The race to scale Ethereum is heating up. Over the crypto winter, layer 2 options have overcome important technological hurdles, and we’re experiencing a growth within the variety of layer 2s accessible.

A subject restricted to state channels, plasma chains, and application-specific rollups is now dominated by general-purpose rollups like Arbitrum, Optimism, and zkSync. Lately, Coinbase has additionally joined the race with Base, and extra gamers are anticipated to enter, together with Polygon with a number of efforts and Scroll with their zkEVM. Much less-hyped gamers like StarkWare are additionally transport tech upgrades at an outstanding tempo.

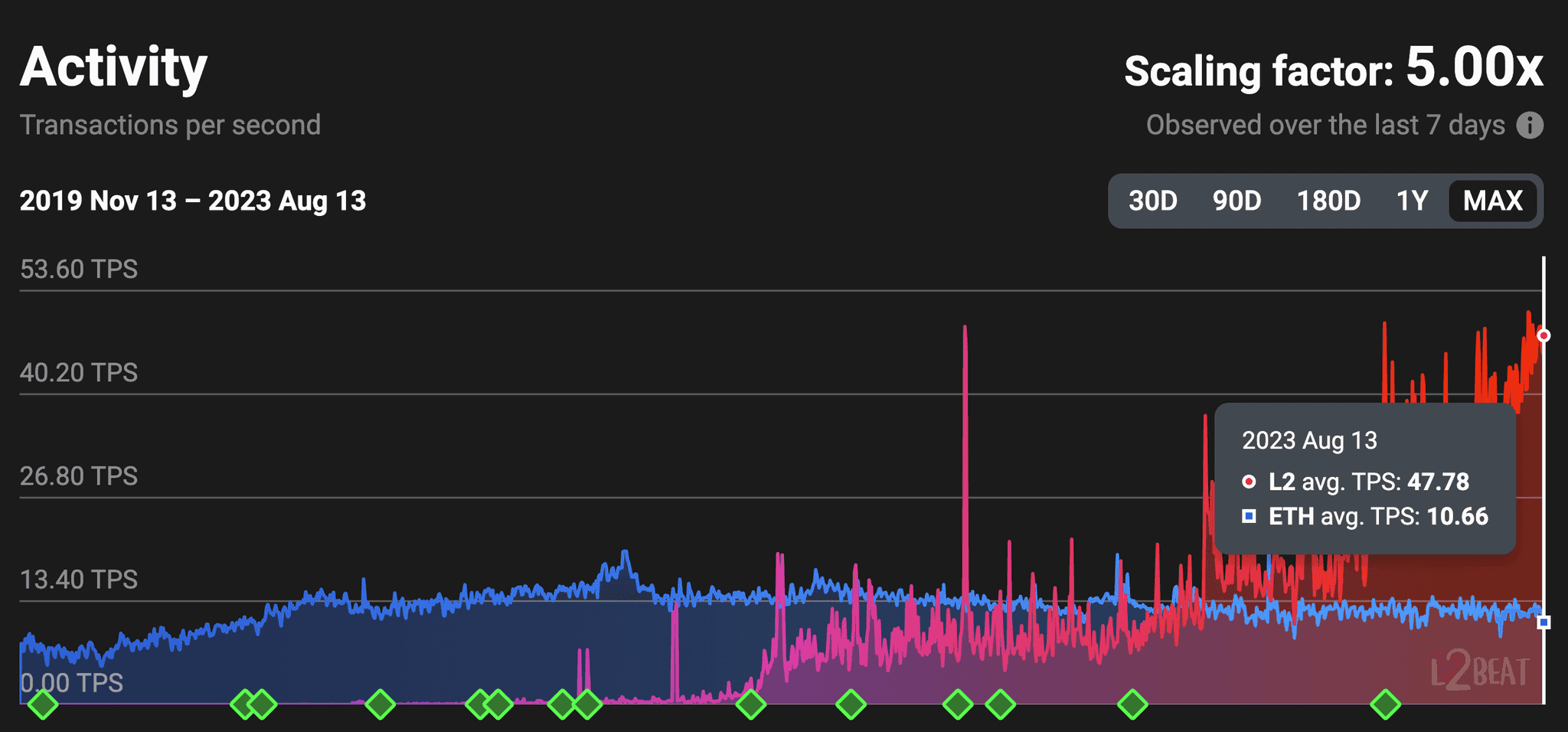

Customers proceed to flock to layer 2s motivated by decrease transaction charges, quicker speeds, flourishing dapp ecosystems, and the potential for airdrops. In lower than a yr, layer 2s have gone from processing fewer transactions than the Ethereum mainnet to 5 instances the variety of transactions.

Much like general-purpose layer 1 blockchains, the place just a few winners have taken the most important slice of the cake, we are going to possible see the identical taking place in rollups. I’m assured on this prediction as a result of the technological variations between rollups are distinguished, so some architectures and implementations will reign over others. Do you need to know who will win?

On this article, we are going to cowl the necessities that you must learn about layer 2 options, the main rollups intimately, and the options that may make a layer 2 superior to others.

Why are Layer 2 Options Crucial?

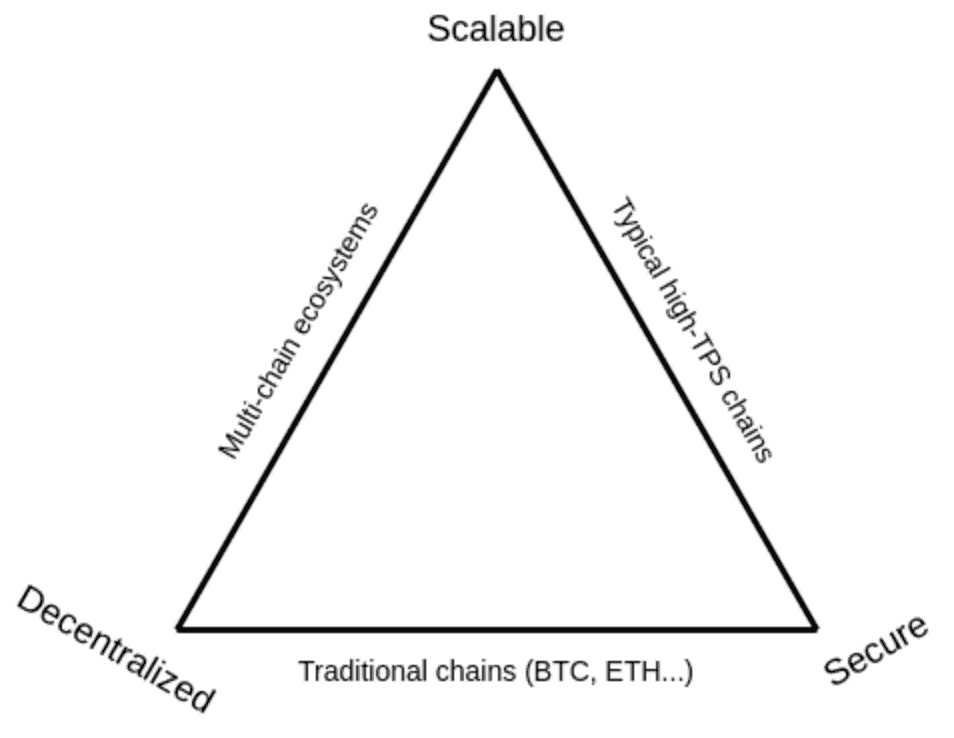

Early blockchain networks equivalent to Bitcoin and Ethereum are restricted in transaction throughput. That is for a superb purpose as these networks have been designed with a concentrate on safety and decentralization. Reaching the three most fascinating pillars – scalability, safety, and decentralization – concurrently is notoriously difficult, an engineering drawback referred to as the blockchain trilemma.

Scalability, Safety, and Decentralization Tradeoffs

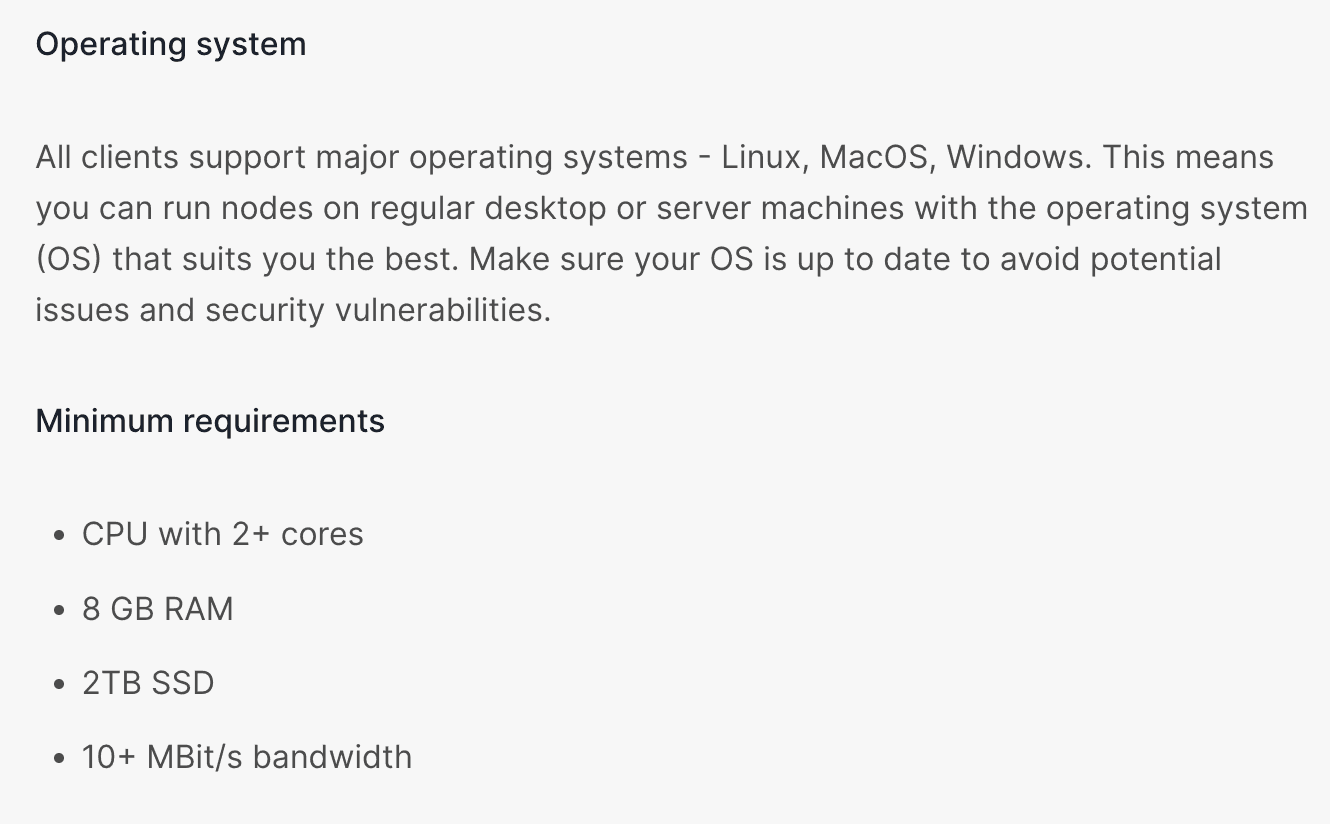

Current high-throughput blockchains like Solana require substantial {hardware} capabilities to accommodate their processing calls for. Consequently, fewer well-resourced members would possibly run nodes, doubtlessly resulting in energy focus and making the community extra vulnerable to manipulation and majority assaults.

On the opposite facet of the blockchain trilemma, {hardware} necessities to run an Ethereum node are comparatively low, with community nodes in a position to run on consumer-grade {hardware}. This mannequin encourages a extra decentralized and strengthens safety.

Nonetheless, Ethereum's intentional design selection has led to a compromise on scalability. It might deal with a most of ≈30 transactions per second, notably lower than Solana's theoretical 65,000 most. This limitation has posed challenges because the blockchain's use instances and consumer base have expanded.

The Early Indicators for the Necessity of Layer 2s

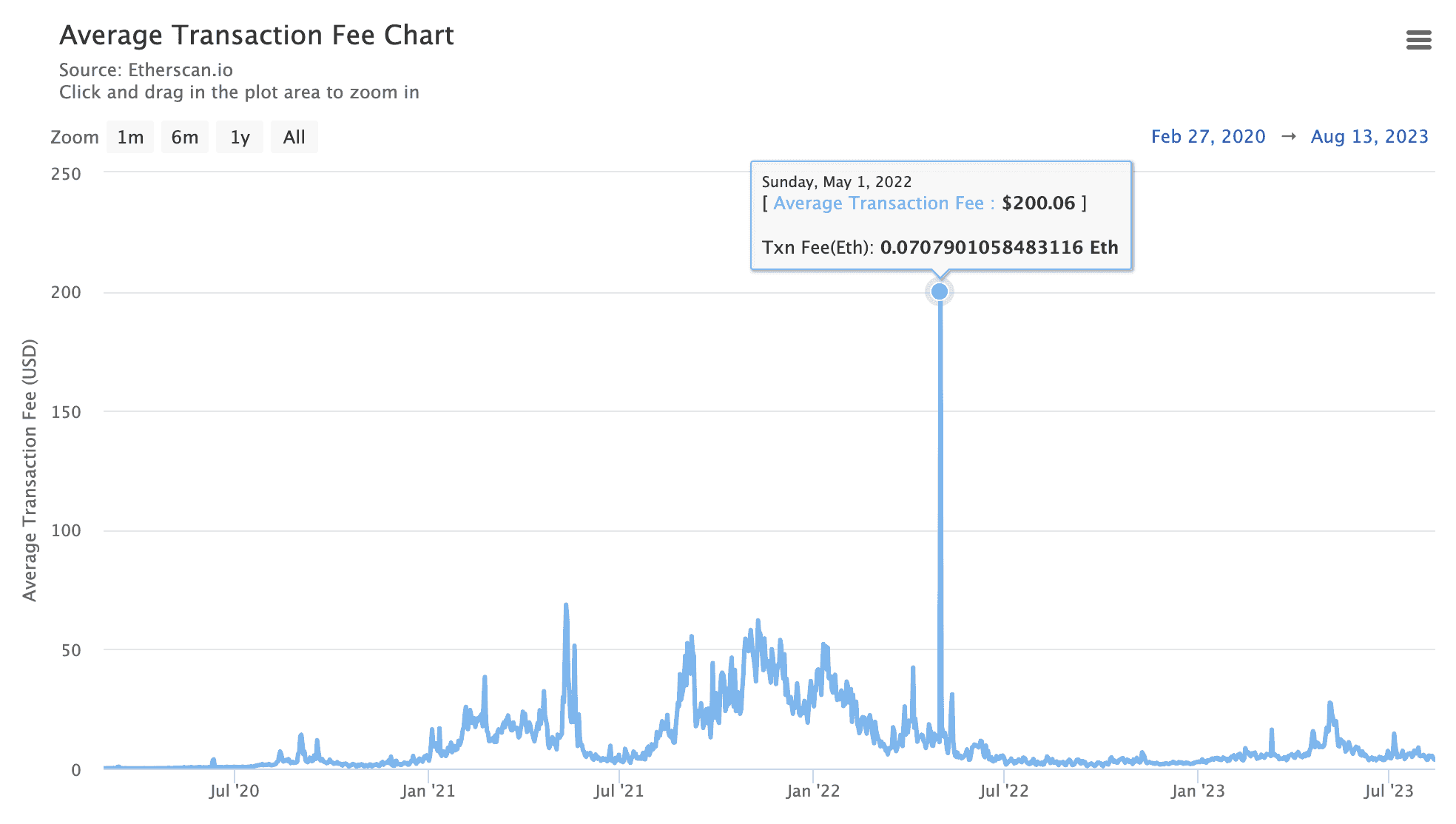

As blockchain expertise matured and use instances diversified past peer-to-peer transactions, Ethereum's scalability limitations grew to become extra obvious. When CryptoKitties, a preferred recreation on the Ethereum blockchain, went viral in 2017, transaction charges and ready instances rose considerably.

This was a wake-up name for the business. It demonstrated that for blockchain networks to help numerous customers and complicated decentralized functions, they want to have the ability to course of transactions a lot quicker and supply decrease charges. After the 2021 bull run, the urge grew to become much more obvious. Ethereum transaction charges soared, peaking at greater than $200.

This necessity offers rise to layer 2 options, which goal to deal with scalability challenges whereas sustaining excessive safety.

What are Layer 2 Options?

Layer 2 options are frameworks constructed on prime of an present layer 1, like Ethereum, and goal to boost the blockchain in some form or type. Layer 2s at this time enhance transaction throughput and velocity by processing transactions exterior the primary Ethereum chain, thereby offloading computational work and scaling the community.

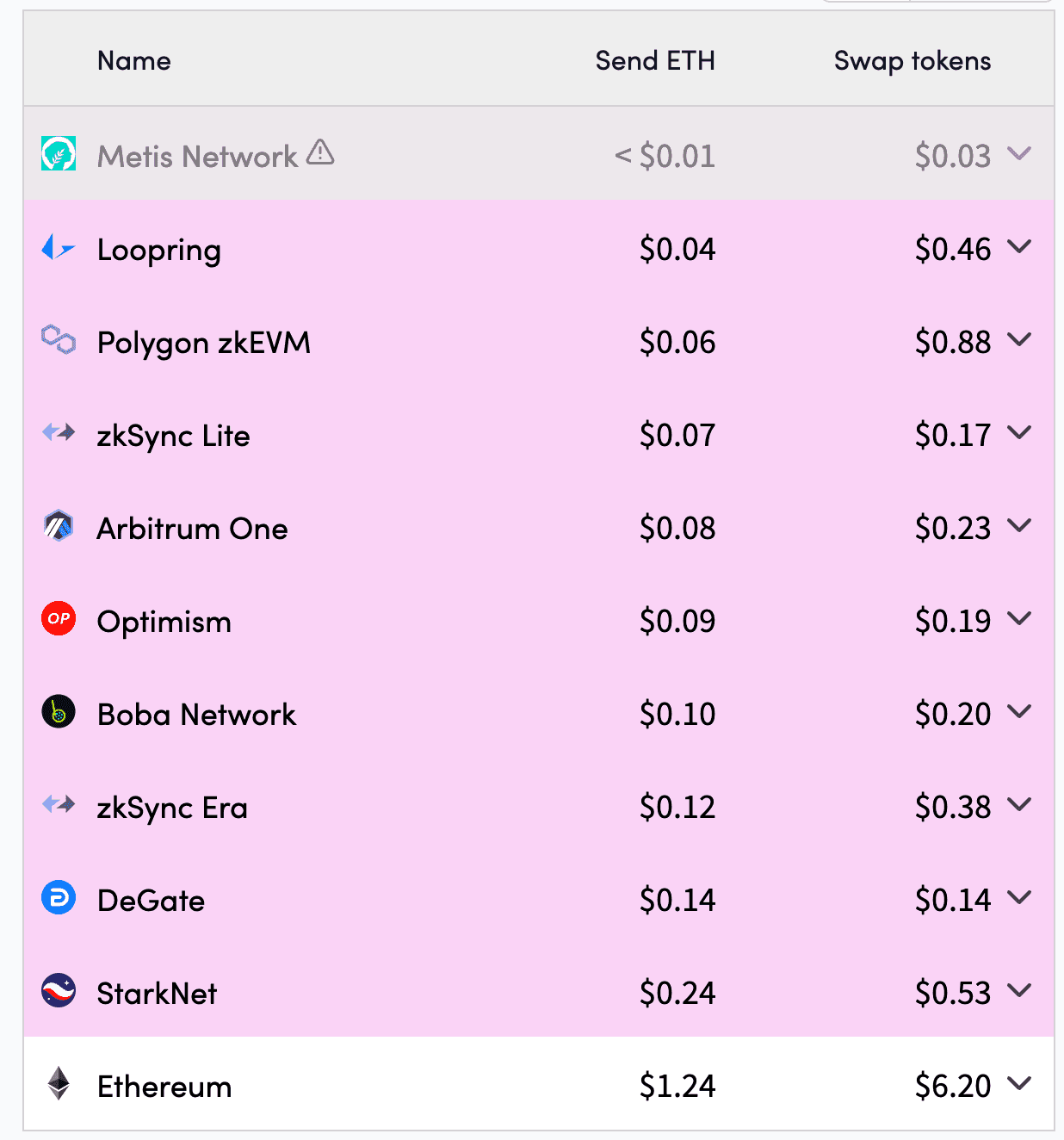

The scaling layer 2 options offered are important, providing a lot quicker and cheaper transaction charges and making blockchain expertise accessible to tens of millions of customers that might in any other case discover charges prohibitive. As an illustration, sending ETH from one deal with to a different utilizing Optimism would price a consumer 0.09$, in comparison with 1.24$ on the Ethereum Community.

A Key Distinction: Why Polygon Proof-of-Stake is Not a Layer 2

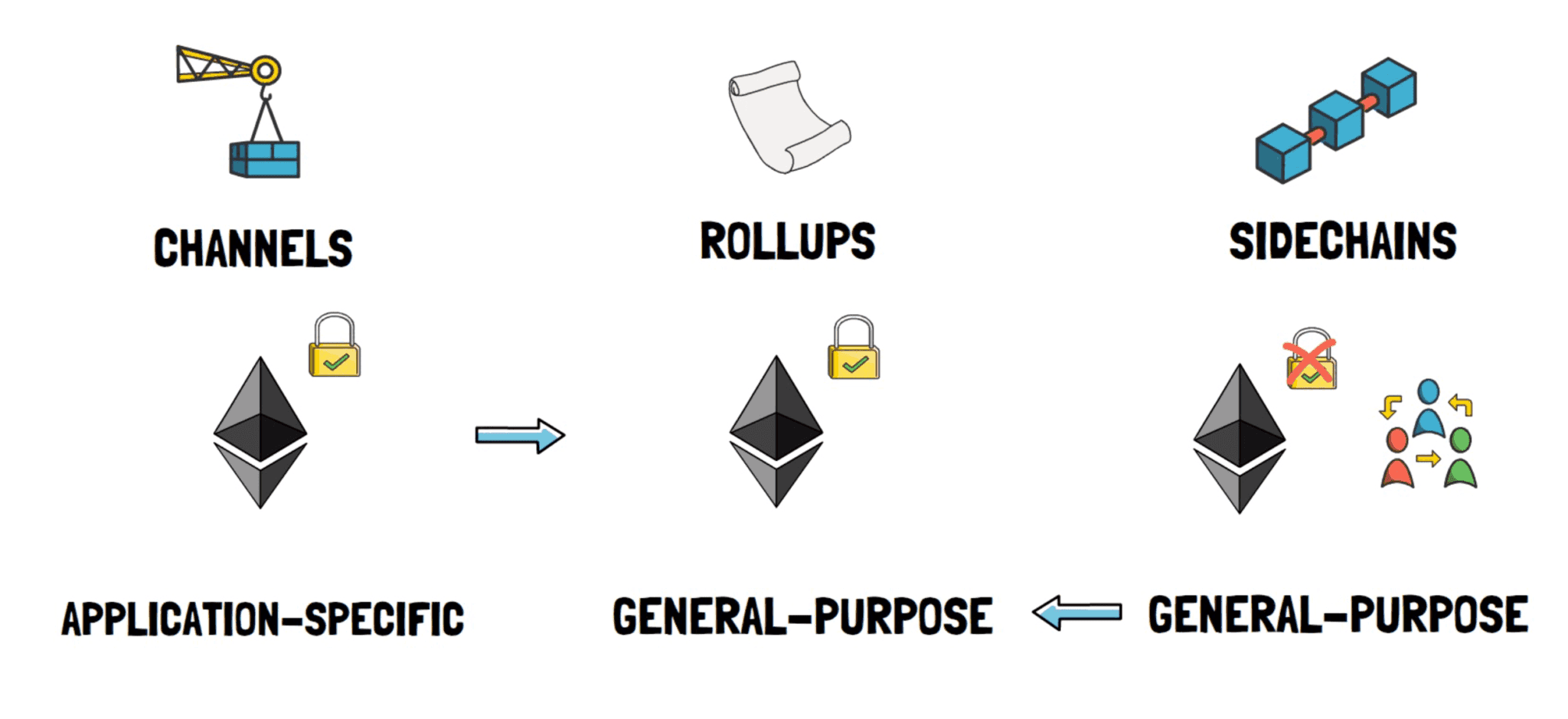

Polygon's Proof-of-Stake (PoS) chain is commonly related to layer 2 options due to its excessive throughput and ease of bridging to Ethereum. Nonetheless, as a result of its safety mannequin, it's not technically a layer 2.

Not like layer 2 options, which derive their safety immediately from Ethereum's consensus protocol, Polygon's PoS chain operates with its personal consensus mechanism and set of validators. This makes it a sidechain, a separate blockchain that runs parallel to the primary one, with its safety assumptions and guidelines, and never a layer 2.

As we speak's Rollup Centric Layer 2 Panorama

The layer 2 panorama at this time is more and more specializing in a sort of layer 2 referred to as a “rollup,” as they’ve turn out to be essentially the most interesting answer to the scalability challenges. Engineers have developed rollups to help Ethereum dapps with minimal-to-no code adjustments, one thing unattainable with different layer 2 options like cost channels.

How do Rollups Scale Ethereum?

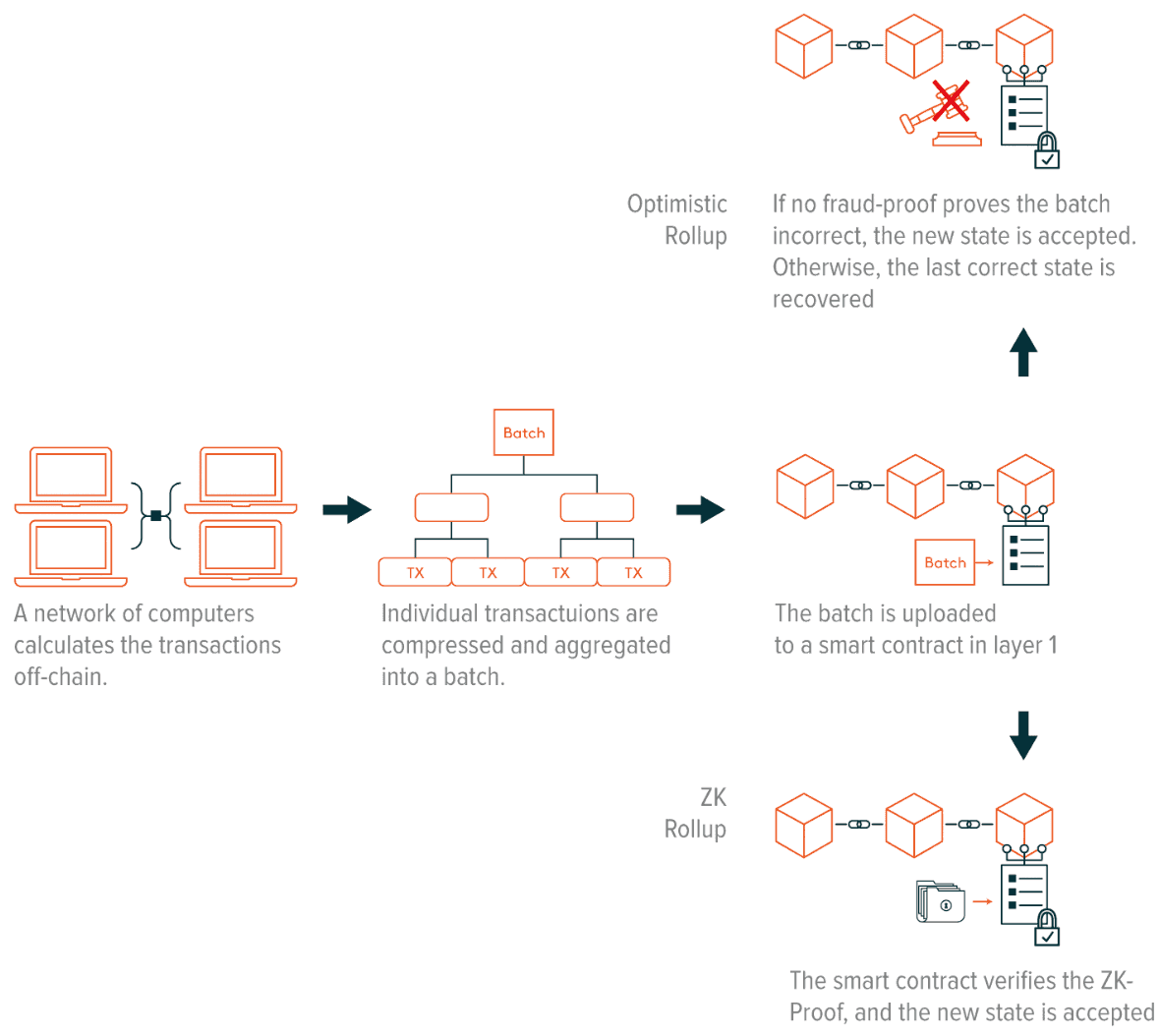

Rollups scale Ethereum by shifting computation off chain, therefore offloading the primary chain. In rollups, transactions are processed off-chain, after which information is compressed and uploaded to Ethereum in a batch containing mandatory transaction information and the brand new rollup state.

The ultimate and complex half is proving to Ethereum that the brand new state is legitimate. That is finished by way of fraud proofs or validity proofs, relying on whether or not the rollup is Optimistic or zero data. The gasoline charges for importing the required information for a number of off-chain transactions and verifying both sort of proof are less expensive than doing the unique computation on the Ethereum community, so the ensuing system dramatically will increase the transaction throughput and reduces prices.

The result’s a system that solves Ethereum's scalability points with strong safety ensures. Safety is maintained because the state of the rollup is on the market within the Ethereum community, which means customers all the time have the knowledge essential to confirm transactions.

The Main Layer 2 Options

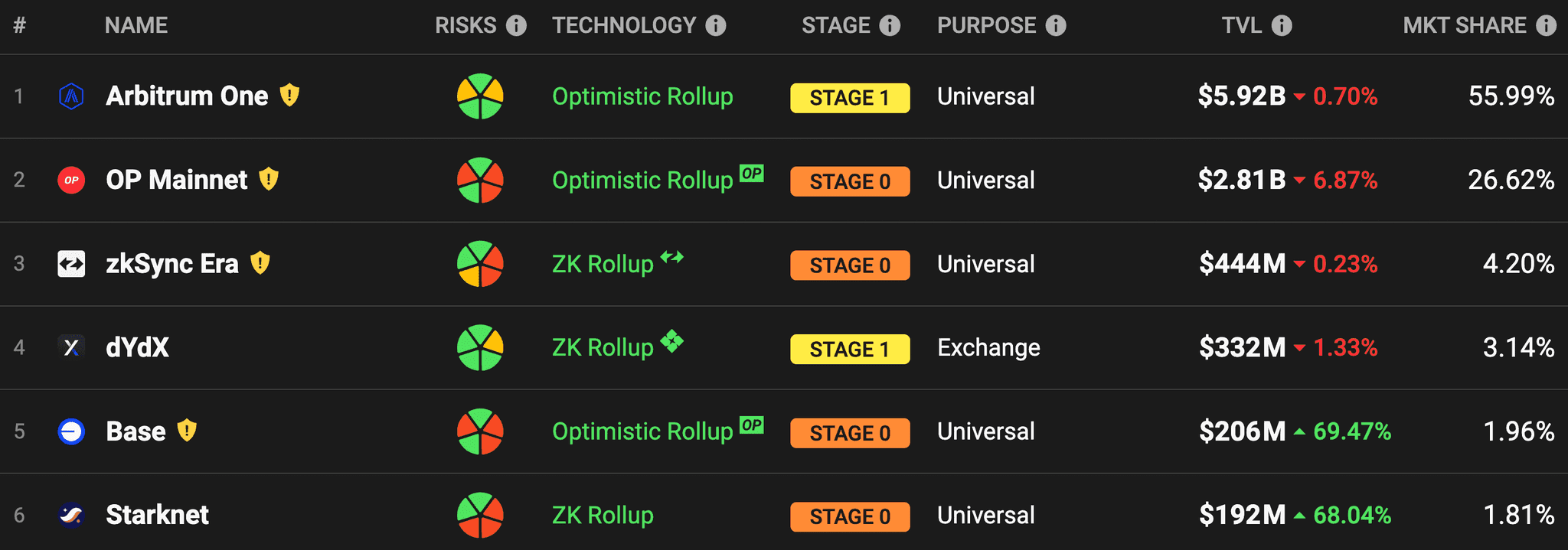

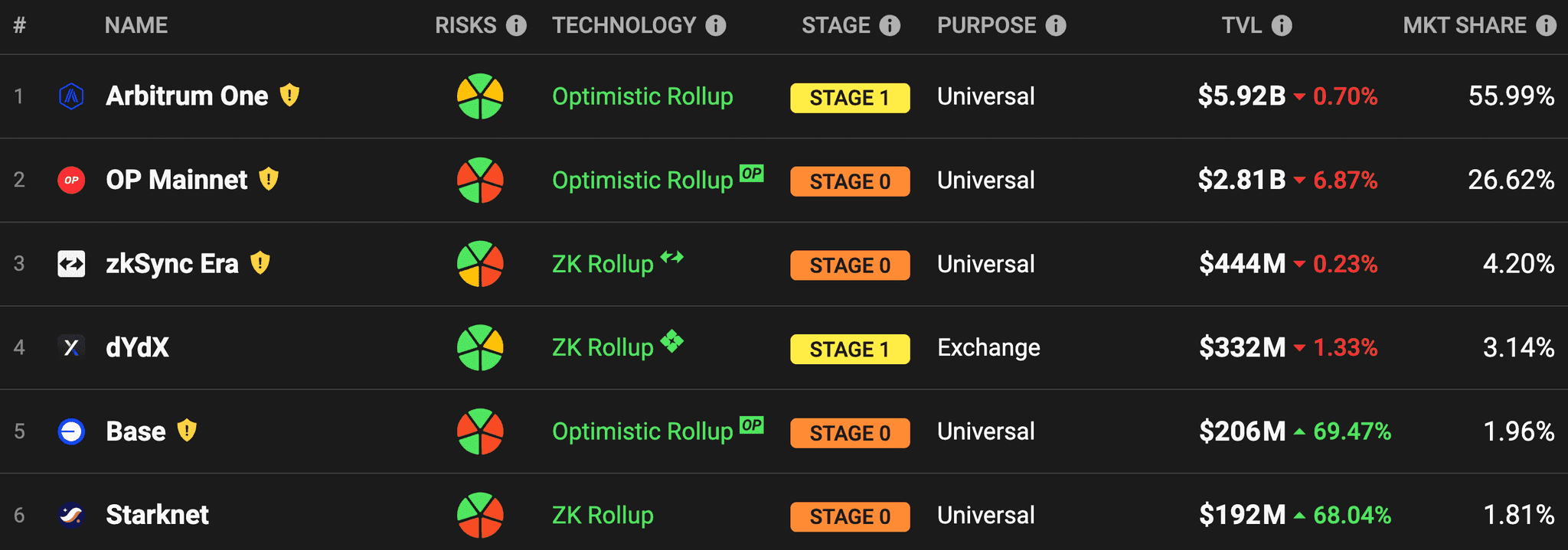

Gamers like Arbitrum, Optimism, zkSync, and Base lead the rollup-centric panorama. The main rollups ranked by whole quantity locked are proven under:

Arbitrum: The Most Mature Rollup

Arbitrum was launched to the general public on August thirty first, 2021, and have become the primary rollup to help the permissionless deployment of good contracts. As the primary optimistic rollup that supported Ethereum dapps with just about no coding work, DeFi in Arbitrum proliferated and is at this time's main layer 2 by whole quantity locked, in addition to probably the most extraordinary DeFi ecosystems in the entire of crypto.

The expansion of the Arbitrum ecosystem has been coordinated by the Arbitrum decentralized autonomous group (DAO) because the distribution of the ARB token on March twenty third, 2023. The Arbitrum Basis, a Cayman Islands basis firm, stewards the ArbitrumDAO. Offchain Labs, a blockchain improvement firm is in command of upgrading the community.

Arbitrum Governance

Arbitrum follows an on-chain governance mannequin that provides the DAO possession of the chain to develop the Arbitrum ecosystem and encompasses a “Security Council” with veto powers.

ARB token holders vote on DAO governance proposals, the place a person's voting energy is proportional to the variety of tokens held.

Though DAOs can not immediately make protocol adjustments, fast motion could also be mandatory in emergencies like a safety vulnerability. That is the place the Safety Council suits. The Council, composed of 12 revered neighborhood representatives, is tasked with sustaining chain safety and appearing rapidly throughout safety emergencies. The Arbitrum DAO governs the Safety Council, holding elections twice yearly.

The Arbitrum Token: ARB

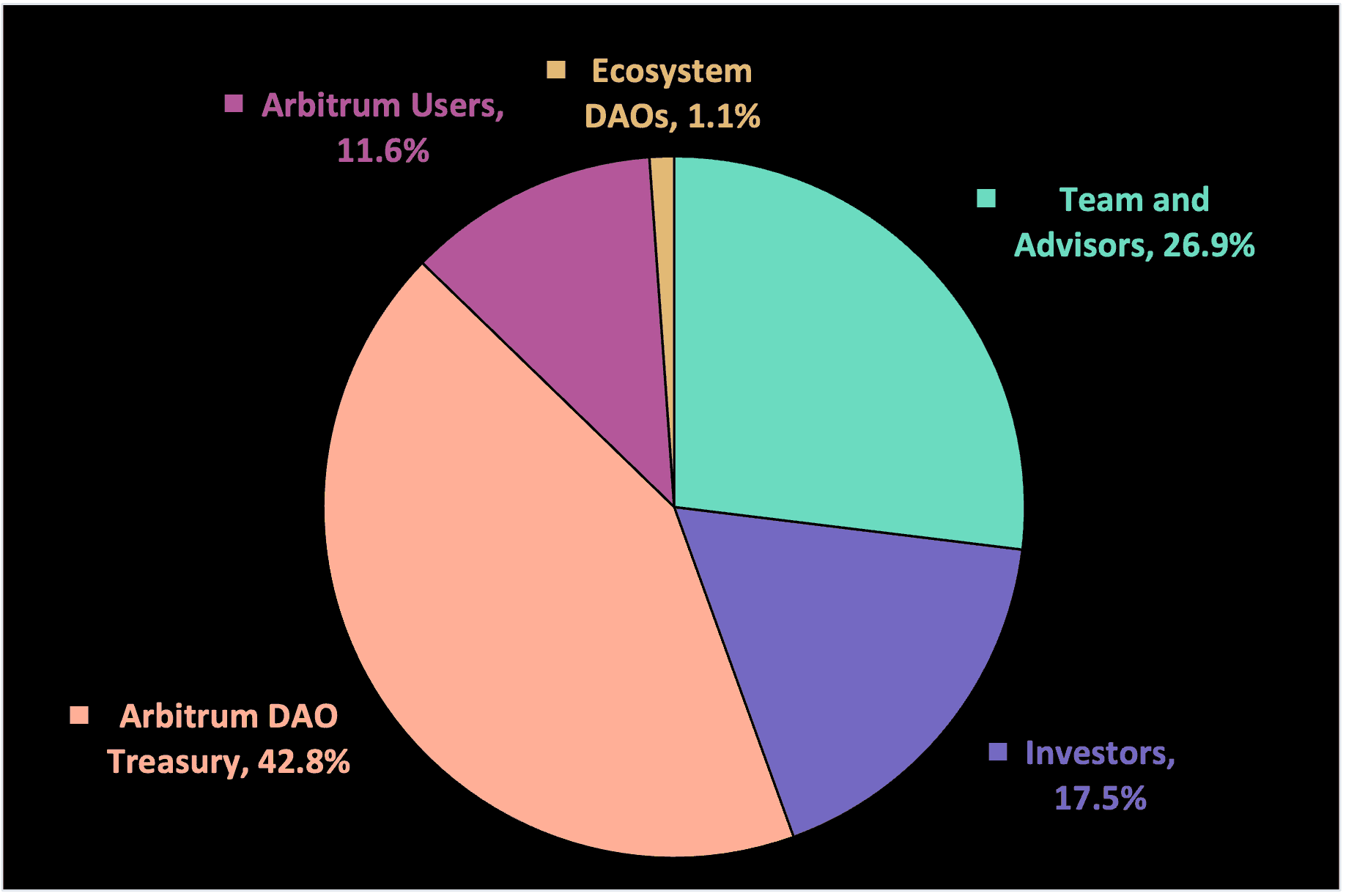

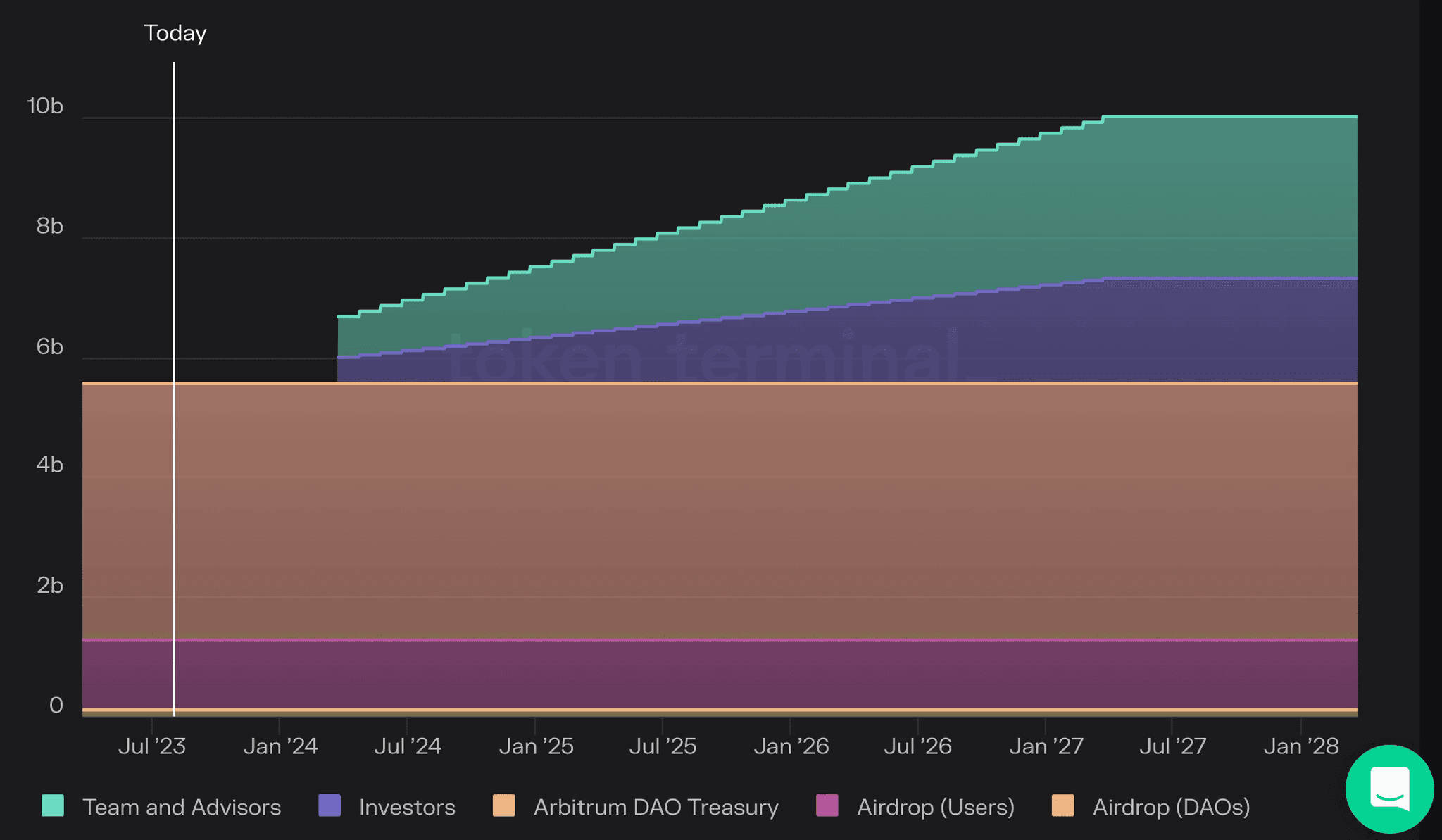

At present, ARB is solely a governance token. ARB has an preliminary provide cap of 10,000,000,000 tokens, with the next preliminary allocation:

11.6% awarded to early Arbitrum customers by way of Airdrop.

1.1% awarded to DAOs within the Arbitrum ecosystem by way of Airdrop.

42.8% allotted to the Arbitrum DAO Treasury. Governance can resolve methods to use these funds.

26.9% allotted to Core Contributors, distributed between Offchain Labs crew, treasury, and Advisors.

17.5 % allotted to Offchain Labs traders.

Optimism: The Superchain

Optimism was the primary rollup to be accessible to the general public, launching on January sixteenth, 2021, though good contract deployment was reserved for a couple of whitelisted builders till December sixteenth, 2021.

The community's ongoing improvement has been coordinated by an modern governance system, the Optimism Collective, because the distribution of the OP token on March twenty third, 2023. The Collective is stewarded by the Optimism Basis, whose aim is to help the institution of the Optimism Collective and the community's decentralization. OP Labs, a blockchain improvement firm, spearheads community engineering upgrades.

The Collective's imaginative and prescient to scale Ethereum is distinct and bold. It options structure that lays the bottom for a number of Layer 2 and Layer 3 options working collectively in an ecosystem coordinated by an modern governance mannequin.

In Optimism's phrases: “Optimism isn’t building a blockchain—it’s building a digital society. Ambitious goals demand equally ambitious infrastructure.”

The OP Stack: the Software program Enabling the Superchain

Optimism’s groundbreaking structure enabled by its open-source software program bundle, the “OP stack,” is its key characteristic. The OP Stack permits appropriate L2s and L3s, termed “op-chains.” that may talk by means of a shared message-passing format. This group of built-in chains will type what the Optimism crew calls the “Superchain.” It goals to offer the scalability of parallel chains and the composability of a single blockchain.

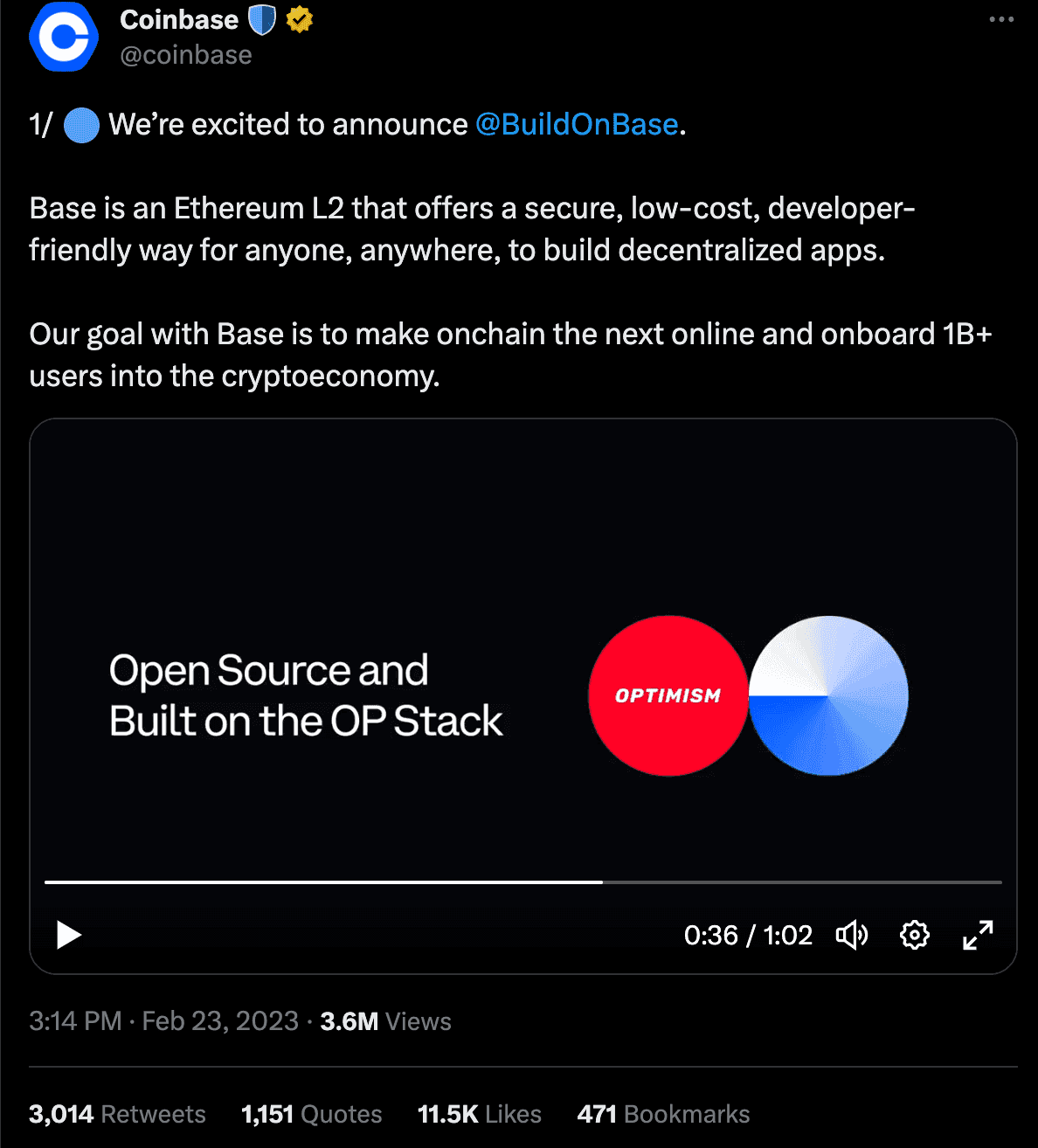

Probably the most infamous participant to subscribe to this imaginative and prescient is Coinbase. The change stunned the world when it introduced the launch of its new Layer 2 answer, Base, which would be the second rollup on the OP stack.

The OP stack was constructed with modularity at its core. Whether or not it's swapping out Ethereum for Celestia as a knowledge availability layer or supporting optimistic rollups and zero-knowledge rollups (zk rollups), the versatile structure of the OP Stack prepares Optimism for future developments in Ethereum.

The Optimism Collective

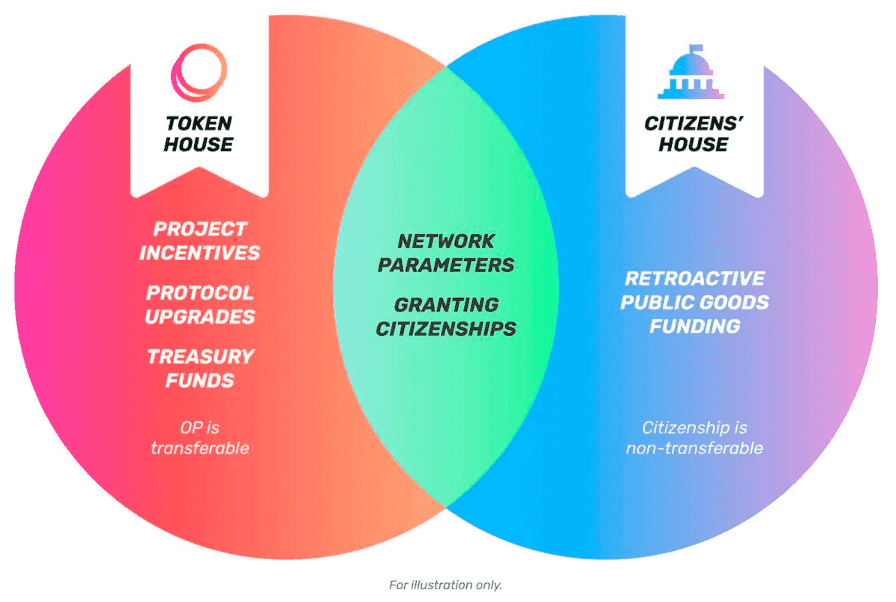

The Optimism Collective is a Bicameral governance system divided into two distinct homes: the Token Home and the Residents’ Home.

Token Home

The Token Home is akin to the Arbitrum DAO. OP token holders have voting rights on issues equivalent to protocol upgrades and allocating the Governance Fund, the equal of the DAO treasury.

Residents’ Home

The Residents’ Home is tasked with facilitating and governing a course of to distribute retroactive public items funding. The membership to the Residents’ Home, or “citizenship,” might be granted by way of non-transferable NFTs, that are soulbound to the holder. Because the Optimism neighborhood expands, so will the set of residents.

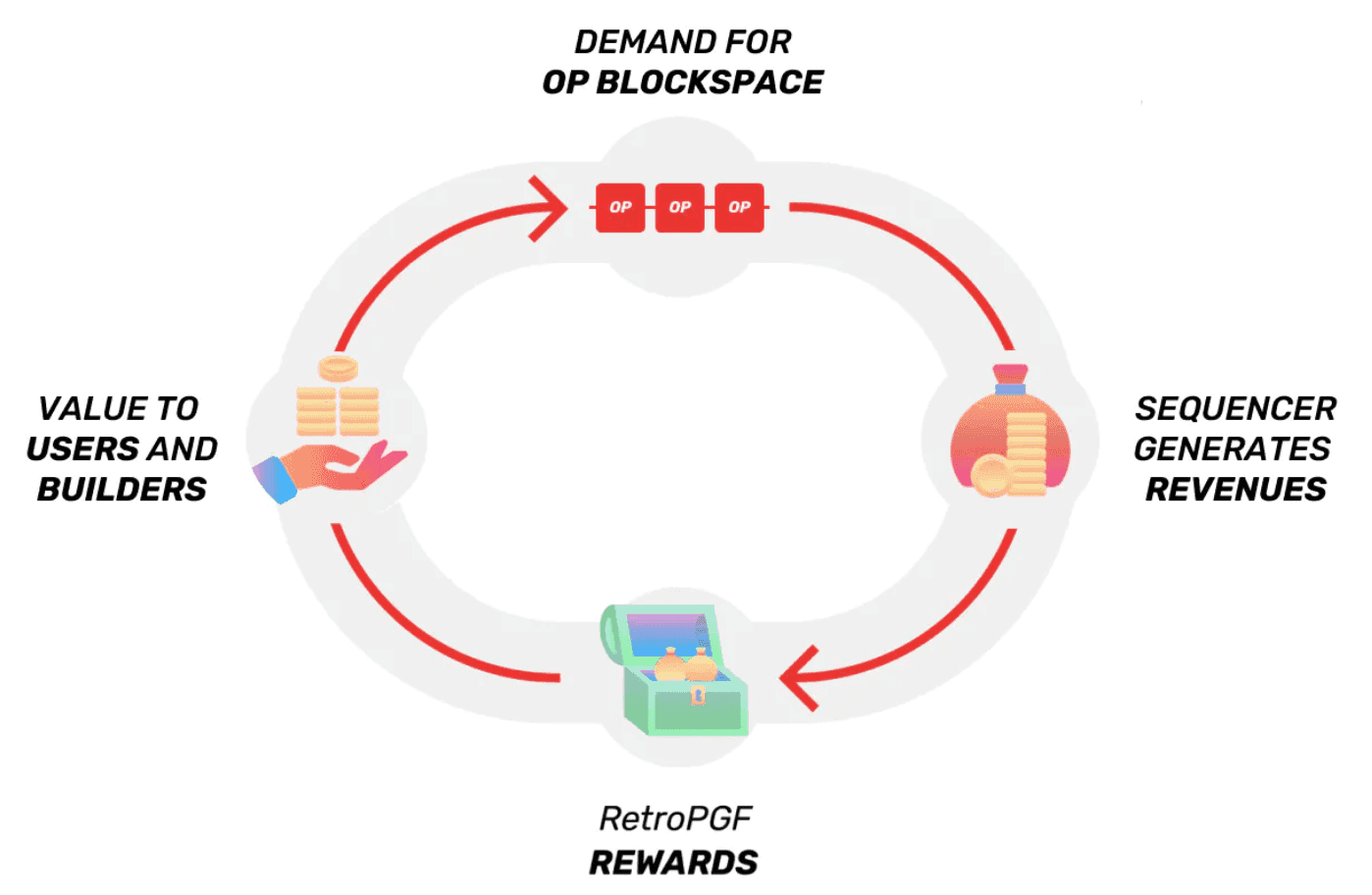

Retroactive Public Items Funding and Community Results

Retroactive public items funding rewards initiatives or contributions which have already demonstrated worth to the Optimism ecosystem. It acknowledges optimistic impacts that may in any other case go unrewarded, incentivizing community progress. Two rounds have taken place, and a 3rd is scheduled for fall 2023.

Funding will come from the next income sources:

- 20% of the preliminary OP token provide is reserved for retroactive funding.

- Optimism and different OP chains’ community transaction charges.

Each the Residents’ Home, by way of retroactive public items funding, and the Token Home, by way of allocation of the OP treasury within the Ecosystem Fund, collaboratively allocate OP to help the expansion of the Superchain. A optimistic suggestions impact is anticipated from this mannequin, the place the funding of public items grows the ecosystem, which boosts the worth of Optimism blockspace, resulting in elevated income for public items and so forth.

The Optimism Token: OP

OP is on the coronary heart of Optimism Collective's imaginative and prescient because the Token Home governance token and the incentives system's cash. The Optimism Collective has created a dynamic, governance-centric system of incentives for initiatives and customers within the Optimism ecosystem that revolves across the OP token.

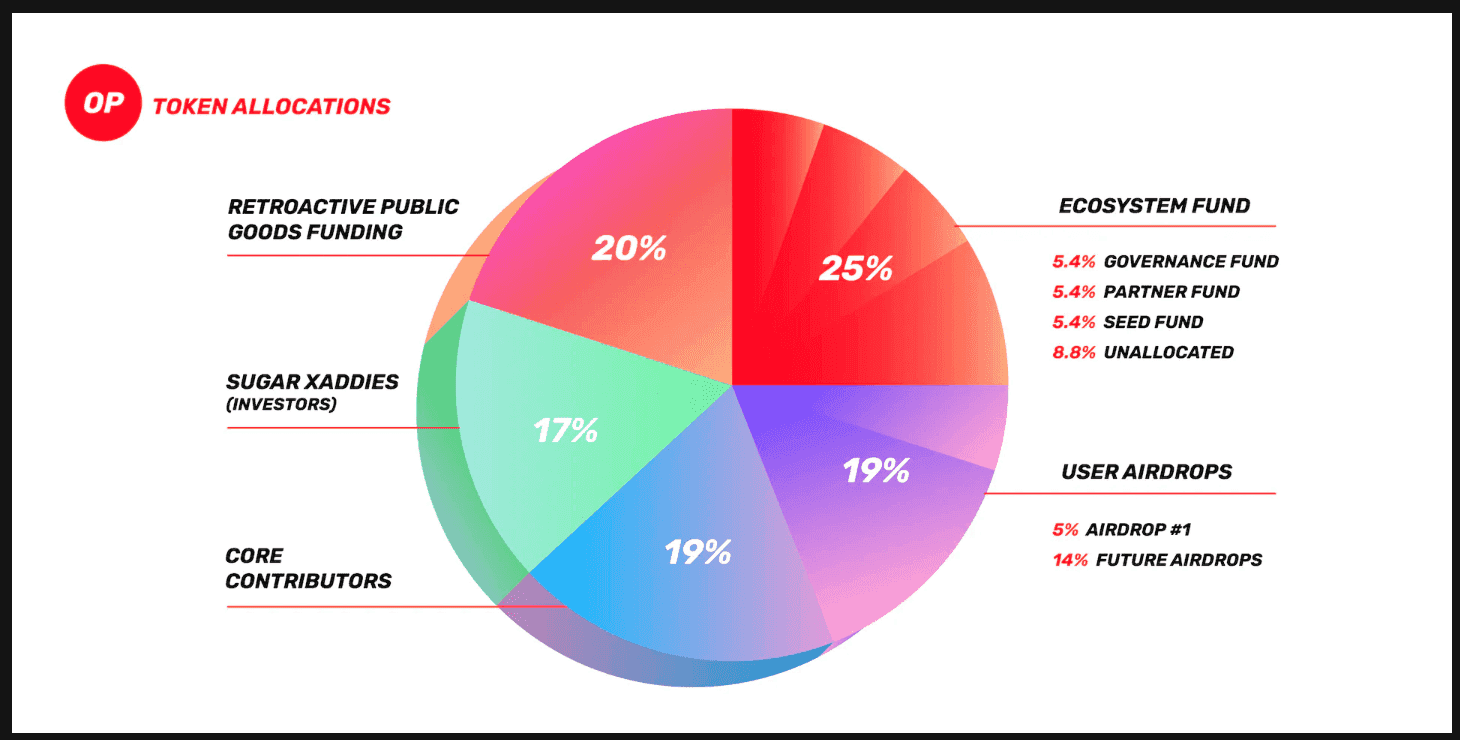

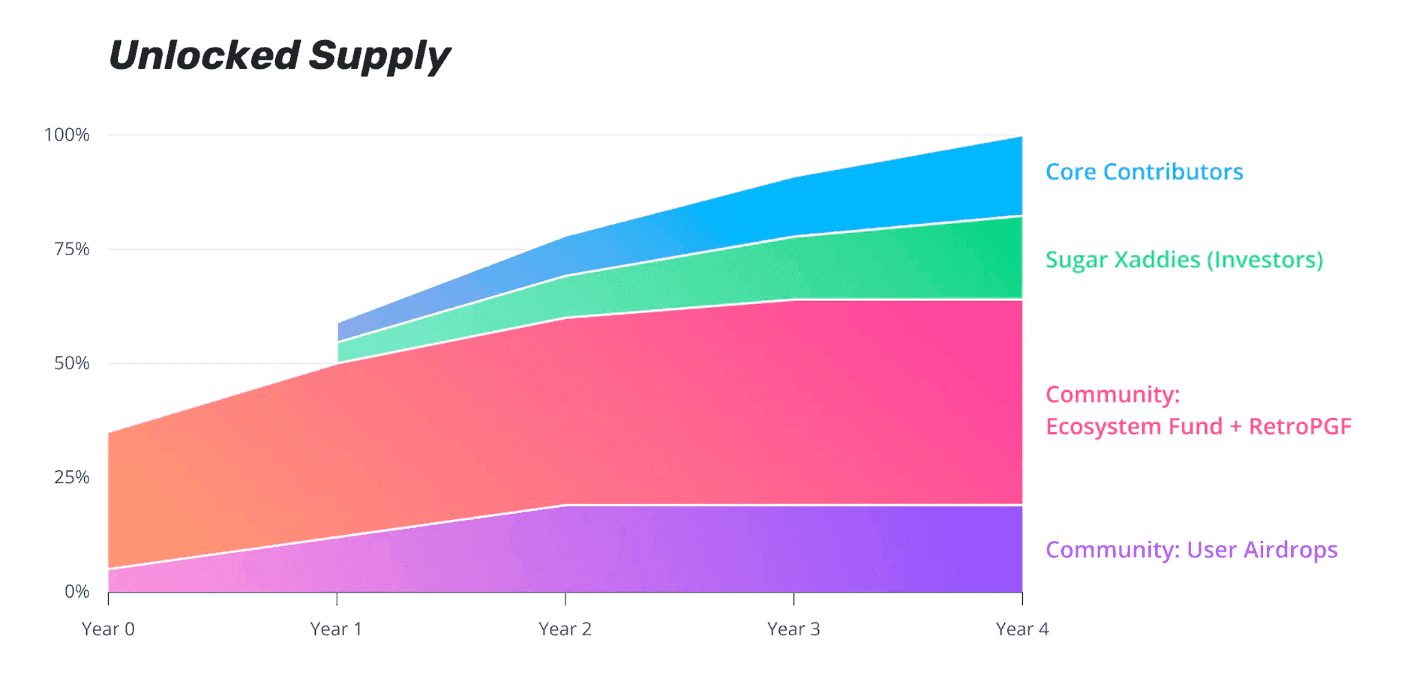

OP has an preliminary provide cap of two^32 (4,294,967,296) tokens, with the next preliminary allocation:

The collective believes that a number of, staggered airdrops are extra conducive to making a longer-lasting incentives system over a single airdrop. There have been two airdrops so far. The first airdrop distributed 5% of the tokens to early customers of Optimism. Airdrop quantity 2, a lot smaller than the primary, distributed 0.27% of OP to Token Home delegators and Optimism energy customers.

20% to the Residents' Home's retroactive public items funding reserve.

25% to the Ecosystem Fund. This allocation is break up into the next classes:

- 5.4% to the Governance Fund, a treasury managed by the Token Home. An experimental governance sub-dao, the Optimism Grants Council, makes grants to help incentive program methods and to help builders innovating on novel functions and infrastructure.

- 5.4% to the Companion Fund. These funds might be distributed strategically by the Optimism Basis to develop the Optimism ecosystem.

- 5.4% to the Seed Fund for early-stage initiatives launching within the Optimism ecosystem.

- 8.8% might be held in reserve for future governance or Basis applications.

The Ecosystem Fund is meant to be a kick-starting mechanism that might be changed as soon as its reserves are used. The Optimism Basis expects the perform served by the Ecosystem Fund to ultimately get replaced by non-public third-party traders who can anticipate to be paid out by the Retroactive Public Items Funding mechanism.

19% allotted to Core Contributors, distributed between Basis members, OP Labs, and advisors.

17% allotted to OP Labs traders.

Base: The Chain To Onboard Billions of Customers

Launched on August ninth, 2023, Base is the most recent optimistic rollup becoming a member of the occasion. Coinbase launched Base as the following step in direction of rising financial freedom worldwide by giving customers a straightforward strategy to onboard the on-chain financial system.

Base might be built-in with the Coinbase Pockets (in addition to different Ethereum wallets) and the Coinbase app in jurisdictions the place the regulatory panorama permits, aiming to make web3 accessible to extra individuals. Importantly, Coinbase's 110 million verified customers may gain advantage from a straightforward path to onboard the Ethereum blockchain, an unprecedented quantity within the on-chain world.

The Second Layer 2 to Be a part of the Superchain

Base joins the Optimism Superchain, with the sources and human capital of Coinbase becoming a member of OP Labs in contributing to the mission of the Optimism Collective. This mutually helpful relationship helps Coinbase by offering Base with a strong, interoperable, scalable structure. It additionally helps Optimism by including worth to the Superchain, accelerating its street to decentralization and accruing funding income. As acknowledged by Coinbase:

“We will provide a percentage of the fees earned through transactions to the Optimism Collective to be a part of the Superchain, contributing back to funding the core public goods infrastructure of both the Superchain and the broader crypto economy.”

Base May Be the Prime Chain For Actual-World Tokenized Property

Base is uniquely positioned within the layer 2 panorama and may very well be the prime platform for deploying real-world blockchain property. Each Coinbase consumer has handed KYC/AML checks to commerce on Coinbase, which means its 110 million verified customers might have much less friction to commerce property equivalent to securities that require KYC/AML checks.

Is there a Base Token?

Coinbase has typically introduced that there’ll NOT be a token native to Base, possible ever. Watch out for scams that attempt to impersonate Base!

ZkSync Period: The Darkish Horse

ZkSync Period (often known as Period or zkSync) is the primary EVM-compatible zk rollup (zkEVM) accessible to the general public, launched on the twenty fourth of March, 2023. Many, together with Vitalik Buterin, have dubbed zkEVMs because the holy grail of scaling as a result of, out of all Ethereum scaling options, zkEVMs are the one ones that provide excessive scalability, EVM compatibility, and trustlessness.

At present, zkSync Period sits third in Layer 2s by whole quantity locked and hovers round first in transaction exercise. Though metrics may very well be inflated in anticipation of its token airdrop, it’s the clear chief of all zk rollups and options essentially the most superior tech.

When Will the zkSync Token Launch?

A zkSync token is coming – it’s even talked about as a given within the documentation. However there isn’t a specified date, and the crew has vaguely acknowledged that the token might be launched “when the time is right.”

Decentralizing the rollup is a main aim for which the token might be important. Nonetheless, the community remains to be in its early levels, and the crew believes that having management over the upgradeability and the sequencers advantages all customers in case there’s a bug or assault and fast motion is required.

The subsequent step in decentralization can be transitioning to a community-elected safety council mannequin, and at this stage, a token would begin making extra sense. Till then, watch out for any zkSync impersonators and scammers!

Evaluating the Layer 2 Options

The competitors inside the layer 2 ecosystem is fierce. The design area for rollups is ample, and every answer is working tirelessly on what they consider is the most effective strategy to scaling Ethereum.

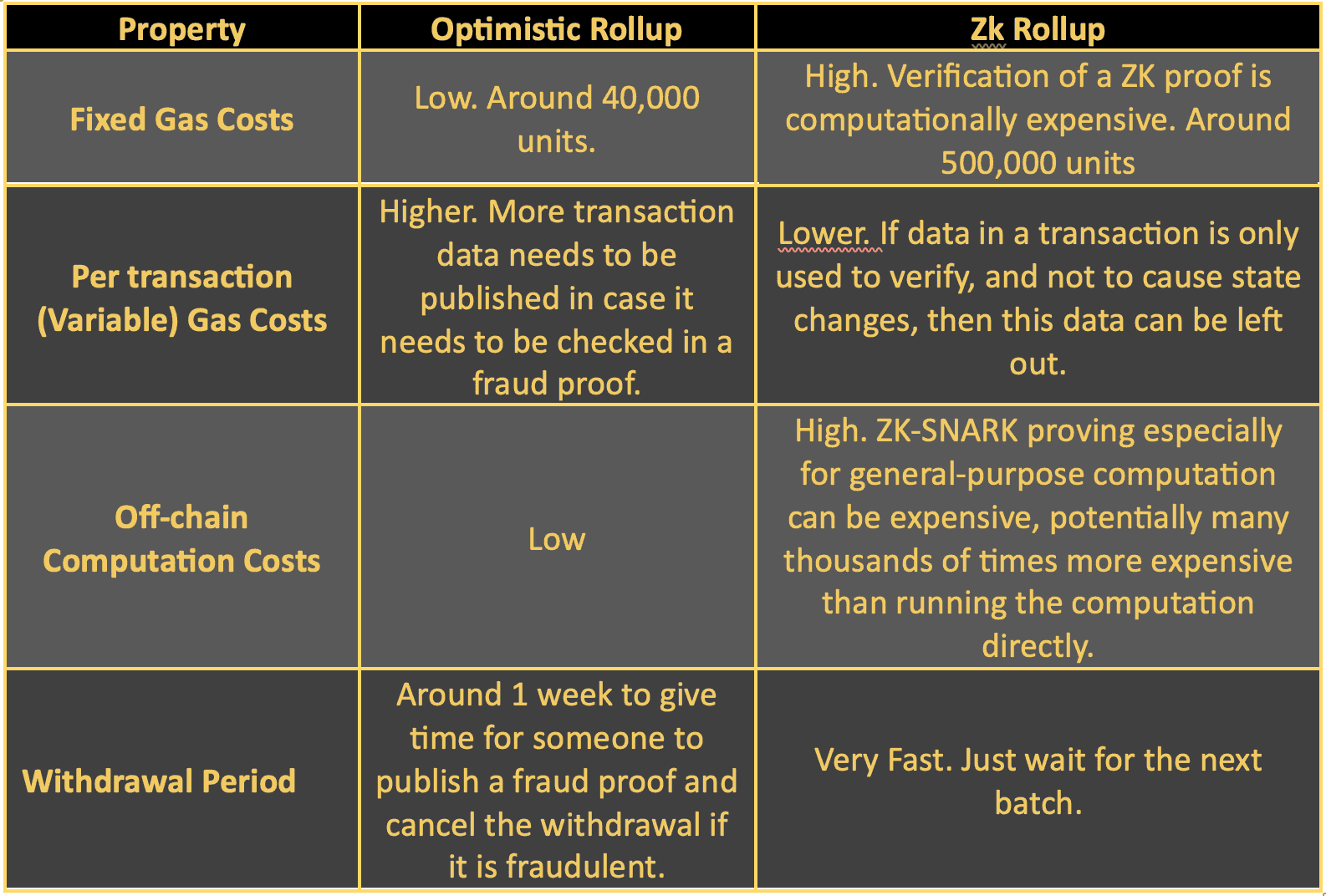

The selection between optimistic rollups and 0 data rollups is a main differentiator affecting efficiency. To know what rollup could win, it’s value understanding some technicals.

The Tech Behind Optimistic Rollups and Zk Rollups

Optimistic rollups use fraud proofs to make sure that the brand new rollup state is legitimate, a course of the place any validator can problem the state information in the event that they detect it invalid. Adequate transaction information have to be printed from the optimistic rollup to the underlying blockchain to permit difficult the state. There may be additionally a window of round seven days to difficulty a fraud proof to permit sufficient time for challenges.

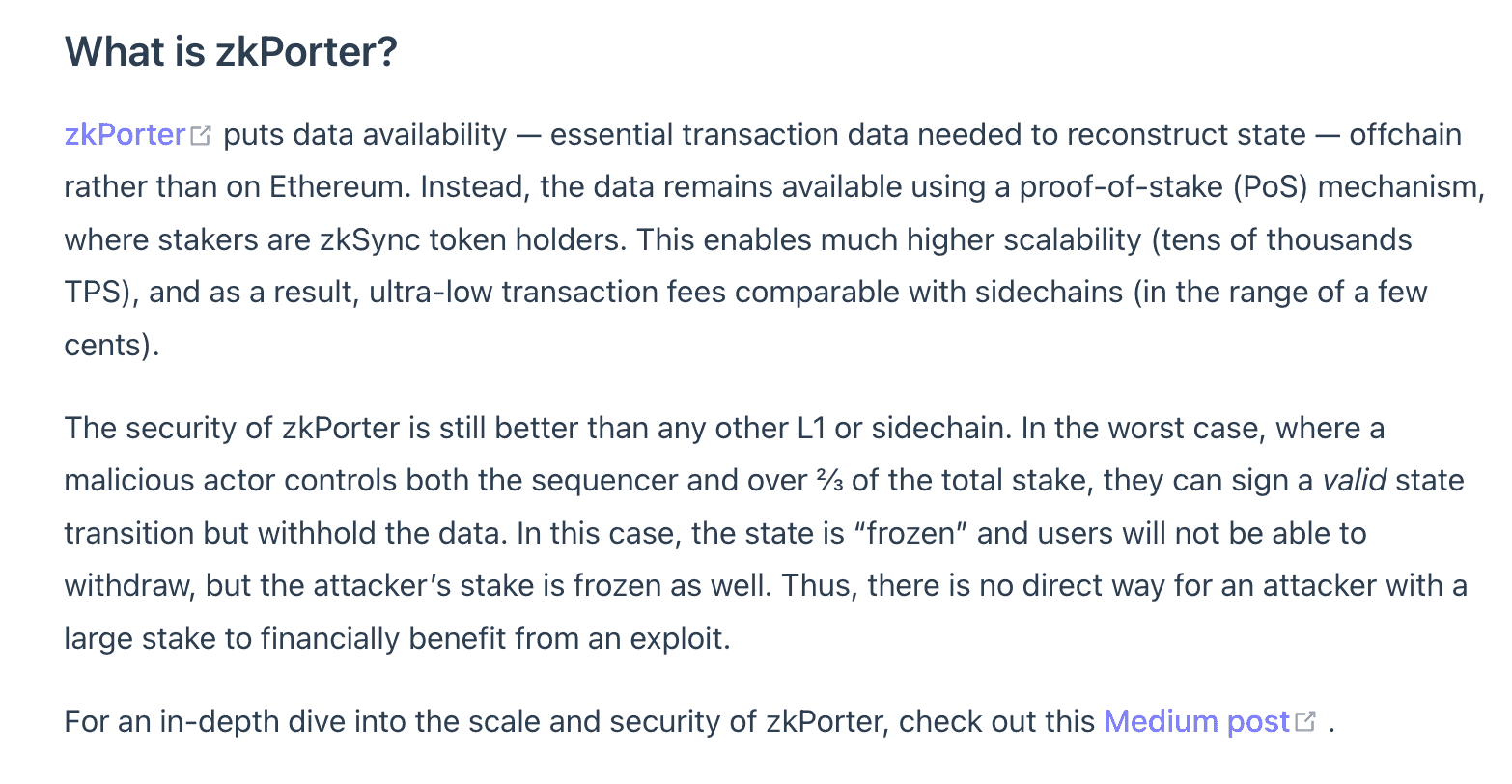

Zk rollups use validity proofs to make sure the brand new rollup state is legitimate. A validity proof is a cryptographic proof that enables proving information with out revealing the information itself (the kind of proof utilized in zkSync is called a ZK-STARK, Zero-Information Scalable Clear Argument of Information). Validity proofs contain greater computational prices than fraud proofs, however they provide key benefits.

Optimistic Rollups vs Zero Information Rollups

Zk rollups depend on math fairly than financial video games and third events to make sure validity, making them fully trustless. Validity proofs are verified rapidly, giving zk rollups a quicker time to finalize transactions than optimistic rollups that need to undergo a seven-day dispute decision interval. Subsequently, bridging again to Ethereum is way faster in zk rollups.

Lastly, as zk rollups are trustless, you’ll be able to have some designs that solely add the state root change to the primary chain, equivalent to zkSync. In distinction, optimistic rollups require transaction information in addition to the state root change to be uploaded to the primary chain to make difficult the state potential.

Shard Chains: How Will Extra Knowledge Availability Have an effect on Rollups?

The primary iteration of shard chains, EIP-4844, aka proto-danksharding, will make importing information to Ethereum less expensive. There isn’t any set date for proto-danksharding but. The phrase is that it might occur as early as late 2023. Each optimistic and zk rollups will profit massively, and transaction prices will lower considerably.

It’s value declaring that as proving zk proofs is expensive, zk rollups use a smaller share of gasoline in importing information out of their whole gasoline consumption than optimistic rollups. Subsequently, shard chains can have a extra pronounced impact on optimistic rollups than zks.

The Present Stage of Main Rollups

In addition to design selections that have an effect on efficiency, when evaluating rollups, additionally it is crucial to have a look at the stage within the improvement of stated rollup, as this could have an effect on the chain's safety.

As we speak, Arbitrum is essentially the most developed rollup, with the required options to make it a "stage 1" rollup, a terminology popularized by Vitalik Buterin describing coaching wheel phases. ZkSync is a "stage 0" rollup with some lacking options that enhance dangers. L2beat does an awesome job displaying the rollup coaching wheel levels and the related dangers.

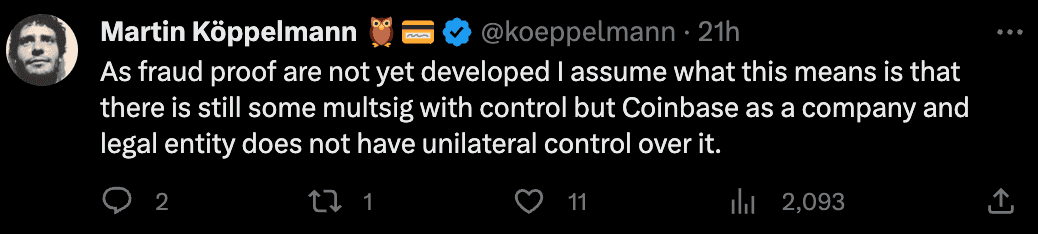

Relating to Optimism and Base, understanding that their fraud proofs are at the moment underneath improvement is important, as this carries important dangers that aren’t absolutely understood.

Condensing The whole lot: Who Will Win?

After we have a look at the present panorama, it’s evident that Arbitrum leads the layer 2 race. Offchain labs have shipped tech quick, which has enabled Arbitrum's lead in DeFi and rollup safety features. With proto-danksharding axing optimistic rollup transaction prices by 5-10x, Arbitrum is ready to remain on the prime of the layer 2 race for the brief time period.

Arbitrum’s most imminent challengers are the opposite two optimistic rollups coated: Optimism and Base. The modern retroactive items funding and grants methods might add vitality to the superchain's flywheel, and each chains might ultimately explode in reputation. My eyes are on Coinbase for a way they may combine Base into their merchandise, as this might onboard many on-chain.

Lastly, zkSync is a major longer-term menace, as zk rollups have the best potential for Ethereum scaling effectivity. Whereas they’ll stay costlier than optimistic rollups within the short-term, zk tech is nascent. We will anticipate game-changing technological developments to make zk rollups the go-to strategy to scale Ethereum for nearly all functions.

Additional down the street, we might anticipate zk rollups that aren’t EVM appropriate however have a specialised setting for effectivity to proliferate. The chief on this subject is Starkware, and they’re engaged on important upgrades to their tech stack.

Often Requested Questions

What is supposed by Layer 2 in Crypto?

Layer 2 (L2) in crypto refers to a secondary framework or protocol constructed atop the primary blockchain, referred to as Layer 1. L2 options are created to deal with scalability points, enabling quicker transaction speeds with out congesting the first layer. Basically, they course of transactions off-chain after which report them on the primary chain, enhancing the general transactional throughput in a blockchain ecosystem.

Are layer 2s good for Ethereum?

Sure, Layer 2s are helpful for Ethereum. They deal with Ethereum’s scalability challenges by enabling quicker and cheaper transactions. By offloading among the transactional quantity from Ethereum’s important chain (Layer 1) to those secondary layers, Ethereum can preserve its safety and decentralization whereas boosting its transactional capability.

Moreover, layer 2 options must pay the community in ETH to settle transactions, and subsequently, contribute to the burning of ETH launched in EIP-1559.

Is there a zkSync token?

Not at the moment, however a zkSync token is within the pipeline. The documentation hints that it’ll exist, however its launch date stays unspecified. The zkSync crew has expressed intentions to launch the token “when the time is right.” As they concentrate on decentralizing the rollup, the token will play an important position. However, potential customers needs to be vigilant about impersonators and scammers till the official token launch.

Is there a Base token?

Coinbase has clearly acknowledged that Base won’t have a local token, and there isn’t any plan to introduce one within the foreseeable future. It is essential for potential traders and customers to stay alert to potential scams or impersonators claiming in any other case.

Does Polygon use zk rollups?

Polygon, the crew, has launched a plethora of scaling options. The preferred, the Polygon PoS chain with the MATIC token as native foreign money does NOT use zk-rollups. The Polygon PoS chain is a side-chain that has its personal safety premises and is not thought of a layer 2 answer.

Different Polygon scaling options, most prominently the Polygon zkEVM does use zk rollups, and it’s a pure layer 2 answer, settling transactions on Ethereum.