Over the course of the previous few years, the digital asset house has fully re-architected the monetary ecosystem as we all know it and has generated a number of the most value-rich, avant-garde financial functions. In truth, with the arrival of Decentralised Finance (DeFi), an increasing number of crypto fanatics, non-public traders and institutional entities have been drawn to experiment with the brand new monetary applied sciences provided by the house and fascinated by its different options.

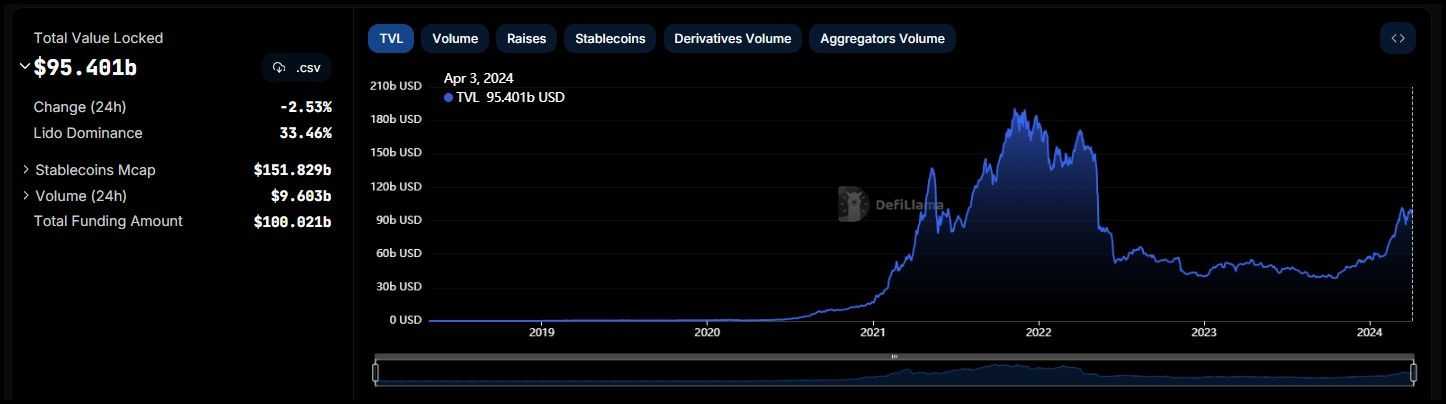

It’s because DeFi is proving to be a quickly rising development within the dynamic world of FinTech, taking components from conventional finance and reworking them into trustless, clear protocols through good contracts and token architectures. In December 2019, the DeFi ecosystem had $700 million value of property locked in its monetary merchandise, whereas now, on the time of writing in 2024, this quantity is closing at $100 billion.

DeFi is a very engaging proposition because it offers contributors entry to a borderless, open different to each monetary service possible, together with saving accounts, loans, insurance coverage, buying and selling and extra.

Decentralized functions (dApps), spearheaded by the good contract big Ethereum, run on the blockchain’s distributed ledger system and fully eradicate the necessity for a government to behave as an middleman like in conventional finance. Primarily, this permits for the creation of a system in which there’s not a single level of failure, as equivalent data are stored throughout 1000’s of computer systems through a peer-to-peer community.

Lending and borrowing, yield farming, liquid staking, restaking, and decentralized buying and selling protocols are only some of the choice companies that Decentralised Finance has to supply. Decentralized buying and selling, specifically, has sparked the curiosity of many traders and crypto customers alike, and has led to many initiatives creating their very own buying and selling, decentralized alternate (DEX) and automatic market maker (AMM) protocols. One of the crucial notable initiatives to take action is Uniswap, with its absolutely decentralized protocol for automated liquidity provision on Ethereum.

About Uniswap

Uniswap is a number one crypto asset alternate working within the EVM ecosystem. It differs from conventional exchanges in that it proposes a completely disintermediated, decentralized mechanism through which no single entity is allowed to personal, management, or function its community. Moreover, Uniswap pioneered a buying and selling mannequin fully completely different from conventional, order-book-style buying and selling markets referred to as an automated liquidity protocol, which obliviates the necessity for trusted intermediaries and prioritizes decentralization and safety.

Launched in 2018, Uniswap has develop into the most well-liked and most used Decentralised Trade (DEX) with over $5 billion locked in its good contracts. It's additionally accessible on cellular.

As a result of it’s Ethereum-based, Uniswap is fully-compatible with all ERC-20 tokens and different Ethereum infrastructures akin to pockets companies like MetaMask and MyEtherWallet. Along with this, the Uniswap platform is totally open-source, which implies that anybody can basically copy its codebase and redeploy it to create an analogous DeFi protocol, as is the case for Sushiswap for example.

As a DEX, Uniswap permits customers to swap varied ERC-20 tokens from a easy, user-friendly, all-in-one internet interface that eliminates the numerous bottlenecks typical of different conventional and centralized exchanges. With the intention to do that, Uniswap implements the particular structure of an Automated Market Maker (AMM) and makes use of liquidity swimming pools, versus conventional order books, to find out asset costs, carry out transactions and execute trades.

AMM infrastructures certainly represent probably the most notable developments to return out of the DeFi ecosystem as they provide customers extremely advantageous options, akin to the flexibility to swap ERC-20 tokens with out having to discover a purchaser or vendor on the alternative facet of the commerce.

In truth, Uniswap doesn’t use an order guide to find out token costs however makes use of obvious market liquidity to calculate costs with a mathematical algorithm. This strategy is essential for working an on-chain buying and selling platform, as the information a conventional order guide produces is simply too huge to retailer on-chain with out inflicting the charges to skyrocket.

Thus, it’s clear {that a} temporary AMM and liquidity pool evaluation is because of higher contextualise Uniswap’s DeFi functionalities and automatic liquidity provision structure. It will assist higher perceive Uniswap’s position within the DeFi house and make clear the issues that it seeks to unravel.

DEXes, AMMs And Liquidity Swimming pools

Automated Market Makers (AMMs) enable digital property to be traded robotically and with out permission by utilizing liquidity swimming pools as an alternative of a conventional market of consumers and sellers. On conventional alternate platforms, consumers and sellers supply up completely different costs for an asset and when different customers discover a listed value to be acceptable, they execute the commerce and that value turns into the asset’s market value. Actual property, shares, gold and most different property depend on this conventional market construction for buying and selling.

If, for example, a dealer wished to promote Bitcoin for a value of say $40,000 on a centralised alternate, they must watch for a purchaser to look on the opposite finish of the order guide who’s trying to purchase an equal or larger quantity of Bitcoin at that value. Nevertheless, the primary situation with this sort of financial construction is liquidity, which on this state of affairs refers back to the market depth, or the quantity of open orders for the asset, and the variety of orders there are on the order guide at any given time.

Thus, if liquidity is low, merchants won’t have the ability to fill their purchase or promote orders, and AMMs try to unravel this situation by providing a monetary software that’s all the time accessible for buying and selling and doesn’t depend on conventional interactions between consumers and sellers.

Liquidity Restructured

Liquidity refers to how simply one asset might be transformed into one other asset with out affecting its market value. Earlier than AMMs got here into being, liquidity offered Decentralised Exchanges (DEXes) on Ethereum with a hefty problem. In truth, as a brand new expertise with a sophisticated interface, the variety of consumers and sellers remained fairly small, which basically meant that it was tough to seek out sufficient customers keen to commerce regularly.

AMMs clear up this drawback of restricted liquidity by creating liquidity swimming pools and providing liquidity suppliers (LPs) an incentive to produce these swimming pools with property. Consequently, the extra property in a pool and the extra liquidity the pool has, the better buying and selling turns into on Decentralised Exchanges.

On AMMs, as an alternative of buying and selling between consumers and sellers, customers commerce in opposition to a pool of tokens often known as the liquidity pool. Customers present liquidity swimming pools with tokens, and in contrast to an order guide, the value of the tokens within the pool is decided by a mathematical ratio.

Anybody who holds any kind of ERC-20 asset and has entry to an web connection can develop into a liquidity supplier by supplying tokens to an AMM protocol. LPs will normally earn a charge for offering tokens to the pool and this charge is paid by merchants who work together with the liquidity pool.

Protocol Structure

As a DEX, Uniswap is extra decentralized and versatile than many different digital asset exchanges. Due to this fact, it could actually supply its customers quite a lot of advantageous options, enriching their DeFi expertise total. When viewing Uniswap’s web site, it is very important do not forget that it’s way more than simply an interface.

In truth, Uniswap standardizes how ERC-20 tokens are exchanged with a set of in-house good contracts and permits anybody to construct an interface connecting to those good contracts to begin exchanging tokens with everybody else utilizing Uniswap instantly. Uniswap has launched a number of variations of those good contracts over time. Whereas Uniwsap V1 facilitated easy ERC20-ETH alternate, V2 launched token-token exchanges, V3 optimized alternate liquidity, and many others.

Each Uniswap model builds on the ideas of its predecessor. Due to this fact, one should perceive the entire line as much as absolutely grasp Uniswap's improvements. Let's go over every model one after the other.

Uniswap V1

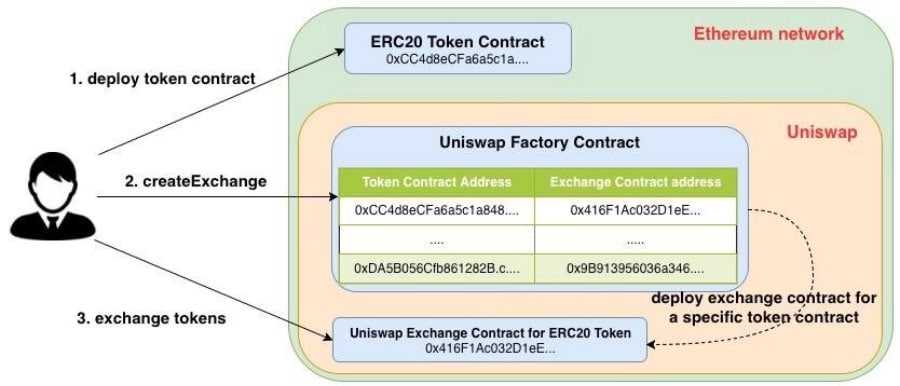

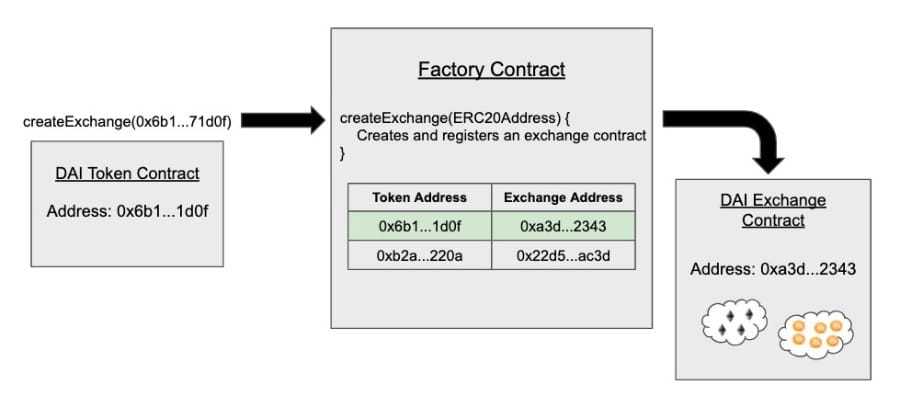

Two various kinds of good contracts make up Uniswap V1: Trade Contracts and Manufacturing unit Contracts.

Trade contracts comprise a pool of particular tokens and Ethereum, with which customers can commerce and alternate. The second kind of contract is Manufacturing unit, which is accountable for creating new alternate contracts and connecting the handle of the ERC-20 token to its private alternate contract.

As a result of Uniswap prices no charges for itemizing new tokens on its protocol, anybody can name a perform within the Manufacturing unit contract to register a brand new token. The determine above shows the method of including the DAI token to Uniswap and this occurred when somebody first referred to as the ‘createExchange’ perform in a Manufacturing unit contract with the DAI contract handle. The Manufacturing unit then checks the registry to confirm if the Trade contract for this token was beforehand created. If it wasn’t created, Manufacturing unit creates an Trade contract and writes its handle to the registry.

Uniswap Liquidity Swimming pools

As beforehand talked about, Uniswap doesn’t leverage the order guide system to estimate the value of property. In additional conventional crypto exchanges akin to Coinbase or Binance, the worth of an asset is only primarily based on provide and demand, the place the best value is the one for which somebody is keen to purchase and the bottom value is the one for which somebody is keen to promote.

The picture displayed above exhibits the best ETH bid value on Binance is $1985.87 and the bottom bid value is $1985.88. As an alternative of implementing order books, Uniswap facilitates token alternate by making a pool of a pair of tokens. Anybody can permissionlessly swap one token from the pool for one more. There are separate swimming pools for all pairs of tokens individuals are buying and selling on-chain.

When a consumer exchanges ETH for one more token on Uniswap, ETH is shipped to the contract pool and the token is returned on to the consumer. So, an order book-based alternate matches purchase orders with promote orders in real-time, however Uniswap swimming pools are easy good contracts that don’t require any matching, the protocol merely swaps one token for one more.

One profound advantage of this mechanism is about liveness. An order guide wants matching consumers and sellers to be stay on the similar time. Uniswap's design alleviates this precondition. Moreover, anybody can create any liquidity pool pair on Uniswap with none permission, enabling full market-making autonomy.

Automated Liquidity Protocol

We realized beforehand that buying and selling on Uniswap works with the assistance of liquidity swimming pools, however the place does this liquidity come from? So as guide adjustments, liquidity comes from the market makers, contributors who decide to repeatedly providing to purchase and promote shares (or different property) to make sure there may be all the time a marketplace for them, thereby facilitating buying and selling and growing liquidity.

Markets work otherwise in Uniswap. Right here, a separate entity referred to as liquidity suppliers (LPs) stake their property in liquidity swimming pools in order that merchants can provoke token swaps. Whereas liquidity is essentially necessary for the value discovery of an asset in any market, it’s a parameter Uniswap's liquidity swimming pools issue immediately within the value calculation algorithm. Due to this fact, liquidity is a extra carefully tied idea for value discovery than conventional exchanges.

Anybody, even the merchants themselves, can develop into a liquidity supplier on Uniswap. The protocol incentivizes liquidity provision by permitting them to earn a portion of the charges collected from the customers swapping tokens on respective swimming pools.

Every listed token has its personal pool that customers can provide liquidity to and the value of every token is decided not by an order guide system however by utilizing a mathematical algorithm pc. In alternate for supplying swimming pools with their funds, LPs obtain a token that represents their staked contribution to the pool.

So, for example, if an LP contributed $1,000 to a liquidity pool that held $10,000 in complete, the LP would obtain a staked contribution token for 10% of that pool. This token might be then redeemed for a share of buying and selling charges as, in reality, Uniswap prices customers a flat 0.30% charge for each commerce that happens on the platform and robotically sends it to Uniswap’s liquidity reserve.

Whereas Uniswap has not too long ago upgraded to Uniswap V3, its V2 protocol entailed the introduction of a charge construction that may very well be turned on and off relying on the group’s vote, by which 0.05% of each 0.30% buying and selling charge was despatched to a Uniswap fund to finance infrastructure and future growth.

Figuring out Token Worth By Fixed Product Formulation

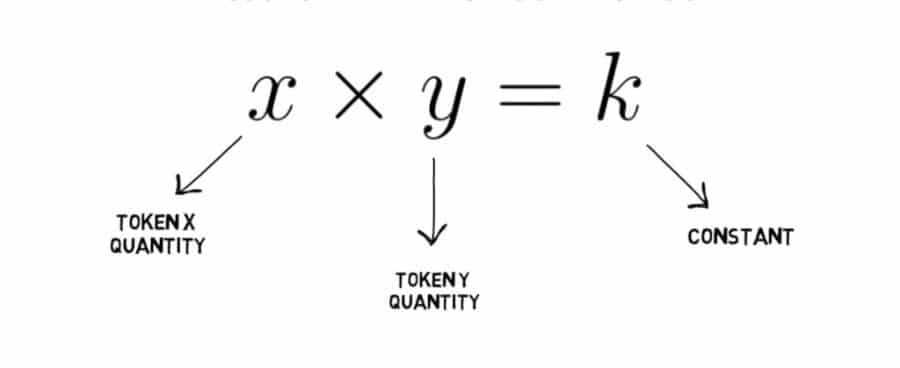

As an alternative of utilizing an order guide to find out an asset’s value, allotted to the best purchaser and the bottom vendor, Uniswap leverages its AMM structure to mathematically modify the value of a token primarily based on its accessible provide obvious to the opposite token in a liquidity pool. This basically works by growing or lowering the value of a token relying on the ratio of tokens in a given liquidity pool.

This token ratio is calculated by what is named the Fixed Product Formulation, an equation that was first proposed by Ethereum founder Vitalik Buterin after which popularised by Uniswap. The Formulation presents itself as follows:

tokenA_balance (x) * tokenB_balance (y) = ok, or just x * y = ok

The fixed, represented by ‘k’, means there’s a fixed steadiness of property that determines the value of tokens in a liquidity pool. As an example, if an AMM holds each ETH and BTC, each time ETH is purchased, its value will enhance as there can be much less ETH within the pool than earlier than the acquisition. Conversely, the value of BTC will lower as there may be extra of it within the pool. It’s also necessary to notice that solely when new liquidity suppliers be a part of will the pool develop in dimension.

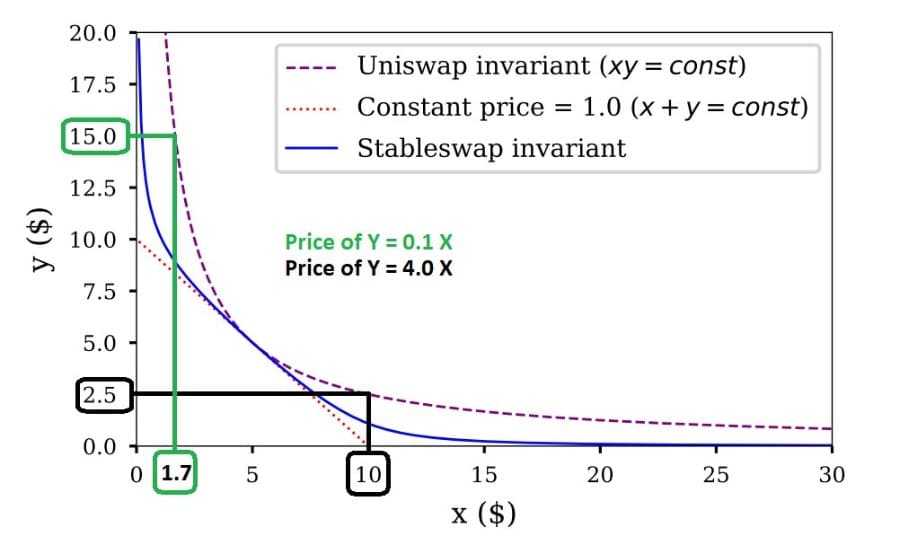

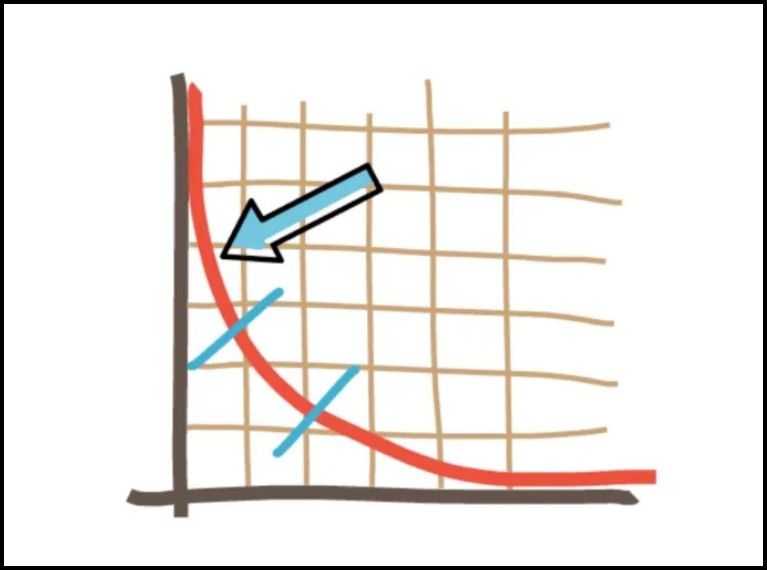

Visually, the value of tokens within the Uniswap AMM follows an exponential curve decided by its Fixed Product Formulation.

On this fixed state of steadiness, outlined by ok, shopping for one ETH in an ETH-BTC liquidity pool brings the value of ETH barely larger alongside the curve, whereas promoting one ETH brings its barely decrease. The alternative occurs to BTC within the ETH-BTC pool, which permits the pool to take care of excessive ranges of volatility and ultimately return to a state of steadiness.

Additional Visible Examples Of (Ok)

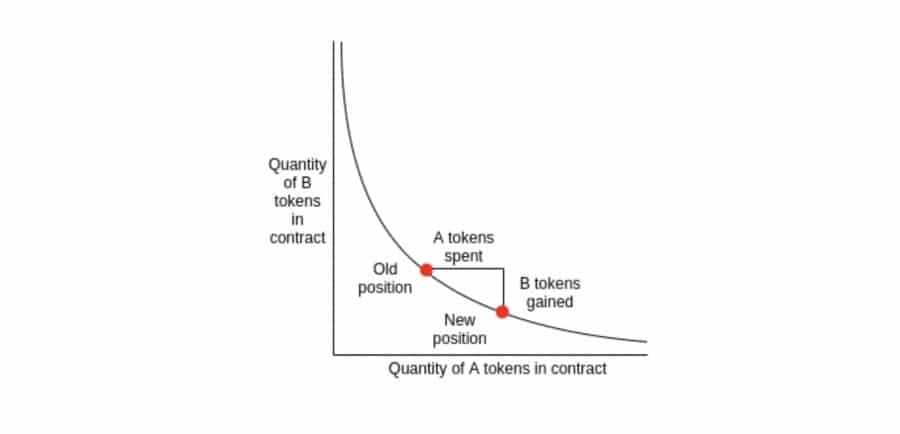

As talked about beforehand, Uniswap makes use of Trade contracts to pool each ETH and a particular ERC-20 token into one particular person pool. When exchanging ETH for a token on Uniswap, ETH is shipped to the contract pool and the token is returned to the consumer. The quantity that’s returned after the alternate is predicated on an AMM system, x * y = ok.

Primarily, the quantity returned to customers will depend on the ratio of ETH to tokens within the pool.

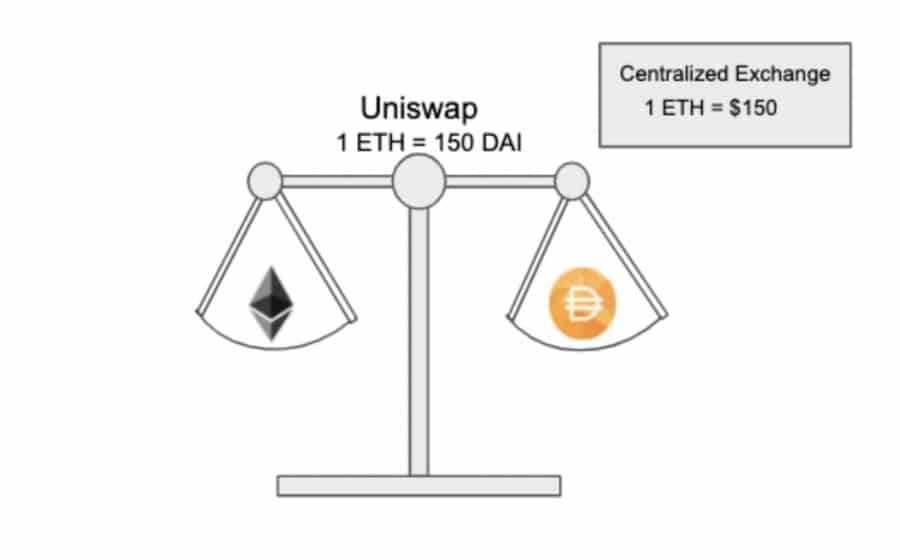

If customers provide liquidity swimming pools with only one token, these swimming pools keep a value steadiness with exterior markets by oracles and merchants who arbitrate between swimming pools. Ideally, taking a DAI-ETH liquidity pool for example, this may very well be conceptualised as weighing scale, as illustrated under.

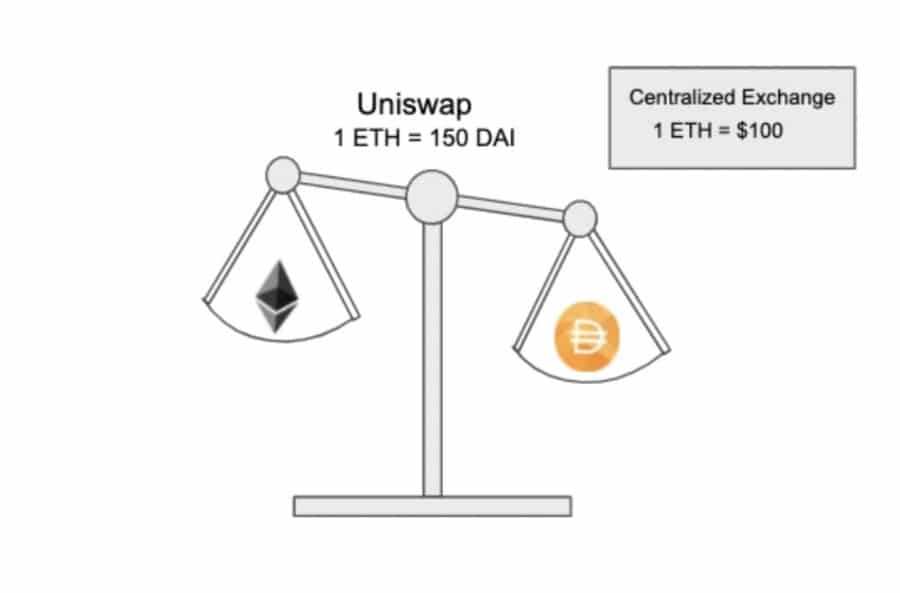

Let’s assume that the present value of ETH is $150 and the ratio within the Uniswap DAI-ETH pool returns 150 DAI per ETH. On this state of affairs, the pool is balanced as the value of its property is coherent with the present market costs. If, nonetheless, there’s a swift market motion that pushes the value of ETH right down to $100 on a centralized alternate, the pool is unbalanced as merchants can nonetheless alternate ETH for 150 DAI on Uniswap when ETH’s market value is $100.

Thus, Uniswap customers can put ETH right into a pool, withdraw DAI, alternate the DAI for ETH and revenue alongside the best way. This may be performed till the pool balances out once more and displays the present market value, creating appreciable arbitrage alternatives for merchants on Uniswap.

Changing into a Liquidity Supplier

liquidity provision entails customers depositing two kinds of tokens in a pool to facilitate buying and selling. This course of earns them liquidity supplier (LP) tokens, representing their share within the pool and entitling them to a portion of the buying and selling charges. The financial incentive is the incomes potential from these charges, balanced in opposition to dangers like impermanent loss, the place the worth of deposited tokens can lower relative to holding them exterior the pool. The economics of liquidity provision additionally take into account components like pool dimension, buying and selling quantity, and the relative value actions of the paired property.

Learn how to Grow to be a Liquidity Supplier in Uniswap?

To develop into a liquidity supplier on Uniswap, it’s worthwhile to add an equal worth of two tokens to a liquidity pool. Right here's a simplified course of:

- Join Your Pockets: Entry the Uniswap interface and join your Ethereum pockets.

- Select a Pool: Choose the pair of tokens you wish to provide liquidity to.

- Add Liquidity: Enter the quantity for one token, and the interface will robotically calculate the equal quantity for the opposite token primarily based on the present pool costs.

- Affirm Transaction: Approve the transaction in your pockets, contemplating fuel charges and potential slippage.

- Obtain LP Tokens: As soon as the transaction is confirmed, you obtain LP tokens representing your share of the pool, which entitle you to a portion of the buying and selling charges.

At all times do not forget that offering liquidity entails dangers like impermanent loss, so it's important to know these earlier than continuing.

Slippage

Slippage happens when the execution value of a commerce differs from the anticipated value, usually seen in risky markets or massive orders. For instance, if a dealer locations an order to purchase a cryptocurrency at $100, however as a result of speedy value actions, the order is executed at $102, the $2 distinction is the slippage.

Impermanent Loss

Impermanent loss occurs to liquidity suppliers in decentralized exchanges when the value ratio of property in a pool adjustments after they've supplied liquidity. If a supplier provides an equal worth of two tokens to a pool, and the value of 1 token rises considerably in comparison with after they deposited, the greenback worth of their pooled property turns into lower than if they’d held the tokens individually. This loss is "impermanent" as a result of it may be reversed if the costs return to the preliminary ratio.

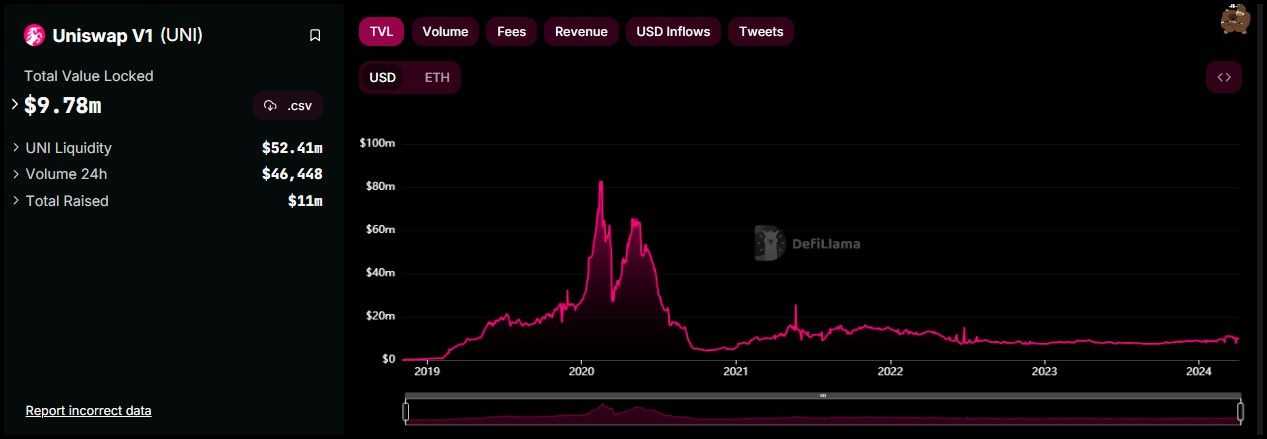

The chart above illustrates the liquidity locked in Uniswap V1 liquidity swimming pools, which have dwindled over time. The rationale these swimming pools are shedding reputation is the launch of Uniswap V2, which introduces much more flexibility for customers. Let's dive in.

Uniswap V2

Uniswap V1 was the primary model of the protocol launched in November 2018 at Devcon 4. Amongst its key options, Uniswap V1 provided:

- Help for any ERC-20 token utilizing Manufacturing unit contracts.

- Liquidity swimming pools to gather charges on ETH-ERC-20 pairs.

- Liquidity-sensitive automated pricing utilizing fixed system (ok).

- ETH buying and selling for any ERC-20 with out wrapping.

- Low fuel charges.

- Help for personal and customized Uniswap exchanges.

- Open supply front-end implementation.

- Funding by an Ethereum Basis grant.

In Might 2020, Uniswap launched its second iteration and launched a sequence of recent optimizations and enhancements. Amongst its key options, Uniswap V2 provided:

- ERC-20 to ERC-20 buying and selling pairs, versus V1’s unique ETH to ERC-20 and ERC-20 to ETH pairs.

- Worth Oracles

- Flash Swaps

- Core/Helper Structure

- Technical Structure

- Path to Sustainability

- Testnet and Launch Particulars

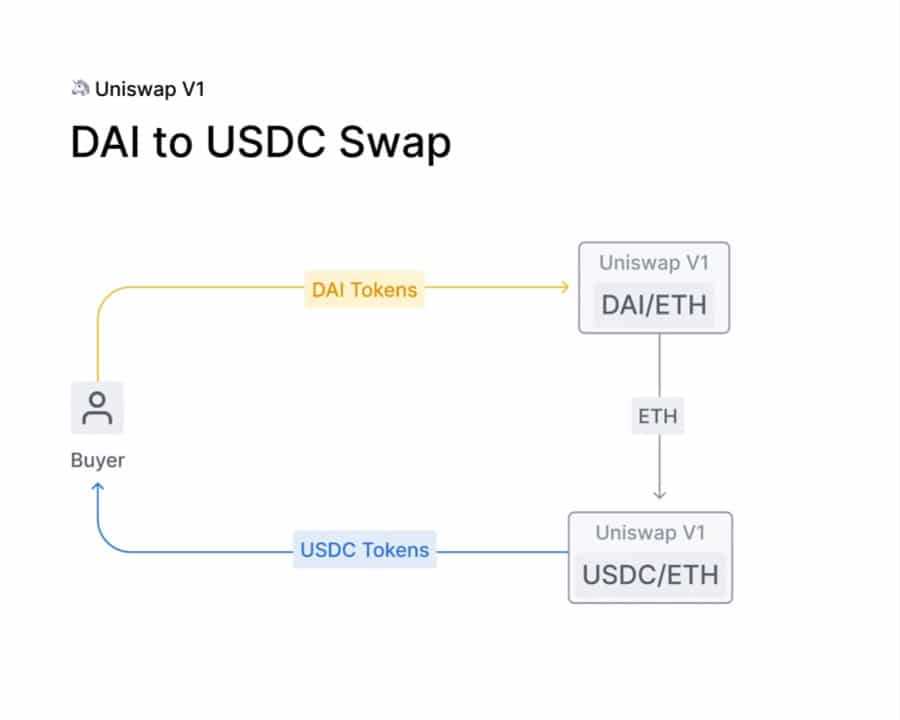

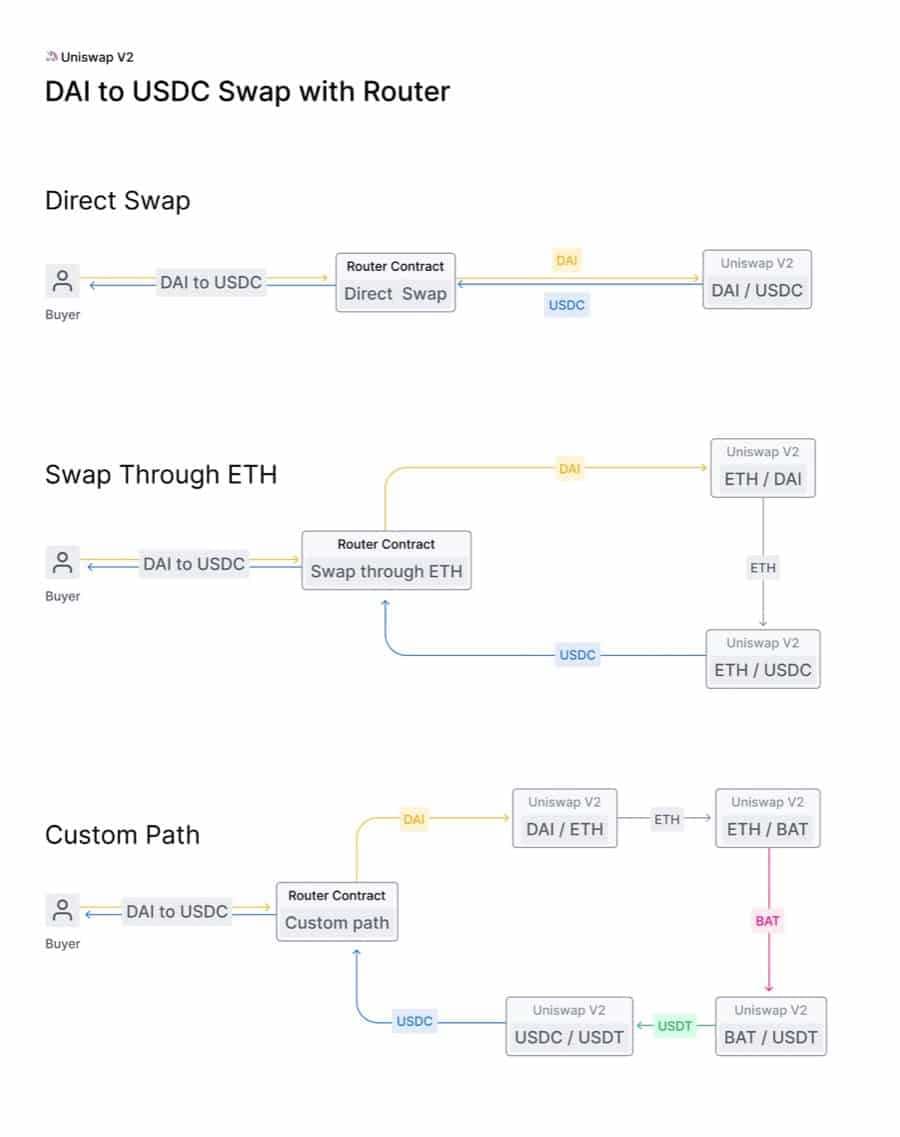

Uniswap V2’s ERC-20 to ERC-20 pairs represent maybe essentially the most notable enchancment as they open up a completely new marketplace for buying and selling digital property, eradicating most of the bottlenecks of centralized exchanges. In Uniswap V2, any ERC-20 asset might be pooled along with every other ERC-20 token. Whereas in Uniswap V1 all liquidity swimming pools are established between ETH and particular person ERC-20s, V2 permits customers to swap any ERC-20 with every other ERC-20 by routing by ETH.

Implementing V2’s ERC-20 to ERC-20 token swimming pools is advantageous for liquidity suppliers, who can keep extra numerous ERC-20 token-denominated positions. Moreover, if a consumer wished to swap say DAI for USDC in V1 they might have needed to bear a double transaction charge, particularly DAI to ETH and ETH to USDC.

With Uniswap V2, nonetheless, customers can transact immediately between two ERC-20s by an ETH Router.

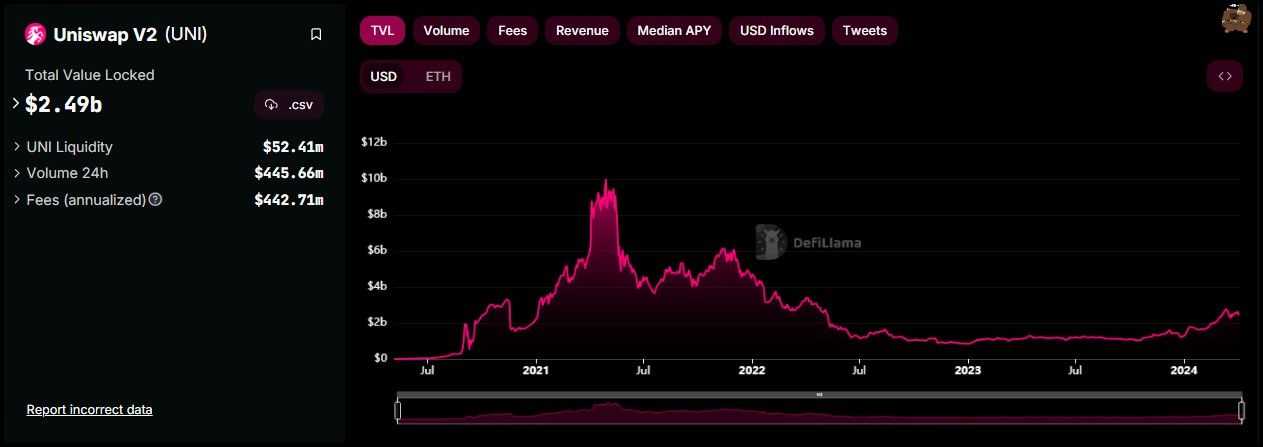

The picture above illustrates the liquidity locked in Uniswap V2 swimming pools. These swimming pools have been out of trend for the reason that launch of Uniswap V3. V3 swimming pools launched important liquidity administration and optimization choices, which resulted in much less slippage for merchants and extra returns for liquidity suppliers. Let's be taught extra about V3.

Uniswap V3: A New Period Of AMMs

It’s by now clear that Uniswap serves as vital infrastructure for decentralized finance and incentivizes builders, merchants, and liquidity suppliers to take part in a sturdy and safe digital asset market.

On Might fifth, 2021, the Uniswap crew introduced the launch of Uniswap V3, its strongest model but, on the Ethereum mainnet.

Uniswap V3 introduces:

- Concentrated Liquidity, giving LPs granular management over what value ranges their capital is allotted to.

- A number of Price Tiers, permitting LPs to be appropriately compensated for taking up various levels of danger.

- Liquidity Provision with as much as 4000x capital effectivity in comparison with V2, that means larger return for LPs.

- Decrease Slippage.

- Quick and Low cost Worth Oracles. Uniswap V3 Oracles are able to offering time-weighted common costs on demand for any interval throughout the final 9days of execution.

- Considerably Cheaper Fuel Charges! V3 swap transactions will happen on Optimism’s Layer-2 answer.

V3 Capital Effectivity

One of the crucial important adjustments coming with Uniswap V3 pertains to capital effectivity. It’s because most AMMs have confirmed to be relatively capital inefficient, nearly all of their funds at any given time should not used. As an example, Uniswap presently has $5 billion locked in its contracts, nonetheless, it does solely $1 billion in quantity per day.

Uniswap V3 seeks to unravel this situation by permitting LPs to set customized costs for which they wish to present liquidity for. It will, in flip, result in extra concentrated liquidity within the value vary that almost all buying and selling exercise occurs in.

Let's dive into Uniswap V3, visualizing the idea step-by-step:

- Understanding the V2 Curve: Think about a graph the place the x-axis represents the quantity of 1 token (say, Token A), and the y-axis represents one other token (Token B). The product of Token A and Token B quantities is a continuing, forming a hyperbolic curve. In V2, liquidity is unfold throughout this complete curve, even in value ranges the place no trades happen.

- Figuring out Liquidity Inefficiencies: In V2, if most trades occur inside a slim value vary, the tokens exterior this vary aren't successfully utilized, resulting in inefficiencies. As an example, if Token A is usually traded between 1 and a pair of models for Token B, liquidity past these values is much less energetic, not contributing a lot to charge earnings for LPs.

- Introducing V3's Concentrated Liquidity: Now, envision transitioning to V3. As an alternative of offering liquidity throughout the entire curve, LPs can select a particular section—say, between 1 and a pair of models of Token A for Token B. They allocate their tokens solely inside this vary, concentrating liquidity the place it's most wanted.

- Visualizing Concentrated Liquidity: On the identical graph, think about a vertical band between 1 and a pair of models of Token A, representing the chosen value vary. LPs now contribute liquidity solely inside this band, making a denser, extra targeted space of liquidity.

Implications of Concentrated Liquidity:

For Liquidity Suppliers:

- LPs earn charges from trades inside their chosen value band. The narrower the band, the higher their share of charges from that section, rewarding precision in choosing value ranges.

- LPs should now strategize on the place to position their liquidity, contemplating market traits and potential value actions.

- Expert LPs can capitalize on anticipated value shifts by inserting liquidity at much less energetic ranges, doubtlessly incomes extra if the market strikes as anticipated.

For Pool Customers:

- Buying and selling inside a concentrated liquidity band leads to much less slippage and extra environment friendly trades, as there's extra liquidity on the particular costs the place buying and selling is going on.

- This focus might result in higher value discovery, reflecting extra precisely the market's valuation of the property inside that vary.

Improved Worth Oracles

Uniswap V3 introduces an enhanced oracle system that gives extra correct and granular value knowledge. These oracles accumulate value info over time, permitting customers and builders to entry historic value knowledge effectively. This function is especially helpful for exterior functions requiring dependable value feeds, like lending platforms or monetary merchandise, enhancing the DeFi ecosystem's total performance and interconnectivity.

Uniswap On Layer-2

Transaction charges on the Ethereum community have been at an all-time excessive within the final 12 months and this has, at instances, made Uniswap unaffordable for a lot of smaller traders on the market. Thus, to counter this, Uniswap V3 can be deployed on a Layer-2 scaling answer referred to as Optimism.

By implementing a Layer-2 Optimistic rollup, Uniswap will profit from the safety of the Ethereum blockchain and revel in higher transactional throughput in addition to scalability.

Uniswap V4

With each new iteration, Uniswap continues to improve and enhance its liquidity swimming pools. The aim has been to maintain refining the expertise of utilizing Uniswap. It could be that Uniswap V1 was a proof of idea that good contracts can help environment friendly on-chain market-making by liquidity swimming pools.

Uniswap V2 improved the expertise by introducing token-token liquidity swimming pools and V4 made these swimming pools considerably capital environment friendly with concentrated liquidity. On June thirteenth, 2023, Uniswap unveiled V4, a whole overhaul of how good contracts handle liquidity swimming pools and customers work together with the Uniswap protocol. There’s a lot to unpack in Uniswap V4. Each change launched has main implications, making it essentially the most important improve the group has pushed to date.

Singleton Contract

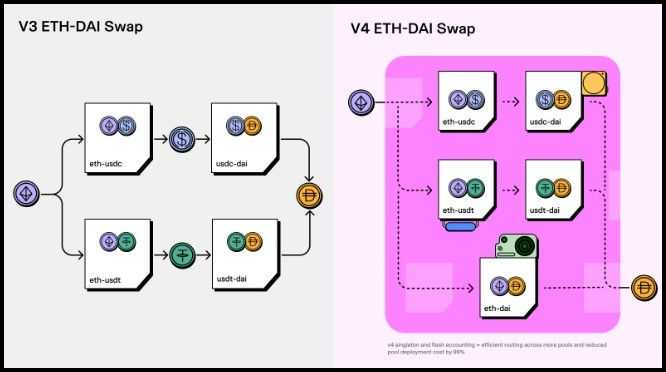

Uniswap V1 launched Manufacturing unit contracts and Trade contracts, the place the manufacturing unit was accountable for deploying distinctive good contracts, every representing a specific liquidity pool. On this system, the manufacturing unit produces mutually unique token swimming pools, every with separate liquidity and requiring the customers to work together with them individually. Such a system is fuel inefficient as a result of cross-pool swaps, involving a number of particular person steps, value important fuel.

Uniswap V4 relieves the Manufacturing unit contract in favor of a singleton contract. Consider the singleton contract as a grasp contract that consolidates all swimming pools inside it. When all of the swimming pools stay underneath the identical contract, cross-pool interactions develop into considerably cheaper. The place such transactions in V3 needed to hop stepwise from one pool to a different, singleton contract allows advanced, multi-step transactions to be executed in a single step, decreasing fuel charges. Singleton contract additionally reduces the fuel value of deploying new swimming pools by 99%.

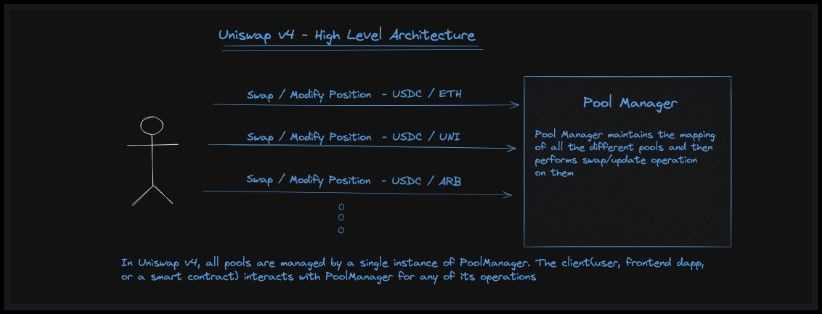

Pool Supervisor

Uniswap V4 introduces the Pool Supervisor, a wise contract that has mapped out all of the swimming pools and acts because the interface between the consumer and the liquidity swimming pools. The pool supervisor is the singleton contract caring for all operations in Uniswap.

Flash Accounting System

Uniswap V4 introduces a novel “flash accounting” system that allows customers to execute multi-step atomic transactions. An atomic transaction entails a number of steps, and the contract ensures that if any step fails to execute efficiently, your entire transaction is reverted.

Due to this fact, it’s going to allow customers to chain collectively a number of transactions, like swap-and-add liquidity, and the protocol will guarantee they’re executed atomically. The protocol reduces the charges for such advanced transactions by making all the inner calculations concurrently and executing solely the ultimate consequence.

Different Updates in Uniswap V4

Uniswap V4 additionally consists of some extra updates, which, whereas not as profound as flash accounting or singleton contracts, are nonetheless important, including as much as enhanced flexibility of the ecosystem. These updates are:

- Limitless Price Tiers: Uniswap V4 introduces limitless charge tiers, providing extra flexibility to accommodate varied property and buying and selling methods. This function permits for custom-made charge buildings for various liquidity swimming pools, enhancing the platform's adaptability to numerous market circumstances and consumer preferences.

- Native ETH Help: The brand new model additionally helps native ETH buying and selling pairs, simplifying transactions by eradicating the necessity to use Wrapped ETH (WETH). This alteration is anticipated to streamline the buying and selling expertise and scale back related prices, making it extra user-friendly and environment friendly.

- Group Pushed Growth: V4 emphasizes community-driven growth, encouraging contributions from customers worldwide. This collaborative strategy fosters innovation, with the group actively taking part in proposing options, figuring out points, and enhancing the protocol, shaping the longer term course of Uniswap's automated market makers.

As of April 2024, Uniswap V4 is underneath growth, with a tentative launch deliberate for Q3 2024.

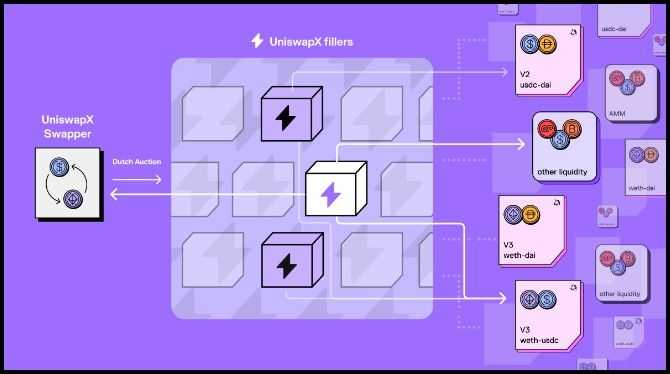

UniswapX

Since its launch in 2018, Uniswap has performed a pivotal position within the development of onchain buying and selling, boasting a staggering $1.5 trillion in buying and selling quantity. Constructing on this legacy, Uniswap is now unveiling UniswapX, a groundbreaking protocol designed to advance onchain buying and selling and facilitate self-custody swapping.

Unveiling UniswapX

- Revolutionary Buying and selling Protocol: UniswapX is a permissionless, open-source protocol primarily based on the Dutch public sale mechanism. It’s designed to optimize buying and selling throughout varied AMMs and liquidity sources.

- Decide-in Beta Launch: The protocol is presently accessible in an opt-in beta model on the Uniswap Labs interface for Ethereum Mainnet, with plans to develop to different chains and the Uniswap app.

Key Options of UniswapX

- Enhanced Worth Effectivity: By aggregating a number of liquidity sources, UniswapX ensures customers get higher pricing for his or her trades.

- Fuel-Free Swapping: Customers can provoke swaps with out incurring on-chain fuel charges, a revolutionary step ahead in decreasing buying and selling prices.

- Safety In opposition to MEV: UniswapX consists of mechanisms to guard customers from Maximal Extractable Worth, guaranteeing fairer transaction outcomes.

- No Price for Failed Transactions: Customers should not penalized financially for transactions that don’t succeed, enhancing the buying and selling expertise.

Future Developments

- Cross-Chain Swapping: UniswapX is about to introduce gas-free cross-chain swaps, additional enhancing its utility and adaptability.

- Routing Optimization: With an evolving panorama of liquidity swimming pools and protocols, UniswapX's revolutionary routing system ensures aggressive pricing and environment friendly commerce execution.

Safety and Governance

- Immutable Sensible Contract: The UniswapX protocol is designed as an immutable good contract, guaranteeing reliability and belief.

- Group-Pushed Governance: UniswapX maintains a protocol charge swap, ruled by Uniswap Governance, reinforcing its community-centric strategy.

Conclusion: UniswapX – Main the Subsequent Wave of DeFi Innovation

UniswapX represents a major leap ahead in decentralized finance, providing a collection of options that improve buying and selling effectivity, scale back prices, and shield customers. With its dedication to innovation, safety, and group governance, UniswapX is poised to redefine the DeFi panorama, persevering with Uniswap's legacy as a trusted chief within the house. There's a complete lot extra within the UniswapX whitepaper.

Uniswap's Regulatory Headwinds

The US Securities and Trade Fee issued a Wells Discover to Uniswap in April 2024.

A Wells discover is a preliminary notification issued by the SEC to point its preliminary resolution to advocate enforcement motion by the fee for securities legislation violations. It outlines the particular violations recognized and presents the person a possibility to reply.

Throughout a press convention, Uniswap COO Mary-Catherine Lader and Chief Authorized Officer Marvin Ammori disclosed that the Wells Discover focuses on allegations of working as an unregistered securities dealer and alternate, in line with CoinDesk. Ammori argued that Uniswap doesn’t match the SEC's definition of an alternate and referenced a beneficial ruling for Coinbase in an analogous case, suggesting optimism for Uniswap's defence in opposition to the SEC's prices.

Sure, I'm pissed off that the SEC appears to be extra involved with defending opaque methods than defending customers. And that we'll must combat a US authorities company to guard our firm and our trade. – Uniswap founder Hayden Adams on X

In a weblog submit, Uniswap argued in opposition to the SEC's stance that almost all tokens are securities, emphasizing that tokens, as a digital file format, inherently maintain varied kinds of worth and should not robotically securities. The platform highlights that almost all of traded tokens, together with stablecoins, group and utility tokens, and commodities like Ethereum and Bitcoin, don’t qualify as securities. Uniswap additionally contends that tokens traded on secondary markets don’t represent funding contracts. The corporate additionally criticizes the SEC for not offering a transparent regulatory pathway for tokens that is likely to be thought of securities to be registered.

I believe freedom is value preventing for. I believe DeFi is value preventing for. – X

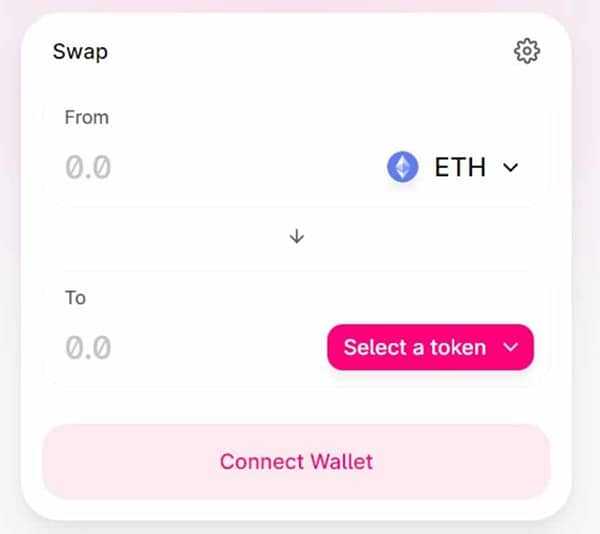

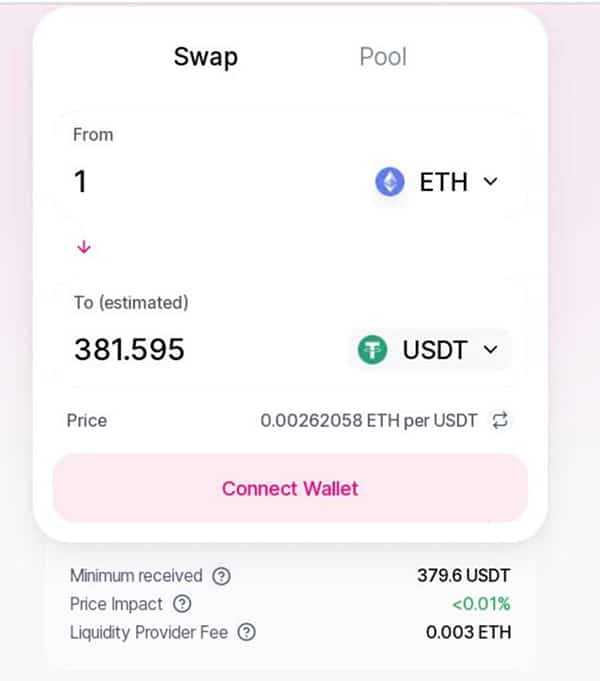

How To Use Uniswap

Uniswap presents a user-friendly interface that permits customers to attach their Metamask, Portis, WalletConnect, Coinbase Pockets or Fortmatic wallets and start buying and selling instantly. Under is a step-by-step information on the way to get began utilizing the Uniswap platform:

- As soon as a pockets is absolutely arrange, customers can go to the official Uniswap web site, click on ‘Launch App’ after which ‘Connect Wallet’.

- Customers can then choose their most well-liked pockets and start utilizing the platform.

- A pop-up will subsequently seem displaying the consumer’s account, and they need to click on ‘next’ and ‘connect’.

- Now that the chosen pockets is linked to Uniswap, customers can start swapping.

- On the swap tab, customers can select the token quantity they want to swap, and if a token shouldn’t be listed they must manually enter the official contract handle of the specified token.

- Uniswap will then present customers with an estimate of the quantity of tokens they are going to obtain after the swap.

- Customers can affirm the swap just by clicking ‘Confirm Swap’.

- After having confirmed the swap, a window will present up with the fuel charge required to execute the transaction.

- As soon as the transaction is accomplished, Uniswap gives customers with a hyperlink to their transaction on Etherscan.

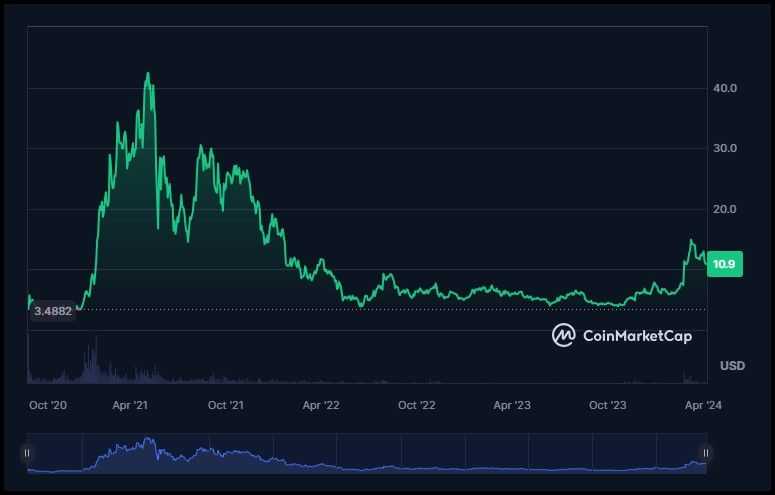

UNI Token

UNI is an ERC-20 token and Uniswap’s native asset. The UNI token acts as a governance token for the Uniswap platform and provides holders the best to vote on new adjustments and developments to the platform, together with how minted tokens must be distributed to the group and builders, in addition to any adjustments to the charge construction.

UNI was created in September 2020 in an effort to stop Uniswap customers from migrating to SushiSwap, which had provided Uniswap customers SUSHI tokens in return for his or her migration. Thus, Uniswap minted 1 billion UNI tokens and determined to distribute them to anybody who had beforehand used the platform. On September 1st, every consumer obtained 400 UNI tokens, equating to roughly $1,400 on the time.

Uniswap obtained backing and investments from heavyweight enterprise capital companies within the blockchain house, akin to Andreessen Horowitz, Paradigm Enterprise Capital, Union Sq. Ventures, and Parafi.

What are Uniswap's charges?

Beginning Oct. 17, Uniswap began charging a 0.15% swap charge, the primary in its historical past, on sure tokens in its internet app and pockets, Founder Hayden Adams introduced on X (previously Twitter). This charge is separate from the Uniswap Protocol charge swap, which is voted on by Uniswap governance.

In April 2024, Uniswap raised the buying and selling charge on its interface to 0.25% from 0.15% for many swaps. Nevertheless, sure transactions like these involving stablecoins or swaps between Ethereum and wrapped Ether stay exempt from this charge enhance. Customers can even keep away from the charge hike by utilizing different interfaces to entry the protocol. Nonetheless, all different trades on the mainnet and supported Layer 2 networks will now be topic to the upper charge, set by Uniswap Labs.

Uniswap Staff

Uniswap was based on November 2nd 2018 by Hayden Adams, a former mechanical engineer for Siemens. Hayden graduated from Stony Brook College with a bachelor's in engineering in 2016 and was deeply impressed by Vitalik Buterin’s 2016 proposal for a Decentralised Trade that will make use of an on-chain automated market maker with sure distinctive traits. Simply two years later, Hayden Adams started engaged on his personal AMM-DEX and has since then develop into the founder and main catalyst of Uniswap.

After receiving a number of funding rounds in addition to a $100,000 grant from the Ethereum Basis, Hayden started increasing his worker base for the Uniswap platform.

The Staff at Uniswap Labs consists of:

- Hayden Adams – Inventor and CEO

- Mary-Catherine Lader – COO

- Justin Wong – Finance

- Deb Bentlage – Token Integration Lead

- Sonal Tolman – Authorized Counsel

- Connor Martin – Technical Liaison

- Emily Williams – Software program Engineer

- Sara Reynolds – Integration Engineer

- Will Hennessy – Product

Conclusion

Uniswap has taken the DeFi house by storm because it presents its customers quite a lot of thrilling and advantageous functionalities, in the end re-architecting the idea of liquidity through its AMM infrastructure.

As a DEX, Uniswap permits customers to swap varied ERC-20 tokens from a easy, user-friendly, all-in-one internet interface that eliminates the numerous bottlenecks typical of different conventional, centralized exchanges, and it moreover incentivizes merchants and builders to offer liquidity to its swimming pools and obtain engaging buying and selling charges. Uniswap has created an revolutionary DeFi structure that’s actually reshaping the method of decentralized on-chain buying and selling.

Continuously Requested Questions

What’s UniswapX?

UniswapX is a permissionless, open-source protocol primarily based on the Dutch public sale mechanism. It’s designed to optimize buying and selling throughout varied AMMs and liquidity sources.

How Does Concentrated Liquidity Work?

In Uniswap V3, concentrated liquidity permits liquidity suppliers to allocate their funds to particular value ranges inside a pool. This implies liquidity is denser the place it is most wanted, enhancing capital effectivity. Suppliers can earn larger charges if trades happen inside their chosen value vary, incentivizing strategic liquidity placement primarily based on market predictions.

What are the Upcoming Updates in Uniswap v.4?

Uniswap V4 plans to introduce limitless charge tiers, enabling extra tailor-made charge buildings for various liquidity swimming pools. It would additionally help direct buying and selling pairs with native ETH, simplifying transactions. Moreover, V4 emphasizes community-driven growth, encouraging consumer contributions to its open-source protocol and enhancing its performance and inclusivity.

What’s the Utility of UNI Token?

The UNI token serves a number of functions within the Uniswap ecosystem. It grants governance rights, permitting holders to vote on key protocol choices, together with upgrades and treasury administration. UNI additionally performs a task in incentivizing participation within the platform’s growth and operation, contributing to its decentralized governance construction.

Can You Carry out Cross-chain Transactions on Uniswap?

Presently, Uniswap operates on the Ethereum blockchain and doesn’t natively help cross-chain transactions. Nevertheless, with the introduction of UniswapX and different developments, there are plans to facilitate cross-chain swaps, enabling customers to commerce property throughout completely different blockchain networks seamlessly, enhancing Uniswap’s interoperability and utility.