“0 value. Do not buy it. Earn it.” – the ultimate phrases of the Medium submit which launched the now well-known yearn.finance (YFI) token to an already overexcited DeFi area.

Hailed as probably the most decentralized tasks in cryptocurrency, the yearn.finance protocol goals to simplify DeFi whereas concurrently offering customers with the best potential annual share yields (APY) on their deposited cryptocurrencies.

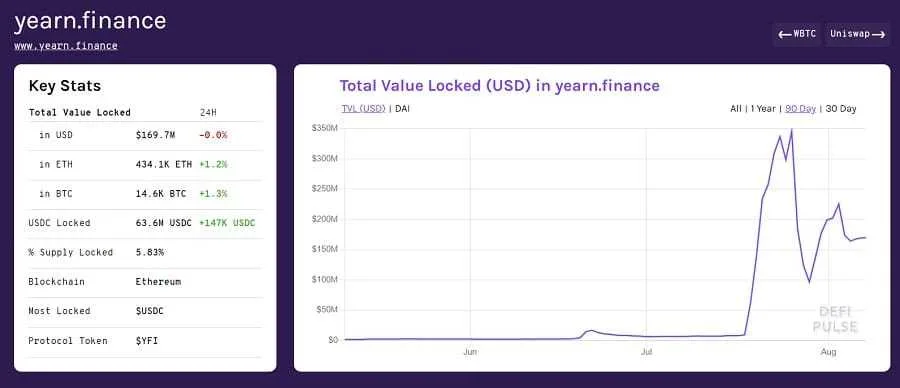

Yearn.finance’s YFI token is referred to by some because the Bitcoin of DeFi and is answerable for the face-melting 2000%+ APY which early customers of the protocol capitalized on. Couple this with almost 200 million USD of property locked within the protocol and you’ve got a recipe for some severe hype. 1000’s are tripping over themselves to get a slice of the YFI pie and by the tip of this text you’ll know why!

Who made Yearn.Finance?

Yearn.finance was created by rogue programmer Andre Cronje. After dropping out of the school the place he was finding out legislation, he accomplished a 3-year pc science program in simply 6 months which landed him a suggestion to show on the establishment which provided the course. As an alternative, he dove into the personal sector, working in insurance coverage, fintech, massive knowledge, and distributed ledger applied sciences (centralized blockchains).

Whereas his colleague was away on honeymoon, Cronje began researching cryptocurrencies and claims that if his colleague had by no means gotten married, he would have by no means gotten concerned within the crypto area.

Though Cronje believes most cryptocurrencies are too unstable and speculative to significantly put money into, he’s nonetheless fascinated by decentralized finance protocols and the unimaginable yields provided for stablecoins deposited onto these platforms.

Cronje started investing his and others’ cash into these protocols and would manually transfer the funds to the platform/stablecoin mixture that offered the best APY. He was in the midst of creating a program which might routinely change between DeFi protocols to optimize yield when he realized he might scale it up and make it public. He started working carefully with Curve Finance and Aave to create what would turn out to be often known as iEarn.

By this time, Cronje was well-known within the cryptocurrency area for his in-depth code critiques on Medium. He turned so influential that the critiques he did for Crypto Briefing had been for a time thought of to make or break a challenge within the eyes of many within the crypto neighborhood.

Cronje believes that DeFi has turn out to be so difficult that it has turn out to be almost unimaginable for the common particular person to work together with, therefore the main focus round a easy and intuitive person expertise which is central to the now rebranded yearn.finance (AKA yEarn) which was launched in February of this yr.

Cronje additionally goals to make yearn.finance the most secure DeFi protocol out there, just lately proclaiming that he was the primary one to place his funds into it and he would be the final one to take his funds out.

Cronje is enthusiastic about open supply applied sciences, refuses to shoulder any credit score for the protocols he has created, is obsessive about dissecting the code of different DeFi platforms in an goal method, and stays extremely energetic in the neighborhood and the event of yearn.finance.

In his personal phrases, this requires “hating yourself more than the thing you are building”. Most significantly, when the YFI token was created, he didn’t preserve any of it for himself as is usually completed in lots of cryptocurrency tasks (although he did farm a few of it as a daily person). Cronje additionally pronounces the YFI token as “waifu” and insists it has 0 worth.

What’s Yearn.Finance?

Yearn.finance is an ecosystem of protocols constructed on Ethereum which goals to simplify person interplay with in style DeFi protocols and maximize the annual share yields (APY) of cryptocurrencies deposited into DeFi.

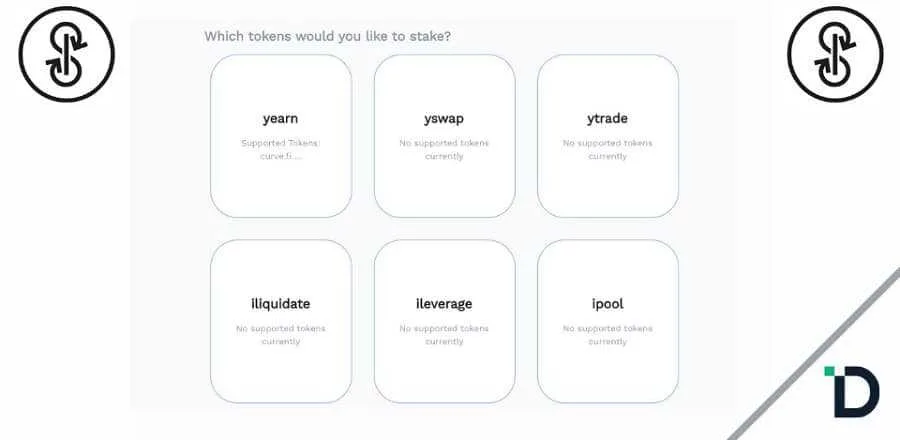

The preferred protocol inside this ecosystem is yearn.finance (similar identify) which routinely strikes person funds between DeFi lending protocols akin to Compound, Aave, and Dydx to maximise APY. The whole yearn.finance ecosystem is community-developed and neighborhood ruled by way of the YFI token.

Different protocols within the yearn.finance ecosystem embody: ytrade.finance, which permits customers to lengthy or quick stablecoins with 1000x leverage, yliquidate.finance, which makes use of flash loans in Aave to liquidate funds, yswap.alternate, which acts as a single supply from which customers can manually deposit funds to and between varied DeFi protocols.

Lastly, you’ve iborrow.finance, which entails tokenizing debt in different protocols with the help of Aave in order that it may be utilized in further DeFi protocols. On the time of writing, solely yearn.finance and yswap.alternate are dwell. The others stay in testnet section.

What’s YFI cryptocurrency?

YFI is an ERC-20 token used to control the protocols throughout the yearn.finance ecosystem. YFI tokens might be earned by interacting with these protocols. There’s a max provide of 30 000 YFI tokens and there was no ICO or pre-mine. You possibly can earn YFI tokens is by offering liquidity to considered one of yearn.finance’s platforms (or purchase the token from an alternate). The final YFI token was issued within the ecosystem on July twenty sixth.

The yearn.finance neighborhood is at the moment within the technique of releasing a brand new provide of YFII tokens (not a typo – there are two Is) as a method of additional incentivizing customers to supply liquidity to the yearn.finance ecosystem. YFII is a ‘fork’ of YFI and has a max provide of 60 000. The whole provide of YFII tokens can be distributed over the course of 10 weeks in the identical method as the unique YFI token (extra on this later).

How does Yearn.Finance work?

The perceived complexity of yearn.finance might be mentioned to be as a result of lack of obtainable documentation concerning the protocol. The clockwork inside yearn.finance is definitely remarkably simple to know in comparison with different DeFi tasks. Provided that yearn.finance is often used to confer with the protocol of the identical identify throughout the yearn.finance ecosystem, that is the one we’ll give attention to on this article.

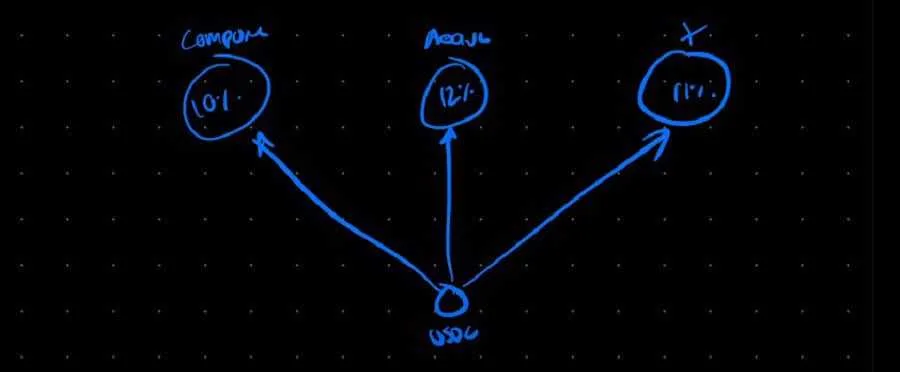

As talked about beforehand, yearn.finance strikes stablecoin funds between Compound, Aave, and DyDx relying on which stablecoin asset pool is producing the best APY. Yearn.finance at the moment helps DAI, USDC, USDT, TUSD, and sUSD. Since yearn.finance is neighborhood ruled, the lending protocols it switches between in addition to the record of supported cryptocurrencies could and sure will change over time.

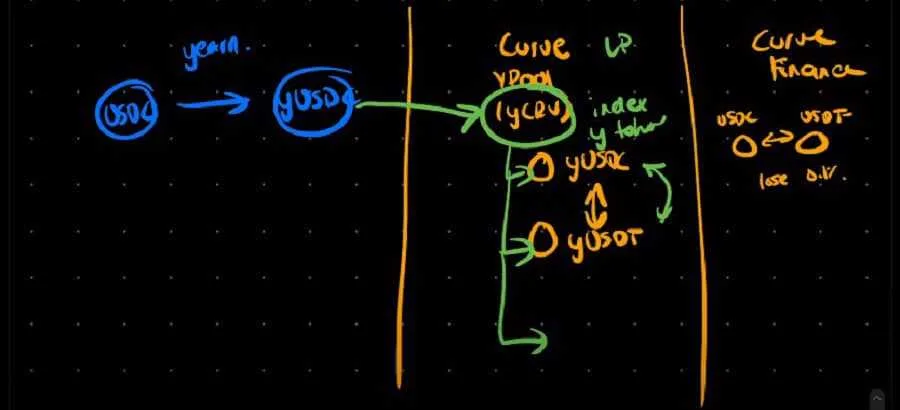

When a person deposits a stablecoin into yearn.finance, it’s transformed into an equal quantity of ytokens (e.g. DAI into yDAI). These are often known as “yield optimized tokens” and can be utilized to earn YFI tokens.

Yearn.finance, nonetheless, takes the unique funds deposited into the protocol and routinely shuffles them between Compound, Aave, and DyDx swimming pools with the best yield. The protocol additionally takes a small lower which is deposited into the yield.finance pool which is simply accessible to YFI token holders.

How you can Earn YFI(I) Cryptocurrency

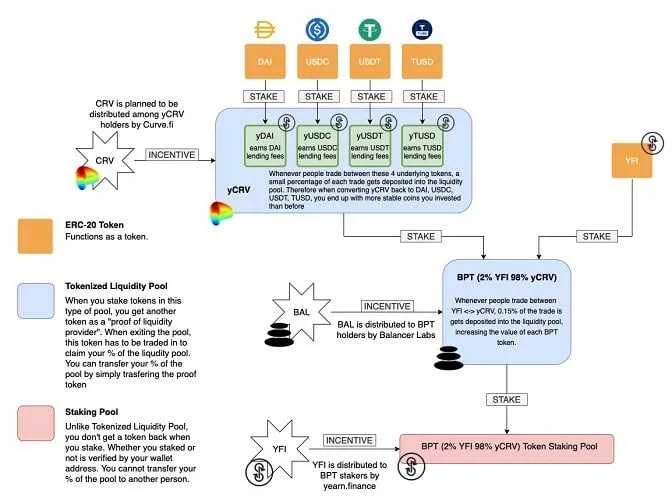

Earlier than we get into the three methods of incomes YFI (and YFII), allow us to take a minute to look at what’s going on behind the curtains. Recall the ytokens talked about within the earlier paragraph. These ytokens might be despatched to the ypool in Curve Finance, which is a DeFi protocol that permits you to simply commerce between stablecoins with low slippage (good alternate charges).

Since Curve Finance incentivizes liquidity mining, this provides you a return in yCRV (yCurve) tokens that are generated for offering liquidity to the Curve Finance protocol. Initially, these rewards had been “stuck” in Curve Finance.

The YFI token was created by Cronje to permit customers to ‘trade’ the yCRV which their funds had been accumulating within the yCRV pool in alternate for governance over the yearn.finance ecosystem.

There are 3 ways you may earn YFI (and YFII). The primary is one was talked about within the earlier paragraph and entails depositing your yCRV into the yGov pool in yearn.finance. The second entails depositing a 98%-2% mixture of DAI and YFI into the Balancer protocol in alternate for BAL (Balancer protocol) tokens. These BAL tokens are then despited into yGov in alternate for YFI.

The third technique entails depositing a mixture of YFI and yCRV into Balancer in alternate for BPT (Balancer pool) tokens that are then deposited into yGov and accrue YFI tokens. When YFI was created, it was designed so that every of the three swimming pools would have 10 000 YFI tokens up for grabs. As talked about earlier, all YFI tokens had been farmed by July twenty sixth, roughly 10 days after the token was launched.

This would possibly all appear complicated however ought to be simple to know if you happen to view it by a proof of stake lens. The distinction is that as a substitute of staking some cryptocurrency in alternate for the block rewards of mentioned cryptocurrency, you might be primarily staking the tokens being given to you by Curve Finance and Balancer in yearn.finance in alternate for governance over yearn.finance. If you’re nonetheless having hassle understanding how this works, you may watch this handy video (we needed to watch it twice).

Yearn.finance Governance

The weather concerned in yearn.finance’s governance are a bit trickier to pin down, primarily as a result of the truth that the small print about them are scattered throughout varied yearn.finance Medium posts. For starters, 1 YFI token is the same as one vote.

Proposals to the yearn.finance ecosystem can solely be tabled if 33% of YFI token holders agree to take action. If this minimal requirement is met, it may be vetoed if greater than 25% of YFI token holders oppose the proposal. If authorised for voting, greater than 50% of YFI holders should vote within the affirmative for the proposal to cross and for the adjustments to be made to the ecosystem or protocol.

That is the place issues get fascinating. The one YFI holders who can vote are those that have deposited their BPT tokens into the yGov governance pool (the third method of incomes YFI famous within the earlier part).

That is maybe why Cronje refers to this governance system as “meta governance” – it entails not solely holding the YFI token, however placing your self able of upper threat and vulnerability by having your property custodied by about half a dozen DeFi protocols which work together with yield.finance.

Maybe probably the most fascinating aspect about yearn.finance’s preliminary governance was that YFI token holders might burn their YFI tokens in alternate for the equal share of funds at the moment locked within the yearn.finance rewards pool (e.g. in the event that they maintain 30% of the YFI provide they will burn it in alternate for 30% of the gathered property within the rewards pool).

This was famous earlier within the article, however the precise technique of withdrawing funds is a little more complicated. When a YFI token holder requests their share of the pool, the equal share of funds from the pool are despatched to a vault contract which converts them into aDAI, Aave’s interest-generating DAI token. These tokens can then be despatched to Aave to be redeemed for normal DAI.

veYFI

In October 2023, Yearn Finance underwent a serious transformation in its tokenomics with the introduction of a Vote Escrow mechanism. Customers can lock YFI tokens and obtain veYFI, which permits them to spice up vault rewards and vote on the place bought-back YFI can be despatched.

The lock length is versatile and might be chosen on the time of deposit, starting from one week to 4 years. Whereas locking for as much as 10 years is feasible, any length past 4 years doesn’t lead to further veYFI accrual. This function supplies customers with the comfort of avoiding weekly relocks, as they will reset the length to 4 years to provoke decay.

Boosted rewards are solely out there to customers with a veYFI lock, and the absence of a lock interprets to no enhanced rewards. To maximise rewards, customers can go for a most lock length, constantly renewing it as wanted.

Customers with out a veYFI lock can nonetheless deposit right into a vault and stake the corresponding token right into a gauge, securing a base enhance. With the minimal enhance, 10% of the farmed dYFI is retained by the person, whereas the remaining 90% is allotted to veYFI lockers.

Exiting the lock prematurely will incur a penalty of as much as 75% of the locked quantity. This penalty diminishes over time and is distributed amongst different veYFI holders.

Now that veYFI has been applied, solely veYFI is the accepted voting energy in Yearn's governance.

dYFI Token

dYFI (beforehand specified as oYFI) is a token launched as a part of Yearn's veYFI tokenomics program. It’s an ERC-20 token that permits its holder to purchase again YFI at a reduction.

dYFI grants the fitting to redeem tokens for an equal quantity of YFI, exchanged for ETH at a reduced charge in comparison with the market charge of YFI/ETH. Ether obtained throughout redemption contributes to Yearn's buyback initiative, whereas the redeemed dYFI tokens are systematically burned.

The Yearn.Finance Roadmap

Provided that the yearn.finance protocol has solely existed for a couple of months and that governance has solely existed for about one month on the time of writing, there’s not all that a lot to say relating to roadmaps. In an interview with Cronje, he describes his growth of DeFi protocols akin to yearn.finance as a form of manic episode, with nearly all the groundwork for the protocol being created within the span of some weeks.

The speedy succession of Medium posts regarding the protocol and the ecosystem is proof of this – nearly all the details about yearn.finance was posted in the identical week.

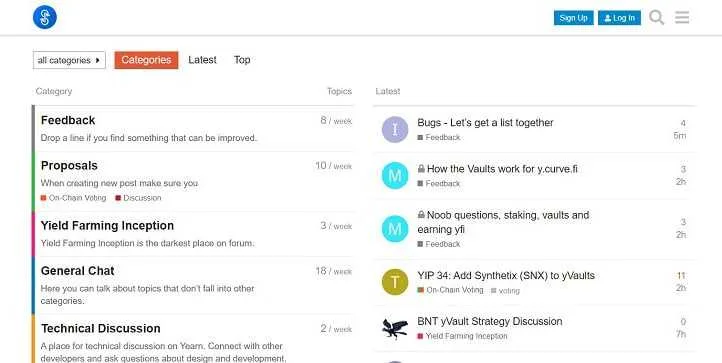

Cronje created the YFI token to usher in a brand new period of neighborhood governance not primarily based on precept, however as a result of he and the opposite core builders had been “lazy and don’t want to [manage the ecosystem]”. Yearn.finance enchancment proposals (aka YIPs) are what have been driving the event of the ecosystem since neighborhood governance was launched.

A current YIP to extend the provision cap of the YFI token failed to succeed in the 33% vote quorum and resulted within the ‘forking’ of the YFI token into one other token known as YFII. This was supposed as a method to proceed incentivizing customers to supply liquidity to the protocols throughout the ecosystem (the property deposited into yearn.finance dropped by over 60% within the day after the final YFI token was farmed).

In an amusing doc created by the yearn.finance neighborhood, they clarify that the YFII token can be distributed in the same method to YFI however will as a substitute have a complete provide of 60 000 and see the token emission halve each week, with 10 000 tokens being distributed to every pool within the first week after which seeing a 50% emission discount on a weekly foundation till all 3 pool distributes 20 000 tokens every.

The YFII token doesn’t seem to play a task within the governance of yearn.finance, however that is one thing that the neighborhood might vote to alter sooner or later.

Probably the most notable adjustments in yearn.finance’s new stage, yEarn v2, entails including extra property to the ecosystem and introducing a form of gamification mechanism to incentivize the creation of extra environment friendly yield farming methods for yield.finance.

Briefly, anybody can suggest a brand new technique. If accepted by the neighborhood, the proposer will get a lower of the curiosity generated at any time when their technique is at the moment in use by any of the protocols inside yearn.finance. You possibly can preserve monitor of ongoing YIPs by way of yearn.finance’s Twitter account and the yEarn governance discussion board.

YFI Cryptocurrency Value Evaluation

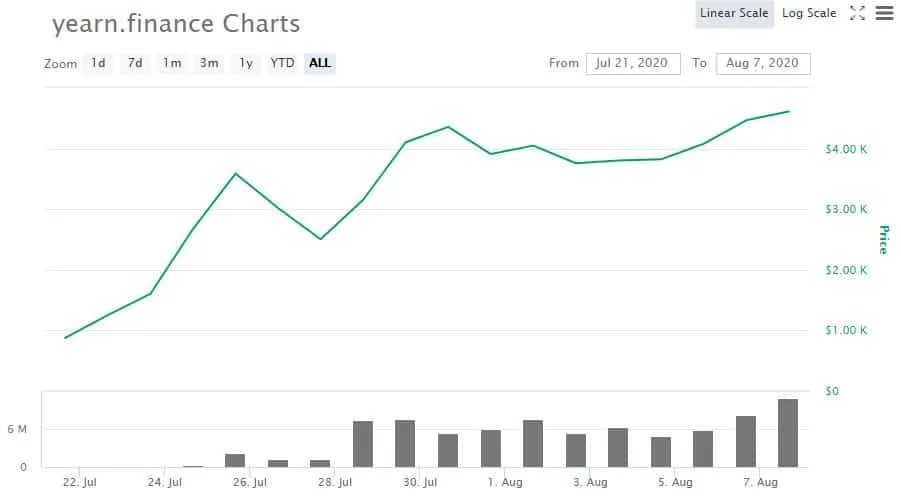

The YFI token has not even been available on the market for greater than a month and has already hit an astounding value of 4900$USD. What’s exceptional is that the worth continues to understand regardless that all of the tokens have been issued and are already in circulation. In addition to a ‘slight’ pullback from 3900$USD to 2800$USD on the day earlier than the final YFI token was issued, YFI has been in a visual uptrend because it was issued and doesn’t appear to be slowing down.

One fascinating factor to notice is that the circulating provide of YFI is nearly equal to the whole provide. Solely 51 YFI tokens should not in circulation in accordance with CoinMarketCap. It’s price noting that it’s potential that these 51 tokens now not exist since it’s potential that somebody determined to burn their YFI tokens in alternate for some DAI from yearn.finance’s bountiful asset pool/treasury earlier than the burning perform was voted away.

YFII (bonus spherical!)

Since you’ve made it this far by the article, it could be a disgrace if we didn’t at the least contact on the worth efficiency of the just lately issued YFII token. Launched to crypto markets lower than two weeks in the past at a value of almost 1000$USD, it settled right down to round 130$USD per token inside days.

The worth seems to be to be comparatively secure over the previous week and reveals no clear development to the upside or draw back.

The place to purchase YFI Tokens

Provided that yearn.finance is on the reducing fringe of DeFi, it ought to come as no shock that one of the best place to get YFI tokens is on decentralized exchanges. It seems that Uniswap is your finest wager, accounting for greater than 40% of YFI’s 24-hour buying and selling quantity with simply the YFI/WETH (wrapped Ethereum) buying and selling pair.

If you happen to favor centralized exchanges, Poloniex and CoinEx are the one respected exchanges at the moment providing YFI token buying and selling pairs. Be aware that the buying and selling quantity on the latter is sort of restricted.

YFI Cryptocurrency wallets

Since YFI is an ERC-20 token, you may retailer it on nearly any pockets which helps Ethereum-based property. If you happen to wish to preserve your YFI tremendous safe and don’t plan on buying and selling it any time quickly, think about getting your fingers on a tough pockets akin to Trezor, Ledger, or Keepkey.

Software program wallets are best if you happen to plan on shifting your YFI round or just are not looking for the effort of protecting monitor of a tiny USD system. Respected software program wallets for YFI cryptocurrency embody Atomic Pockets (cellular/desktop), Exodus pockets (cellular/desktop), and Coinomi (cellular).

Our YFI connection (Our Opinion of yearn.finance)

Yearn.finance could very properly mark the daybreak of a brand new period for DeFi. Cronje actually hits the nail on the pinnacle when he says that DeFi has turn out to be too difficult for the common particular person to make use of, a lot much less perceive. Moreover, the protocols used inside DeFi are so complicated that even when they’re open supply, it makes them virtually unimaginable to correctly audit.

Yearn.finance is bringing a much-needed degree of precise neighborhood governance to DeFi whereas additionally offering some spectacular returns on funding with (comparatively) low threat. That being mentioned, the danger inside DeFi stays excessive, even in yearn.finance protocols.

That is very true when you think about how overextended your funds are if you work together with the yGov utilizing BPT tokens. You’re primarily taking part in with a derivate of a spinoff of a spinoff of an underlying asset. If something goes incorrect in that chain, you threat dropping your funds.

In what could also be a primary for a cryptocurrency which has in comparison with Bitcoin, the worth of YFI appears to be on its method to hitting the same USD valuation. Whereas many different governance tokens might be mentioned to be extra speculative, the worth of the YFI token is perhaps depending on the whole quantity of property locked within the yearn.finance pool.

Whereas the way forward for yearn.finance is fuzzy, it would present what is maybe the primary actual experiment in decentralized finance that the world has ever seen. Whereas the probability that the DeFi protocols we see immediately might not be right here tomorrow, yearn.finance will eternally mark a watershed second in DeFi for a lot of and with good motive: it’s a totally functioning proof of idea.

Right here is to hoping yearn.finance will nonetheless be round for a few years to return!

Featured Picture by way of Shutterstock & Yearn Finance

Disclaimer: These are the author’s opinions and shouldn’t be thought of funding recommendation. Readers ought to do their very own analysis.