With regards to my emergency money wanted readily available, I’m pleased for it to be chillin’ within the financial institution and never incomes something in the way in which of curiosity. My crypto property, nevertheless, have to get themselves working for a good wage. Whereas procuring round for a rock-solid crypto platform to park my property in, I got here throughout YouHodler by an advert from the Courageous browser (the place I can earn some BAT tokens by ignoring a lot of the advertisements they flash at me). The identify of the platform struck me as barely tacky however hey, don’t decide a ebook by its cowl, proper?

⚠️Security Discover⚠️- In gentle of the liquidity points confronted by the lending platforms Celsius, BlockFi, Voyager, and others, which resulted in misplaced buyer funds, we advocate customers do further due diligence on centralized crypto platforms they’re contemplating and apply secure monetary habits corresponding to diversification and self-custody when doable.

What’s YouHodler?

YouHolder is a centralised crypto-lending and borrowing platform providing providers that caters to lenders and debtors to earn curiosity and procure loans. It additionally affords an alternate service to swap between fiat and crypto or two sorts of crypto. What makes it totally different from different platforms of comparable features are the MultiHODL and Turbocharge merchandise that assist customers maximise their returns in a dangerous method.

Exchanging Between Fiat and Crypto

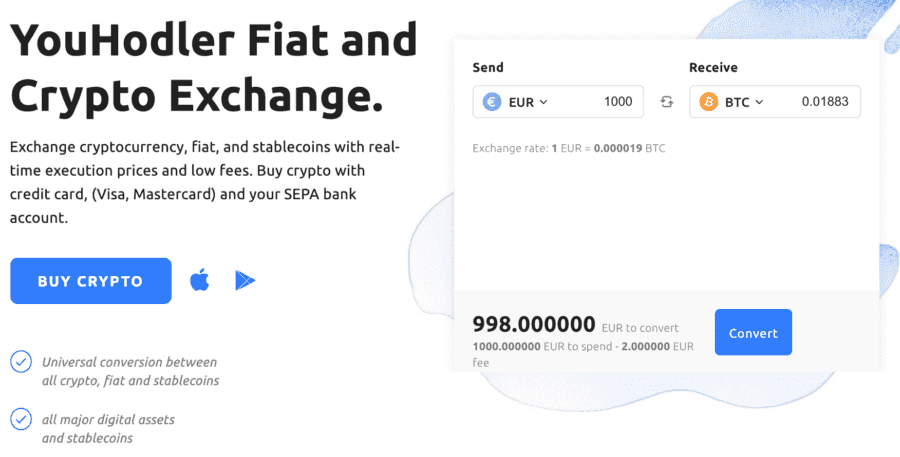

For these new to the crypto area, YouHodler affords an alternate service for swaps between fiat and crypto. You’ll be able to deposit your money on this platform and alternate them for crypto. It’s also helpful for individuals who wish to swap the opposite manner round.

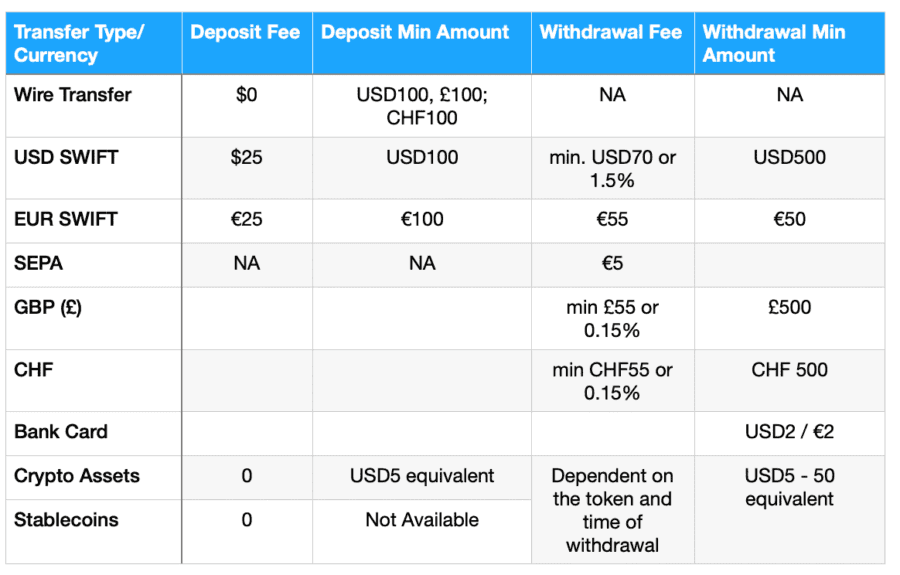

The charges could differ based mostly on the cryptocurrency swapped however right here's a chart for deposit and withdrawal charges on your reference:

The minimal deposit required to get began is $5. Opening an account with YouHodler requires going by the Know-Your-Buyer ( KYC) course of. That is the place you might be required to add private info, tying up your id with the account. This step is a vital factor of the Anti-Cash-Laundering (AML) insurance policies enacted to forestall felony exercise.

After that, the following factor to think about is the safety of the funds held on the platform. There are two essential components which might be of key significance: insurance coverage and the individuals working the corporate.

Insurance coverage by Ledger Vault

The platform’s homepage advertises that it makes use of Ledger Vault to offer as much as $150 million of pooled crime insurance coverage. What does that imply actually? To reply that query, I made a decision to take a fast peek at Ledger Vault and right here’s what I discovered:

- It’s an enterprise-level product by the Ledger firm (the identical ones that make my Ledger chilly pockets).

- It’s a program for managing non-public keys that has entry to the storage space the place tokens are saved.

- Ledger Vault is relied on by one different lending platform, not like a few of its opponents which affords security to some. That is good as a result of within the occasion of a significant occasion, the variety of firms in search of insurance coverage on the identical time is much less.

In different phrases, entry to the tokens are as well-guarded as these hi-tech financial institution vaults proven in motion films. The weakest hyperlink subsequently, are the individuals who have entry. Let’s direct our highlight on the group.

YouHodler Background

YouHodler was arrange in 2017 and there are two firms working it: Naumard Ltd based mostly in Cyprus and YouHodler SA in Switzerland. I'm barely elevating one eyebrow right here concerning the Cyprus location due to its 'golden passport' scheme that raised a little bit of a kerfuffle.

Three key personnel are listed on the web site: Ilya Volkov the CEO, Renat Gafarov the CTO, and Alex Vinny, Head of Product.

Ilya Volkov, CEO and Founder

Ilya graduated with a level in Philosophy in Moscow earlier than venturing into the FinTech world. He’d spent 10 years in Industrial Finance adopted by one other 10 years in on-line buying and selling. In a latest interview, he shared his journey on beginning YouHodler impressed by the LUMIAMI method and Design Considering. He sees YouHodler as an integral piece that connects banking, buying and selling and cryptocurrency. That is definitely mirrored within the choices on YouHodler.

Renat Gafarov, CTO

Renat began his profession as a frontend developer, shortly shifting up the ranks whereas additionally going by a number of firms. His present stint at YouHodler is the longest he’s been in an organization (4 years).

Alex Vinny, Head of Product

From what I can inform, I believe Alex went to the identical college as Renat, Altai State College in Russia. He’s additionally related to Ilya by way of The Foreign exchange Membership the place he labored, first as a UI/UX Designer, then a Product Designer earlier than becoming a member of YouHodler as a UI/UX Designer.

The administration group appears like they arrive from rank-and-file backgrounds, which is one thing I like as a result of it means they know what they’re doing of their space of experience. The danger is that there’s not a variety of administration expertise, which hopefully, might be addressed as the corporate scales up.

When it comes to how seemingly they’ll run away with all the things in the midst of the evening, aka do a rug pull, in that interview with the founder, his intention to construct one thing higher is convincing sufficient. Until I can dig up extra grime about them, which isn’t straightforward as a result of they appear pretty low-key, I’m cautiously constructive.

At this level, understanding what concerning the firm, you possibly can resolve in the event you'd prefer to proceed exploring the platform and the opposite providers it affords. For myself, I’m curious to see what else is obtainable, so am continuing with warning.

How Does it Work for Lenders?

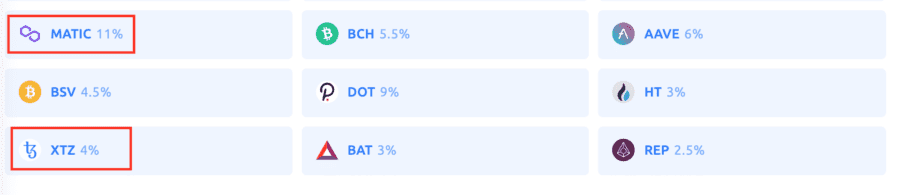

The promoting level on the web site is which you can stand up to 12.3% curiosity yearly for each crypto property and fiat. Often, with these sorts of claims, there’s a little bit of truth-stretching concerned. Good of them to offer a earnings calculator for me to verify what I’m most probably getting for my crypto tokens. Right here’s what I discovered (so as):

- MKR, COMP, REP 2.5%

- HT, BNB, BAT, BNT, DOGE, OMG 3.0%

- XLM, XRP, YFI. ZRX 4.5%

- BTC 4.8%

- EOS 5.0%

- LTC, BCH, DASH, ETH 5.5%

- SNX, ADA, AAVE 6.0%

- LINK 6.2%

- UNI, SUSHI, TRX 7.0%

- PAXG 8.2%

- DOT 9.0%

- BUSD 10%

- EURS, USDP 12%

- USDT 12.3%

Evaluating my findings with their revealed listing beneath, I seen it has two tokens which weren’t from the dropdown menu of the calculator (marked in pink). I ponder why.

Typically, I like the concept of getting weekly curiosity funds, particularly if it may also be compounded. The curiosity paid can also be within the forex/token deposited. There’s no requirement to just accept a platform’s native token to be able to earn a greater price. I suppose there are two methods to take a look at this:

- There may be safety in having curiosity paid within the unique type. For instance, I’d take curiosity in BTC any day over any native token.

- If there’s a native token, then what you’re banking on is that the quantity of curiosity within the unique type is lower than what you might doubtlessly get with the native token, particularly if the native token is doing properly and fetches a better value available in the market. This is able to require an extra layer of monitoring. How a lot work are you prepared to place in on the subject of keeping track of your property?

There’s additionally the flexibleness of withdrawing my crypto anytime. It’s price noting that I received’t get any curiosity for the week that I make the withdrawal.

Placing my crypto to work right here would require me to deposit a minimal of $100 price of every sort of asset I wish to earn curiosity on. Eg: If I wish to earn curiosity for BTC, USDT, ETH, and UNI, I would want to lock in a complete of min $400 price of tokens in my account. No surprise they’ve a most deposit quantity of $100k throughout all currencies. In comparison with different platforms that don’t have any minimal, it is a little bit of an entry barrier.

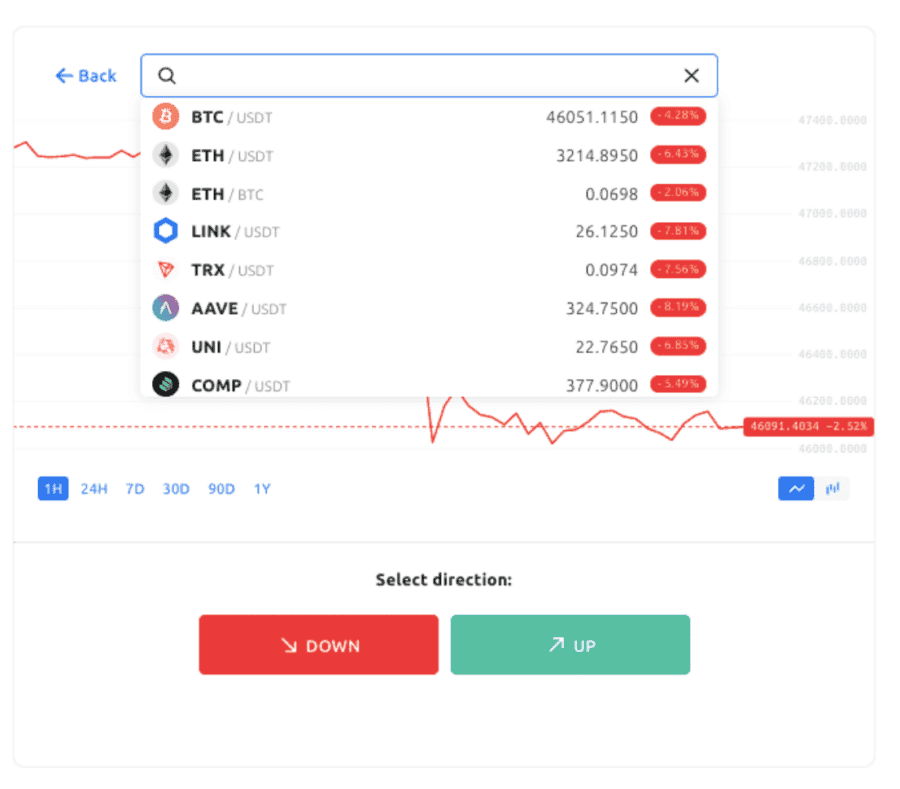

MultiHODL

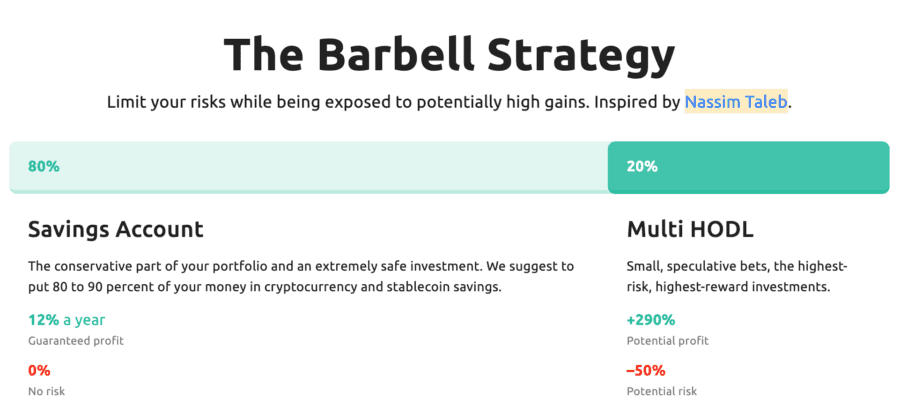

One factor that makes YouHodler distinctive from different platforms for lenders is the MultiHODL product. The important thing concept for this product is predicated on one thing known as The Barbell Technique by Nassim Taleb, a mathematician and danger analyst, well-known for his ebook “The Black Swan”.

The way it works

Let’s say:

- I put in $1,000 in USDT. 90% of it’s in a deposit, and I resolve, with 10% of my deposit, i.e. $100 on a crypto token like AAVE, that its value will go up.

- I open a place, i.e. I place my wager. Then I watch and wait to see what occurs.

- If I’m improper, I lose the hundred {dollars}.

- If I’m proper, I may stand to achieve greater than 12.3%, relying on the place I set the extent of profit-taking. The revenue goes instantly into my account.

- I get to resolve how lengthy to maintain the place open or when to shut it. There’s a charge related to the period of the open place.

Additionally, the place will routinely shut after 10 days (in case I neglect about it), or if the value falls beneath the extent of loss. Aside from steady cash, I may additionally use different crypto tokens as capital too.

The mechanics of how the wager placement works is much like margin buying and selling, the place one sells one other’s shares, then buys again the shares at a later value, both decrease or greater than predicted. It’s often paired with leverage, i.e. I put in $100 and purchase $200 price (that’s a 2x leverage). If issues go improper, I may stand to lose $200.

Margin buying and selling has all the time been one thing I’d shrink back from as a result of I’m not snug shedding greater than what I’ve put in. With the MultiHODL product, leverage is an choice. They name it “multiplier”. There’s a slider to decide on how far you wish to go. In fact, the extra you multiply, the upper the chance/reward.

Should you’re getting began in crypto buying and selling and bought a bit of data in studying charts or doing technical evaluation (TA), you might think about testing out your hypotheses right here, whether or not the value will go up or down. If not, and also you’re feeling fortunate, simply shut your eyes and decide one thing. You might have a 50-50 probability of being proper anyway.

That being mentioned, it’s price giving it a go together with a small quantity, like nothing greater than 10%. Should you’re undecided of your danger stage, attempt asking your self: if I get up the following morning and I discovered that I’d misplaced the quantity I’d put in, how terrible would I really feel on a scale of 1 to five?

In contrast to the deposit-and-earn situation, which is just about set-and-forget, doing the MultiHODL manner requires a little bit of effort to observe your bets. If monitoring could be a irritating factor, I counsel skipping this product.

As for me, I’m nearly able to throw my pitiful BAT stash into this platform and allocate perhaps 20% of my BAT holdings to this product. However wait, there are charges to think about:

- one-time origination charge

- rollover charge – the hourly charges in the course of the period of the wager

- one-time 10% revenue share charge

How Does It Work for a Borrower?

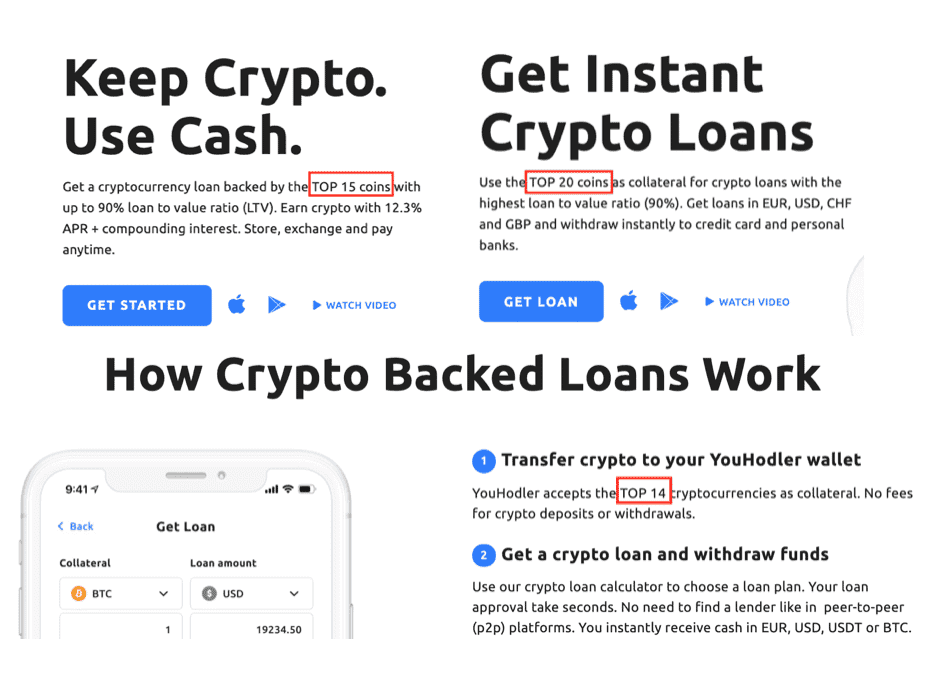

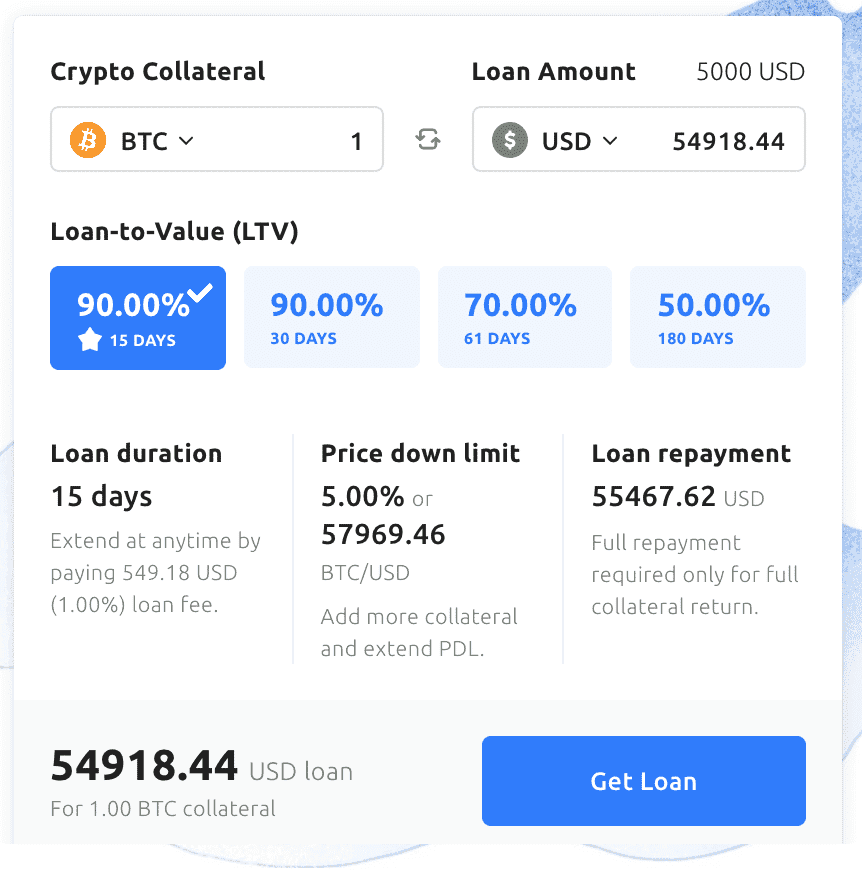

In line with their mortgage web page, the highest 20 cash used as collateral can be utilized to safe as much as a mortgage of as much as 90% of the collateral worth. That is generally often known as Mortgage-To-Worth ratio, aka LTV. On this case, a 90% LTV means I can get $900 from collateral that’s price $1,000. Whoa!

Additional down the web page, I seen that it mentioned high 14 cash as collateral. Nevertheless, on the homepage, the promoting mentioned high 15 cash. This sort of complicated messaging doesn’t sit properly with me. If it's a real error, they should pay extra consideration to their copywriting; if it's not, may one thing else be afoot? It didn’t assist that the highest cash weren’t listed.

Getting a Mortgage and Dangers

As with all crypto platforms that makes use of sensible contracts, so long as you could have the required collateral, you’re virtually assured to get the mortgage. The draw back is the chance of instantaneous liquidation if the collateral quantity is price lower than the mortgage quantity, particularly with the volatility available in the market. That is the place Value Down Restrict (PDL) is available in. It’s just like the minimal variety of objects within the warehouse ready to be bought. As soon as that minimal quantity is reached, it’s time to order extra inventory earlier than you run out of things to promote. On this case, as soon as 2/3 of the Value Down Restrict is reached, the YouHodler group will attain out to you to ask for extra collateral. If you want so as to add extra collateral to the mortgage, you activate the Prolong PDL perform.

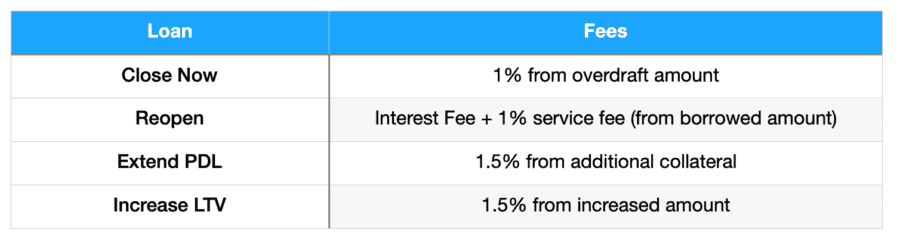

As well as, you can too do one of many following on your mortgage:

- Shut the mortgage utilizing the Shut Now perform – this lets you not repay the mortgage by having your collateral liquidated.

- Set Shut Value characteristic aka Take Revenue – Set the value the place you wish to take revenue. As soon as it reaches that value, a part of the collateral is bought to repay the mortgage and the remaining is deposited into the account. This may be outlined upon making use of for the mortgage or in the course of the mortgage.

- Reopen characteristic – lengthen the mortgage with out repaying it by activating this perform. Charges apply each time the mortgage is prolonged.

Final however not least, let's try the mortgage parameters and costs.

- Mortgage minimal: $100 or its equal.

- Mortgage most: varies in response to market situations and collateral used.

- Mortgage forex: USD, EUR, CHF, GBP, BTC and Stablecoins

- Mortgage reimbursement strategies: crypto (by changing it to fiat), wire switch, debit/bank card, from account, Shut Now characteristic

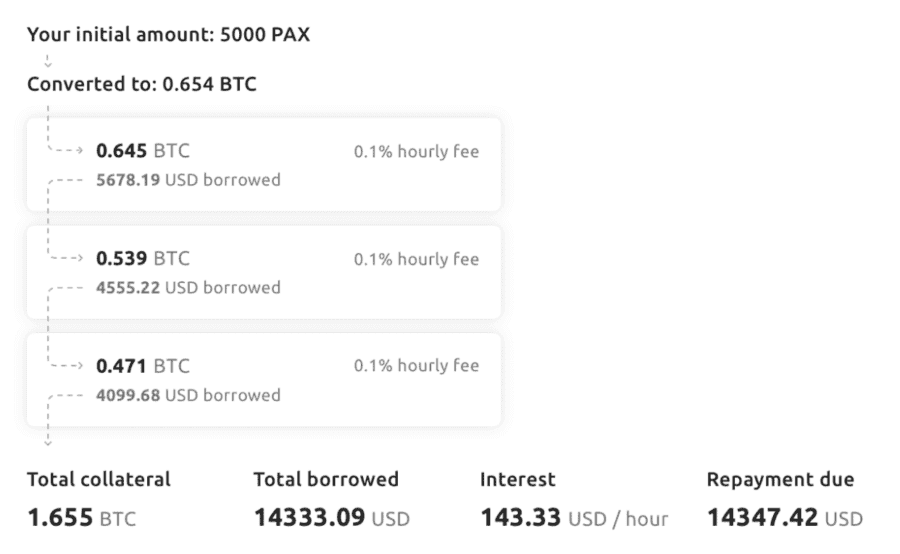

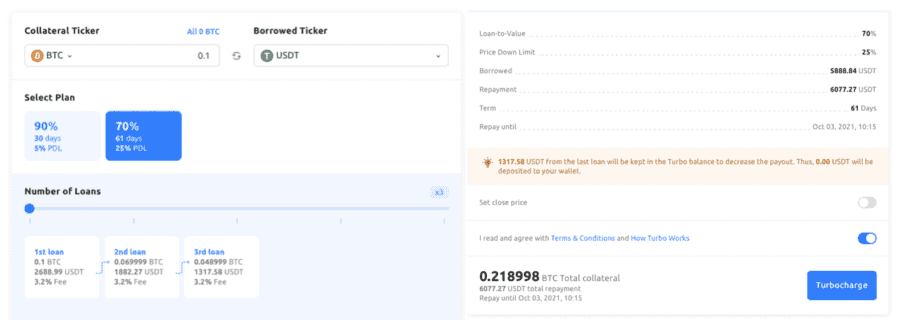

Turbocharge

The classic-loan situation above is for individuals who wish to use their crypto as collateral to get money. However what if you wish to generate profits out of your crypto? Now you're speaking about leverage. It's like utilizing the still-mortgaged first property to behave as collateral to take out a mortgage on your second property. Think about that we're speaking about loans on this identical style. Let's say you deposit collateral that will get you $1,000. Then, you employ that quantity to get a second mortgage, which will get you $800. It then turns into the "capital" for the third mortgage and so forth.

That's basically what Turbocharge is, one other distinctive product solely provided on YouHodler. This product is designed based mostly on the "cascade of loans" precept which sounds, to me, like a most harmful phrase. It's nothing greater than the domino impact in motion however in, hopefully, a constructive manner, i.e. all the things going up as an alternative of down. Whereas it might really feel such as you solely should be out of pockets as soon as for the primary mortgage, and also you're utilizing "free money" to take out the following mortgage and the one after, you might be nonetheless accountable for the whole thing. All it takes is one mortgage to default and all the factor will come tumbling down like a home of playing cards. I need my crypto property to be working exhausting, however I don't want them to be doing exhausting labour in a chain-gang!

Should you actually wish to have the expertise, then do one thing actually small, just like the minimal of $100 and take out no more than 3 loans to get a style, not max it out at 15 instances. Train excessive warning right here!

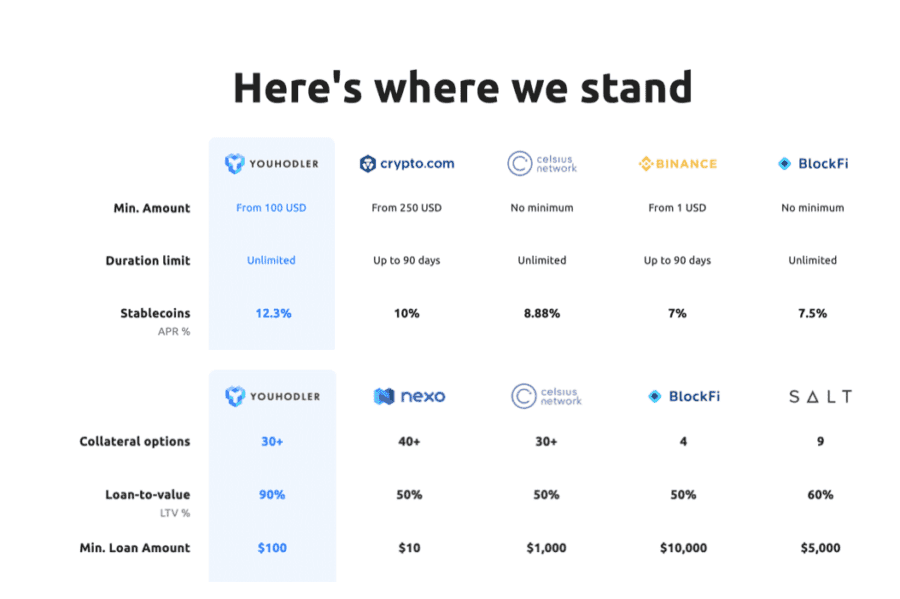

Competitors

There is no such thing as a scarcity of competitors for the area that YouHodler operates in, because the picture beneath exhibits:

Since this chart was compiled by YouHodler, it’s affordable to search out that it paints the platform in a reasonably flattering gentle. Regardless of that, it additionally is aware of it's not the most effective in all the things and possibly doesn't attempt to be. With the 2 distinctive merchandise it affords, it has confidence sufficient to seize the variety of customers it wants to stay wholesome and aggressive.

In case you are focused on YouHodler alternate options, make sure to try our High CeFi Platforms article.

Normal Security and Dangers

Ever because the knowledge leak difficulty from 2019 occurred, YouHodler has beefed up their safety together with 2FA password safety ("what you have and what you know") for all their customers. Additionally they included a 3FA safety measure for these with greater than $10k of their account that permits the customers to disable all withdrawals. If a withdrawal is important, there might be further verification steps taken to make this occur. Historically, 3FA requires some type of pre-authorisation of the machine the place you carry out the duty. A devoted digital certificates on the machine is a typical manner to do that. Whether or not YouHodler takes this route of their definition of 3FA, I don't know. It's price paying attention to.

With regards to regulatory issues, i.e. the platform getting shut down by some authorities, it's unlikely to occur, given the place they’ve their headquarters in.

One key level of concern is how the platform truly makes cash. Whereas it’s doable to consider that the charges they accumulate from the customers' transactions could be sufficient to cowl all prices associated to the operations of the corporate, there isn't something within the web site that offers a transparent indication of their enterprise mannequin. A few of their opponents brazenly point out loaning quantities to institutional traders by way of rehypothecation. Because of this the deposited collateral is used as a pledge for one more mortgage made by the corporate by itself behalf. YouHodler doesn’t point out this nevertheless it doesn’t imply they don’t seem to be doing it. Extra transparency on this matter could be useful to know.

Conclusion

As platforms of this nature goes, YouHodler isn’t any worse than what's on the market. The 2 distinctive merchandise they’ve presently provides them an edge, however solely till the following smartest thing comes alongside. I might not be parking all my property onto one platform as a result of diversification is necessary. Right here's what I might do:

- Put in a small quantity, perhaps barely above the minimal quantity of $100 to get began on incomes curiosity.

- As soon as the curiosity amassed has reached a sizeable stage for me, I'll allocate half of the additional curiosity into the MultiHODL product to make educated guesses of the market traits.

- With the opposite half (min $100 in worth), I’ll put it in a Turbocharge mortgage 3 instances over to look at what occurs.

- Final however not least, I'll withdraw the additional revenue earned and purchase myself some ice-cream. (After charges are deducted, in all probability the one factor I can afford!)

After weighing all of the dangers and advantages, I believe it's price going by the KYC course of to provide this platform a attempt. The sum of money I'm risking isn’t an quantity I’ll lose sleep over. If all the things seems peachy, it is going to be a pleasant shock.

Regularly Requested Questions

Is YouHodler Legit?

Sure, YouHodler is taken into account a official platform. It’s an EU and Swiss-based Web3 crypto and fiat fintech firm that gives quite a lot of providers together with holding, buying and selling, lending, and crypto-rewards.

Who’s the Proprietor of YouHodler?

Ilya Volkov is the CEO and co-founder of YouHodler. With over 15 years of expertise in FinTechs, Industrial Finance, and Buying and selling, Volkov leads the corporate with a powerful background in finance.

What does a Hodler imply?

HODL is an acronym which stands for Maintain On For Pricey Life, referring to crypto holders persevering with to carry an asset as risky as crypto. A hodler is just somebody who holds crypto by the turbulent ups and downs of the market.