Two fundamental principles exist in Web3: Bitcoin is the ultimate store of value, while Ethereum is the decentralized finance hub. This has led to people calling Bitcoin "digital gold" Ethereum is the biggest cryptocurrency "decentralized computer" Internet. The networks have different purposes. Bitcoin’s limitations are meant to make it better at preserving its value. Ethereum, on the other hand, allows for seamless exchange of value and programability through smart contracts.

However, users have always tried to get the best of worlds – leveraging Bitcoin's value within Ethereum's DeFi ecosystem. This demand inspired the Wrapped Bitcoin, a system that creates an ERC-20 token counterpart of Bitcoin so it is compatible with Ethereum-based decentralized applications (DApps). This interoperability between the two networks has made wrapped Bitcoin an essential tool for anyone looking to unlock the value of Bitcoin within Ethereum's DeFi landscape.

This article will explain what Bitcoin is, how it functions, and the benefits of using Bitcoin. We’ll also discuss its place in an ever-evolving Web3 ecosphere.

Wrapped Bitcoin: What Is It?

Web3 is a collection of diverse blockchain networks that are constantly expanding. Each network operates independently, using its own set of unique nodes. The networks are isolated but still communicate with each other and confirm transactions. This isolation ensures that no external interference can compromise the network's security, as each blockchain upholds its own rules and mechanisms.

This separation does have a downside, however, and while it increases security, the result is a fragmentation of liquidity. Bitcoin and other blockchain assets are not able to interact natively with Ethereum or applications on that network. This means that despite Ethereum's growing decentralized finance (DeFi) sector, Bitcoin's liquidity remains locked within its own ecosystem, limiting its use to a single chain. Users cannot move assets seamlessly across blockchains without bridging the divide. This reduces their utility and engagement.

Bridges for Connecting Liquidity in the Interchain

The need for cross-chain asset movement has led to the development of wrapped tokens. Wrapped Tokens are synthesized versions of native assets, designed to work on different blockchains from their original networks. The process involves securely locking the original tokens—like Bitcoin—on their source blockchain. The tokens, which are usually locked in a smart contract but do not have an execution layer on Bitcoin, are kept by a custodian. This locked asset’s proof is sent on to the target chain, and an equivalent number of tokens wrapped to represent it is created.

This method allows the asset's value to be transferred across chains without losing integrity. Wrapped tokens, in essence, are pegged to the same value as the original token. The wrapped version of the token can then be converted into the asset. Wrapped tokens are a great way to allow assets to communicate with DApps on Ethereum networks that would be otherwise inaccessible. The process minimizes risks such as double spending, which can occur if assets are replicated across chains without proper safeguards.

Wrapping Bitcoin

Wrapping Bitcoin allows the asset's use outside the Bitcoin network, allowing BTC holders to participate in DeFi activities like trading, lending, and yield farming while also benefiting from the price action of BTC. Wrapped Bitcoin has been created by several projects. These are some of the most notable:

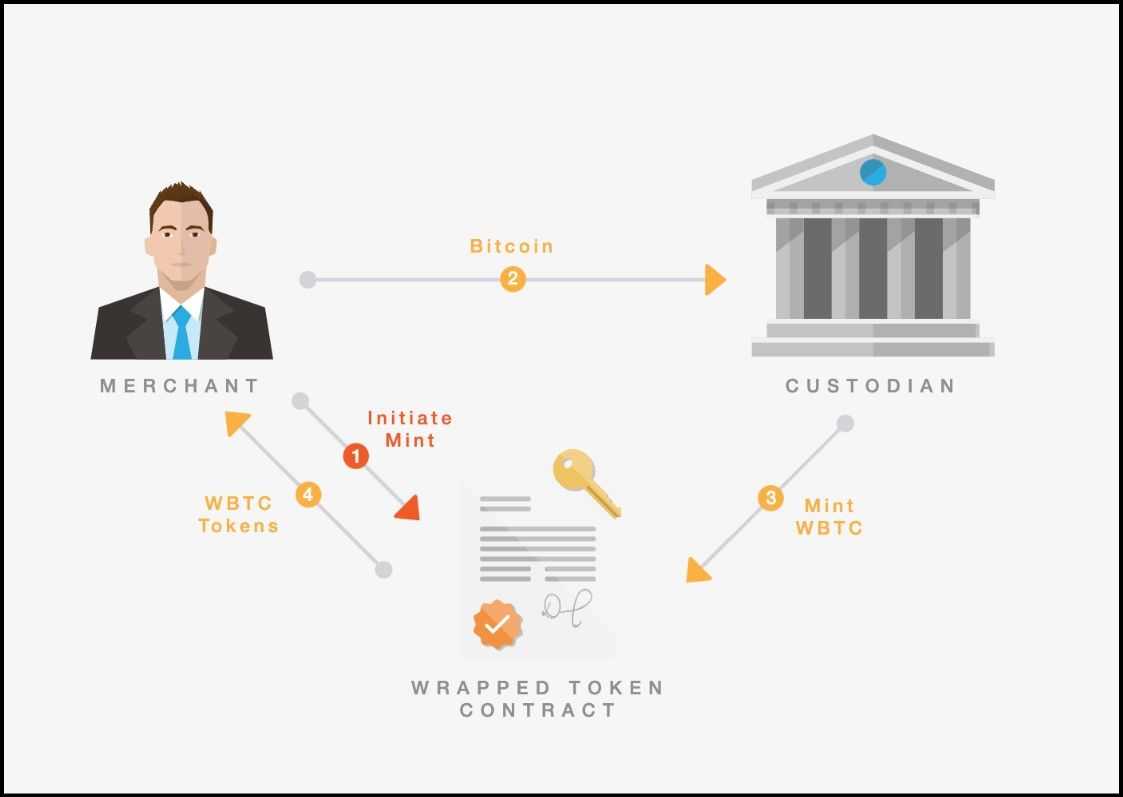

- Wrapped bitcoin (WBTC) Wrapped Bitcoin is an ERC-20 Token that integrates Bitcoin in the Ethereum Ecosystem. This allows BTC owners to take part in Decentralized Finance (DeFi). By converting Bitcoin into WBTC, users can engage in trading, lending, yield farming, and more within Ethereum's vast network of decentralized applications, all while maintaining Bitcoin's value. WBTC has a 1:1 peg to Bitcoin. This ensures that every WBTC is backed up by the same amount of Bitcoin.

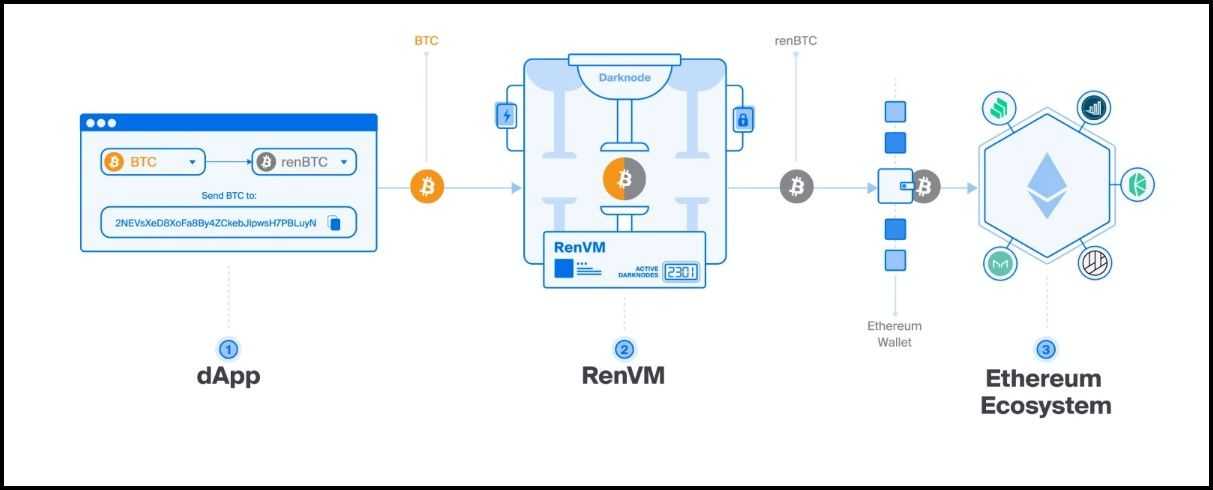

- renBTC: Issued by the Ren Protocol, renBTC offers a decentralized approach to Bitcoin wrapping. Unlike WBTC that relies on a custody service, renBTC’s management is done through RenVM. RenVM is a decentralized, network-based node system which facilitates interoperability across chains. The decentralization of renBTC reduces reliance upon a single service provider, thereby enhancing security. However, renBTC's process has its own risks, particularly in terms of smart contract vulnerabilities.

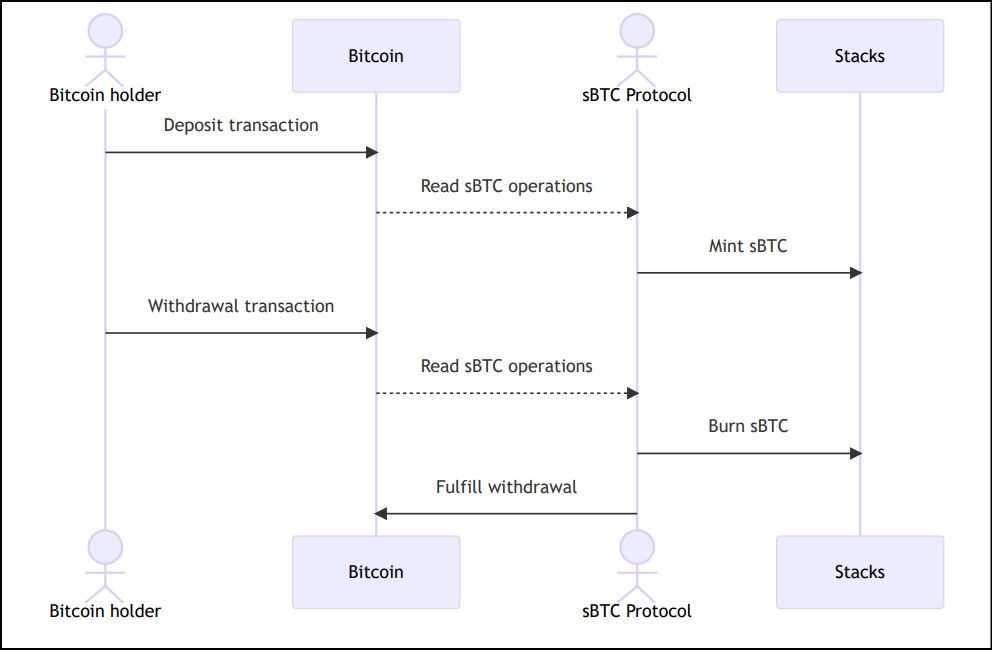

- Stacks BTC: A newer entry in the space, sBTC is part of the Stacks protocol, which aims to bring smart contract functionality to Bitcoin. Unlike traditional custodial services, sBTC enables a secure two-way system that allows Bitcoin to be moved into or out of Stacks while remaining protected by its blockchain. This setup unlocks new possibilities, such as DeFi applications and smart contracts for Bitcoin, while maintaining Bitcoin's simplicity.

These different versions of wrapped Bitcoin serve the same purpose—unlocking the value of Bitcoin within other blockchain ecosystems—but each takes a different approach to security, decentralization, and use cases. Wrapped Bitcoin can be used in a variety of ways, including custodial BTC (WBTC), trustless peg system (sBTC) or decentralized BTC (renBTC).

Through these innovations, Bitcoin's liquidity and utility can be extended far beyond its native blockchain, opening doors to a range of decentralized applications without sacrificing the core value and security that Bitcoin provides.

Is Bitcoin Wrapped Safe?

Wrapped Bitcoin’s safety is largely dependent on how it was wrapped and what protocols were used. The following is an evaluation of the security aspects of three popular wrapped Bitcoin tokens, WBTC renBTC and sBTC.

Wrapped Bitcoin, or WBTC for short, is an wrapped asset that relies on custodians to hold Bitcoin in reserve. Its safety depends upon the reputation of those custodians. They are in charge of locking Bitcoin into secure vaults, and issuing WBTC equivalents on the Ethereum Blockchain.

renBTC is based on the RenVM protocol. This protocol uses a network of Darknodes, a distributed decentralized node. The nodes manage the locking and coining of the renBTC together, thus reducing the dependency on a singular entity. Darknodes are centralized and have smart contract vulnerabilities.

sBTC from the Stacks protocol is a more recent form of wrapped Bitcoin. This newer version takes a distrustless approach by offering decentralized custody, without intermediaries. Using a two-way peg system, sBTC enables Bitcoin to move in and out of the Stacks network while being secured by Bitcoin's own blockchain. Stacks provides a trustworthy approach. However, the scope for sBTC remains limited to the Stacks protocols.

Wrapped Bitcoin is safe, but it depends on which protocol you use.

- WBTC: Centralized custodians may be widely accepted and liquid but can also pose trust and counterparty risk.

- renBTC: Decentralized, but vulnerable to recent concerns about governance and smart contracts.

- sBTC: Trustless and anchored to Bitcoin's security but limited to the Stacks network, which restricts its broader DeFi use.

Security, decentralization, usability, and other factors are all considered when evaluating the wrapped Bitcoin options. Users who want to use wrapped assets with DeFi must be aware of these risks.

Wrapped Bitcoin vs. Bitcoin

When considering whether to use Wrapped Bitcoin (WBTC) or original Bitcoin (BTC), the choice largely depends on your specific use case and goals within the blockchain ecosystem. The two forms of Bitcoin have different uses and advantages depending on the goal. The following comparison will help to guide you in choosing the right option.

Wrapped Bitcoin is a great option for anyone.

- Wrapped Bitcoin is ideal for those looking to utilize Bitcoin's liquidity in decentralized applications (DApps) and DeFi platforms on the Ethereum network. It allows users to take advantage of Bitcoin's value while enjoying the flexibility of Ethereum's ecosystem.

- DeFi participants: If you're looking to participate in yield farming, liquidity provision, or borrowing/lending on decentralized finance platforms like Aave, Curve, or Uniswap, WBTC is the better choice. You can use your Bitcoin in the Ethereum ecosystem without selling it for Ether or other tokens.

- WBTC provides a more effective and efficient trading method for Bitcoins at Ethereum-based DEXs. Transaction speeds on Ethereum are generally faster than on Bitcoin, and WBTC can seamlessly integrate with various DEXs and other DeFi protocols.

- Developers building on Ethereum: For developers creating decentralized applications or smart contracts on Ethereum that require Bitcoin's liquidity, WBTC is a natural fit since it behaves as an ERC-20 token, making integration smoother within the Ethereum ecosystem.

Original Bitcoin is for Who?

- The original Bitcoin is the best option for those with a long-term holding period and who value the Bitcoin core principles: decentralization and immutability, as well as security. Bitcoin's value as a store of wealth is unmatched, and its robust security infrastructure makes it ideal for holding and transacting large amounts of value.

- Long-term HODLers: If your primary goal is to hold Bitcoin as a store of value or a hedge against inflation, there's no need to convert it to wrapped versions. Bitcoin's security and decentralized nature make it one of the safest assets to hold in the long term.

- Users looking for security: Since Bitcoin's blockchain has never been compromised, those prioritizing maximum security over other features should continue using the original Bitcoin. Its extensive hashrate and decentralized nature ensures it is the most secure blockchain network.

- Making transactions on Bitcoin's network: If you're using Bitcoin for peer-to-peer transactions or as a payment method, using BTC directly makes more sense. Wrapped versions like WBTC, while useful for DeFi, are designed for different purposes and require trust in custodians.

Description of the Use Cases

| Wrapped Bitcoin WBTC | Original Bitcoin (BTC). |

| DeFi is a form of lending, borrowing and yield farming. | Holding long-term as a value store |

| Trade Ethereum-based DEXs such as Uniswap | Peer-to peer transactions are secure |

| Ethereum smart contracts and DApps | Transfers and storage with high-security |

| Bitcoin has lower transaction fees and faster speeds. | Backed by Bitcoin's full hash power and network security |

In summary, Wrapped Bitcoin provides enhanced utility for DeFi users and traders who want to leverage Bitcoin's value in the Ethereum ecosystem. On the other hand, original Bitcoin remains the gold standard for security and long-term wealth preservation. You should consider your specific requirements and goals when making a decision between these two options.

How can I buy WBTC currency?

If you're looking to acquire Wrapped Bitcoin (WBTC), there are two primary methods:

1. Bitcoins can be used to Mint WBTC

The first way to acquire WBTC is to deposit Bitcoin (BTC) with a custodian who mints an equivalent amount of WBTC on the Ethereum blockchain. The process requires working with custodians and merchants to wrap Bitcoin.

- Process of the custodian: You deposit your BTC with a trusted custodian, such as BitGo, which then locks the BTC in reserve. WBTC is given to you on the Ethereum Network in return.

- Minting WBTC The custodian will then mint WBTC tokens that are 1:1 correlated to the BTC deposited. This option is typically used by institutions or traders looking to convert significant amounts of BTC into WBTC for use in DeFi.

It is ideal for large scale transactions and requires trusting the custodian.

2. Buy WBTC at Decentralized Exchanges

The second and more user-friendly option is to buy WBTC directly from decentralized exchanges (DEXs) or centralized exchanges (CEXs) where WBTC is listed. It is quicker for those who want to buy WBTC immediately and avoids the need to deposit Bitcoin at a custodian.

- Ethereum Decentralized Exchanges:

- Uniswap is one of the biggest DEXs available on Ethereum. It offers liquidity pools that allow users to swap Ether or ERC-20 tokens (other than WBTC) for WBTC.

- SushiSwap is a popular option to Uniswap. It allows trading of WBTC with DeFi assets.

- Curve Finance: Known for stablecoin swaps, Curve also lists WBTC pools, often paired with stablecoins like USDC or DAI, for efficient swaps.

For these platforms to buy WBTC, you will need an Ethereum wallet compatible with the platform (such as MetaMask), a trading pairing (such ETH/WBTC) and then you can execute the exchange.

Overview of Available Options

- Mint WBTC BTC can be deposited with a custodian for larger amounts.

- Purchase WBTC using DEXs Use platforms like Uniswap, SushiSwap, or Curve Finance to swap tokens for WBTC.

Using either method, you can quickly and securely acquire WBTC for use in Ethereum's DeFi ecosystem.

The Wrapped Bitcoin: Final Thoughts

Wrapped Bitcoin is an excellent example of the way blockchain technology bridges gaps between ecosystems, creating a more accessible and interconnected financial system. By allowing Bitcoin to participate in Ethereum's decentralized finance (DeFi) applications, wrapped tokens like WBTC, renBTC, and sBTC unlock new opportunities for users to leverage their Bitcoin holdings in previously impossible ways.

The underlying technology that makes all of this possible is blockchain composability, which allows different networks to interact and communicate seamlessly. Wrapped tokens are among the many innovations driving blockchain's integration, making decentralized finance more accessible and efficient for users of all backgrounds.

DeFi is growing, and the innovation around wrapped assets can play an important role in breaking the silos that exist between the blockchains. This will give users greater flexibility over their financial transactions.

Common Questions

Wrapped Bitcoin: What Is It?

Wrapped Bitcoin is an ERC-20 Token that represents Bitcoin in the Ethereum blockchain. This allows Bitcoin owners to utilize their BTC within Ethereum’s Decentralized Finance (DeFi). Users can convert Bitcoin to WBTC and participate in decentralized apps (dApps) based on Ethereum. WBTC has a 1:1 backing of Bitcoin that is held in reserve. This ensures its value stays pegged to BTC. This interoperability allows Bitcoin holders to tap into Ethereum’s liquidity while retaining the value of their Bitcoin.

What is the best way to wrap Bitcoins?

Users can wrap Bitcoin by either buying WBTC from a decentralized exchange or minting WBTC through a deposit of BTC at a custodian. To mint, Bitcoin must be sent to the custodian. He will lock it up in reserve while minting an equal amount of WBTC using Ethereum. This method can be used in large transactions, but requires that the custodian is trusted. Users may also choose to buy WBTC by trading other tokens in exchange for WBTC on decentralized platforms like Uniswap, SushiSwap, or Uniswap. It is a more convenient and faster option.

What is the difference between wrapped Bitcoin and Bitcoin?

Wrapped Bitcoin (WBTC), and Bitcoin (BTC), are not identical, even though both represent the exact same underlying values. WBTC operates on Ethereum’s blockchain and allows users interact with Ethereum DApps. WBTC, on the other hand, is used to trade, lend, and participate in DeFi. BTC, however, is protected by its own native blockchain, which is primarily used as a means of storing value. WBTC maintains a 1:1 peg to BTC, but it relies on custodians to manage the underlying Bitcoin.