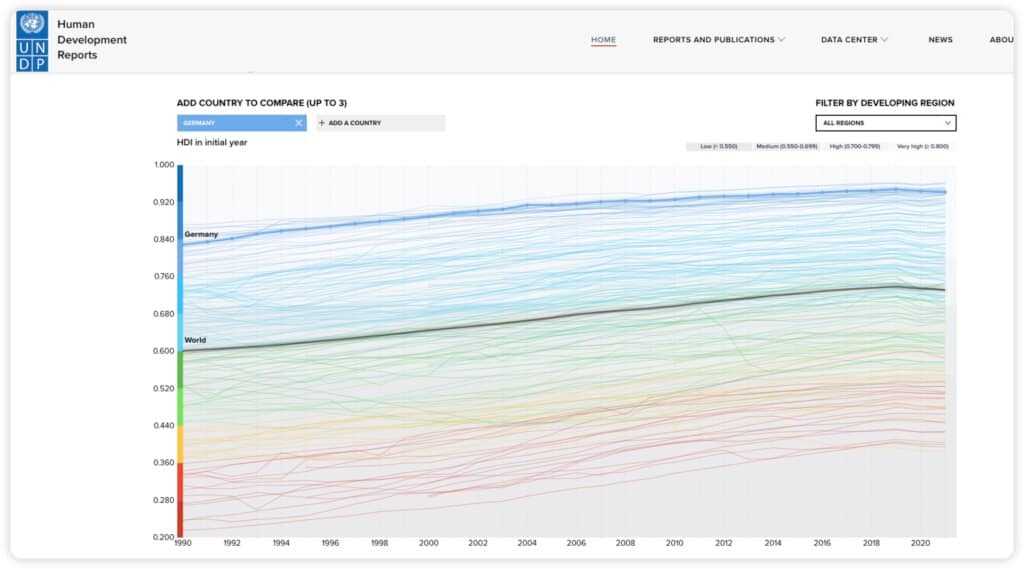

Germany has one of many highest requirements of residing globally and is constantly ranked extremely by way of security and high quality of life. It unfailingly ranks among the many prime international locations for practically each metric and can be a incredible place to name house. In response to the Human Improvement Index, Right here is how Germany has ranked traditionally:

The climate varies considerably in Germany from the north to the south of the nation. As it’s positioned in Central Europe, one can count on chilly, snowy winters within the north, wet winters and heat summers within the south. Germany is a really fashionable nation, among the many most superior globally, so no worries about sluggish web velocity right here.

Costa Rica

Costa Rica has change into a preferred international tax haven and is loved as probably the most stunning locations on the planet by way of pure magnificence. Waterfalls, jungles, exhilarating seashores, no capital good points tax, what's to not love? Costa Rican residents are topic to zero capital good points tax within the nation until revenue is derived from ordinary transactions akin to property. Capital good points derived from common transactions are taxed at a flat charge of 30%.

In response to Costa Rican legislation, cryptocurrencies should not categorised as authorized tender, a financial forex, or a overseas forex, they’ve been labelled as a "quasi-currency" or a "means of payment." It seems the federal government is just selecting to take a extra hands-off method with its digital asset classifications.

Although the federal government has thought of that cryptocurrencies are "outside of the national banking system," that didn’t cease many retailers and companies within the space from fortunately accepting crypto as a type of fee, and Bitcoin ATMs may be discovered across the nation.

A notable replace from final 12 months is that Costa Rica ranked fairly secure, having fun with the identical low crime charges as Italy, rating safer than the UK or Spain. Sadly, this has modified up to now 12 months resulting from elevated felony exercise. Costa Rica has seen its alert ranges enhance and journey advisories encourage warning when travelling to this nation.

Being positioned in Central America, its neighbouring international locations are sometimes making information headlines for fairly heinous felony exercise as properly, so I’d have my guard up and analysis native security earlier than placing roots down.

When you aren't deterred by the uptick in crime, the capital of Costa Rica is San Jose, which is house to over one million folks, so metropolis slickers can get their fill of a reasonably decent-sized metropolis. Costa Rica actually does have loads going for it by way of tropical nature, fashionable residing, nightlife and actions, which is why it has change into one of many fundamental areas in Central America for each tourism and migration.

Costa Rico can be very reasonably priced. A single individual can reside fairly comfortably off about $US 1,500 monthly, making it excellent for digital nomads and crypto merchants. Oh, and it additionally has fairly good web speeds.

Vanuatu

If a stupendous tropical paradise takes your fancy, few locations on the planet are extra beautiful than Vanuatu. Vanuatu is among the islands that make up an archipelago of 83 islands off the coast of Australia, simply above New Zealand.

Vanuatu has change into a preferred vacation spot for buyers as there’s zero capital good points tax on income, dividends, or revenue tax for conventional and crypto investments for people or companies. Buyers can sit straightforward, chilling of their hammocks whereas sipping piña coladas figuring out they don't have to stress about taxes right here.

Enjoyable Truth- Vanuatu is so crypto-friendly that you would be able to truly pay in Bitcoin in your citizenship! Speak about forward-thinking.

The 2 fundamental methods to get residency in Vanuatu are:

- Banking- This selection requires {that a} Vanuatu financial institution must certify your potential to deposit 250,000 Vanuatu Vatu (US$ 2,023) monthly into an account to make sure you have an revenue. Self-funded retirees want to point out they’ve an revenue of at the least 150,000 Vatu monthly.

- Funding- An investor can get hold of residency by investing $10 million Vatu (roughly US$ 80k) in some type of actual property or agricultural undertaking.

The Vanuatu passport is legitimate for 5 years, during which residents will be capable to renew it. Vanuatu will not be for everybody, although. In case you are pleased kicking round coconuts all day on a distant tropical island, then positive, go for it. The inhabitants of the biggest metropolis on the island is house to solely fifty-thousand folks, so if you’re excited by metropolis life and the hustle and bustle, you might need to think about skipping this one.

The price of residing in Vanuatu is sort of excessive in comparison with mainland European cities and comes with out the facilities or comfort of location. Vanuatu is sort of distant and is available in at being 5% dearer than the Belgium capital Brussels for month-to-month residing prices. The usual of residing is sort of excessive in Vanuatu and residents get pleasure from low crime charges, which is smart as it’s tough to get away with being a dirtbag on an island so small that everybody is aware of one another.

Individuals who need to settle in Vanuatu needs to be content material with a reasonably easy life. Sadly, there are few paved roads, so in all probability not the very best place to purchase Lambos and web speeds are sometimes criticized for being sluggish.

Malaysia

If unique places and experiencing completely different cultures is your factor, then look no additional than Malaysia. Malaysia has a few choices for these wanting a second house in Malaysia, with certainly one of their choices even so appropriately being named the "Malaysia as my Second Home" programme. This programme is primarily aimed toward retirees and dealing expats who wish to put down roots within the nation. MM2H is a housing scheme that permits certified people to remain in Malaysia on a multiple-entry social go to move for a interval of as much as 10 years.

A number of the advantages of this program are:

- The power to return and go as they please, as long as they’re current within the nation a minimal of 90 days per 12 months

- Can deliver dependents and members of the family

- Can buy a residential house or property

- Take pleasure in no taxation on pensions or offshore revenue

- These over 50 have the choice to work part-time

- Can personal and run a enterprise

You’ll be able to even deliver pets and apply for maid providers in some circumstances. Sadly, the necessities for the MM2H should not the best to fulfil. In response to this MM2H Information from the Paul Hype Web page, these are the present necessities as of 2024:

These below 50 years outdated should have:

- Minimal liquid property of RM 1,500,000 (approx. $338,409)

- Minimal offshore month-to-month revenue of RM 40,000 (approx. $9,000)

- A set deposit account in Malaysia which incorporates at the least RM 1,000,000 (approx. $225,606)

These over 50 years outdated should have:

- Minimal liquid property of RM 1,500,000 (approx: $338,409)

- Minimal offshore month-to-month revenue of RM 40,000 (approx. $9,000)

- A Mounted deposit account with a Malaysian checking account which incorporates at the least RM 1,000,000 (approx. $225,606)

- For retirees, the requirement to point out proof of pension from the federal government of at the least RM 10,000 (approx. $2,256) monthly

Then there’s the one-off private bond fee that prices approx RM 2,000, ($450) and a social move that requires an annual fee of RM 90 ($20).

Malaysia is comparatively secure concerning low violent crime charges, although pickpocketing may be widespread, so be careful for that. Bank card fraud can be an issue there, so ensure you have a kind of RFID safety wallets to assist decrease dangers.

One threat that shouldn't be taken evenly is animal and bug bites. As humorous because it sounds, monkey bites aren’t any laughing matter, and so they occur extra continuously than you’ll assume. Plus, Malaysia is house to some fairly harmful bugs and animals.

The price of residing in Malaysia may be very low. Individuals who transfer there can reside a reasonably lavish way of life for below $US 2k monthly, particularly on a few of the cheaper islands.

The capital metropolis Kuala Lumpur is a reasonably cool place, an actual fashionable metropolis for individuals who like metropolis life. Lots is going on there by way of nightlife, and town felt very superior and clear with loads of cultural experiences to get pleasure from.

If the Malaysia as my Second House Scheme is out of your attain, there are a few different choices to contemplate.

As per Regulation Workplace Malaysia, Anybody who desires to maneuver to Malaysia and acquire everlasting residency might want to qualify for one of many following:

- excessive internet value individuals- open a checking account in Malaysia and deposit at the least 2 million USD with out withdrawing for 5 years; the partner and youngsters of the applicant may additionally apply for everlasting resident standing after a interval of 5 years;

- extremely expert or proficient individuals- obtainable for a variety of industries, candidates should present a certificates of excellent conduct and make the applying with the Immigration Division;

- professionals- much like the earlier class, these are people who’ve excellent abilities and have a advice from a related Malaysian authority;

- the partner of a Malaysia citizen- people married to a Malaysia citizen might apply for everlasting residency if they’re married for at the least 5 years and so they have additionally lived within the nation throughout this time;

- based mostly on the factors system: a minimal variety of factors obtained throughout their keep within the nation permits foreigners to use for everlasting residency standing.

Then there’s additionally a preferred digital nomad visa which might get you within the nation for 12 months and doesn't require revenue tax funds on any revenue earned outdoors of the nation, so if you’re good at timing the markets and never topic to taxation in your house nation, this may very well be a viable possibility to chop the tax invoice down.

The web velocity within the capital is very rated, however outdoors of town it varies dramatically relying on the situation. The nation states “average” web speeds, however from my expertise in a few of the extra distant places, I’d say the web was non-existent.

Climate is one thing that needs to be considered. As it’s a tropical local weather, humidity is extremely excessive year-round and Malaysia experiences not one however two monsoon seasons per 12 months.

Malta

Malta is a incredible European different to Portugal for these in search of a friendlier place to get pleasure from lax tax legal guidelines. Malta was the primary crypto-friendly tax nation to launch a holistic regulatory framework for blockchain know-how, incomes the title of “Blockchain Island.” Malta is appropriate for crypto hodlers, however energetic day merchants will seemingly need to keep away from this one. Listed here are the highlights for Malta crypto tax:

- No long-term capital good points tax

- Enterprise revenue tax on crypto buying and selling is between 0-35%

Residents right here don’t pay capital good points tax on long-term holdings or when crypto is bought or offered. Crypto day buying and selling shall be taxed right here, much like inventory market day buying and selling, which is 35%, however this may be decreased to 0-5% relying on how a lot you earn and your residency standing. Getting residency right here is pretty easy for EU residents as they merely have to show they’re:

- Financially Secure

- Employed

Non-European residents shall be allowed to acquire residency on the “discretion of the authorities” and think about concerns akin to:

- Dwelling in Malta for at the least 6 months

- Financially Secure

- Employed

I’d presume that as it’s on the discretion of authorities, this selection seemingly isn't typical for non-European residents, however it could be value a glance. Malta residency has no minimal worth property requirement and it’s renewable each 5 years. The price of residing in Valletta is a bit increased than most European cities, coming in because the thirty sixth most costly European metropolis. The typical price of residing for a single individual is available in at round 2,500 Euros monthly.

Malta has a sluggish tempo of life and isn’t recognized a lot for vibrant nightlife, making it extra applicable for these trying to chill out whereas having fun with a stunning tradition and delightful structure. As well as, the web speeds are very quick on the island, which is all the time an necessary consideration.

Malta enjoys good climate year-round, by no means getting too sizzling or chilly, and no monsoon seasons right here.

Cayman Islands

It needs to be no shock to anybody that the Cayman Islands is on this record. These islands have been lengthy generally known as tax havens for companies and rich people. The Cayman Islands Financial Authority doesn’t cost company tax on companies or revenue tax or capital good points tax to its residents. There may be additionally no property tax, so shifting right here may primarily scale back your tax burden to zero.

The Cayman Islands may be summed up in a single phrase, "stunning," in the case of magnificence, surroundings, climate, and just about the whole lot pure on this string of islands. Although I’d be remiss if I didn't additionally spotlight the draw back, and that’s that residing within the Cayman Islands is extremely costly, and should the power be with you if you’re making an attempt to get residency right here as it’s a prolonged and dear course of.

Import duties alone vary from 22-26% and when doing my analysis for this text, it’s clear that these fortunate sufficient to reside there have a unique idea of actuality than many people. One legislation agency acknowledged that “Fortunately, you can get Cayman Island Residency for a fairly low fee of a million dollars.”

Blimey! If that could be a "low fee," I'd hate to know what they think about costly. That cool $1 mill can be just for a brief residence allow for 1 12 months. In case you are excited about residing within the Cayman Islands long run, listed here are the commonest strategies:

Apply as an individual with impartial means– This 25-year allow permits you to deliver your loved ones, however you aren’t allowed to work on the island. It’s good to show an annual revenue of $150k coming from outdoors the Islands, have a checking account with at the least $500k in it, and make investments at the least $1.2 million into the nation if you wish to reside in Grand Cayman. These figures are barely much less if you’re pleased to reside on one of many smaller islands. If this allow is accepted, it’s essential pay a $25k price to situation the allow, and $1,220 per 12 months to maintain it energetic.

Certificates of direct funding– Anybody keen to make an funding of $1,200,000 right into a enterprise that creates native jobs and takes an energetic function within the enterprise can get a allow. This may get you residency for 25 years and requires presence within the nation for at the least 90 days per 12 months. After you make the funding, additionally, you will have to pay the identical 25k for the allow and $1,220 per 12 months to maintain it energetic per dependent.

There are additionally strategies of gaining residency by establishing a considerable enterprise presence on the island, however I feel by now you have got an thought as as to whether or not the Caymans are an appropriate route. You need to be a reasonably severe crypto millionaire to make this selection work.

Notable Exclusions

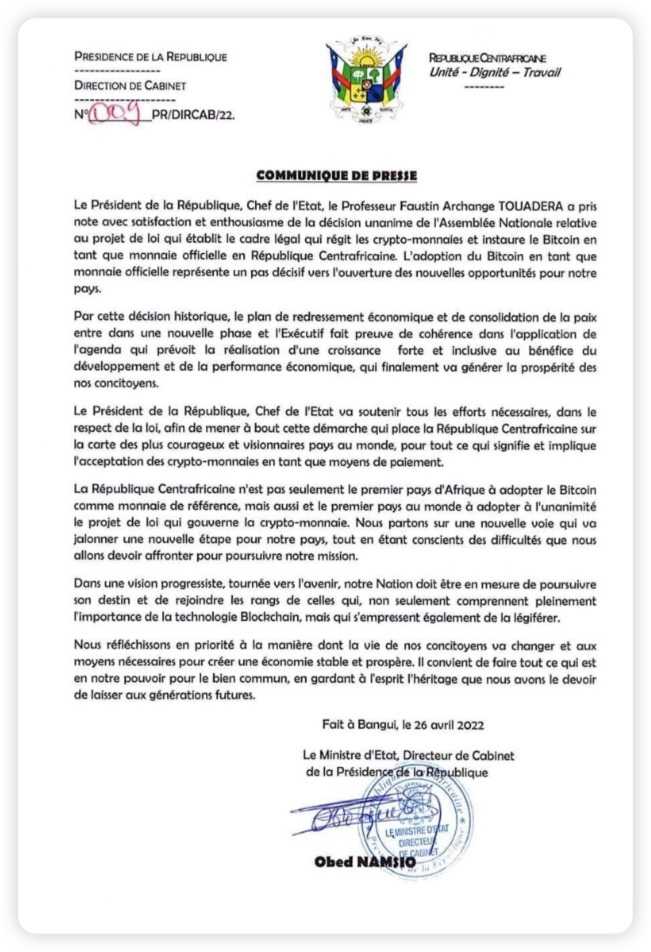

It was tough to not embrace the Central African Republic on this record. After El Salvador opened the door to adopting Bitcoin as authorized tender, the Central African Republic tore a web page out of the identical ebook and formally acknowledged BTC as authorized tender in 2022.

CAR lawmakers unanimously accepted the invoice to legalize the usage of crypto within the nation and made Bitcoin together with the CFA Franc authorized tender. This marked the second nation on the planet to make this leap. The framework permits residents to pay their taxes in crypto and use it as a type of fee for companies.

This transfer didn't go fairly as easily because it did for El Salvador, partly resulting from the truth that lower than 15% of residents within the nation have entry to the web, and plenty of companies do not need the means to have the ability to settle for crypto as a type of fee. Whereas CAR is crypto-friendly on paper, for now, the realities are fairly completely different, which is why it was excluded from this record. However, this was nonetheless an incredible step in the fitting path, I consider.

It was additionally tough to not embrace Nigeria, as they’ve a really well-classified tax construction for crypto property and a very good understanding of find out how to classify them. I used to be very impressed with how forward-thinking this nation is in its method to tax, and really feel that international locations like America, Belgium, and Japan may study from them as they can not appear to control their manner out of a paper bag.

You’ll be able to study their common sense method to crypto taxation on this Coin Textual content article. Sadly, although Nigeria is sort of tax-friendly, I couldn’t embrace them on this record as a result of inherent risks and low high quality of life rating highlighted on this article by the Borgen Venture. Nigeria will not be probably the most appropriate place for these trying to relocate.

Although on a optimistic observe, I do actually consider Bitcoin helps to make your entire continent a greater place, and there’s progress occurring in the fitting path. This extraordinary 10-minute video by Onerous Cash reveals the influence BTC is having there and rendered me speechless, giving us all hope and encouragement for the way forward for Africa.

Components to Take into account Earlier than Making the Transfer

Deciding to maneuver to a brand new nation shouldn’t be all about capital good points and revenue tax avoidance. High quality of life, cultural experiences, security, and local weather ought to critically be thought of earlier than making a transfer, and quite a lot of analysis needs to be performed beforehand. Even concerns akin to meals likes and dislikes or dietary restrictions like vegetarianism are necessary elements to contemplate as not having the ability to benefit from the obtainable meals can actually decrease your enjoyment of a spot.

An instance of that is that it’s fairly widespread in Malaysia to eat scorpions and bugs. Significantly. I attempted to get on board with that, however nooooope, two crickets, a few ants and a beetle later, I used to be performed with that experiment. I’m additionally not a fan of fish and as soon as stayed on a tiny island the place that was actually all they ate, so meals is a legitimate cause to cross locations off a listing.

Skilled recommendation needs to be sought earlier than deciding to maneuver international locations as it could actually have a big influence on asset holdings and tax implications. Many international locations require you to surrender your tax residency standing from your own home nation earlier than turning into a tax resident of one other nation which might produce other important impacts.

For instance, If you wish to transfer from nation B and acquire tax residency in nation C, nation B might have a requirement that you just promote your whole property and shut financial institution accounts to maneuver, and the property offered in nation B could also be topic to capital good points taxation. This implies that you could be have to promote a house, a automobile, and your whole investments in your house nation B, which may all be topic to hefty capital good points tax. Due to this fact, it could not make sense to pay 50k in capital good points tax on a home, a automobile, and different investments to save lots of 5k value of crypto tax by shifting to a different nation.

In wrapping up, there are various superb locations to select from if you’re contemplating uprooting your life and venturing off right into a courageous new world. I can’t stress the significance of doing your personal in-depth analysis and ensuring it’s the proper selection for you. When you determine you’re pleased the place you’re and don't thoughts paying your share of tax, make sure you try our prime crypto tax instruments article to seek out some sources that may make tax season as painless as potential.

🌎 Severe about relocating? E-book a name with our pals from Offshore Citizen to plan and execute your transfer legally. They assist with residency permits, financial institution accounts, firm buildings, and so on.

👉 https://calendly.com/michael-rosmer/coin-bureau-consult

Often Requested Questions

How is Cryptocurrency Taxed?

It’s commonest for a lot of international locations to tax the sale of cryptocurrencies as capital good points tax. The crypto framework varies considerably by nation and exercise. Whereas the sale of crypto might set off a taxable acquire or loss, different actions akin to buying and selling, staking, and mining may be taxed as enterprise revenue, private revenue, or curiosity revenue.

Do American expatriates have to pay American taxes?

Normally, People should pay taxes even when they reside outdoors their house nation. Type 1040 applies to all People who earn over a specific amount. Anybody might face a capital good points tax penalty within the US if the time spent within the states throughout a tax season exceeds 183 days.

What are probably the most tax-friendly states in america?

For People who don’t need to transfer overseas, there are some different states which have tax insurance policies which are extra environment friendly for crypto. These are primarily the states that do not need state-owned revenue taxes like California, Wyoming, Florida, Texas, and Colorado.

What nation is tax-free for crypto?

The very best international locations for “no-strings attacked” tax-free crypto are the UAE, Belarus, and El Salvador. These jurisdictions have the bottom crypto tax at 0% and do not require mass upfront funding or authorized hoops to leap by to learn from.

Is crypto tax-free in Dubai?

Sure, there isn’t a capital good points tax in Dubai, nor taxes on revenue, property, or crypto in Dubai.

Is crypto tax-free in Mexico?

No, though there was no classification or framework for crypto property in Mexico, and the federal government has not created clear laws, crypto shouldn’t be thought of tax-free. People and companies are required to pay revenue tax in Mexico, no matter the place the wealth got here from.

The promoting of crypto property in Mexico is a taxable occasion, both as a capital good points tax or capital loss. You’ll be able to study extra on this Crypto Tax in Mexico Information.

Is Switzerland tax-free for crypto?

No, Switzerland doesn’t have a blanket tax-free method to crypto. For personal buyers, crypto is taxed below the Wealth Tax System.

Crypto is classed as a non-public wealth asset, like shares and bonds. There isn’t a capital good points tax until you’re a self-employed dealer or enterprise.

You’ll pay no capital good points tax on income from crypto:

- That has been held for at the least six months

- had a buying and selling turnover of lower than 5x your holdings firstly of the monetary 12 months

- Your internet capital acquire is lower than 50% of your complete revenue

- You haven’t any debt financing

- You employ derivatives solely for hedging

- You’ll be able to study extra about how crypto is taxed on this Information to Crypto Tax in Switzerland.